Your Tax suppply and tax demand images are ready. Tax suppply and tax demand are a topic that is being searched for and liked by netizens today. You can Download the Tax suppply and tax demand files here. Get all free images.

If you’re looking for tax suppply and tax demand pictures information connected with to the tax suppply and tax demand topic, you have visit the ideal site. Our site always gives you suggestions for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

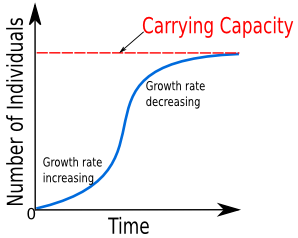

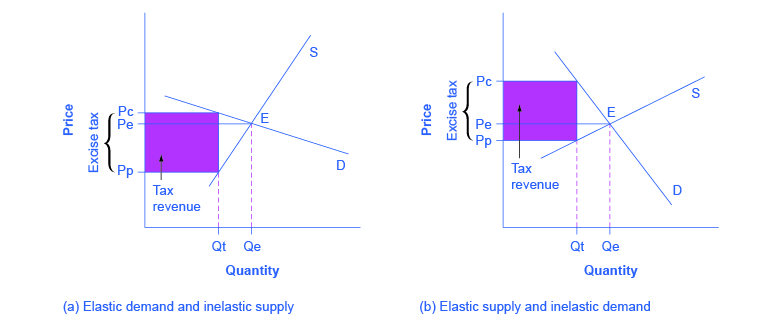

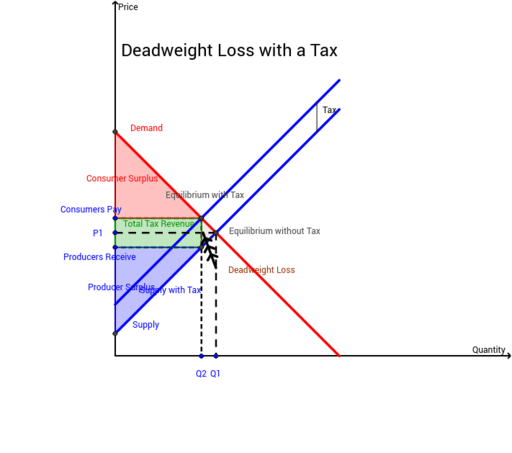

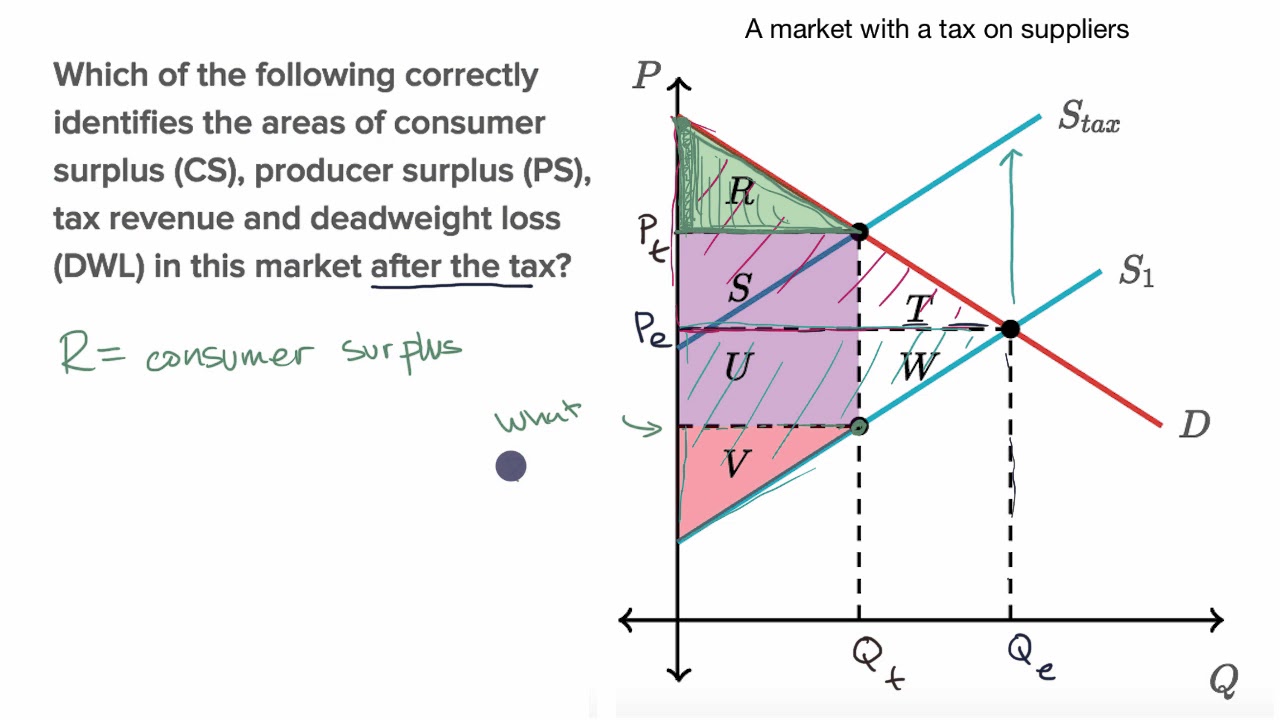

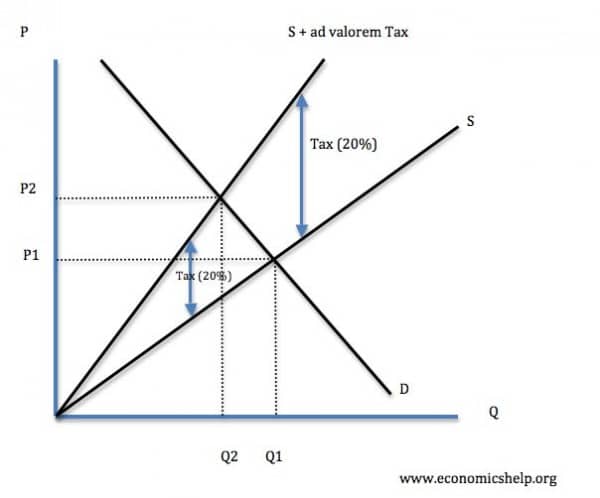

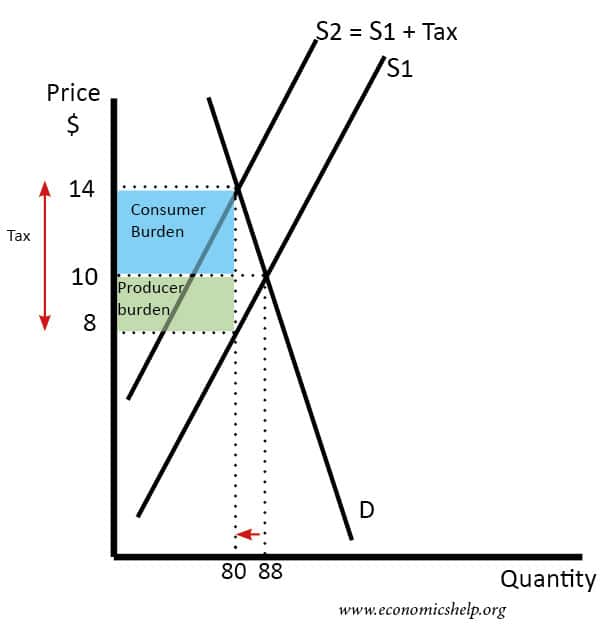

Tax Suppply And Tax Demand. So the demand schedule is not affected only supply. Most corporation tax revenue comes from the taxable profits of limited companies after taking account deductions and allowances. The tax incidence depends on the relative price elasticity of supply and demand. Now now that weve understood everything or hopefully we have lets think about the various surpluses and the deadly weight losses and the tax revenues.

From pinterest.com

From pinterest.com

As a postdoc you will be part of an international Dutch-Indonesian team that will investigate practices of inclusive and collaborative governance in slum areas and work. Since the tax is fixed per unit sold and not a percentage charge then the slope of the supply curve should not change. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. Tax revenue is larger the more inelastic the demand and supply are. Corporation tax was the fourth largest tax in 2018 raising 60 billion for the government.

When supply is more elastic than demand buyers bear most of the tax burden.

Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. This video goes over some brief examples showing how a tax on sellers and then a tax on consumers will affect the efficient equilibrium in a supply and deman. The tax paid by the consumer is. In the graph above the total tax paid by the producer and the consumer is equal to P 0 P 2. When demand is more elastic than supply producers bear most of the cost of the tax. The distinction between demand-side and supply-side tax cuts is important.

Source: pinterest.com

Source: pinterest.com

Therefore what remains is an upwards shift that will lead to increased. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. Thats where the existing demand curve intersects with this new shifted supply with tax curve. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. - Now the same good actually requires buyers to pay 125 times the price.

Source: khanacademy.org

Source: khanacademy.org

When supply is more elastic than demand buyers bear most of the tax burden. Now we should express the price P without taxation through the new price level P_1 when the. If the tax is imposed on the suppliers then the prices will be the same. The relative effect on buyers and sellers is known as the incidence of the tax. Most corporation tax revenue comes from the taxable profits of limited companies after taking account deductions and allowances.

Source: pinterest.com

Source: pinterest.com

A tax causes consumer surplus and producer surplus profit to fall. If the supply curve is relatively flat the supply is price elastic. It is inadequate to address the projected consequences of a proposed tax cut utilizing demand-side logic when a supply. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. Also Know does tax affect supply or demand.

Source: geogebra.org

Source: geogebra.org

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. So the demand schedule is not affected only supply. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall.

Source: youtube.com

Source: youtube.com

The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Corporation tax was the fourth largest tax in 2018 raising 60 billion for the government. Implementing dismalscience comment suggestion the unit tax burdens the suppliers. In the graph above the total tax paid by the producer and the consumer is equal to P 0 P 2. Most corporation tax revenue comes from the taxable profits of limited companies after taking account deductions and allowances.

Source: pinterest.com

Source: pinterest.com

Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. The main rate of corporation tax in the UK is 19. The tax paid by the consumer is. The distinction between demand-side and supply-side tax cuts is important. The main corporation tax rate is being lowered to 17 in April 2020.

Source: pinterest.com

Source: pinterest.com

The tax paid by the consumer is. It is inadequate to address the projected consequences of a proposed tax cut utilizing demand-side logic when a supply. The main corporation tax rate is being lowered to 17 in April 2020. When demand is more elastic than supply producers bear most of the cost of the tax. The tax incidence depends on the relative price elasticity of supply and demand.

- Proportional taxes work the same as per unit taxes except that you now multiply instead of addsubtract in relation to P - If the government imposed a 25 proportional tax on buyers what happens to demand. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Therefore what remains is an upwards shift that will lead to increased. As a postdoc you will be part of an international Dutch-Indonesian team that will investigate practices of inclusive and collaborative governance in slum areas and work. As sales tax causes the supply curve to shift inward it has a secondary effect on the equilibrium price for a product.

Source: pinterest.com

Source: pinterest.com

When the tax is imposed the price that the buyer pays must exceed. Since the tax is fixed per unit sold and not a percentage charge then the slope of the supply curve should not change. The relative effect on buyers and sellers is known as the incidence of the tax. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. The consumers will still pay P and the suppliers will pay the tax thus receiving P.

Source: economicshelp.org

Source: economicshelp.org

The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. Most corporation tax revenue comes from the taxable profits of limited companies after taking account deductions and allowances. - Now the same good actually requires buyers to pay 125 times the price. The quantity traded before a tax was imposed was q B. The tax paid by the consumer is.

Source: in.pinterest.com

Source: in.pinterest.com

The main corporation tax rate is being lowered to 17 in April 2020. Qd 20-2125P 20-25P. - Now the same good actually requires buyers to pay 125 times the price. The tax paid by the consumer is. Implementing dismalscience comment suggestion the unit tax burdens the suppliers.

The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. Indonesian cities are facing both societal and ecological challenges especially in slum areas. The tax revenue is given by the shaded area which is obtained by multiplying the tax per unit by the total quantity sold Qt. Postdoctoral Researcher on Inclusive Governance for Resilient Indonesian Slums. Tax revenue is larger the more inelastic the demand and supply are.

Source: pinterest.com

Source: pinterest.com

Qd 20-2125P 20-25P. In the case of an indirect tax we need to modify our function of supply since the tax is collected from the sellers the demand function will not change. And similarly that point of intersection also tells us our quantity with the taxes. If the supply curve is relatively flat the supply is price elastic. Implementing dismalscience comment suggestion the unit tax burdens the suppliers.

Source: economicshelp.org

Source: economicshelp.org

A tax increases the price a buyer pays by less than the tax. The tax revenue is given by the shaded area which is obtained by multiplying the tax per unit by the total quantity sold Qt. The tax paid by the consumer is. Indonesian cities are facing both societal and ecological challenges especially in slum areas. If the tax is imposed on the suppliers then the prices will be the same.

Source: pinterest.com

Source: pinterest.com

If a demand curve is relatively steep the demand is price inelastic. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. Indonesian cities are facing both societal and ecological challenges especially in slum areas.

Source: economicshelp.org

Source: economicshelp.org

AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Tax revenue is larger the more inelastic the demand and supply are. The quantity traded before a tax was imposed was q B. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. It is inadequate to address the projected consequences of a proposed tax cut utilizing demand-side logic when a supply.

Tax increases do not affect the demand curve nor do they increase supply or demand more or less. A tax increases the price a buyer pays by less than the tax. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. A tax causes consumer surplus and producer surplus profit to fall. Tax revenue is larger the more inelastic the demand and supply are.

Source: pinterest.com

Source: pinterest.com

Now we should express the price P without taxation through the new price level P_1 when the. A tax causes consumer surplus and producer surplus profit to fall. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. As a postdoc you will be part of an international Dutch-Indonesian team that will investigate practices of inclusive and collaborative governance in slum areas and work.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax suppply and tax demand by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.