Your Supply and demand diagram with tax images are available in this site. Supply and demand diagram with tax are a topic that is being searched for and liked by netizens today. You can Get the Supply and demand diagram with tax files here. Find and Download all royalty-free photos.

If you’re searching for supply and demand diagram with tax pictures information connected with to the supply and demand diagram with tax interest, you have come to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Supply And Demand Diagram With Tax. - a wedge driven between the demand curve. Supply Demand and Government Policies Review Questions Using supply-demand diagrams show the difference between a non-binding price ceiling and a binding price ceiling in the wheat market. Use the diagram to find out the new equilibrium price and quantity. Supply and Demand Calculator.

Economics Of The Sugar Tax Economics Lessons Managerial Economics Teaching Economics From pinterest.com

Economics Of The Sugar Tax Economics Lessons Managerial Economics Teaching Economics From pinterest.com

Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. Since it doesnt matter whether a tax shifts the demand curve or the supply curve we can more easily draw a tax as. The Calculator helps calculating the market equilibrium given Supply and Demand curves. In a supply-and-demand diagram show how a tax on car buyers of 1000 per car affects the quantity of cars sold and the price of cars. - a wedge driven between the demand curve. Show the price paid by consumers the price received by producers and the quantity.

The interaction of producers and consumers for a particular good or service.

- a wedge driven between the demand curve and the supply curve to the left of the original market equilibrium. The tax aims to correct an undesirable or unsustainable market result by setting the external marginal cost of negative externalities at the same amount. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. Suppose the federal government requires beer drinkers to pay a 2 tax on each case of beer purchased. Economic costs include private costs and external costs. The diagrams representing a general demand and supply graph pre-tax and post tax equilibrium are posted in the explanation section.

Source: wikiwand.com

Source: wikiwand.com

Suppose the federal government requires beer drinkers to pay a 2 tax on each case of beer purchased. Economic costs include private costs and external costs. Income taxes will affect demand in the same way as changes in income did because they are essentially the same thing. In this diagram the supply curve shifts to the left. A 33-29 900-0.

Source: pinterest.com

Source: pinterest.com

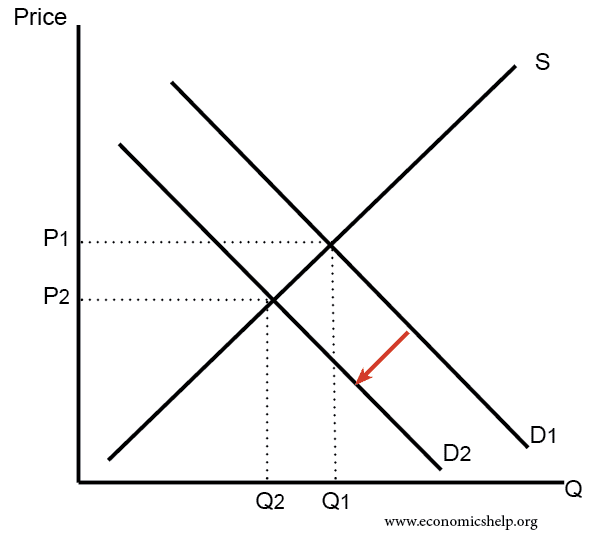

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The tax aims to correct an undesirable or unsustainable market result by setting the external marginal cost of negative externalities at the same amount. Indicate the consumer and producer surplus before the tax using colour may help - I would just outline the relevant areas rather than shading them. This causes price to increase from P1 to P1. Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax.

Source: pinterest.com

Source: pinterest.com

Income taxes will affect demand in the same way as changes in income did because they are essentially the same thing. Pigouvian Tax is a tax on any business operation that produces negative externalities. Draw a supply-and-demand diagram of the market for beer without the tax. Created by jrincayc for the purpose of illustrating the effect of taxes and subsidies on price. A diagram showing the effect of a per unit tax on the standard supply and demand diagram.

Source: pinterest.com

Source: pinterest.com

Suppose the federal government requires beer drinkers to pay a 2 tax on each case of beer purchased. The Calculator helps calculating the market equilibrium given Supply and Demand curves. - a wedge driven between the demand curve. Economic costs include private costs and external costs. In a supply-and-demand diagram show how a tax on car buyers of 1000 per car affects the quantity of cars sold and the price of cars.

Source: slideplayer.com

Source: slideplayer.com

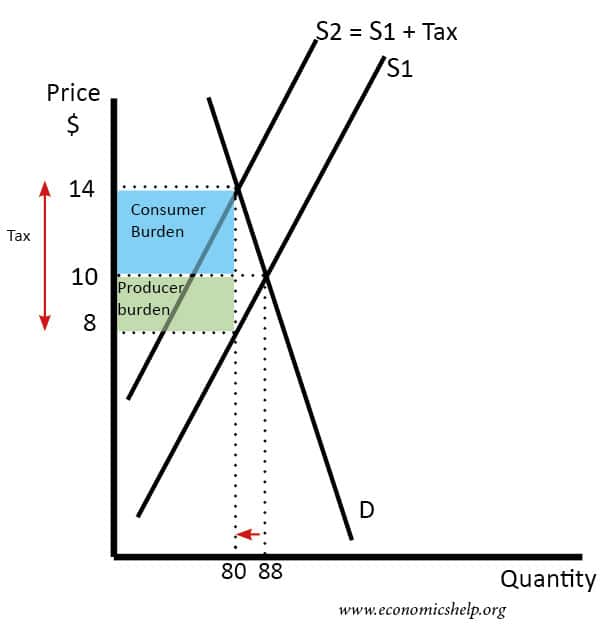

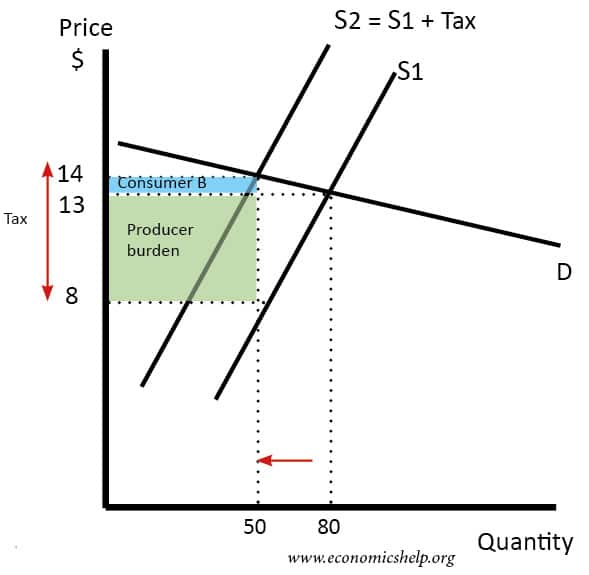

The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. A tax increases the price a buyer pays by less than the tax. In another diagram show how a tax on car sellers of 1000 per car affects the quantity of cars sold and the price of cars. Pigouvian Tax is a tax on any business operation that produces negative externalities.

Source: pinterest.com

Source: pinterest.com

It postulates that in a competitive market the unit price for a particular good or other traded item such as labor or liquid. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. This diagram shows a specific tax. - a wedge driven between the demand curve. The interaction of producers and consumers for a particular good or service.

- a wedge driven between the demand curve and the supply curve to the left of the original market equilibrium. Each of these changes in demand will be shown as a shift in the demand curve. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Pigouvian Tax is a tax on any business operation that produces negative externalities. The aggregate supply-aggregate demand diagram models a.

Source: pinterest.com

Source: pinterest.com

In 2016 the World Health Organization urged countries around the world to impose a tax on sugary drinks presenting research that showed just a 20 percent increase in soda prices would result in a proportionate reduction in their consumption. Pigouvian Tax is a tax on any business operation that produces negative externalities. Suppose the federal government requires beer drinkers to pay a 2 tax on each case of beer purchased. Supply Demand and Government Policies Review Questions Using supply-demand diagrams show the difference between a non-binding price ceiling and a binding price ceiling in the wheat market. Who benefits from a binding price ceiling.

Source: economicshelp.org

Source: economicshelp.org

Draw a supply-and-demand diagram of the market for beer without the tax. In 2016 the World Health Organization urged countries around the world to impose a tax on sugary drinks presenting research that showed just a 20 percent increase in soda prices would result in a proportionate reduction in their consumption. Supply Demand and Government Policies Review Questions Using supply-demand diagrams show the difference between a non-binding price ceiling and a binding price ceiling in the wheat market. As a result quantity decreases from Q1 to Q2 thus helping to reduce consumption as well as production of the goodservice. The Calculator helps calculating the market equilibrium given Supply and Demand curves.

Source: tr.pinterest.com

Source: tr.pinterest.com

Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax. In fact both the federal and state governments impose beer taxes of some sort a. Tax supply and demandsvg. - a wedge driven between the demand curve and the supply curve to the left of the original market equilibrium.

Source: pinterest.com

Source: pinterest.com

Tax supply and demandsvg. - a wedge driven between the demand curve. Actually the imposition of a tax upon a commodity causes the supply curve to move vertically upwards by the amount of the tax ie the distance AC in the diagram represents the amount of the tax in this case 10 paise. In microeconomics supply and demand is an economic model of price determination in a market. Created by jrincayc for the purpose of illustrating the effect of taxes and subsidies on price.

Source: economicshelp.org

Source: economicshelp.org

Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. Show the price paid by consumers the price received by producers and the quantity. A tax increases the price a buyer pays by less than the tax. Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. This causes price to increase from P1 to P1.

Source: pinterest.com

Source: pinterest.com

The aggregate supply-aggregate demand diagram models a. The Calculator helps calculating the market equilibrium given Supply and Demand curves. Supply Demand and Government Policies Review Questions Using supply-demand diagrams show the difference between a non-binding price ceiling and a binding price ceiling in the wheat market. Your instructor asks you to determine P_E and Q_E and plot the demand and supply curves if the government has imposed an indirect tax at a rate of 125 from each sold kilogram of potatoes. A 33-29 900-0.

Source: pinterest.com

Source: pinterest.com

Show the price paid by consumers the price received by producers and the quantity. In a supply-and-demand diagram show how a tax on car buyers of 1000 per car affects the quantity of cars sold and the price of cars. Actually the imposition of a tax upon a commodity causes the supply curve to move vertically upwards by the amount of the tax ie the distance AC in the diagram represents the amount of the tax in this case 10 paise. It is obvious that Q_D Q_S and we get. The specific tax increases production costs for the firm and therefore supply decreases from S1 to S1tax.

Source: pinterest.com

Source: pinterest.com

If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The diagrams should look like panels a and b of Figure 6-1 in the text. In this diagram supply and demand have shifted to the right. A tax increases the price a buyer pays by less than the tax. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher.

Source: pinterest.com

Source: pinterest.com

A diagram showing the effect of a per unit tax on the standard supply and demand diagram. 2 Calculate the Total Tax Revenue in this economy by finding the area of the rectangle border. Since it doesnt matter whether a tax shifts the demand curve or the supply curve we can more easily draw a tax as. As a result quantity decreases from Q1 to Q2 thus helping to reduce consumption as well as production of the goodservice. Show the price paid by consumers the price received by producers and the quantity.

Source: pinterest.com

Source: pinterest.com

The behavior of individual firms. In this diagram supply and demand have shifted to the right. - a wedge driven between the demand curve. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Tax supply and demandsvg.

Source: economicshelp.org

Source: economicshelp.org

While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. Similarly the price the seller obtains falls but by less than the tax. Use the diagram to find out the new equilibrium price and quantity. It leads to a higher price and fall in quantity demand. The result is shown in Fig.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand diagram with tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.