Your Taxes on supply and demand curve images are ready in this website. Taxes on supply and demand curve are a topic that is being searched for and liked by netizens today. You can Find and Download the Taxes on supply and demand curve files here. Download all free photos.

If you’re looking for taxes on supply and demand curve pictures information related to the taxes on supply and demand curve keyword, you have visit the ideal site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

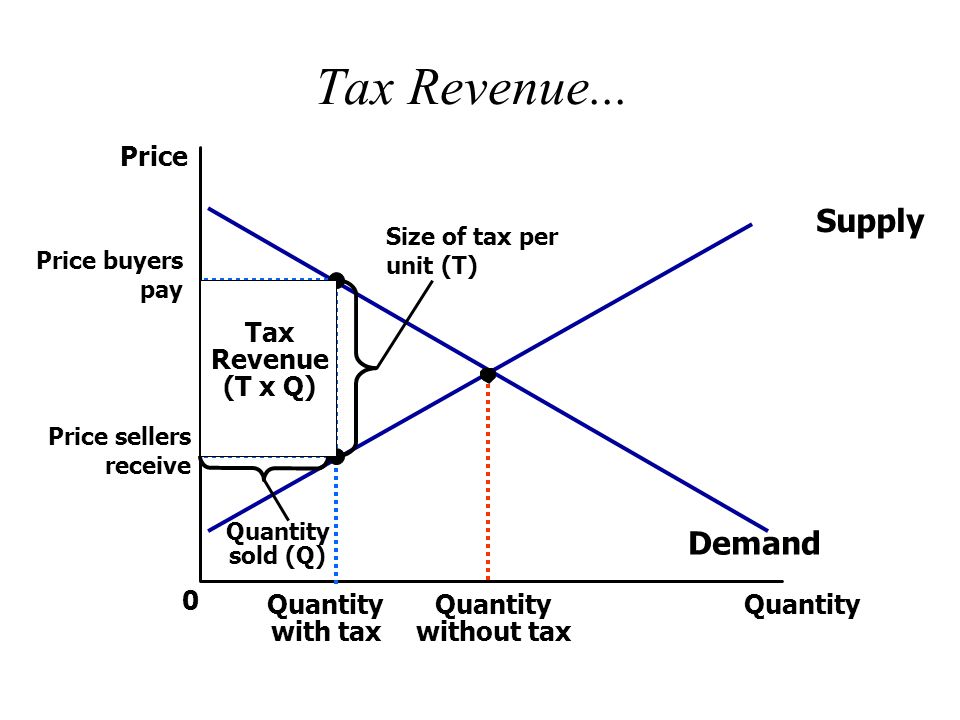

Taxes On Supply And Demand Curve. Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. 430 demonstrates the sharing of the burden of a sales tax between buyers and sellers. Taxation shifts a supply curve to the left.

As shown above the equilibrium price will rise and the equilibrium quantity will fall. Excise Tax Imposed on Producers. Tax increases do not affect the demand curve nor do they increase supply or demand more or less. We can use these linear demand and supply curves to calculate the effect of a 50 cents per gallon tax. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost times the new value of the multiplier. A tax on buyers is thought to shift the demand curve to the leftreduce consumer demandbecause the price of goods relative to their value to consumers has gone up.

The demand curve because of the tax t.

The following graph shows the annual supply and demand for this good as well as the supply curve shifted up by the amount of the proposed tax 100 per phone. Excise Tax Imposed on Producers. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Im just making it instead of a percentage Im just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price. It is also the amount the demand curve shifts from D 0 to D 1.

What ends up getting passed is a tax of 10 per vial. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Government subsidies reduce the cost of production and increase supply at.

Source: pinterest.com

Source: pinterest.com

And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. Similarly the price the seller obtains falls but by less than the tax. At a given level of demand taxations reduction of incentives will result in a decrease in the production of goods or services. Similarly the price the seller obtains falls but by less than the tax. Government subsidies reduce the cost of production and increase supply at.

Source: pinterest.com

Source: pinterest.com

Also does excise tax increase or decrease supply. 430a we have drawn a perfectly elastic demand curve D and a normal-shaped supply curve S. From the firms perspective taxes or regulations are an additional cost of production that shifts supply to the left leading the firm to produce a lower quantity at every given price. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Rewrite the demand and supply equation as P 20 Q and P Q3.

Source: in.pinterest.com

Source: in.pinterest.com

And similarly that point of intersection also tells us our quantity with the taxes. Government subsidies reduce the cost of production and increase supply at. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. For simplicity Figure 510 omits the shift in the supply curve. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices.

Source: in.pinterest.com

Source: in.pinterest.com

And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices. 125 125 from each sold kilogram of potatoes. If a new tax is enacted the demand curve may be expected to shift depending on the tax. Im just making it instead of a percentage Im just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price.

Source: in.pinterest.com

Source: in.pinterest.com

The following graph shows the annual supply and demand for this good as well as the supply curve shifted up by the amount of the proposed tax 100 per phone. Taxes are among the market and regulatory conditions that define the demand curve. A tax increases the price a buyer pays by less than the tax. The following graph shows the annual supply and demand for this good as well as the supply curve shifted up by the amount of the proposed tax 100 per phone. The demand curve is the graphed curve demonstrating customers purchases.

Source: slideplayer.com

Source: slideplayer.com

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. A subsidy is an amount of money given directly to firms by the government to. Intersection of these two curves define equilibrium price and equilibrium quantities prior to the imposition of sales tax. Im just making it instead of a percentage Im just doing it as a fixed amount so that we get kind of a fixed shift in terms of the perceived supply price. The following graph shows the annual supply and demand for this good as well as the supply curve shifted up by the amount of the proposed tax 100 per phone.

Source: economicshelp.org

Source: economicshelp.org

At a given level of demand taxations reduction of incentives will result in a decrease in the production of goods or services. When costs of production increase the business will decrease its supply of the item. Rewrite the demand and supply equation as P 20 Q and P Q3. And similarly that point of intersection also tells us our quantity with the taxes. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

Source: pinterest.com

Source: pinterest.com

Since a tax can be viewed as raising the costs of production this could also be represented by a leftward shift of the supply curve where the new supply curve would intercept the demand at the new quantity Qt. 125 125 from each sold kilogram of potatoes. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. The demand curve because of the tax t. Taxes are among the market and regulatory conditions that define the demand curve.

Source: pinterest.com

Source: pinterest.com

Taxation shifts a supply curve to the left. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Thats where the existing demand curve intersects with this new shifted supply with tax curve. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. First we write the four conditions that must hold as given by equations 91a-d.

It is illustrated as the supply curve shifts from S 0 to S 1. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. A tax increases the price a buyer pays by less than the tax. Excise Tax Imposed on Producers. Also does excise tax increase or decrease supply.

Source: pinterest.com

Source: pinterest.com

A tax increase does not affect the demand curve nor does it make supply or demand more or less elastic. A subsidy is an amount of money given directly to firms by the government to. A tax increases the price a buyer pays by less than the tax. How do subsidies generally affect the supply curve Why. Shifts from D to D.

Source: researchgate.net

Source: researchgate.net

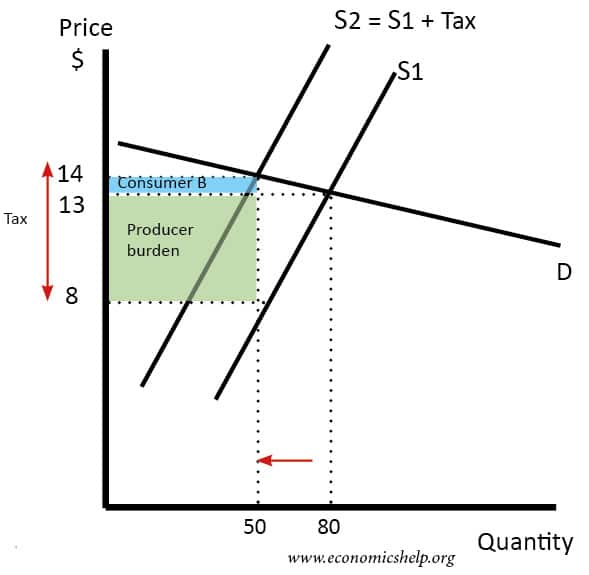

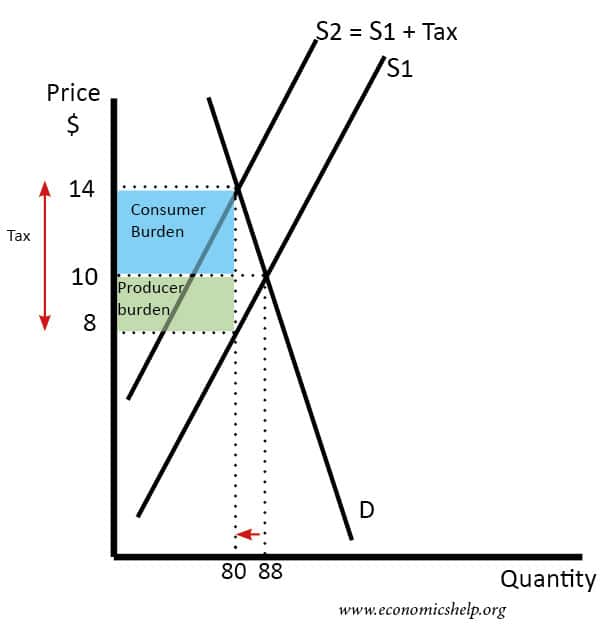

What ends up getting passed is a tax of 10 per vial. If excise tax is imposed on the producer the supplier will provide less quantity of Good A. On the following graph do for smartphones the same thing you did previously on the graph for leather jackets. QD 150 - 50Pb Demand QS 60 40Ps. The pre-tax elasticity of demand and supply are calculated below.

Government subsidies reduce the cost of production and increase supply at. The demand curve because of the tax t. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. If excise tax is imposed on the producer the supplier will provide less quantity of Good A. In the model of aggregate demand and aggregate supply a tax rate increase will shift the aggregate demand curve to the left by an amount equal to the initial change in aggregate expenditures induced by the tax rate boost times the new value of the multiplier.

Source: pinterest.com

Source: pinterest.com

How do you calculate tax on supply and demand curve. The demand curve is the graphed curve demonstrating customers purchases. 125 125 from each sold kilogram of potatoes. When costs of production increase the business will decrease its supply of the item. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12.

Source: pinterest.com

Source: pinterest.com

Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. The pre-tax elasticity of demand and supply are calculated below. A tax increase does not affect the demand curve nor does it make supply or demand more or less elastic. Since a tax can be viewed as raising the costs of production this could also be represented by a leftward shift of the supply curve where the new supply curve would intercept the demand at the new quantity Qt. Instead suppose the government taxes smartphones.

Source: economicshelp.org

Source: economicshelp.org

A tax increase does not affect the demand curve nor does it make supply or demand more or less elastic. Similarly the price the seller obtains falls but by less than the tax. The pre-tax elasticity of demand and supply are calculated below. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A. From the firms perspective taxes or regulations are an additional cost of production that shifts supply to the left leading the firm to produce a lower quantity at every given price.

Source: tr.pinterest.com

Source: tr.pinterest.com

Now now that weve understood everything or hopefully we have lets think about the various surpluses and the deadly weight losses and the tax revenues. The following graph shows the annual supply and demand for this good as well as the supply curve shifted up by the amount of the proposed tax 100 per phone. When costs of production increase the business will decrease its supply of the item. A tax increases the price a buyer pays by less than the tax. Shifts from D to D.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title taxes on supply and demand curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.