Your Supply and demand curve with tax images are available in this site. Supply and demand curve with tax are a topic that is being searched for and liked by netizens today. You can Get the Supply and demand curve with tax files here. Find and Download all royalty-free vectors.

If you’re searching for supply and demand curve with tax images information related to the supply and demand curve with tax interest, you have visit the right blog. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that fit your interests.

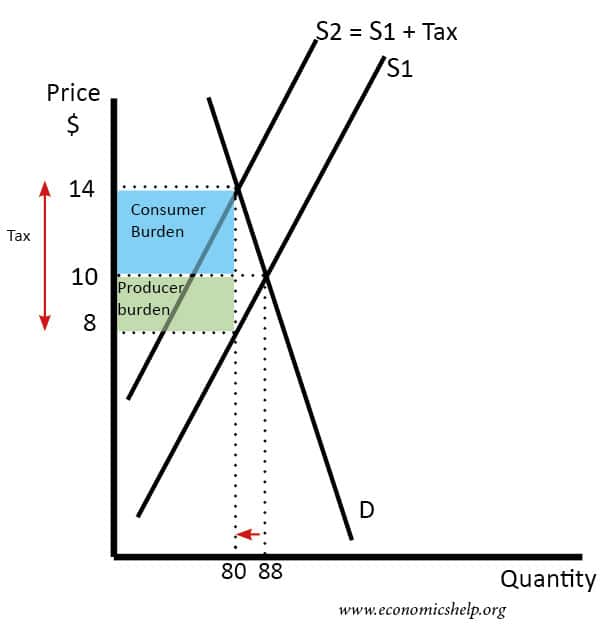

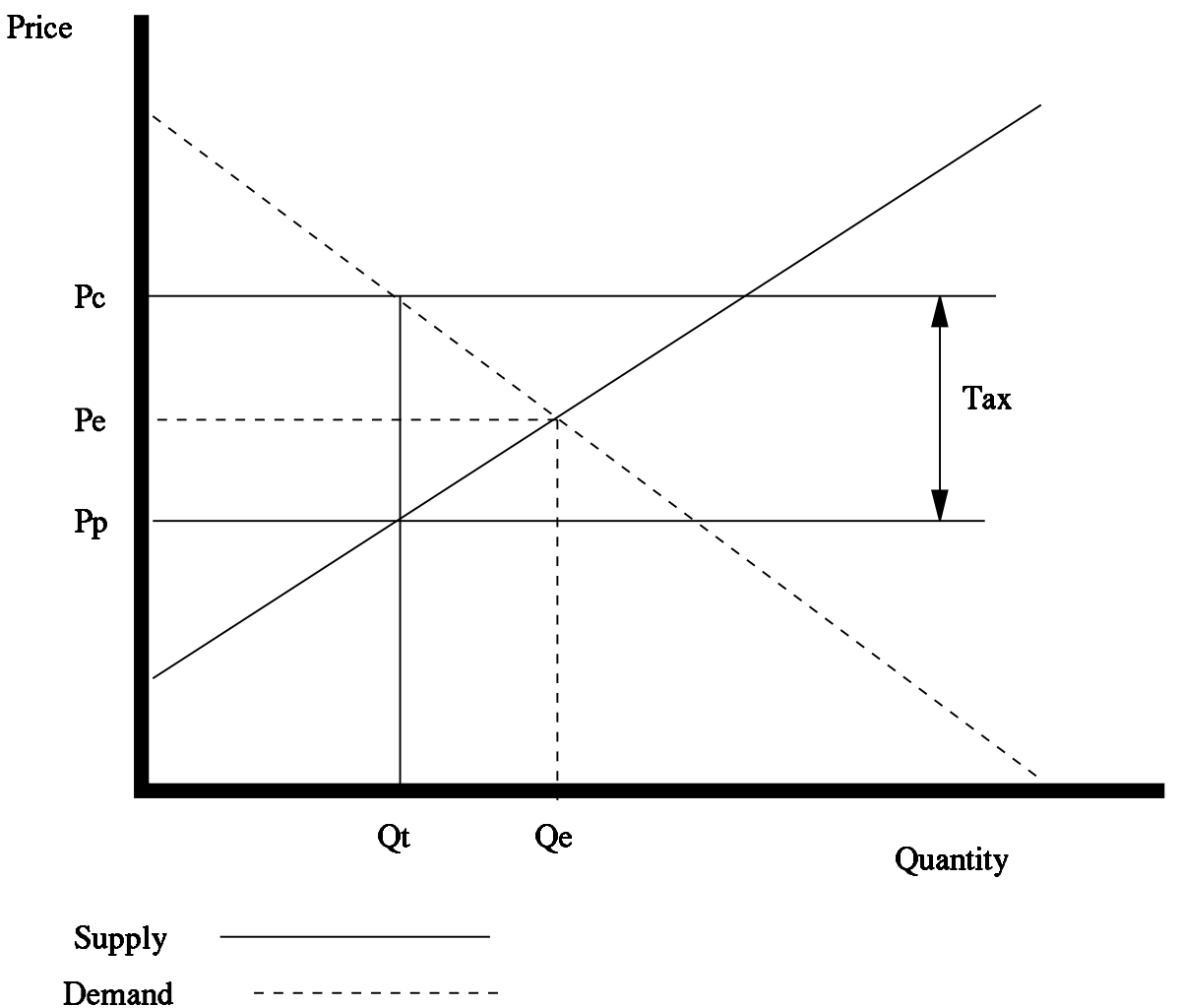

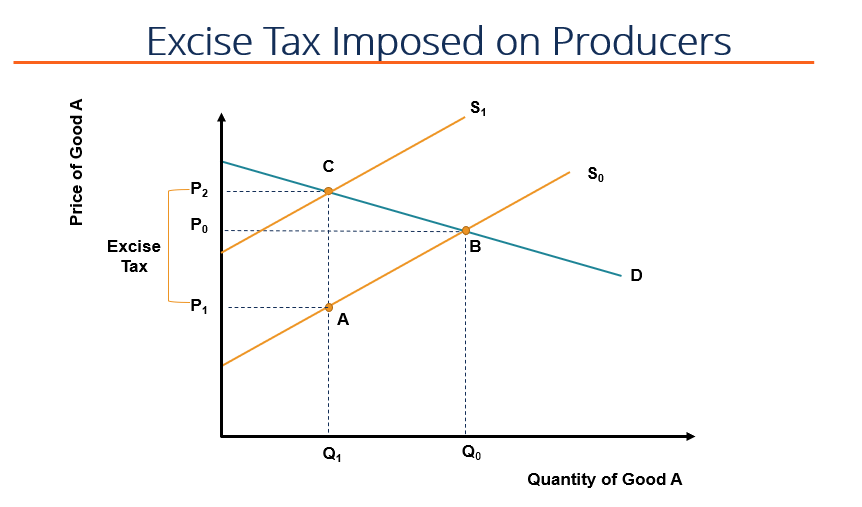

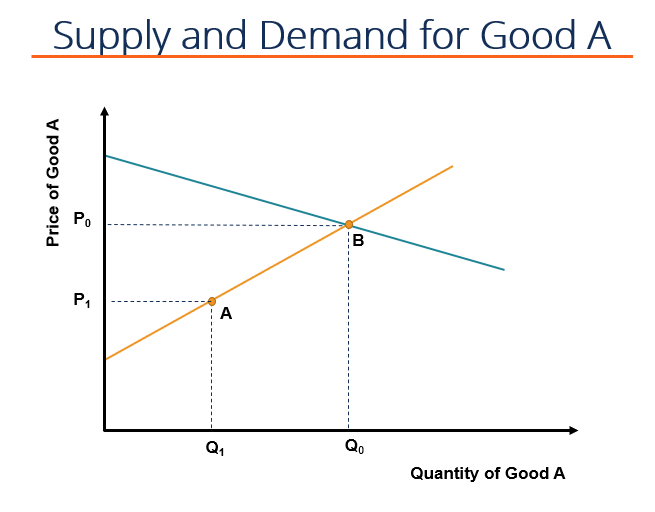

Supply And Demand Curve With Tax. Its submitted by processing in the best field. When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases. As the tax affects supply the supply curve tends to shift upward thus establishing the new equilibrium with the same demand curve. 125 125 from each sold kilogram of potatoes.

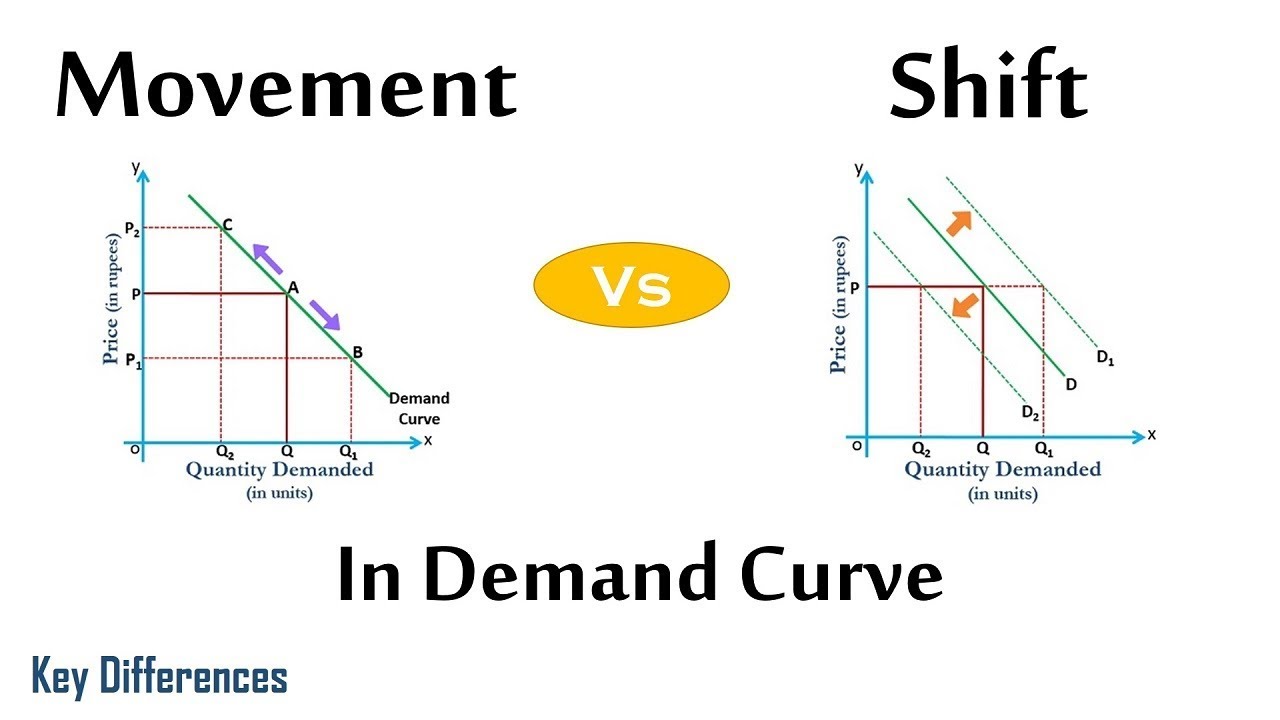

In this case the supply curve is relatively inelastic and the demand curve is highly elastic. The vertical distance between the original and new supply curve is the amount of the tax. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. That means buyers bear a bigger burden when demand is more inelastic and sellers bear a bigger burden when supply is more inelastic. The above figure has clearly shown the given case. The variation of the surplus of each agents is quite telling.

A tax increases the price a buyer pays by less than the tax.

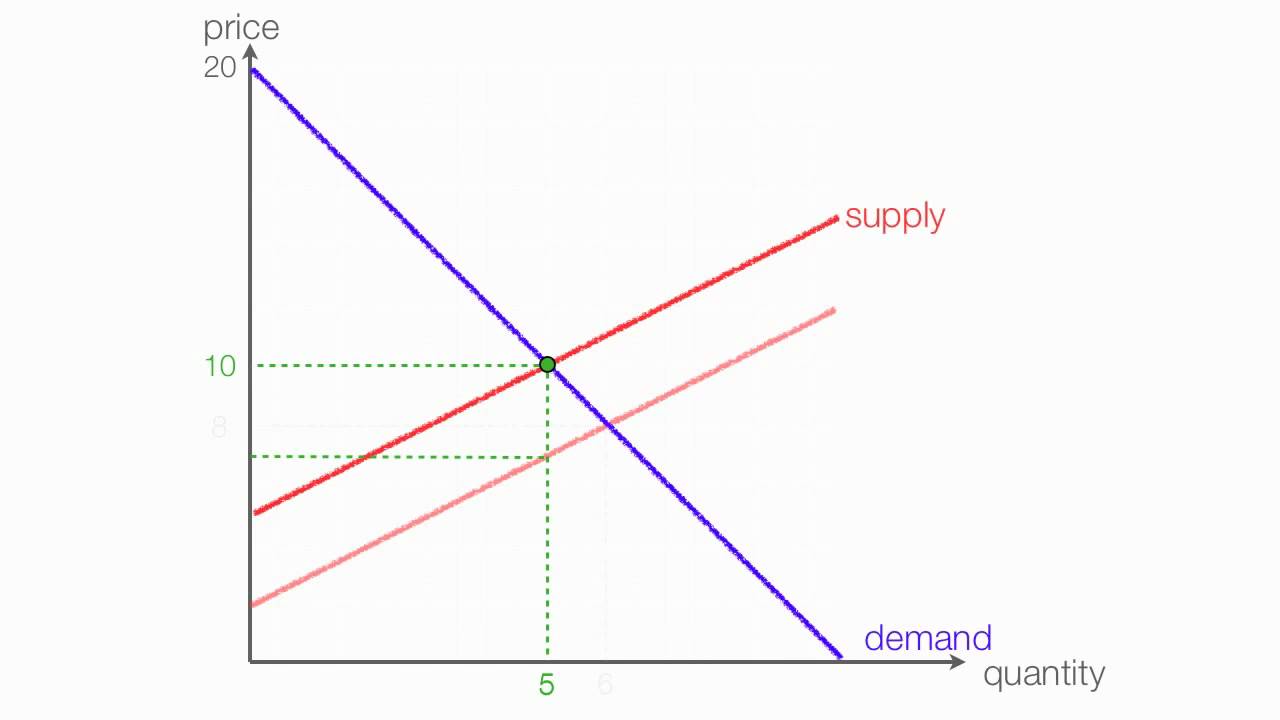

However demand being perfectly elastic price is not altered. After the imposition of sales tax supply curve shifts to the leftward direction. However demand being perfectly elastic price is not altered. With 4 tax on producers the supply curve after tax is P Q3 4. The vertical distance between the original and new supply curve is the amount of the tax. Additionally the Demonstration shows and calculates the revenue for the government raised by the tax.

Source: economicshelp.org

Source: economicshelp.org

Its submitted by processing in the best field. The consumers will now pay price P while producers will receive P P - t. However demand being perfectly elastic price is not altered. We identified it from honorable source. In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus.

Source: en.wikipedia.org

Source: en.wikipedia.org

Similarly the price the seller obtains falls but by less than the tax. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. Understanding the basics of the effect of tax on the demand curve is important. View tax with elastic demand curvejpg from ECON 201 at Singapore Polytechnic. In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

The variation of the surplus of each agents is quite telling. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. The burden of a tax falls most heavily on someone who cant adjust to a price change. In the graph above the total tax paid. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer.

We can use these linear demand and supply curves to calculate the effect of a 50 cents per gallon tax. Additionally the Demonstration shows and calculates the revenue for the government raised by the tax. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. The difference between the two supply curves S and S T determines the volume of tax. QD 150 - 50Pb Demand QS 60 40Ps Supply QD QS Supply must equal.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer. Understanding the basics of the effect of tax on the demand curve is important. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The variation of the surplus of each agents is quite telling. View tax with elastic demand curvejpg from ECON 201 at Singapore Polytechnic.

Source: assignmentexpert.com

Source: assignmentexpert.com

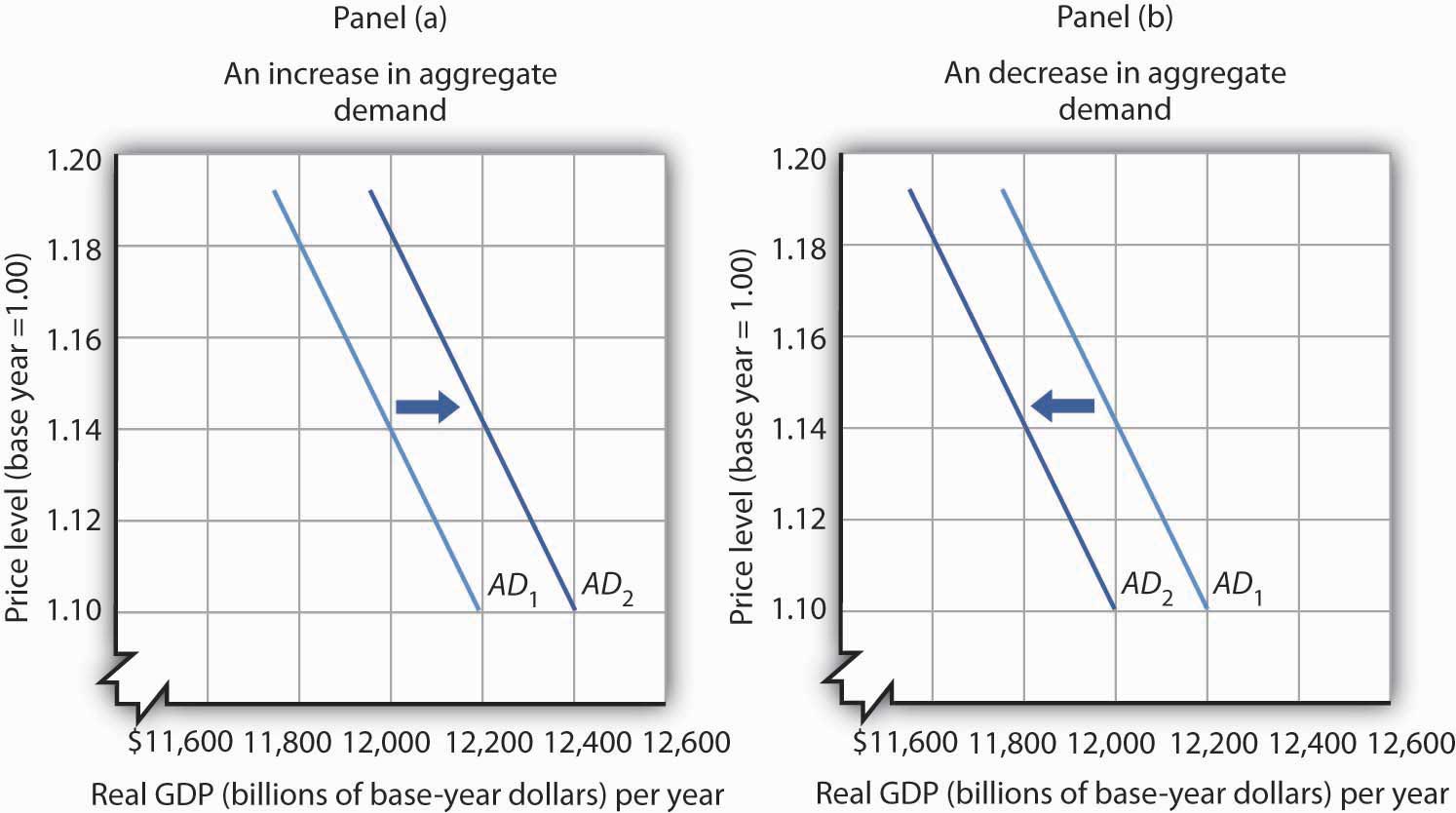

Here are a number of highest rated Tax On Supply And Demand Graph pictures upon internet. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. We identified it from honorable source. The demand curve because of the tax t.

Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. The above figure has clearly shown the given case. Elastic Demand and Inelastic Supply. In the graph above the total tax paid. Due to the tax the new equilibrium price P1 is higher and the equilibrium quantity Q1 is lower.

Source: wikiwand.com

Source: wikiwand.com

First we write the four conditions that must hold as given by equations 91a-d. The demand curve because of the tax t. To consumers the tax increases the price of the good purchased moving them along the demand curve to a lower quantity demanded. In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus. When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases.

We identified it from honorable source. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. Shifts from D to D. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. The burden of a tax falls most heavily on someone who cant adjust to a price change.

Source: researchgate.net

Source: researchgate.net

Elastic Demand and Inelastic Supply. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. You should also verify that these demand and supply curves imply a market price of 1 and quantity of 100 bgyr. The difference between the two supply curves S and S T determines the volume of tax. Rewrite the demand and supply equation as P 20 Q and P Q3.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As the tax affects supply the supply curve tends to shift upward thus establishing the new equilibrium with the same demand curve. AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. That means buyers bear a bigger burden when demand is more inelastic and sellers bear a bigger burden when supply is more inelastic. Due to the tax the new equilibrium price P1 is higher and the equilibrium quantity Q1 is lower.

Source: slideplayer.com

Source: slideplayer.com

When the tax is introduced the consumer surplus orange and producer surplus blue shrink while deadweight loss purple the inefficiency caused by the tax increases. Tax increases If the government increases the tax on a good that shifts the supply curve to the left consumer prices rise and sellers prices fall. The variation of the surplus of each agents is quite telling. Rewrite the demand and supply equation as P 20 Q and P Q3. The above figure has clearly shown the given case.

Source: ppt-online.org

Source: ppt-online.org

After the imposition of sales tax supply curve shifts to the leftward direction. In other words pre-tax and post-tax price P P T are the same. Elastic Demand and Inelastic Supply. Tax increases do not affect the demand curve nor do they increase supply or demand more or less. Shifts from D to D.

Source: wikiwand.com

Source: wikiwand.com

Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. That means buyers bear a bigger burden when demand is more inelastic and sellers bear a bigger burden when supply is more inelastic. Tax increases do not affect the demand curve nor do they increase supply or demand more or less. In this case the supply curve is relatively inelastic and the demand curve is highly elastic. Shifts from D to D.

Source: slideplayer.com

Source: slideplayer.com

The burden of a tax falls most heavily on someone who cant adjust to a price change. In the graph above the total tax paid. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point further up the demand curve at a higher. The variation of the surplus of each agents is quite telling. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

Source: youtube.com

Source: youtube.com

Thus the incidence of a sales tax falls. Thus the incidence of a sales tax falls. After the imposition of sales tax supply curve shifts to the leftward direction. View tax with elastic demand curvejpg from ECON 201 at Singapore Polytechnic. 125 125 from each sold kilogram of potatoes.

Source: researchgate.net

Source: researchgate.net

Similarly the price the seller obtains falls but by less than the tax. Here are a number of highest rated Tax On Supply And Demand Graph pictures upon internet. We can use these linear demand and supply curves to calculate the effect of a 50 cents per gallon tax. Elastic Demand and Inelastic Supply. When demand happens to be price inelastic and supply is price elastic the majority of the tax burden falls upon the consumer.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As the tax affects supply the supply curve tends to shift upward thus establishing the new equilibrium with the same demand curve. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. QD 150 - 50Pb Demand QS 60 40Ps Supply QD QS Supply must equal. The demand curve because of the tax t. Due to the tax the new equilibrium price P1 is higher and the equilibrium quantity Q1 is lower.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand curve with tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.