Your Tax revenue supply and demand graph images are available in this site. Tax revenue supply and demand graph are a topic that is being searched for and liked by netizens today. You can Download the Tax revenue supply and demand graph files here. Find and Download all free photos and vectors.

If you’re searching for tax revenue supply and demand graph images information related to the tax revenue supply and demand graph topic, you have visit the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

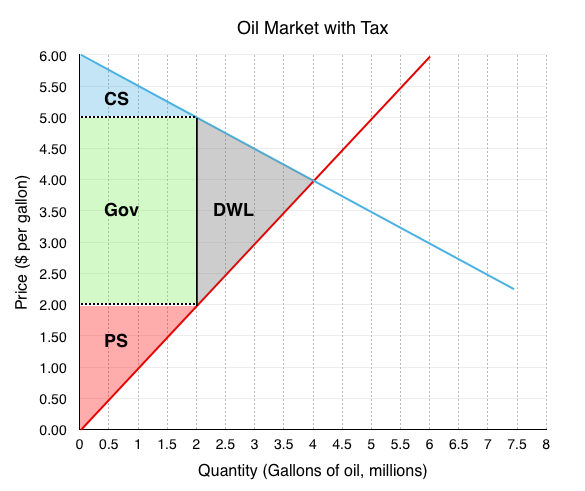

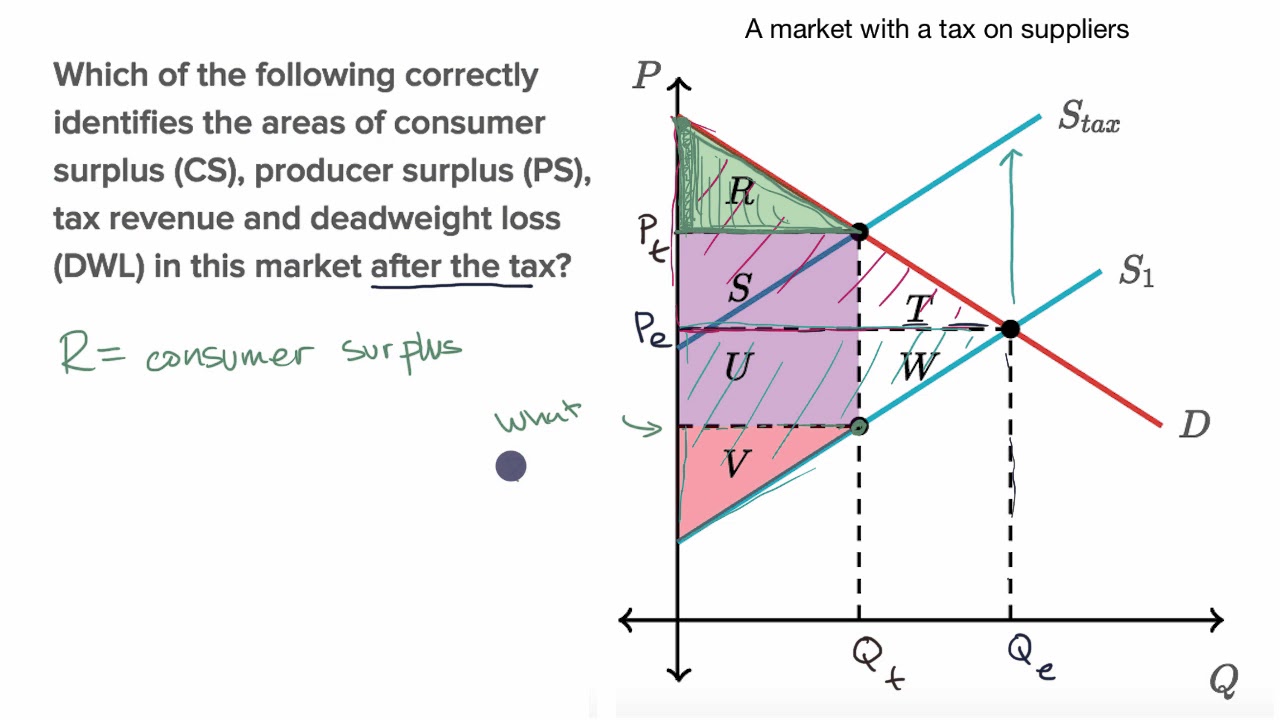

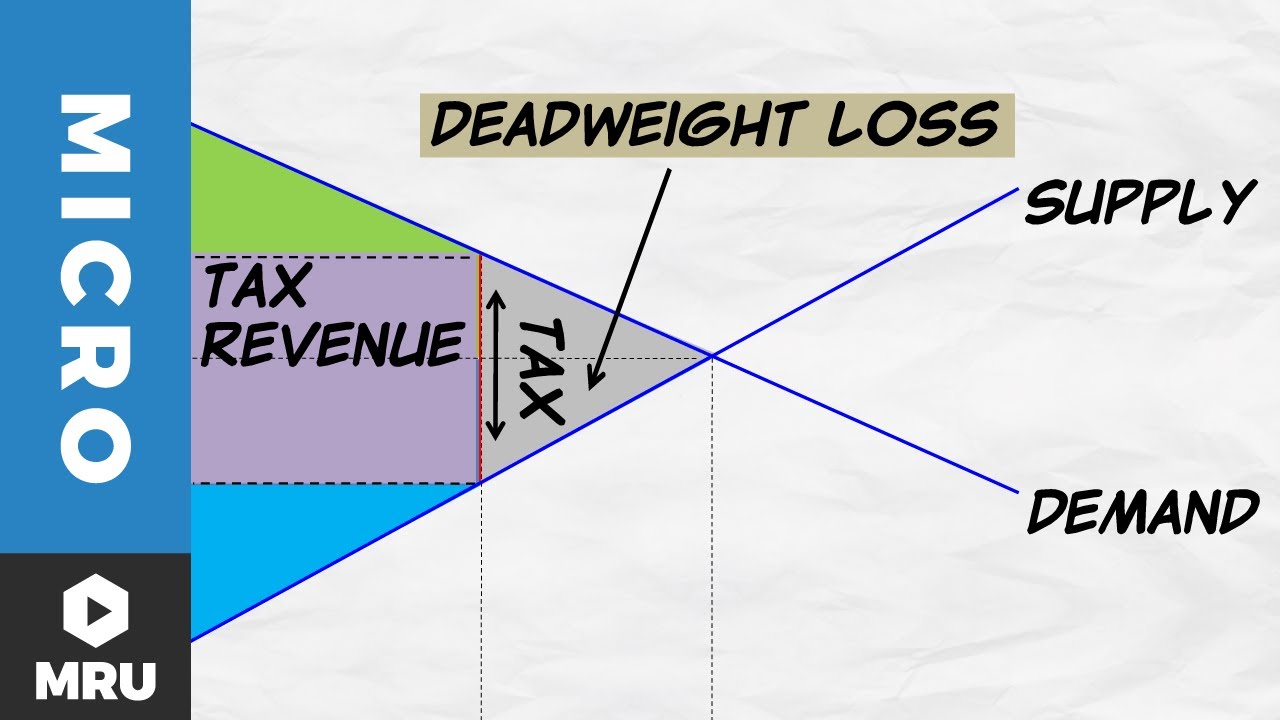

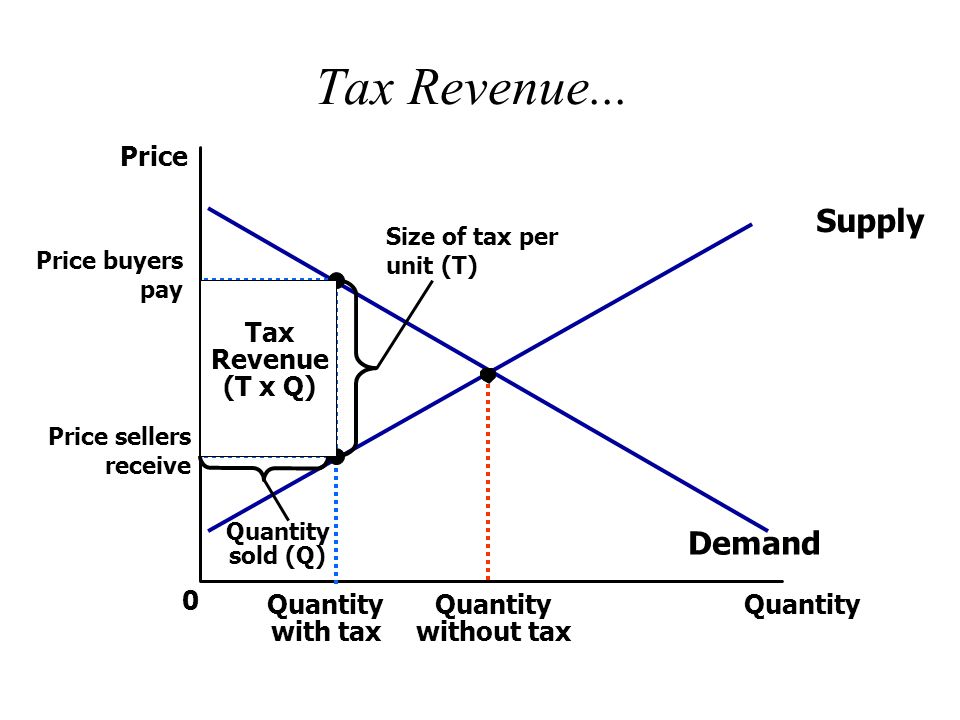

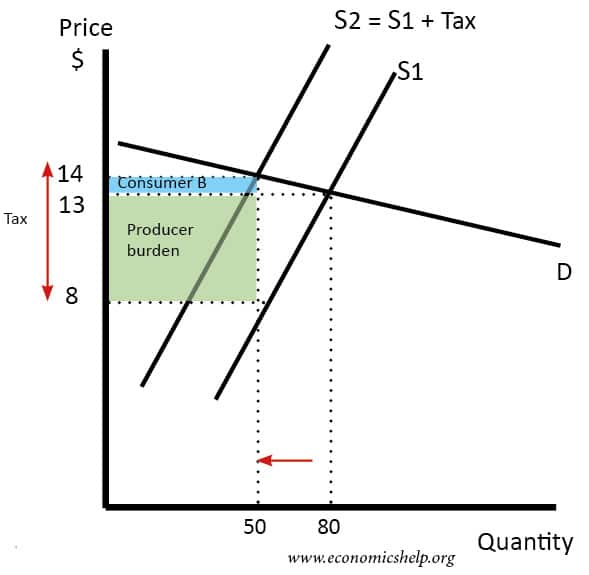

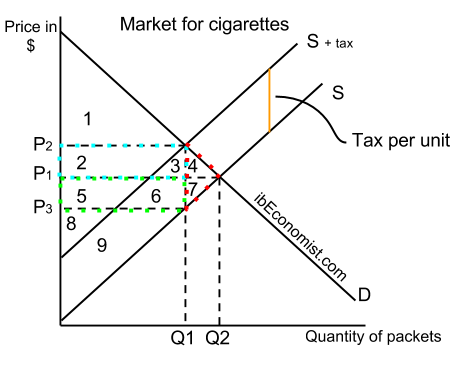

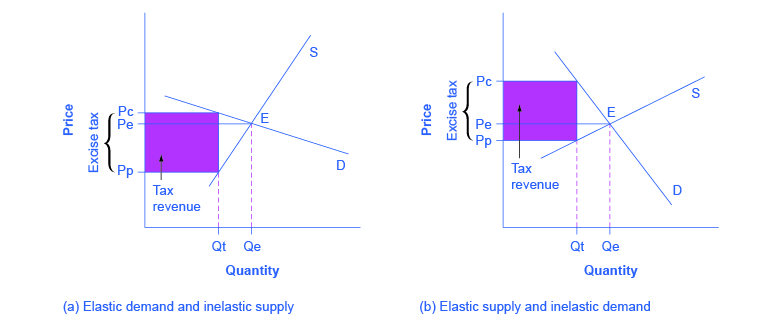

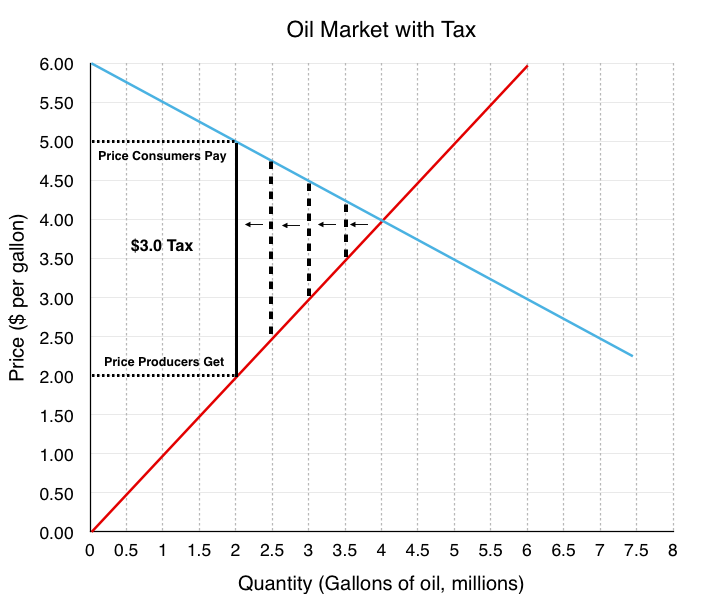

Tax Revenue Supply And Demand Graph. Drp Dp - Sop Demand function and total revenue. Tax revenue is represented by the area of the rectangle between the supply and demand curves. As David Ricardo a British economist in the 19th century said Taxes on luxuries have some advantage over taxes on. If the demand curve is linear then it has the form.

Excise Tax From ingrimayne.com

Excise Tax From ingrimayne.com

The residual demand curve is the market demand curve Dp minus the supply of other organizations Sop. Tax revenue is represented by the area of the rectangle between the supply and demand curves. Section 116511e of the Income Tax Regulations requires a taxpayer to make the 165i election by filing a return an amended return or a refund claim on or before the later of. When a low tax is levied tax revenue is relatively small. The varying deadweight loss from a tax also affects the governments total tax revenue. Server products revenue increased 6 due to continued demand for premium versions and hybrid solutions GitHub and demand ahead of end-of-support for SQL Server 2008 and Windows Server 2008.

Enterprise Services revenue increased 278 million or 5 driven by growth in Premier Support Services and Microsoft Consulting Services.

The intuition behind shifts in demand and supply are a bit different in the labor market vs. An increase in the tax of an inelastic good would increase the total revenue because there would be no real change in the demand for the good despite the tax increase. They are based on the belief that higher rates of production will lead to higher rates of economic growth. A short summary of this paper. As the size of the tax increases tax revenue expands. The residual demand curve is the market demand curve Dp minus the supply of other organizations Sop.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

When a low tax is levied tax revenue is relatively small. A short summary of this paper. Full PDF Package Download Full PDF Package. Drp Dp - Sop Demand function and total revenue. They are based on the belief that higher rates of production will lead to higher rates of economic growth.

Source: youtube.com

Source: youtube.com

1 the due date of the taxpayers income tax return determined without regard to any extension of time for filing the return for the taxable year in which. P a - bq where p is the. Supply Side Economics involves policies aimed at increasing aggregate supply AS a shift from left to right. Matching Supply with Demand An Introduction to Operations. Full PDF Package Download Full PDF Package.

Source: slidetodoc.com

Source: slidetodoc.com

When a low tax is levied tax revenue is relatively small. This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market. Matching Supply with Demand An Introduction to Operations. A short summary of this paper. As David Ricardo a British economist in the 19th century said Taxes on luxuries have some advantage over taxes on.

Section 116511e of the Income Tax Regulations requires a taxpayer to make the 165i election by filing a return an amended return or a refund claim on or before the later of. They are based on the belief that higher rates of production will lead to higher rates of economic growth. The varying deadweight loss from a tax also affects the governments total tax revenue. As David Ricardo a British economist in the 19th century said Taxes on luxuries have some advantage over taxes on. They are aimed at enhancing the productive capacities of an economy by fostering what they view as a better business climate via deregulation and tax.

Source: youtube.com

Source: youtube.com

Full PDF Package Download Full PDF Package. The intuition behind shifts in demand and supply are a bit different in the labor market vs. Enterprise Services revenue increased 278 million or 5 driven by growth in Premier Support Services and Microsoft Consulting Services. When a low tax is levied tax revenue is relatively small. Supply Side Economics involves policies aimed at increasing aggregate supply AS a shift from left to right.

Source: slideplayer.com

Source: slideplayer.com

Section 116511e of the Income Tax Regulations requires a taxpayer to make the 165i election by filing a return an amended return or a refund claim on or before the later of. 6 Full PDFs related to this paper. The varying deadweight loss from a tax also affects the governments total tax revenue. When a low tax is levied tax revenue is relatively small. This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market.

Source: economicshelp.org

Source: economicshelp.org

If the demand curve is linear then it has the form. Server products revenue increased 6 due to continued demand for premium versions and hybrid solutions GitHub and demand ahead of end-of-support for SQL Server 2008 and Windows Server 2008. As David Ricardo a British economist in the 19th century said Taxes on luxuries have some advantage over taxes on. They are aimed at enhancing the productive capacities of an economy by fostering what they view as a better business climate via deregulation and tax. A short summary of this paper.

Source: instructables.com

Source: instructables.com

Server products revenue increased 6 due to continued demand for premium versions and hybrid solutions GitHub and demand ahead of end-of-support for SQL Server 2008 and Windows Server 2008. Drp Dp - Sop Demand function and total revenue. An increase in the tax of an inelastic good would increase the total revenue because there would be no real change in the demand for the good despite the tax increase. P a - bq where p is the. They are aimed at enhancing the productive capacities of an economy by fostering what they view as a better business climate via deregulation and tax.

Source: khanacademy.org

Source: khanacademy.org

They are based on the belief that higher rates of production will lead to higher rates of economic growth. A short summary of this paper. Shifts in the traditional goods and services market. As David Ricardo a British economist in the 19th century said Taxes on luxuries have some advantage over taxes on. Section 116511e of the Income Tax Regulations requires a taxpayer to make the 165i election by filing a return an amended return or a refund claim on or before the later of.

Source: researchgate.net

Source: researchgate.net

Enterprise Services revenue increased 278 million or 5 driven by growth in Premier Support Services and Microsoft Consulting Services. They are based on the belief that higher rates of production will lead to higher rates of economic growth. When a low tax is levied tax revenue is relatively small. If the demand curve is linear then it has the form. A short summary of this paper.

This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market. Enterprise Services revenue increased 278 million or 5 driven by growth in Premier Support Services and Microsoft Consulting Services. This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market. 1 the due date of the taxpayers income tax return determined without regard to any extension of time for filing the return for the taxable year in which. Drp Dp - Sop Demand function and total revenue.

Drp Dp - Sop Demand function and total revenue. The residual demand curve is the market demand curve Dp minus the supply of other organizations Sop. As the size of the tax increases tax revenue expands. P a - bq where p is the. Supply Side Economics involves policies aimed at increasing aggregate supply AS a shift from left to right.

Source: instructables.com

Source: instructables.com

Server products revenue increased 6 due to continued demand for premium versions and hybrid solutions GitHub and demand ahead of end-of-support for SQL Server 2008 and Windows Server 2008. P a - bq where p is the. 1 the due date of the taxpayers income tax return determined without regard to any extension of time for filing the return for the taxable year in which. They are based on the belief that higher rates of production will lead to higher rates of economic growth. Drp Dp - Sop Demand function and total revenue.

Source: ibeconomist.com

Source: ibeconomist.com

Shifts in the traditional goods and services market. As the size of the tax increases tax revenue expands. The intuition behind shifts in demand and supply are a bit different in the labor market vs. 1 the due date of the taxpayers income tax return determined without regard to any extension of time for filing the return for the taxable year in which. This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market.

Source: instructables.com

Source: instructables.com

As the size of the tax increases tax revenue expands. Matching Supply with Demand An Introduction to Operations. When a low tax is levied tax revenue is relatively small. Supply Side Economics involves policies aimed at increasing aggregate supply AS a shift from left to right. Tax revenue is represented by the area of the rectangle between the supply and demand curves.

Source: khanacademy.org

Source: khanacademy.org

When a low tax is levied tax revenue is relatively small. If the demand curve is linear then it has the form. Shifts in the traditional goods and services market. Tax revenue is represented by the area of the rectangle between the supply and demand curves. Enterprise Services revenue increased 278 million or 5 driven by growth in Premier Support Services and Microsoft Consulting Services.

Source: atlas101.ca

Source: atlas101.ca

The residual demand curve is the market demand curve Dp minus the supply of other organizations Sop. Supply Side Economics involves policies aimed at increasing aggregate supply AS a shift from left to right. P a - bq where p is the. The residual demand curve is the market demand curve Dp minus the supply of other organizations Sop. When a low tax is levied tax revenue is relatively small.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

Drp Dp - Sop Demand function and total revenue. This post will go over the effect of an income tax on the labor market and discuss some ways to help develop the intuition of why this is important in the labor market. Tax revenue is represented by the area of the rectangle between the supply and demand curves. 6 Full PDFs related to this paper. A short summary of this paper.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax revenue supply and demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.