Your What is the loanable funds market images are available in this site. What is the loanable funds market are a topic that is being searched for and liked by netizens now. You can Download the What is the loanable funds market files here. Download all free photos and vectors.

If you’re looking for what is the loanable funds market images information linked to the what is the loanable funds market keyword, you have visit the right site. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

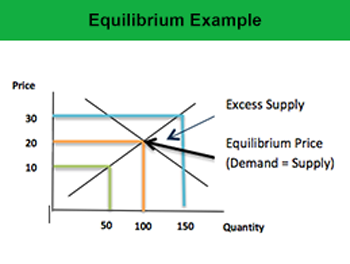

What Is The Loanable Funds Market. In the loanable funds market the price is the interest rate and the thing being exchanged is money. The supply of loanable funds is based on savings. The demand for loanable funds is based on borrowing. Importance of loanable funds market for the economy.

99 Tumblr From pinterest.com

99 Tumblr From pinterest.com

Loanable funds market is a market where the demand and supply of loanable funds interact in an economy. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. By saving thus the firms may not enter the loanable-funds market but this influences the rate of interest by reducing the demand for loanable funds. The supply of loanable funds is based on savings. Without it future GDP dries up because firms arent spending today for necessary resources to produce GDP later. The loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

The market for loanable funds.

The demand for loanable funds is based on borrowing. The Loanable Funds Market. R 10. Without it future GDP dries up because firms arent spending today for necessary resources to produce GDP later. The market for loanable funds. The loanable funds market includes.

Source: pinterest.com

Source: pinterest.com

In most emerging countries people save little as they. The loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. Now to the loanable funds market. You can consider the interest rate a lender earns or a borrower.

Source: in.pinterest.com

Source: in.pinterest.com

This term you will probably often find in. The first is the Federal Reserve which sets the fed. Money Market vs Loanable funds Market This market refers to the Money Supply M1 and M2. 72 the curve S slopes from left. In the loanable funds market the price is the interest rate and the thing being exchanged is money.

Source: pinterest.com

Source: pinterest.com

2 days agoThe Loanable Funds Market For each of the following draw a correctly labeled graph of the loanable funds market in equilibrium. Demand for loanable funds increase and interest rates rise bc the govt is going to the loanable funds market which increases the demand If the govt suddenly raises taxes then real interest. Borrowers demand loanable funds and savers supply loanable funds. The market in which borrowers demanders of funds and lenders suppliers of funds meet is the loanable funds market. 2 days agoThe Loanable Funds Market For each of the following draw a correctly labeled graph of the loanable funds market in equilibrium.

Source: pinterest.com

Source: pinterest.com

The Loanable Funds Market. Demand for loanable funds increase and interest rates rise bc the govt is going to the loanable funds market which increases the demand If the govt suddenly raises taxes then real interest. The loanable funds market includes. In a few words this market is a simplified view of the financial system. The loanable funds market is a representation of decisions made by households and companies in relation to their lending and borrowing.

Source: pinterest.com

Source: pinterest.com

The loanable funds market illustrates the interaction of borrowers and savers in the economy. Now this might seem like a very technical term loanable funds but it literally just means funds that people are supplying to be lent out to other people and funds that people are demanding. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. Importance of loanable funds market for the economy. 2 days agoThe Loanable Funds Market For each of the following draw a correctly labeled graph of the loanable funds market in equilibrium.

Source: pinterest.com

Source: pinterest.com

The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. All savers come to the market for loanable funds to deposit their savings. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. Money Market vs Loanable funds Market This market refers to the Money Supply M1 and M2. The loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

Source: pinterest.com

Source: pinterest.com

You can consider the interest rate a lender earns or a borrower. Without it future GDP dries up because firms arent spending today for necessary resources to produce GDP later. In most emerging countries people save little as they. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. The loanable funds market illustrates the interaction of borrowers and savers in the economy.

Source: pinterest.com

Source: pinterest.com

The market for loanable funds describes how that borrowing happens. The market for loanable funds. Now this might seem like a very technical term loanable funds but it literally just means funds that people are supplying to be lent out to other people and funds that people are demanding. Borrowers demand loanable funds and savers supply loanable funds. The loanable funds market illustrates the interaction of borrowers and savers in the economy.

Source: pinterest.com

Source: pinterest.com

Now to the loanable funds market. All savers come to the market for loanable funds to deposit their savings. This term you will probably often find in. The Money Supply curve is vertical because it is determined by the Feds or central banks. The market for loanable funds.

Source: pinterest.com

Source: pinterest.com

The loanable funds market is a representation of decisions made by households and companies in relation to their lending and borrowing. Demand for loanable funds increase and interest rates rise bc the govt is going to the loanable funds market which increases the demand If the govt suddenly raises taxes then real interest. By saving thus the firms may not enter the loanable-funds market but this influences the rate of interest by reducing the demand for loanable funds. R 10. Market Price for Loanable Funds.

Source: in.pinterest.com

Source: in.pinterest.com

Money Market vs Loanable funds Market This market refers to the Money Supply M1 and M2. The market in which borrowers demanders of funds and lenders suppliers of funds meet is the loanable funds market. The loanable funds market illustrates the interaction of borrowers and savers in the economy. In most emerging countries people save little as they. The loanable funds market illustrates the interaction of borrowers and savers in the economy.

Source: pinterest.com

Source: pinterest.com

Now to the loanable funds market. All savers come to the market for loanable funds to deposit their savings. In a few words this market is a simplified view of the financial system. The demand for loanable funds is based on borrowing. The loanable funds market is characterized by the following demand function DLF where the demand for loanable funds curve includes only investment demand for loanable funds.

Source: pinterest.com

Source: pinterest.com

Now to the loanable funds market. This term you will probably often find in. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The Money Supply curve is vertical because it is determined by the Feds or central banks. Now this might seem like a very technical term loanable funds but it literally just means funds that people are supplying to be lent out to other people and funds that people are demanding.

Source: pinterest.com

Source: pinterest.com

Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance. 2 days agoThe Loanable Funds Market For each of the following draw a correctly labeled graph of the loanable funds market in equilibrium. Market Price for Loanable Funds. The loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. Without it future GDP dries up because firms arent spending today for necessary resources to produce GDP later.

Source: in.pinterest.com

Source: in.pinterest.com

The market for loanable funds. The loanable funds market includes. The market in which borrowers demanders of funds and lenders suppliers of funds meet is the loanable funds market. The law of supply and demand is applicable in the market for loanable funds. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance.

Source: pinterest.com

Source: pinterest.com

The supply of loanable funds is based on savings. The loanable funds market is characterized by the following demand function DLF where the demand for loanable funds curve includes only investment demand for loanable funds. Borrowers demand loanable funds and savers supply loanable funds. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The loanable funds market includes.

Source: pinterest.com

Source: pinterest.com

The law of supply and demand is applicable in the market for loanable funds. Households act as suppliers of money though saving and. In a few words this market is a simplified view of the financial system. The supply of loanable funds is based on savings. It is a variation of a market model but what is being bought and sold is money that has been.

Source: pinterest.com

Source: pinterest.com

The loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. It is a variation of a market model but what is being bought and sold is money that has been. Loanable funds market is a market where the demand and supply of loanable funds interact in an economy. In the loanable funds market the price is the interest rate and the thing being exchanged is money. The Money Supply curve is vertical because it is determined by the Feds or central banks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the loanable funds market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.