Your What are the effects of money laundering on economic growth images are available. What are the effects of money laundering on economic growth are a topic that is being searched for and liked by netizens today. You can Download the What are the effects of money laundering on economic growth files here. Find and Download all free photos.

If you’re searching for what are the effects of money laundering on economic growth images information related to the what are the effects of money laundering on economic growth interest, you have come to the ideal site. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

What Are The Effects Of Money Laundering On Economic Growth. Microeconomic effects of money laundering is that which affect the private sector. For a long time money laundering has become another terror threatening the growth of the economy such that it drags the wheel of governance and economic development. Thus the purpose of this paper is to evaluate. Diverting resources to less-productive activity and by facilitating domestic corruption and crime which in turn depress economic growth.

Illicit Activity And Money Laundering From An Economic Growth Perspective A Model And An Application To Colombia Sciencedirect From sciencedirect.com

Illicit Activity And Money Laundering From An Economic Growth Perspective A Model And An Application To Colombia Sciencedirect From sciencedirect.com

Diverting resources to less-productive activity and by facilitating domestic corruption and crime which in turn depress economic growth. However most theories state that by not. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Relationship of Anti-Money Laundering Index with GDP financial. The laundered funds are often placed in sterile investments to preserve their value or make them more easily transferable rather than being placed in productive channels for further investment. Also money laundering has positive effects on increasing the likelihood of achieving higher growth Issaoui et al 2017.

Money laundering distorts the investments and depresses the productivity.

Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth. Money laundering is indeed a global phenomenon which undermines the economic and political stabilities of States. It decreases tax revenues and cause a serious negative impact on the economy. Also money laundering has positive effects on increasing the likelihood of achieving higher growth Issaoui et al 2017. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Microeconomic effects of money laundering is that which affect the private sector.

Source: researchgate.net

Source: researchgate.net

Effects of inclusive finance. Historically the economies of the country like Nauru flourished due to money laundering but later the country collapsed. However money launder- ing and other financial and economic crimes in Nigeria reduce government revenue from taxation thereby pos- ing a great challenge on the social and economic growth of the country Anele 2013a26 24. The laundered funds are often placed in sterile investments to preserve their value or make them more easily transferable rather than being placed in productive channels for further investment. Microeconomic effects of money laundering is that which affect the private sector.

Source: researchgate.net

Source: researchgate.net

Moreover government loss revenue as tax collection becomes more complicated and confusing. Historically the economies of the country like Nauru flourished due to money laundering but later the country collapsed. Moreover government loss revenue as tax collection becomes more complicated and confusing. One of the most serious microeconomic effects of money laundering is felt in the private sector. In some countries for example entire industries such as construction and hotels have been financed not because of actual demand but because of the short-term interests of money launderers.

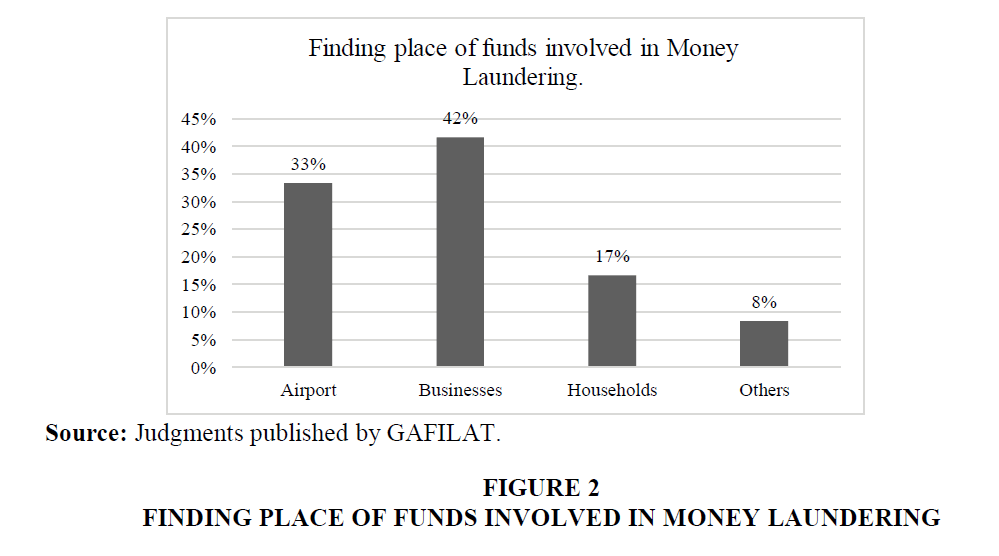

Source: abacademies.org

Source: abacademies.org

However money launder- ing and other financial and economic crimes in Nigeria reduce government revenue from taxation thereby pos- ing a great challenge on the social and economic growth of the country Anele 2013a26 24. Money Laundering-A Negative Impact on Economy Table no2 Affects of money laundering on business Salary Persons Businessmen Questions Yes No Do not know Yes No Do not know Freque ncy F F F Is there any money laundering 22 88 2 8 1 4 25 962 0 0 1 38 Is saving tax is a money laundering. Historically the economies of the country like Nauru flourished due to money laundering but later the country collapsed. In some countries for example entire industries such as construction and hotels have been financed not because of actual demand but because of the short-term interests of money launderers. Money laundering is indeed a global phenomenon which undermines the economic and political stabilities of States.

Source: researchgate.net

Source: researchgate.net

After considering the factor of money laundering we re-examine the relationship between inclusive finance and economic growth and find that with the increase of the risk of money laundering the negative effect of inclusive finance on economic growth is significantly enhanced. However as much as money laundering is a global phenomenon over the last decade it has been apparent that development countries have been more exposed and vulnerable to its exploits. Relationship of Anti-Money Laundering Index with GDP financial. The effects of economic crime can be more damaging than what analysts often describe especially in a developing country like Nigeria. Country Reputation Risk.

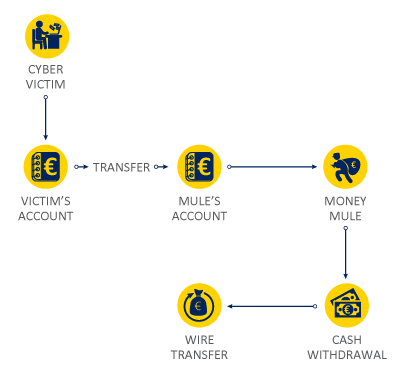

Source: europol.europa.eu

Source: europol.europa.eu

There are many negative risks and effects from money laundering and terrorism financing and governments must put in place anti-money laundering regulations and processes to prevent them as much as possible. One of the most serious microeconomic effects of money laundering is felt in the private sector. Money laundering constitutes a serious threat to national economi es and respective governments. Money laundering and financial crime redirect funds from sound investments to low-quality investments that hide their proceeds economic growth can suffer. After considering the factor of money laundering we re-examine the relationship between inclusive finance and economic growth and find that with the increase of the risk of money laundering the negative effect of inclusive finance on economic growth is significantly enhanced.

Source: unodc.org

Source: unodc.org

It is customary to expect that once the money laundering has completed money is ready to return in the economy providing funds for investment and consumption and consequently economic growth Araujo Moreira 2005 Masciandaro 1999. Money laundering is indeed a global phenomenon which undermines the economic and political stabilities of States. It decreases tax revenues and cause a serious negative impact on the economy. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. However as much as money laundering is a global phenomenon over the last decade it has been apparent that development countries have been more exposed and vulnerable to its exploits.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

For developing countries the diversion of such scarce. Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Also money laundering has positive effects on increasing the likelihood of achieving higher growth Issaoui et al 2017. Money launderers often use front companies which co-mingle the proceeds of illicit activity with legitimate funds to hide the ill.

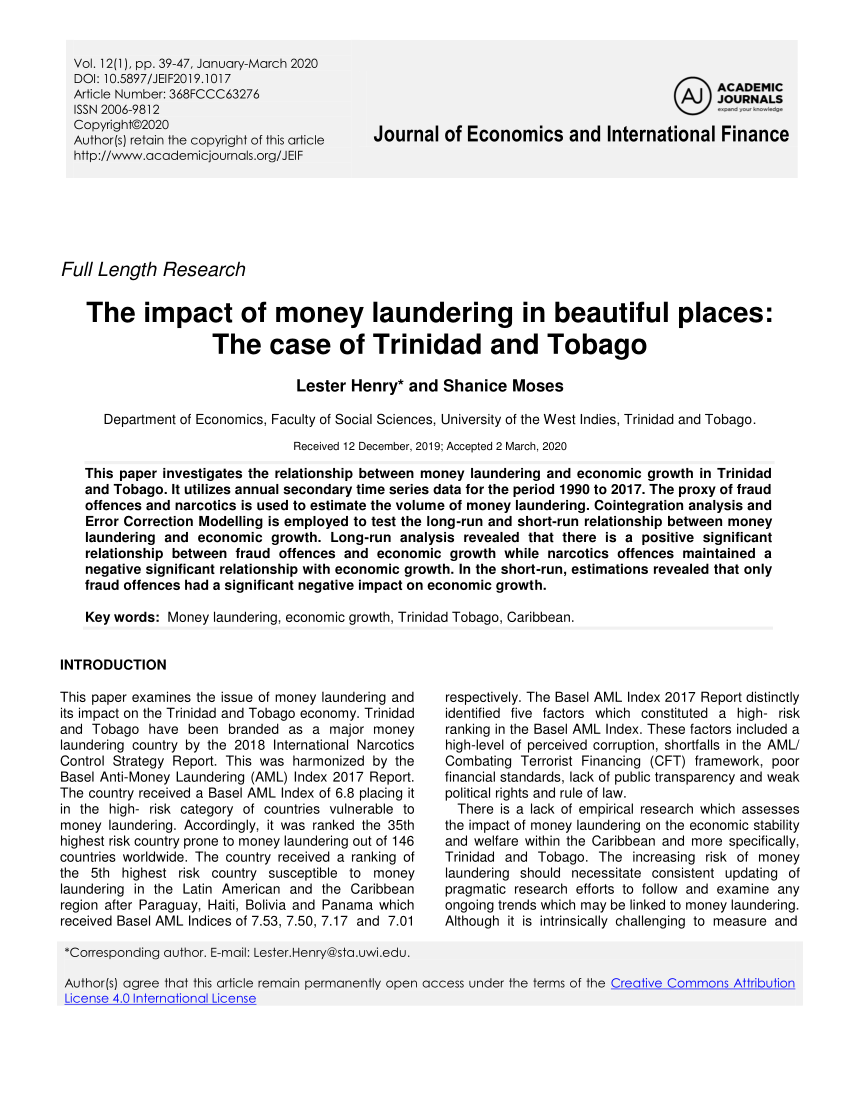

Source: mdpi.com

Source: mdpi.com

Money laundering distorts the investments and depresses the productivity. Effects of Money Laundering on Economy. Money laundering has a negative effect on the economy such as loss of control on the economical policy economic distortion and instability. One of the most serious microeconomic effects of money laundering is felt in the private sector. Money laundering has a direct negative impact on economic growth.

Source: sciencedirect.com

Source: sciencedirect.com

Money laundering is indeed a global phenomenon which undermines the economic and political stabilities of States. Laundering has effect on the level of economic growth. However money launder- ing and other financial and economic crimes in Nigeria reduce government revenue from taxation thereby pos- ing a great challenge on the social and economic growth of the country Anele 2013a26 24. After considering the factor of money laundering we re-examine the relationship between inclusive finance and economic growth and find that with the increase of the risk of money laundering the negative effect of inclusive finance on economic growth is significantly enhanced. However as much as money laundering is a global phenomenon over the last decade it has been apparent that development countries have been more exposed and vulnerable to its exploits.

Source: researchgate.net

Source: researchgate.net

Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. There are many negative risks and effects from money laundering and terrorism financing and governments must put in place anti-money laundering regulations and processes to prevent them as much as possible. Money Laundering-A Negative Impact on Economy Table no2 Affects of money laundering on business Salary Persons Businessmen Questions Yes No Do not know Yes No Do not know Freque ncy F F F Is there any money laundering 22 88 2 8 1 4 25 962 0 0 1 38 Is saving tax is a money laundering. What Are The Negative Effects of Money Laundering on The Economy. It decreases tax revenues and cause a serious negative impact on the economy.

Source: slideplayer.com

Source: slideplayer.com

It decreases tax revenues and cause a serious negative impact on the economy. Microeconomic effects of money laundering is that which affect the private sector. One of the most serious microeconomic effects of money laundering is felt in the private sector. There are many negative risks and effects from money laundering and terrorism financing and governments must put in place anti-money laundering regulations and processes to prevent them as much as possible. Effects of Money Laundering on Economy.

Source: regtechtimes.com

Source: regtechtimes.com

For a long time money laundering has become another terror threatening the growth of the economy such that it drags the wheel of governance and economic development. However as much as money laundering is a global phenomenon over the last decade it has been apparent that development countries have been more exposed and vulnerable to its exploits. However money launder- ing and other financial and economic crimes in Nigeria reduce government revenue from taxation thereby pos- ing a great challenge on the social and economic growth of the country Anele 2013a26 24. Money generates short term economic growth. There are many negative risks and effects from money laundering and terrorism financing and governments must put in place anti-money laundering regulations and processes to prevent them as much as possible.

Source: intosaijournal.org

Source: intosaijournal.org

Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. However money launder- ing and other financial and economic crimes in Nigeria reduce government revenue from taxation thereby pos- ing a great challenge on the social and economic growth of the country Anele 2013a26 24. Therefore the research will help to reduce these drawbacks.

Source: sciencedirect.com

Source: sciencedirect.com

In some countries for example entire industries such as construction and hotels have been financed not because of actual demand but because of the short-term interests of money launderers. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. Diverting resources to less-productive activity and by facilitating domestic corruption and crime which in turn depress economic growth. The reputation of being a money laundering or terrorist financing paradise could have negative effects on the development and economic growth of a country.

Source: mdpi.com

Source: mdpi.com

Relationship of Anti-Money Laundering Index with GDP financial. Effects of Money Laundering on Economy. It decreases legitimate global opportunities because foreign financial institutions may decide to limit their transactions with money laundering haven institutions since the necessary. Diverting resources to less-productive activity and by facilitating domestic corruption and crime which in turn depress economic growth. Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth.

Source: mdpi.com

Source: mdpi.com

Microeconomic effects of money laundering is that which affect the private sector. But when the country suffers from money laundering then it affects the collection of direct or indirect tax or duties. Microeconomic effects of money laundering is that which affect the private sector. Indeed the companies having access to illicit funds could substantially subsidize products or services by selling them at less than the market. The negative economic effects of money laundering on economic development are difficult to quantify yet it is clear that such activity damages the financial-sector institutions that are critical to economic growth reduces productivity in the economys real sector by diverting resources and encouraging crime and corruption which slow.

Source: researchgate.net

Source: researchgate.net

The laundered funds are often placed in sterile investments to preserve their value or make them more easily transferable rather than being placed in productive channels for further investment. But when the country suffers from money laundering then it affects the collection of direct or indirect tax or duties. Relationship of Anti-Money Laundering Index with GDP financial. For developing countries the diversion of such scarce. Two whether the effect of money laundering on economic growth was negative and three whether the increase of crime corruption and informal economy decrease the economic growth.

Source: slideplayer.com

Source: slideplayer.com

Money generates short term economic growth. Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. Money laundering has a negative effect on the economy such as loss of control on the economical policy economic distortion and instability. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Therefore the research will help to reduce these drawbacks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are the effects of money laundering on economic growth by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.