Your What is outward supply in gst in hindi images are ready in this website. What is outward supply in gst in hindi are a topic that is being searched for and liked by netizens now. You can Find and Download the What is outward supply in gst in hindi files here. Download all royalty-free photos.

If you’re searching for what is outward supply in gst in hindi images information connected with to the what is outward supply in gst in hindi keyword, you have come to the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

What Is Outward Supply In Gst In Hindi. In GSTR 1 - Outward Supply - in Table 8. Outward Supply in relation to a person shall mean supply of goods or services whether by sale transfer barter exchange licence rental lease or disposal or any other means made or agreed to be made by such. Hence salary interest etc will have to be inserted in point no 5 of gstr 3B. Non GST Outward Supply.

Inward Supply Vs Outward Supply Income Tax Tax Finance From in.pinterest.com

Inward Supply Vs Outward Supply Income Tax Tax Finance From in.pinterest.com

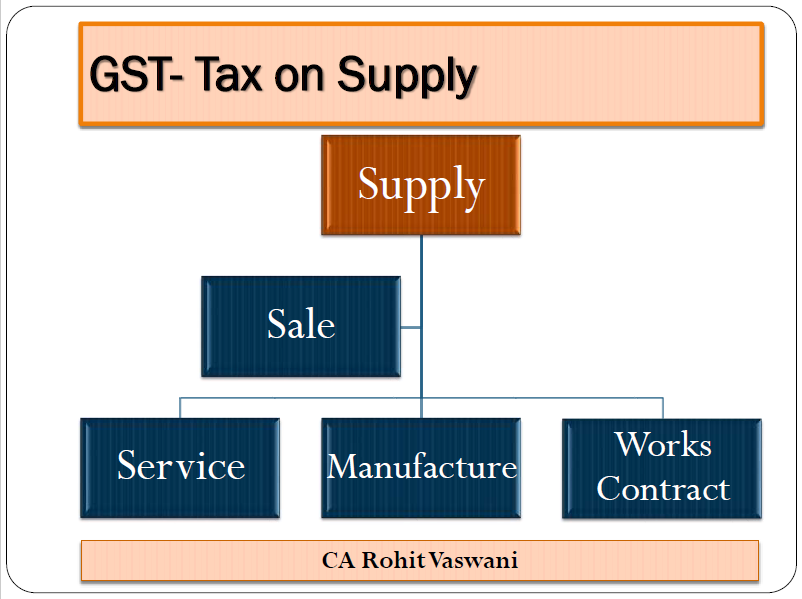

You will not be able to claim any ITC on such supplies. Goods and Services Tax GST One Nation One Tax हद म इस वसत और सव कर कह जत ह आप इस बह-सतरय कर यन. Section 273 Outward Supply. Sales of goods or provision of services of goods or services or both. Since they are basic essentials they do not attract any GST at all. Outward supplies means any supply made by your business Sales and any other services provided.

But they need to file CMP 08 quarterly.

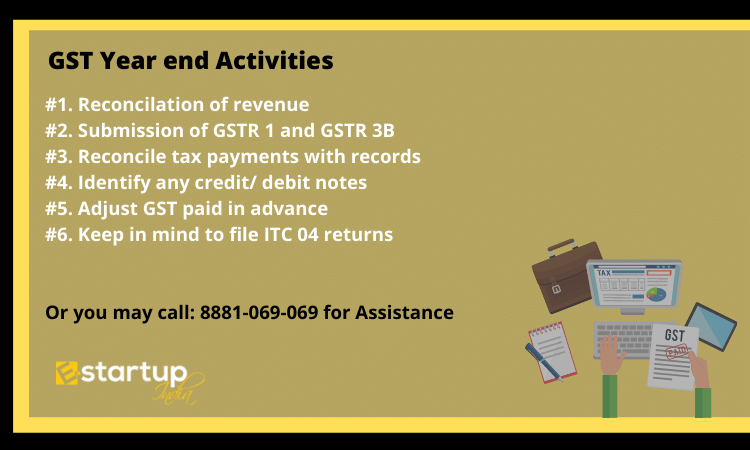

FORM GSTR-1 is a statement of the details of outward supplies ie. Outward supplies means any supply made by your business Sales and any other services provided. Exempted This supply includes items which are used for everyday purposes. The details filed in table of this statement are to be communicated to the respective recipients of the said supplies. Interest payable if any. The registered persons opting for the Scheme would be required to furnish the details of an outward supply in FORM GSTR-1 quarterly as per rule 59 of the CGST Rule.

Source: cleartax.in

Source: cleartax.in

Non GST Outward Supply. But form is still not live. Goods and Services Tax GST One Nation One Tax हद म इस वसत और सव कर कह जत ह आप इस बह-सतरय कर यन. In GST In Hindi जएसटआर -4 एक Document ह जस हर 3 महन म एक बर पजकत कर दतओ क जम करन क आवशयकत हत ह जनहन कपजशन सकम क. For each of the first and second months of a quarter such a registered person will have the optional facility Invoice Furnishing Facility IFF to furnish the details of such outward supplies to a registered.

Source: tutorial.gst.gov.in

Source: tutorial.gst.gov.in

Not Defined in GST. Non GST outward supply is nowhere defined in the Act. The new definition reads as follows. In GST In Hindi जएसटआर -4 एक Document ह जस हर 3 महन म एक बर पजकत कर दतओ क जम करन क आवशयकत हत ह जनहन कपजशन सकम क. Its due date is extended to 31st July 2019.

Source: pinterest.com

Source: pinterest.com

36000 as IGST that will further go to the center. The total amount payable would be amounting to 236000 rupees. You will not be able to claim any ITC on such supplies. While Filling GSTR 3B the turnover where 100 RCM is payable by recipient of service example transportation of Goods by Road having 5 or manpower services having 18 gst rate are filled in Table 31 a Outward taxable supplies other than zero rated nil rated and exempted. Outward Supply or Sales Outward Supply in relation to a person shall mean supply of goods andor services whether by sale transfer barter exchange license rental lease or disposal made or agreed to be made by such person in the course or furtherance of business.

Source: pinterest.com

Source: pinterest.com

Definition of Outward Supply under GST. Supplies made internationally will also be obligated to pay this tax. To ensure the smooth roll out of GST the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for the first two months has been extended and in lieu of Form GSTR 3 summarized details of outward and inward supplies in. Outward Supply in relation to a person shall mean supply of goods or services whether by sale transfer barter exchange licence rental lease or disposal or any other means made or agreed to be made by such. B import of goods and services made.

Source: in.pinterest.com

Source: in.pinterest.com

To ensure the smooth roll out of GST the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for the first two months has been extended and in lieu of Form GSTR 3 summarized details of outward and inward supplies in. Non GST outward supply is nowhere defined in the Act. The details filed in table of this statement are to be communicated to the respective recipients of the said supplies. Some items which are nil rated include grains salt jaggery etc. Outward supplies means any supply made by your business Sales and any other services provided.

Source: in.pinterest.com

Source: in.pinterest.com

The new definition reads as follows. 52 What is the proposed Permissible Normal Time Period to confirm the Outward Supply of Some One else as Inward Supply of a Recipient of Supply by viewing such statement of out ward supplies and ticking the same either manually or with the help of any third party software and to add the missing invoices and to make necessary deletion or modification will be. Goods and Services Tax GST One Nation One Tax हद म इस वसत और सव कर कह जत ह आप इस बह-सतरय कर यन. While Filling GSTR 3B the turnover where 100 RCM is payable by recipient of service example transportation of Goods by Road having 5 or manpower services having 18 gst rate are filled in Table 31 a Outward taxable supplies other than zero rated nil rated and exempted. 36000 as IGST that will further go to the center.

Source: thetaxtalk.com

Source: thetaxtalk.com

GSTR-1 समन Goods और सवओ Services क बहर आपरत External supply करन वल सभ समनय और आकसमक पजकत करदतओ दवर परसतत क जन वल बहय आपरत eternal. Some items which are nil rated include grains salt jaggery etc. Sales Entry in Tally with GST GST IN HINDI GST EXPLAINED. This type of supply attracts a GST of 0. Exempted This supply includes items which are used for everyday purposes.

Source: tutorial.gst.gov.in

Source: tutorial.gst.gov.in

Outward supplies means any supply made by your business Sales and any other services provided.

Source: legalraasta.com

Source: legalraasta.com

To ensure the smooth roll out of GST the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for the first two months has been extended and in lieu of Form GSTR 3 summarized details of outward and inward supplies in. The total amount payable would be amounting to 236000 rupees. But they need to file CMP 08 quarterly. In GST In Hindi जएसटआर -4 एक Document ह जस हर 3 महन म एक बर पजकत कर दतओ क जम करन क आवशयकत हत ह जनहन कपजशन सकम क.

Source: in.pinterest.com

Source: in.pinterest.com

Not Defined in GST Table 7 of GSTR 9C Reconciliation Statement Certification Instruction to GSTR 9 Annual Return for table 5D 5E 5F. Since they are basic essentials they do not attract any GST at all. Section 273 Outward Supply. In GSTR 1 - Outward Supply - in Table 8. B import of goods and services made.

Source: legalraasta.com

Source: legalraasta.com

Input tax credit cannot be claimed on such supplies. Since they are basic essentials they do not attract any GST at all. For exact definition please refer section 2 of CGST Act 2017. The details of inward supplies of goods or services or both furnished in FORM GSTR-2 shall include inter alia. Not Defined in GST.

Source: legalraasta.com

Source: legalraasta.com

Taxable person to avail input tax credit used in making outward supply of goods or service or both and make zero-rated supply-Without any payment of IGST on such outward supply by executing LUT Letter of Undertaking or bond dispensed off vide notification 372017-Central tax Claim refund of input tax credit used in the outward supply. Interest payable if any. February 10 2017by Ca Pradeep Jain. The total amount payable would be amounting to 236000 rupees. Some items which are nil rated include grains salt jaggery etc.

Source: legalraasta.com

Source: legalraasta.com

For exact definition please refer section 2 of CGST Act 2017. GST FERS Chapter Thirty Three Statement of Outward Supplies GSTR-1 in GST Introduction. In GSTR 1 - Outward Supply - in Table 8. Interest payable if any. Its due date is extended to 31st July 2019.

Source: taxguru.in

Source: taxguru.in

The applicable GST rates in addition to IGST is equal to 18. GSTR-1 समन Goods और सवओ Services क बहर आपरत External supply करन वल सभ समनय और आकसमक पजकत करदतओ दवर परसतत क जन वल बहय आपरत eternal. In GSTR 1 - Outward Supply - in Table 8. GSTR-1 return is a monthly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services. But form is still not live.

Source:

Source:

But form is still not live. The details filed in table of this statement are to be communicated to the respective recipients of the said supplies. 52 What is the proposed Permissible Normal Time Period to confirm the Outward Supply of Some One else as Inward Supply of a Recipient of Supply by viewing such statement of out ward supplies and ticking the same either manually or with the help of any third party software and to add the missing invoices and to make necessary deletion or modification will be. But form is still not live. Definition of Outward Supply under GST.

Source: tutorial.gst.gov.in

Source: tutorial.gst.gov.in

Exempted This supply includes items which are used for everyday purposes. Some items which are nil rated include grains salt jaggery etc. There is a huge confusion about Non GST outward Supplies. Sales of goods or provision of services of goods or services or both. The new definition reads as follows.

Source: consultease.com

Source: consultease.com

Definition of Outward Supply under GST. 36000 as IGST that will further go to the center. Not Defined in GST. Non GST Outward Supply. I will explain these terms in simple language.

Source: legalraasta.com

Source: legalraasta.com

Interest payable if any. B import of goods and services made. Interest payable if any. GST FERS Chapter Thirty Three Statement of Outward Supplies GSTR-1 in GST Introduction. Sales of goods or provision of services of goods or services or both.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is outward supply in gst in hindi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.