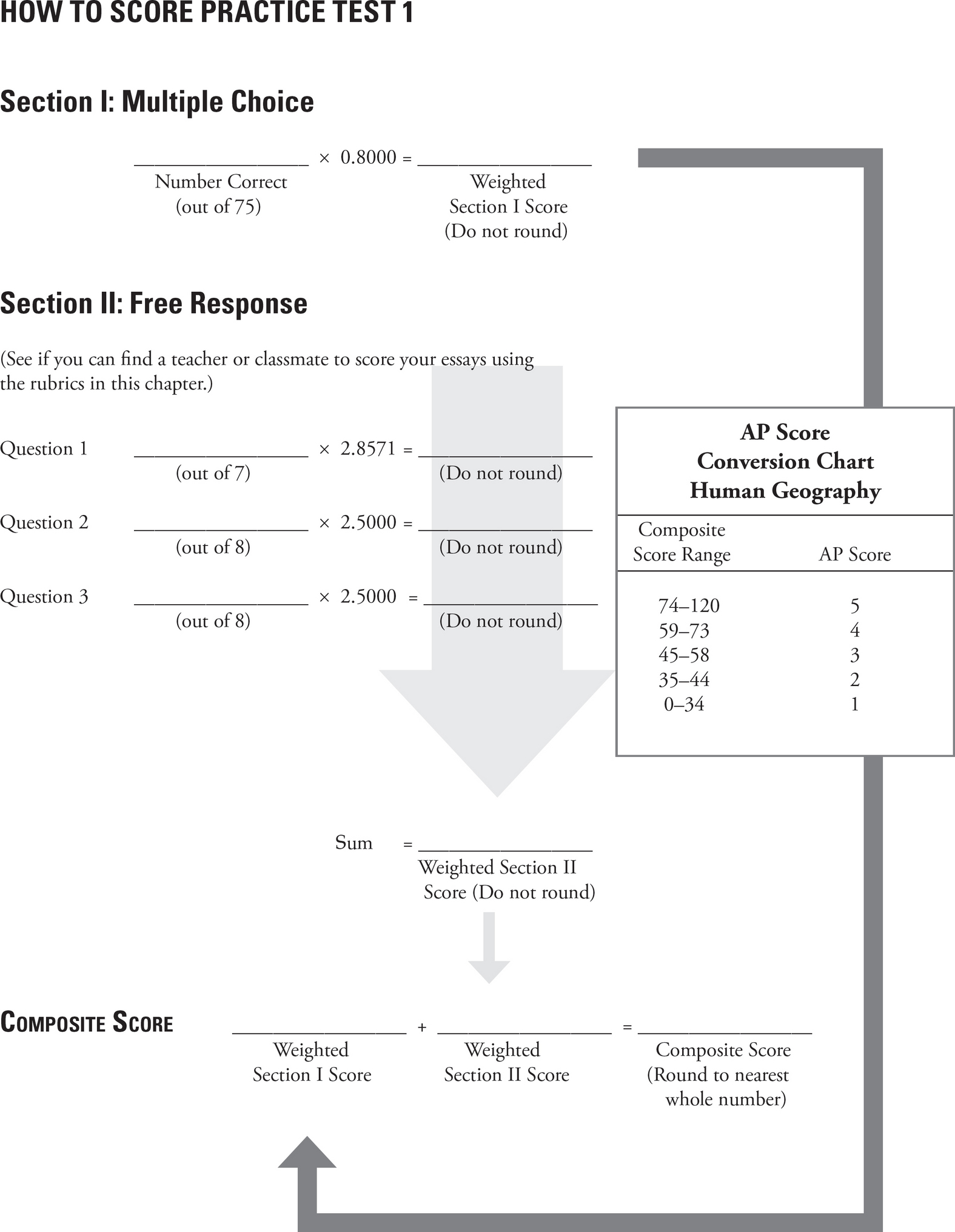

Your What factors shift the supply curve of loanable funds images are available. What factors shift the supply curve of loanable funds are a topic that is being searched for and liked by netizens now. You can Find and Download the What factors shift the supply curve of loanable funds files here. Find and Download all royalty-free vectors.

If you’re searching for what factors shift the supply curve of loanable funds images information linked to the what factors shift the supply curve of loanable funds topic, you have pay a visit to the right blog. Our website always gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

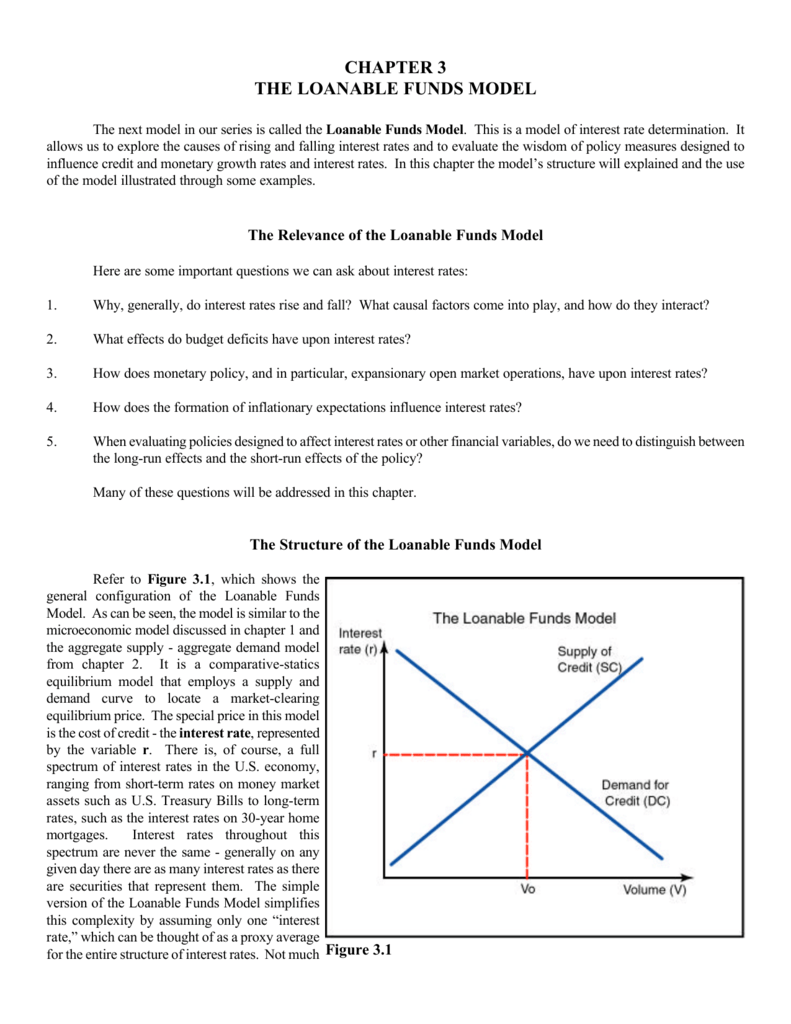

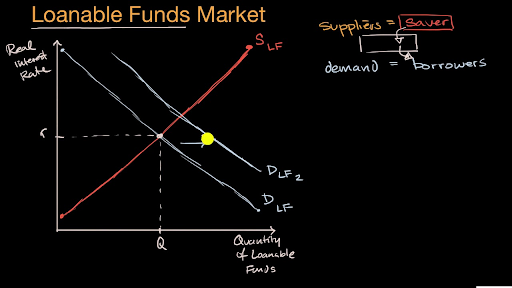

What Factors Shift The Supply Curve Of Loanable Funds. Looking for a Similar. 1 Supply increases ii Supply decreases or iii Supply does not change. Demand for Loanable Funds. Shift supply curve down and to the right Decrease 8 Factors that affect Demand for Loanable Funds for a Financial Security.

Supply Of Loanable Funds Shifts Youtube From youtube.com

Supply Of Loanable Funds Shifts Youtube From youtube.com

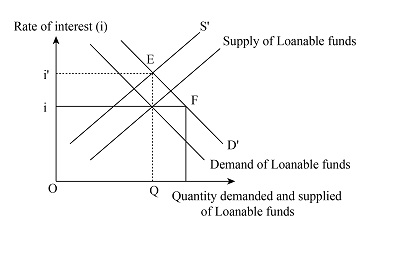

Why does the demand for loanable funds curve slope downward. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. 1 Factors Causing Shifts in Supply and Demand Curves for Loanable Funds Fin. Which factors shift the curve. What factors shift the supply of loanable funds. Supply curve of loanable funds shifts right.

Here a decrease in consumer saving causes a shift in the supply of.

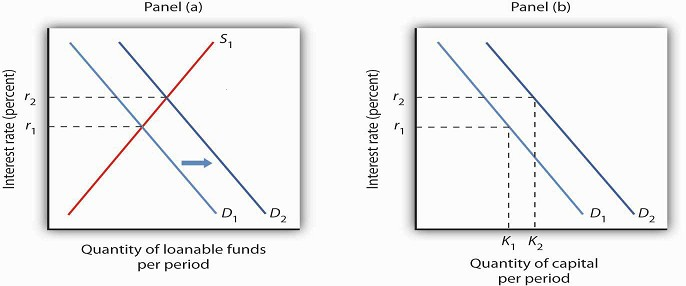

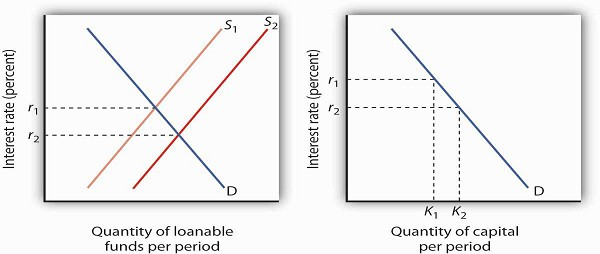

What might cause the supply curve for loanable funds to shift from S1 to S2. A change that begins in the loanable funds market can affect the quantity. - income and wealth - time preferences - consumption smoothing. Rate Wealth increases Increases Decreases Risk decreases Increases Decreases Near-term spending needs decreases Increases Decreases Monetary expansion increases Increases Decreases Economic conditions The flow of foreign funds. Consumption smoothing is another factor that shifts the loanable funds supply. Increase in private savings.

A change that begins in the loanable funds market can affect the quantity. List the factors that affect the demand side of the loanable funds market. What factors shift the demand for loanable funds. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right.

Source: youtube.com

Source: youtube.com

List the factors that affect the demand side of the loanable funds market. 325 Factor Affect on Affect on Impacting Supply Demand Wealth Income Increase NA As wealth and income increase funds suppliers are more willing to supply funds to. Changes in government spending. 1 Factors Causing Shifts in Supply and Demand Curves for Loanable Funds Fin. Here a decrease in consumer saving causes a shift in the supply of.

Which factors shift the curve. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. Why does the supply of loanable funds curve slope upward. List that factors that affect the supply side of the loanable funds market. Rate Wealth increases Increases Decreases Risk decreases Increases Decreases Near-term spending needs decreases Increases Decreases Monetary expansion increases Increases Decreases Economic conditions The flow of foreign funds.

The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. Factors that cause the supply and demand curves for loanable funds shift Factors Supply of Funds Equilibrium Int. Shift demand curve down and to the left Decrease Utility derived from asset purchased with borrowed funds Willingness to borrow increases. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. Rate Wealth increases Increases Decreases Risk decreases Increases Decreases Near-term spending needs decreases Increases Decreases Monetary expansion increases Increases Decreases Economic conditions The flow of foreign funds.

Source: quizlet.com

Source: quizlet.com

Decrease in the desire to save. A change that begins in the loanable funds market can affect the quantity. Demand for Loanable Funds. Consumption smoothing is another factor that shifts the loanable funds supply. Increase in national savings.

Source: itprospt.com

Source: itprospt.com

Think about factors that may shift the supply of loanable funds. 1 Factors Causing Shifts in Supply and Demand Curves for Loanable Funds Fin. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. Decrease in national savings. Why does the supply of loanable funds curve slope upward.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Anything which increases national savings other than a decrease in the real interest. Decrease in private savings. Investor confidence also affects the demand for loanable funds. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market. List that factors that affect the supply side of the loanable funds market.

Source: slidetodoc.com

Source: slidetodoc.com

Movement along the supply curve for loanable funds - a change in the interest rate shift in the supply of loanable funds. This video explains why the supply curve for loanable funds increases. 1 Supply increases ii Supply decreases or iii Supply does not change. Think about factors that may shift the supply of loanable funds. Movement along the supply curve for loanable funds - a change in the interest rate shift in the supply of loanable funds.

Source: slideplayer.com

Source: slideplayer.com

Why does the demand for loanable funds curve slope downward. What factors shift the demand for loanable funds. Changes in income and wealth shift the supply of loanable funds. Why does the demand for loanable funds curve slope downward. Some of these factors for loanable funds include the same factors that affect demand or supply generally including technology improvements shift in consumer tastes substitution possibilities changes in income of consumers taxes etc.

Source: study.com

Source: study.com

Looking for a Similar. Movement along the supply curve for loanable funds - a change in the interest rate shift in the supply of loanable funds. What factors shift the demand for loanable funds. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. List that factors that affect the supply side of the loanable funds market.

Source: studylib.net

Source: studylib.net

Say the government increases the budget deficit. Shift demand curve down and to the left Decrease Utility derived from asset purchased with borrowed funds Willingness to borrow increases. List the factors that affect the demand side of the loanable funds market. The demand for loanable funds comes from many sides. - income and wealth - time preferences - consumption smoothing.

Source: slidetodoc.com

Source: slidetodoc.com

Changes in time preferences also affect the supply of loanable funds. Supply curve of loanable funds shifts right. Factors that cause the supply curve of loanable funds to shift at any given interest rate include the wealth of fund suppliers the risk of the financial security future spending needs monetary policy objectives and economic conditions. Capital productivity is the main determinant of the demand for loanable funds. - income and wealth - time preferences - consumption smoothing.

Changes in government spending. Some of these factors for loanable funds include the same factors that affect demand or supply generally including technology improvements shift in consumer tastes substitution possibilities changes in income of consumers taxes etc. 325 Factor Affect on Affect on Impacting Supply Demand Wealth Income Increase NA As wealth and income increase funds suppliers are more willing to supply funds to. Investor confidence also affects the demand for loanable funds. The increase in deficit prompted the government to increase the demand for loanable funds on the financial market.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Increase in private savings. List that factors that affect the supply side of the loanable funds market. A change that begins in the loanable funds market can affect the quantity. How are shortages and surpluses eliminated in the loanable funds market. What factors can shift the demand for loanable funds curve.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Sort the following scenarios into one of three possibilities. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. Supply curve of loanable funds shifts right. Demand for Loanable Funds.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Think about factors that may shift the supply of loanable funds. Decrease in the desire to save. A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. The demand for loanable funds comes from many sides. Investor confidence also affects the demand for loanable funds.

Source: lisbdnet.com

Source: lisbdnet.com

How is the real interest rate determined. Sort the following scenarios into one of three possibilities. Why does the demand for loanable funds curve slope downward. Increase in the desire to save. How is the real interest rate determined.

Source: econ101help.com

Source: econ101help.com

Think about factors that may shift the supply of loanable funds. List the factors that affect the demand side of the loanable funds market. List that factors that affect the supply side of the loanable funds market. Changes in time preferences also affect the supply of loanable funds. - income and wealth - time preferences - consumption smoothing.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what factors shift the supply curve of loanable funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.