Your Supply and demand deadweight loss calculator images are ready. Supply and demand deadweight loss calculator are a topic that is being searched for and liked by netizens today. You can Download the Supply and demand deadweight loss calculator files here. Get all free images.

If you’re searching for supply and demand deadweight loss calculator pictures information linked to the supply and demand deadweight loss calculator keyword, you have come to the right site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

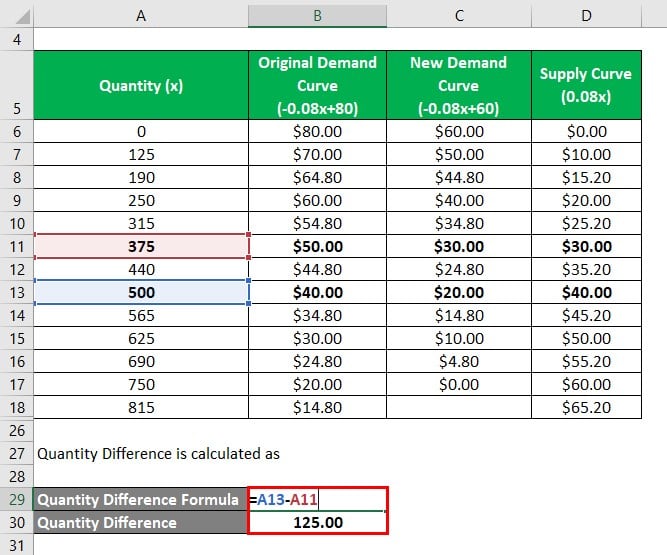

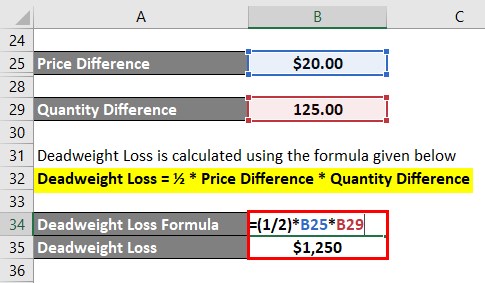

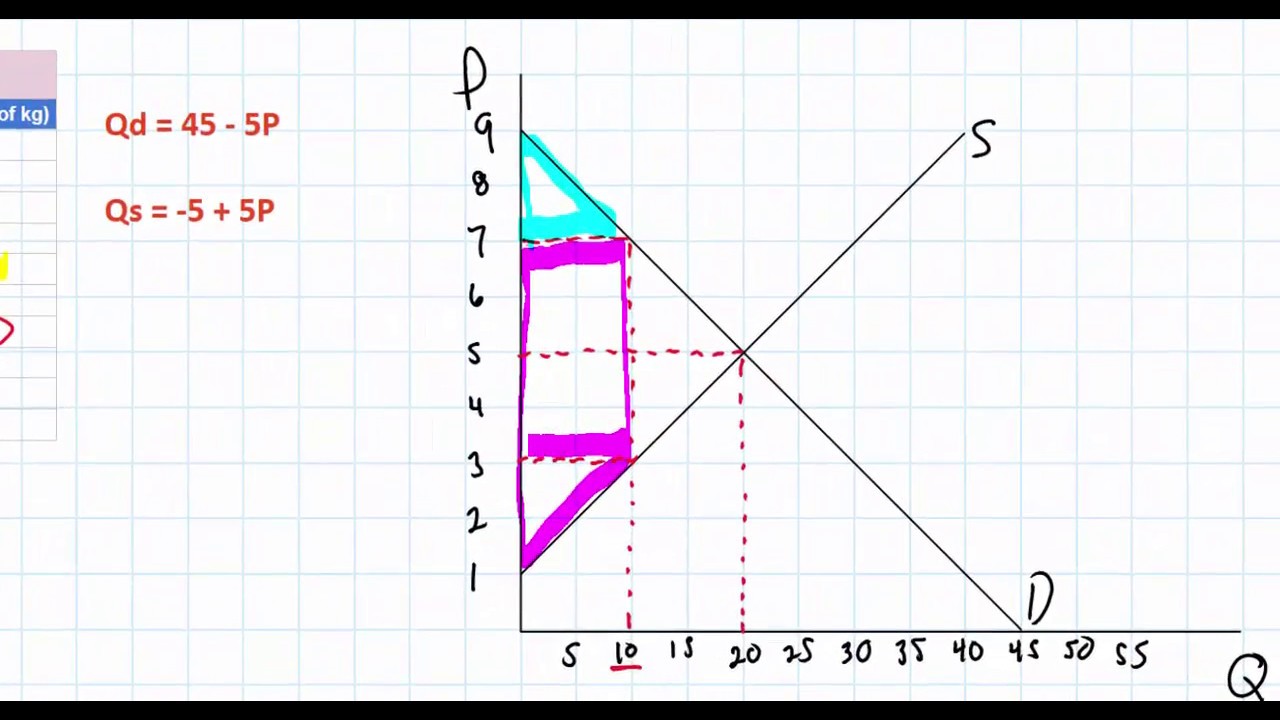

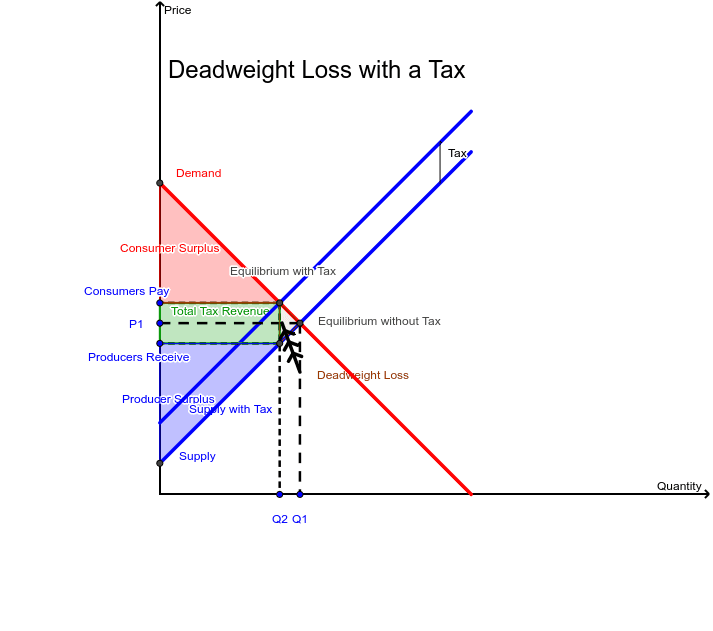

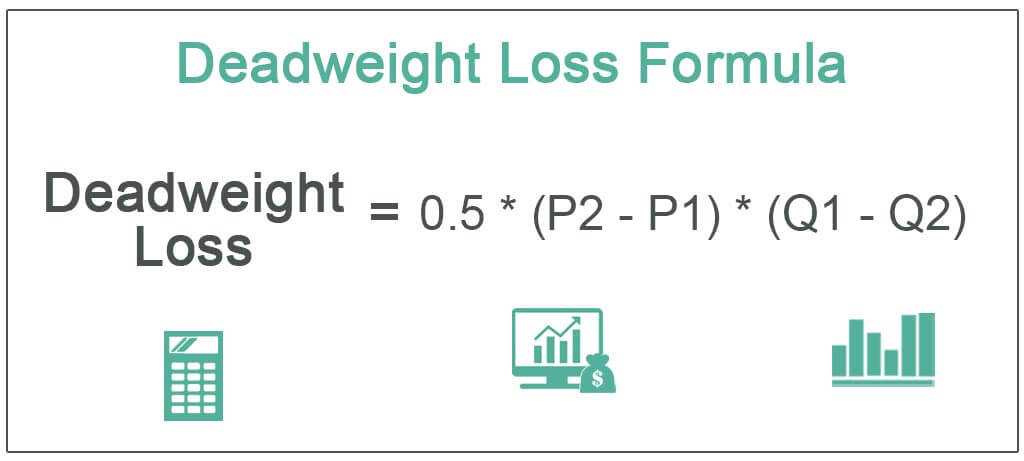

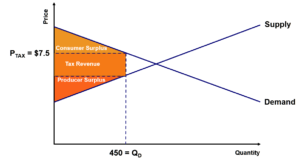

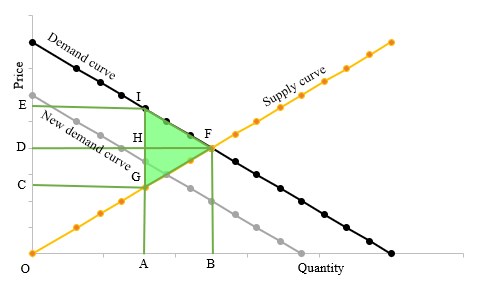

Supply And Demand Deadweight Loss Calculator. These manipulate the prices of goods and so are responsible for deadweight losses caused by variations in supply and demand. Use the following formula. Except in limiting special cases a tax imposes a deadweight loss or excess burden on buyers and sellers. Calculating the area of Deadweight Loss welfare loss in a Linear Demand and Supply model by Jason Welker Once youve learned how to calculate the areas of consumer and producer surplus on a graph when the market is in equilibrium the next question is how so we determine the loss of total welfare when a market is out of equilibrium.

Deadweight Loss Formula How To Calculate Deadweight Loss From educba.com

Deadweight Loss Formula How To Calculate Deadweight Loss From educba.com

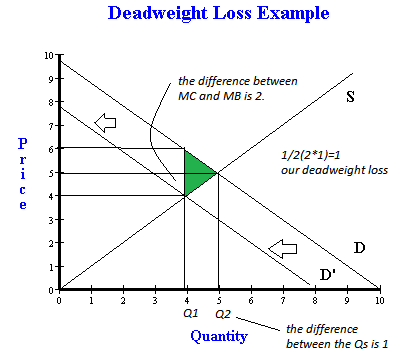

These manipulate the prices of goods and so are responsible for deadweight losses caused by variations in supply and demand. The difference between supply and demand curve with the tax imposed at Q1 is 2. Above the supply curve and up to the price. What Is Deadweight Loss. Wv 05 price change changed demand If the price rises by 100 units and the demand falls by 50 units the equation would look like this. Supply and Demand Calculator.

What is the Deadweight Loss Formula.

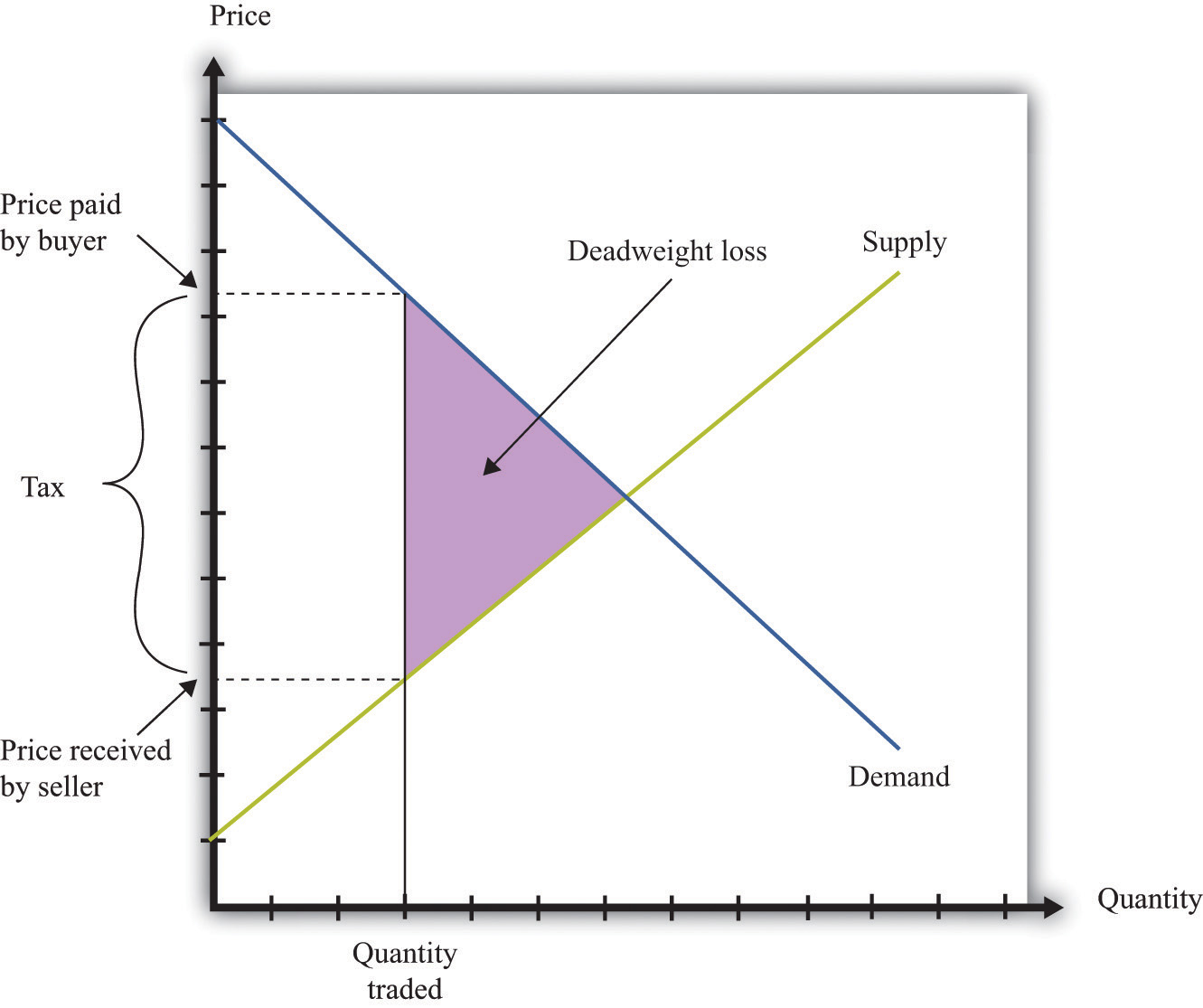

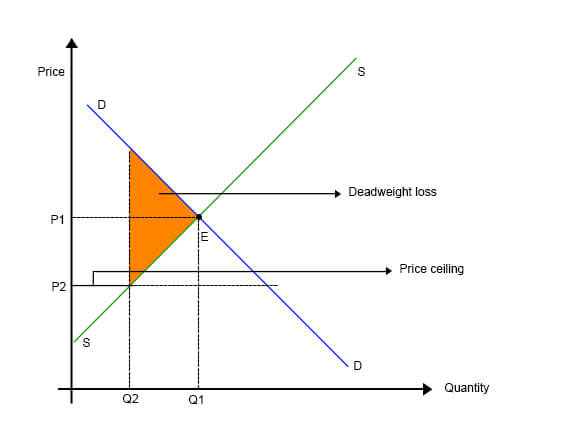

The deadweight loss is the amount by which the reduction in buyers surplus and sellers surplus exceeds the tax revenue. In addition regarding consumer and producer surplus. Deadweight loss is defined as the loss to society that is caused by price controls and taxes. It postulates that in a competitive market the unit price for a particular good or other traded item such as labor or liquid. What is the Deadweight Loss Formula. Government revenue is given by tax times the quantity transacted in the market so 4 x 12 48.

Source: educba.com

Source: educba.com

The deadweight loss is given by the triangle. The Deadweight Loss Calculator helps calculating Deadweight Loss given Supply and Demand curves and Selling Price. How do you calculate government tax revenue. Calculating the area of Deadweight Loss welfare loss in a Linear Demand and Supply model by Jason Welker Once youve learned how to calculate the areas of consumer and producer surplus on a graph when the market is in equilibrium the next question is how so we determine the loss of total welfare when a market is out of equilibrium. Except in limiting special cases a tax imposes a deadweight loss or excess burden on buyers and sellers.

Source: youtube.com

Source: youtube.com

The deadweight loss is given by the triangle. Its important to note that external factors have the potential to affect the supply and demand of a good or service. It postulates that in a competitive market the unit price for a particular good or other traded item such as labor or liquid. A deadweight loss is a loss in economic efficiency as a result of disequilibrium of supply and demand. Set P2 at 4500 and P1 at 500.

Source: geogebra.org

Source: geogebra.org

So the base of our deadweight loss triangle will be 1. Consumer surplus is the consumers gain from an exchange. Government revenue is given by tax times the quantity transacted in the market so 4 x 12 48. This area equals DW 05dtdQ. The government setting a limit on how low a price can be charged for a good or service.

Source: freeeconhelp.com

Source: freeeconhelp.com

For calculation of deadweight loss you must know how the price has changed and the changes in the. Use the following formula. How do you calculate government tax revenue. So the base of our deadweight loss triangle will be 1. What Is Deadweight Loss.

Source: slidesharetips.blogspot.com

Source: slidesharetips.blogspot.com

The Deadweight Loss Calculator helps calculating Deadweight Loss given Supply and Demand curves and Selling Price. Between the demand and supply curves up to the point of equilibrium. Above the supply curve and up to the price. We can calculate the value of the deadweight loss precisely again using the formula for the area of a triangle. The deadweight loss is given by the triangle.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

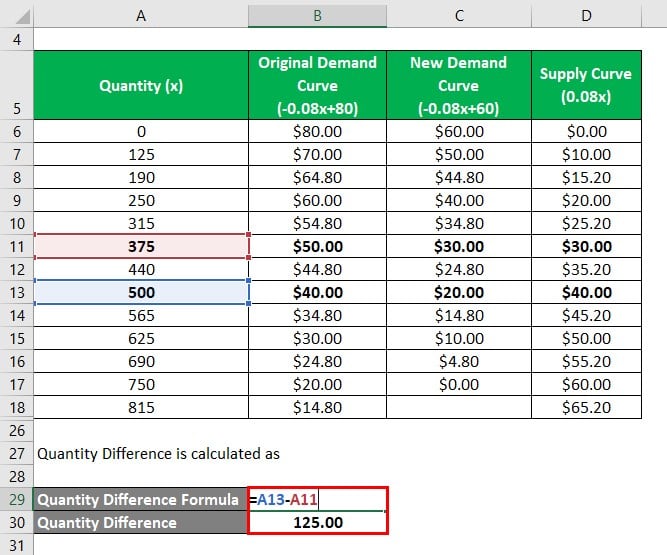

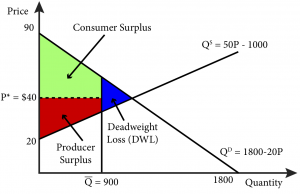

Deadweight loss is calculated from ½ x 4 x 15 12 6 of which 45 is from consumers under-consumption and 15 is from producers under-production. Equilibrium with Step Function Demand and Supply and a Per Unit Tax Deadweight Loss of a Tax. 2 In terms of total change in equilibrium quantity caused by tax. The Calculator helps calculating the market equilibrium given Supply and Demand curves. P - Q.

Source: omnicalculator.com

Source: omnicalculator.com

How do you calculate government tax revenue. Deadweight Loss 5 P2 - P1 Q1 - Q2. The deadweight loss formula can be derived from the deadweight loss graph based on the supply and demand curves. Deadweight loss is created by. Deadweight Loss ½ 3 400.

Source: youtube.com

Source: youtube.com

To do so one must examine the effects of a shift in price from its natural equilibrium on the surplus and loss areas of all market players. Equilibrium with Step Function Demand and Supply and a Per Unit Tax Deadweight Loss of a Tax. A deadweight loss is a loss in economic efficiency as a result of disequilibrium of supply and demand. Between the demand and supply curves up to the point of equilibrium. These cause deadweight loss by altering the supply and demand of a good through price manipulation.

Source: youtube.com

Source: youtube.com

Above the supply curve and up to the price. Deadweight Loss 600. The deadweight loss is the amount by which the reduction in buyers surplus and sellers surplus exceeds the tax revenue. We can calculate the value of the deadweight loss precisely again using the formula for the area of a triangle. Deadweight Loss ½ 3 400.

Source: youtube.com

Source: youtube.com

P Q. In other words goods and services are either being under or oversupplied to the market leading to an economic loss to the nation. How do you calculate government tax revenue. For information on deadweight loss look here. Government revenue is given by tax times the quantity transacted in the market so 4 x 12 48.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The consumer surplus is the area below the. Does not vary in amount when the amount of the tax per unit changes. Wv 05 price change changed demand If the price rises by 100 units and the demand falls by 50 units the equation would look like this. 3 In terms of change in government revenue this will be a rst-order approximation Hilary Hoynes Deadweight Loss UC Davis Winter 2012 8 81. Under the supply curve and up to the price.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In order to calculate deadweight loss you need to know the change in price and the change in quantity demandedThe formula to make the calculation is. Supply and Demand Calculator. Deadweight Loss ½ 3 400. A deadweight loss is a loss in economic efficiency as a result of disequilibrium of supply and demand. For ease of calculation drop the penthouse and set Q0 at 200 to reflect the 200 corner units in the business plan.

Source: econ101help.com

Source: econ101help.com

P Price Q Quantity. Deadweight Loss We showed taxes induce deadweight losses the size of the losses will depend on the elasticities of supply and demand Start from tax t0. Set Q1 at 150 to reflect the 50 units that now fall under the price ceiling. In order to calculate deadweight loss you need to know the change in price and the change in quantity demandedThe formula. This post goes over the economics of a deadweight loss causes by a subsidy.

Source: educba.com

Source: educba.com

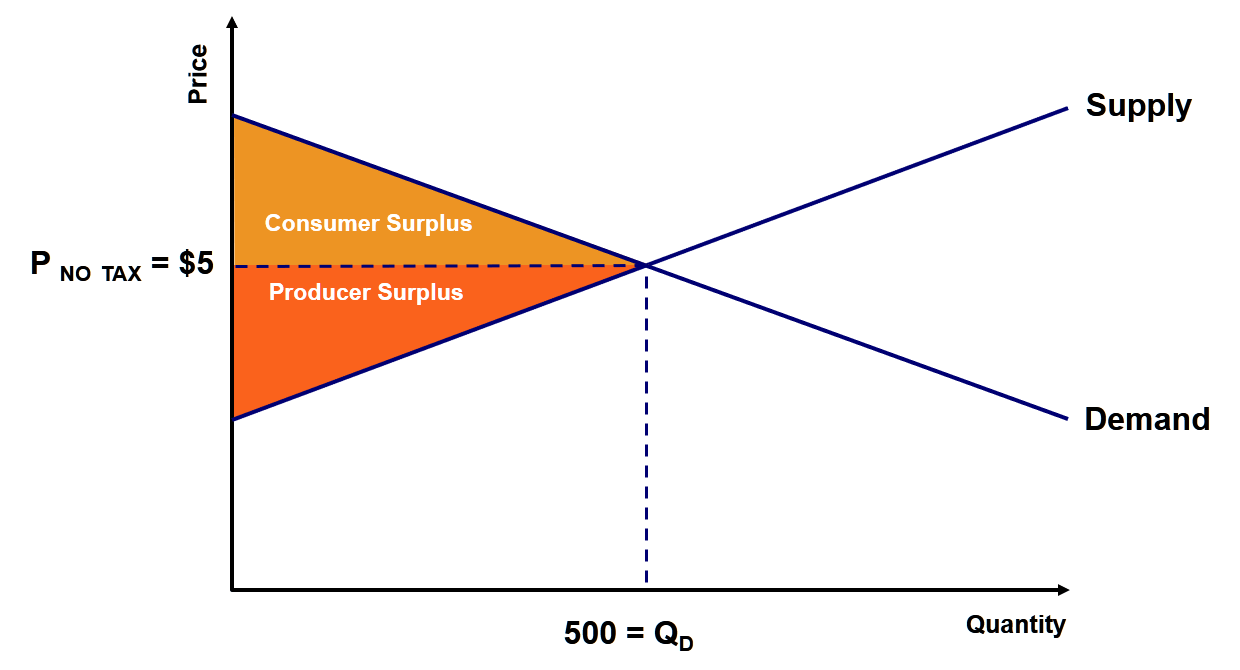

For ease of calculation drop the penthouse and set Q0 at 200 to reflect the 200 corner units in the business plan. Since the demand function is Q D 1800 20 P the point on the demand curve that results in a demand of 900 is a price of 45. Equilibrium with Step Function Demand and Supply and a Per Unit Tax Deadweight Loss of a Tax. At equilibrium the price would be 5 with a quantity demand of 500. Consumer surplus is the consumers gain from an exchange.

Source: open.oregonstate.education

Source: open.oregonstate.education

Deadweight Loss ½ 3 400. Wv 05 price change changed demand If the price rises by 100 units and the demand falls by 50 units the equation would look like this. This post goes over the economics of a deadweight loss causes by a subsidy. Equilibrium with Step Function Demand and Supply and a Per Unit Tax Deadweight Loss of a Tax. This part of economics is fairly algebra intensive and the trick to solving these problems is knowing how to manipulate the demand and supply functions to.

Source: freeeconhelp.com

Source: freeeconhelp.com

These cause deadweight loss by altering the supply and demand of a good through price manipulation. For information on deadweight loss look here. If the supply remains the same calculate the new prices and demand taxes previously added or efficiency reduction occurred Calculating the welfare loss using the equation. In addition regarding consumer and producer surplus. How to calculate deadweight loss.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Does not vary in amount when the amount of the tax per unit changes. The government setting a limit on how low a price can be charged for a good or service. At equilibrium the price would be 5 with a quantity demand of 500. Since the demand function is Q D 1800 20 P the point on the demand curve that results in a demand of 900 is a price of 45. Its important to note that external factors have the potential to affect the supply and demand of a good or service.

Source: educba.com

Source: educba.com

When the two fundamental forces of Economy Supply and Demand are not balanced it leads to Deadweight loss. Under the supply curve and up to the price. Consider the graph below. Deadweight Loss 600. Equilibrium price 5.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand deadweight loss calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.