Your What affects the loanable funds market images are available in this site. What affects the loanable funds market are a topic that is being searched for and liked by netizens today. You can Download the What affects the loanable funds market files here. Download all royalty-free vectors.

If you’re searching for what affects the loanable funds market images information connected with to the what affects the loanable funds market keyword, you have visit the ideal site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

What Affects The Loanable Funds Market. Individuals supply loanable funds through savings. Investment is expenditure of funds on the building up of new capital goods and inventories. Magnitudes like expected inflation if they have an effect is to shift the whole demand schedule. When the government borrows money this results in an increase in the demand for loanable funds as shown in this graph.

Reading Loanable Funds Macroeconomics From courses.lumenlearning.com

Reading Loanable Funds Macroeconomics From courses.lumenlearning.com

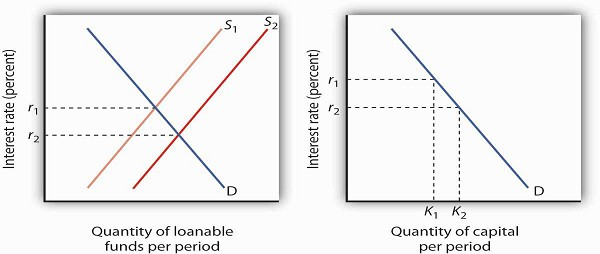

If there is an increase in savings by the private sector the supply of loanable funds increases shifts right causing the real interest rate to fall. Surpluses decrease the demand for loanable funds. With a decrease in government spending your demand curve for the loan-able funds market will shift inward and push the interest rate lower. Surpluses increase the supply of loanable funds. There is one very important addition to the group of those who supply credit in the loanable funds model. The market for loanable funds describes how that borrowing happens.

Investment is expenditure of funds on the building up of new capital goods and inventories.

The price of loanable funds is the nominal interest rate. If decrease in tax the gdp will go up and increase will decrease gdp. AWhat would you expect to happen to the new equilibrium interest rate and quantity of loanable funds. Consumers and businesses hold money instead to calm their unease and reduce risk. Deficits decrease the supply of loanable funds. Secondly since people wants to convert their euros into a more secure currency supply of.

Source: slidetodoc.com

Source: slidetodoc.com

If decrease in tax the gdp will go up and increase will decrease gdp. The deficit increases the demand for loanable funds and shifts the demand curve to the right increasing the interest rate and crowding out investment spending. The most important factor responsible for the demand for loanable funds is the demand for investment. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out. The supply curve is upward sloping because as the interest rate increases people will want to save more.

Source: khanacademy.org

Source: khanacademy.org

So the sign of the deflator depends on which direction the taxes are going. The crowding out effect occurs when a government runs a budget deficit and as a result causes a decrease in private investment spending. Higher interest rates and greater saving. If decrease in tax the gdp will go up and increase will decrease gdp. Equilibrium in the loanable fund market.

The logic of this point of view is that if the government runs a deficit it has to borrow money just like everyone else. Changes in private savings and capital inflows shift the supply curve. The deficit decreases the demand for loanable funds and shifts the demand curve to the left decreasing the interest rate and crowding out investment spending. Crowding out in the loanable funds market. Secondly since people wants to convert their euros into a more secure currency supply of.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

The demand for loanable funds is based on borrowing. The deficit increases the demand for loanable funds and shifts the demand curve to the right increasing the interest rate and crowding out investment spending. The most important factor responsible for the demand for loanable funds is the demand for investment. So an increase in expected inflation will have the effect of increasing the nominal interest rate and nothing else. Changes in private savings and capital inflows shift the supply curve.

Source: econ101help.com

Source: econ101help.com

This will affect both the market for loanable funds and the market for foreign currency exchange. Economy the nations monetary and credit system is regulated and strongly influenced by the central bank the Federal Reserve. The higher the interest rate the greater the cost of paying it back. The deficit decreases the demand for loanable funds and shifts the demand curve to the left decreasing the interest rate and crowding out investment spending. Deficits increase the demand for loanable funds.

First it will increase the demand for loanable funds in order to increase the purchase of assets overseas shifting the demand curve D LF to the right increasing the real interest rate. Lets say that the government decides to increase government purchases which will increase the demand for loanable funds. The deficit increases the demand for loanable funds and shifts the demand curve to the right increasing the interest rate and crowding out investment spending. What affects the loanable funds market. An equilibrium in the loanable fund market occurs when demand equals supply for loanable funds.

Source: slidetodoc.com

Source: slidetodoc.com

The demand schedule for loanable funds is drawn with respect to their price. The most important factor responsible for the demand for loanable funds is the demand for investment. The demand schedule for loanable funds is drawn with respect to their price. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out. As the interest rate falls the quantity of loanable funds demanded decreasesincreases.

Source: econowaugh.blogspot.com

Source: econowaugh.blogspot.com

Deficits increase the demand for loanable funds. If there is an increase in savings by the private sector the supply of loanable funds increases shifts right causing the real interest rate to fall. Higher interest rates and greater saving. The price of loanable funds is the nominal interest rate. This will affect both the market for loanable funds and the market for foreign currency exchange.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

Surpluses decrease the demand for loanable funds. Money makes the biggest difference for the loanable funds market. When taxes are reduced loanable fund market become active since investors feel they have opportunity to make profits. The gdp deflator is negatively correlated with tax. When the government borrows money this results in an increase in the demand for loanable funds as shown in this graph.

Source: slideplayer.com

Source: slideplayer.com

The price of loanable funds is the nominal interest rate. Economy the nations monetary and credit system is regulated and strongly influenced by the central bank the Federal Reserve. An equilibrium in the loanable fund market occurs when demand equals supply for loanable funds. Changes in perceived business opportunities and in government borrowing shift the demand curve for loanable funds. This rise in savings shifts the supply curve for loanable funds rightward and reducing the equilibrium interest rate in the loanable funds market.

Source: slidetodoc.com

Source: slidetodoc.com

An equilibrium in the loanable fund market occurs when demand equals supply for loanable funds. The loanable funds market shows the relationship between the real interest rate and quantity of loanable funds. First it will increase the demand for loanable funds in order to increase the purchase of assets overseas shifting the demand curve D LF to the right increasing the real interest rate. Deficits decrease the supply of loanable funds. Consumers and businesses hold money instead to calm their unease and reduce risk.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Changes in private savings and capital inflows shift the supply curve. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out. The demand for loanable funds is based on borrowing. Economy the nations monetary and credit system is regulated and strongly influenced by the central bank the Federal Reserve. The supply curve is upward sloping because as the interest rate increases people will want to save more.

Source: slideplayer.com

Source: slideplayer.com

The ability to affect the money market the national bank may engage in open market operations to bring interest rates back up to pre-shock levels. A change in the demand for capital affects the demand for loanable funds and hence the interest rate in the loanable funds market. As the interest rate falls the quantity of loanable funds demanded decreasesincreases. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out. The deficit increases the demand for loanable funds and shifts the demand curve to the right increasing the interest rate and crowding out investment spending.

As the interest rate falls the quantity of loanable funds demanded decreasesincreases. So when interest rates rise the demand for loanable funds decreases. The deficit decreases the demand for loanable funds and shifts the demand curve to the left decreasing the interest rate and crowding out investment spending. This rise in savings shifts the supply curve for loanable funds rightward and reducing the equilibrium interest rate in the loanable funds market. The interaction between the supply of savings and the demand for loans determines the real interest rate and how much is loaned out.

Changes in perceived business opportunities and in government borrowing shift the demand curve for loanable funds. Economy the nations monetary and credit system is regulated and strongly influenced by the central bank the Federal Reserve. A change in the demand for capital affects the demand for loanable funds and hence the interest rate in the loanable funds market. How is this rationalized. This will affect both the market for loanable funds and the market for foreign currency exchange.

Source: freeeconhelp.com

Source: freeeconhelp.com

When a change in the supply of money leads to a change in the interest rate the resulting change in real GDP causes the supply of loanable funds to change as well. The Loanable Funds Market. So an increase in expected inflation will have the effect of increasing the nominal interest rate and nothing else. To bring interest rates back up the government must engage in. The deficit increases the demand for loanable funds and shifts the demand curve to the right increasing the interest rate and crowding out investment spending.

The demand schedule for loanable funds is drawn with respect to their price. When demand for investment decreases quantity quantity of loanable funds decreases and real interest rate decreases. There is one very important addition to the group of those who supply credit in the loanable funds model. Surpluses decrease the demand for loanable funds. A change in the interest rate in turn affects the quantity of capital demanded on any demand curve.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

There is one very important addition to the group of those who supply credit in the loanable funds model. If a change in the tax laws encouraged greater investment the result would be. With a decrease in government spending your demand curve for the loan-able funds market will shift inward and push the interest rate lower. AWhat would you expect to happen to the new equilibrium interest rate and quantity of loanable funds. Changes in private savings and capital inflows shift the supply curve.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what affects the loanable funds market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.