Your Why does a decrease in money supply increase interest rates images are ready. Why does a decrease in money supply increase interest rates are a topic that is being searched for and liked by netizens today. You can Download the Why does a decrease in money supply increase interest rates files here. Download all free photos and vectors.

If you’re looking for why does a decrease in money supply increase interest rates pictures information linked to the why does a decrease in money supply increase interest rates interest, you have visit the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Why Does A Decrease In Money Supply Increase Interest Rates. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. The national money supply is the amount of money available for consumers to spend in the economy. As interest rates are lowered more people are able to borrow more money. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks.

As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. A weaker currency on world markets can serve to boost exports as these products are effectively less. The national money supply is the amount of money available for consumers to spend in the economy. This causes the economy to grow and inflation to increase. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. In the United States the circulation of money is managed by the Federal Reserve Bank.

A weaker currency on world markets can serve to boost exports as these products are effectively less.

Increasing the money supply or lowering interest rates tends to devalue the local currency. In the United States the circulation of money is managed by the Federal Reserve Bank. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. The national money supply is the amount of money available for consumers to spend in the economy. A weaker currency on world markets can serve to boost exports as these products are effectively less. This causes the economy to grow and inflation to increase.

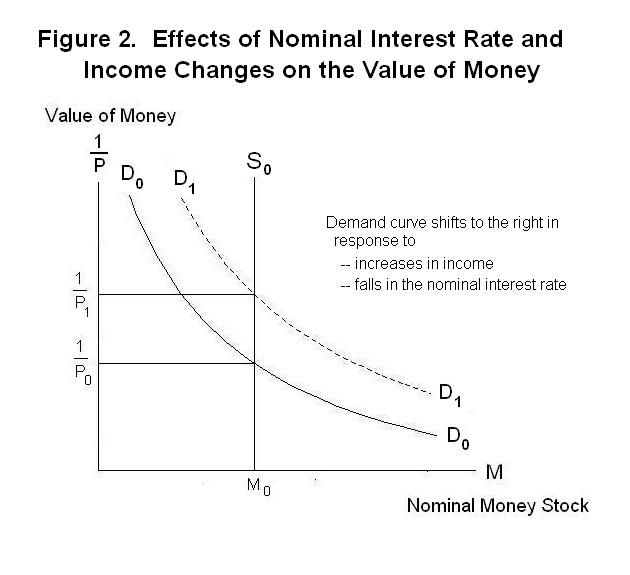

Source: economics.utoronto.ca

Source: economics.utoronto.ca

When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. In the United States the circulation of money is managed by the Federal Reserve Bank. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. Inflation and interest rates are often linked and frequently. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise.

Source: study.com

Source: study.com

Inflation and interest rates are often linked and frequently. This causes the economy to grow and inflation to increase. The national money supply is the amount of money available for consumers to spend in the economy. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Increasing the money supply or lowering interest rates tends to devalue the local currency. Inflation and interest rates are often linked and frequently. In the United States the circulation of money is managed by the Federal Reserve Bank. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. As interest rates are lowered more people are able to borrow more money.

Source: slidetodoc.com

Source: slidetodoc.com

As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. A weaker currency on world markets can serve to boost exports as these products are effectively less. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. The national money supply is the amount of money available for consumers to spend in the economy. This causes the economy to grow and inflation to increase.

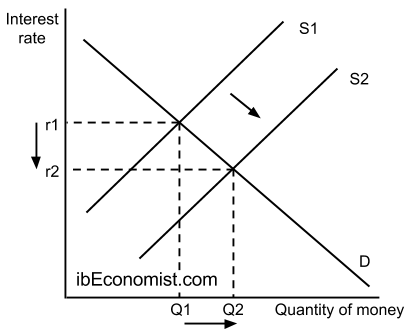

Source: ibeconomist.com

Source: ibeconomist.com

As interest rates are lowered more people are able to borrow more money. A weaker currency on world markets can serve to boost exports as these products are effectively less. The national money supply is the amount of money available for consumers to spend in the economy. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise.

Source: pinterest.com

Source: pinterest.com

A weaker currency on world markets can serve to boost exports as these products are effectively less. A weaker currency on world markets can serve to boost exports as these products are effectively less. In the United States the circulation of money is managed by the Federal Reserve Bank. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. This causes the economy to grow and inflation to increase.

Source: slidetodoc.com

Source: slidetodoc.com

An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. Increasing the money supply or lowering interest rates tends to devalue the local currency. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. In the United States the circulation of money is managed by the Federal Reserve Bank. As interest rates are lowered more people are able to borrow more money.

Source: faculty.washington.edu

Source: faculty.washington.edu

Increasing the money supply or lowering interest rates tends to devalue the local currency. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. Increasing the money supply or lowering interest rates tends to devalue the local currency. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. Inflation and interest rates are often linked and frequently.

Source: pinterest.com

Source: pinterest.com

As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. Increasing the money supply or lowering interest rates tends to devalue the local currency. In the United States the circulation of money is managed by the Federal Reserve Bank. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise.

Source: econlib.org

Source: econlib.org

A weaker currency on world markets can serve to boost exports as these products are effectively less. As interest rates are lowered more people are able to borrow more money. This causes the economy to grow and inflation to increase. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise.

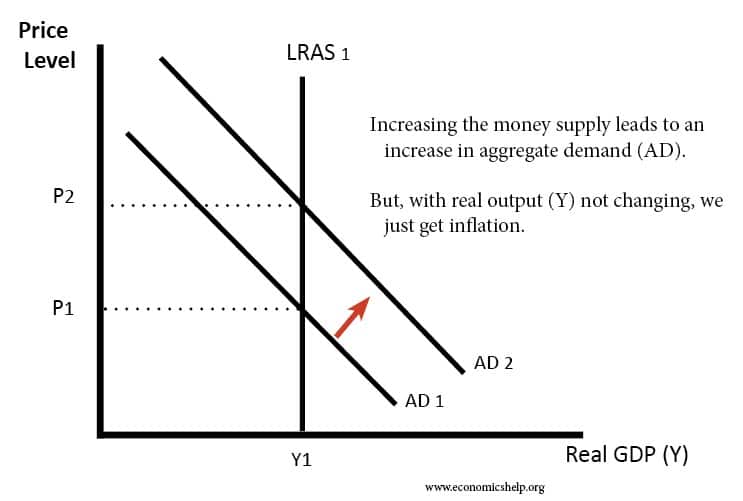

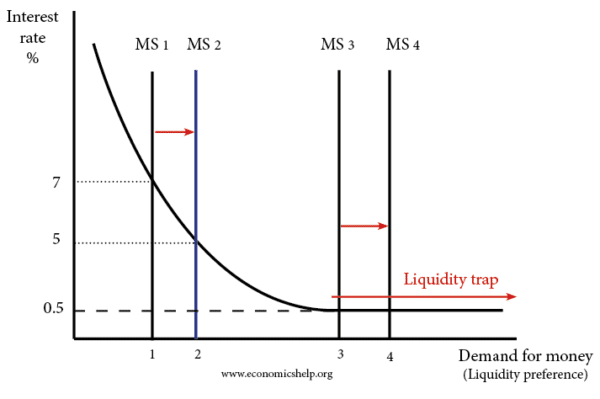

Source: economicshelp.org

Source: economicshelp.org

The national money supply is the amount of money available for consumers to spend in the economy. Inflation and interest rates are often linked and frequently. A weaker currency on world markets can serve to boost exports as these products are effectively less. As interest rates are lowered more people are able to borrow more money. The national money supply is the amount of money available for consumers to spend in the economy.

Source: faculty.washington.edu

Source: faculty.washington.edu

An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. Inflation and interest rates are often linked and frequently. Increasing the money supply or lowering interest rates tends to devalue the local currency. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. In the United States the circulation of money is managed by the Federal Reserve Bank.

Source: cz.pinterest.com

Source: cz.pinterest.com

The national money supply is the amount of money available for consumers to spend in the economy. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. This causes the economy to grow and inflation to increase. A weaker currency on world markets can serve to boost exports as these products are effectively less. In the United States the circulation of money is managed by the Federal Reserve Bank.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. As banks indeed are paying more for the money they lend to borrowers they have to charge them more causing interest rates to rise. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. The national money supply is the amount of money available for consumers to spend in the economy.

Source: pinterest.com

Source: pinterest.com

In the United States the circulation of money is managed by the Federal Reserve Bank. This causes the economy to grow and inflation to increase. The national money supply is the amount of money available for consumers to spend in the economy. When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. As interest rates are lowered more people are able to borrow more money.

Source: slidetodoc.com

Source: slidetodoc.com

As interest rates are lowered more people are able to borrow more money. An increase in money supply causes interest rates to drop and makes more money available for customers to borrow from banks. The national money supply is the amount of money available for consumers to spend in the economy. In the United States the circulation of money is managed by the Federal Reserve Bank. A weaker currency on world markets can serve to boost exports as these products are effectively less.

In the United States the circulation of money is managed by the Federal Reserve Bank. Increasing the money supply or lowering interest rates tends to devalue the local currency. A weaker currency on world markets can serve to boost exports as these products are effectively less. In the United States the circulation of money is managed by the Federal Reserve Bank. The national money supply is the amount of money available for consumers to spend in the economy.

Source: economicshelp.org

Source: economicshelp.org

When the money supply is low like when other investments such as stocks and shares provide a higher return banks increase interest rates paid to depositors to encourage deposits. In the United States the circulation of money is managed by the Federal Reserve Bank. Inflation and interest rates are often linked and frequently. Increasing the money supply or lowering interest rates tends to devalue the local currency. A weaker currency on world markets can serve to boost exports as these products are effectively less.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title why does a decrease in money supply increase interest rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.