Your Supply and demand curve of ad valorem tax images are available. Supply and demand curve of ad valorem tax are a topic that is being searched for and liked by netizens today. You can Find and Download the Supply and demand curve of ad valorem tax files here. Get all free vectors.

If you’re looking for supply and demand curve of ad valorem tax pictures information connected with to the supply and demand curve of ad valorem tax topic, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

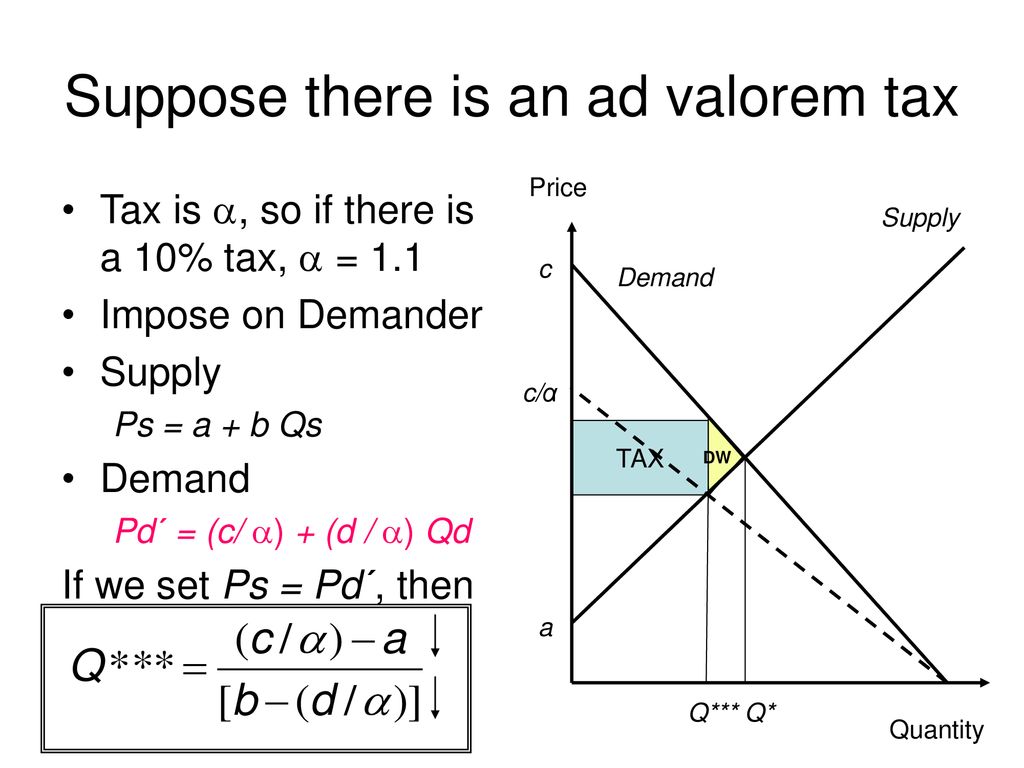

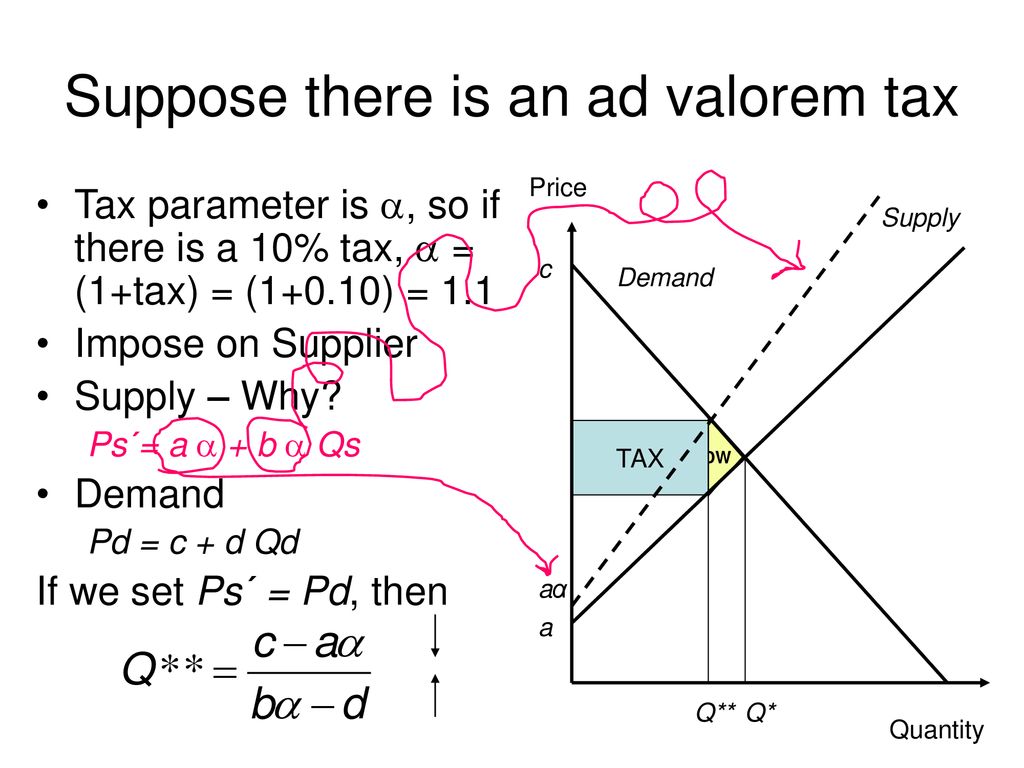

Supply And Demand Curve Of Ad Valorem Tax. 5 tax on purchases from 250000 up to 925000. This is an ad valorem tax on buying a new house. PX 50 - 5QX and PX 32 QX. The sales tax on the consumer shifts the demand curve to the left symbolizing a reduction in demand for the product because of the higher price.

Incidence Of Ad Valorem Taxes Ppt Download From slideplayer.com

Incidence Of Ad Valorem Taxes Ppt Download From slideplayer.com

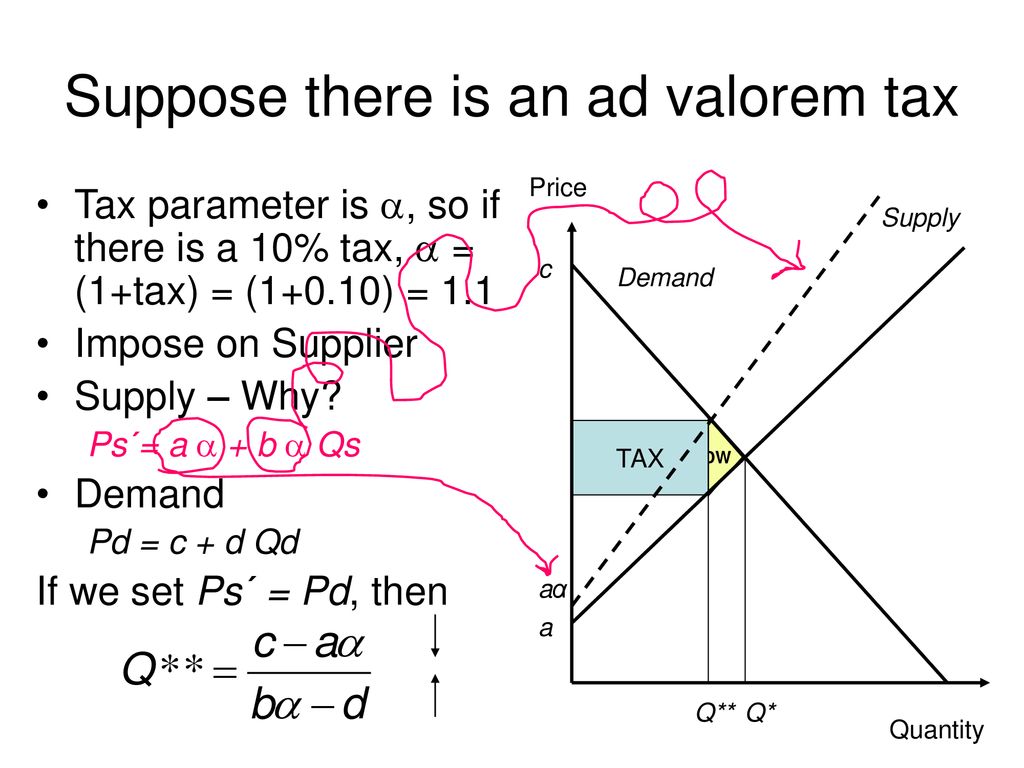

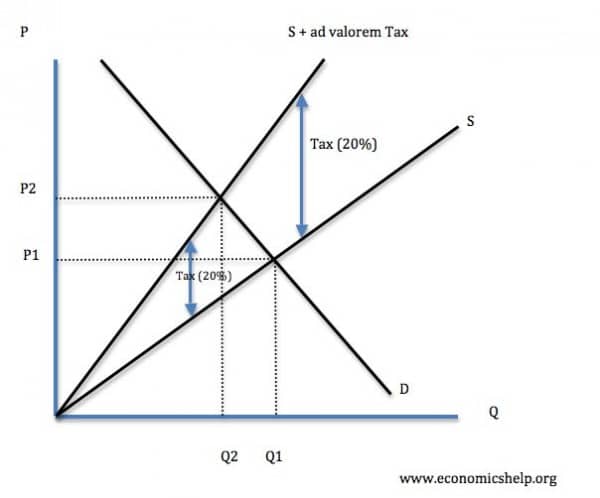

The ad-valorem tax effectively shift the supply curve from S1 upward to supply curve S2 as in diagram2. We want to characterize dpdt. PX 50 - 5QX and PX 32 QX. Is where the tax is a percentage of the selling price. However the ad-valorem tax is a percentage of the selling price. 10 tax on purchases from 925000 to 15m.

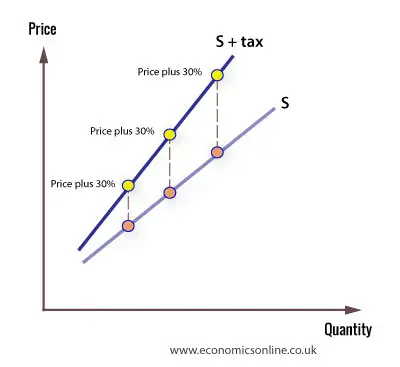

An ad valorem tax will make the new supply curve diverge from the original the vertical gap between the two supply curves will increase when moving along the X axis click here for examples.

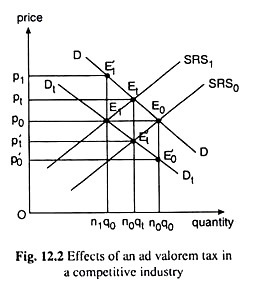

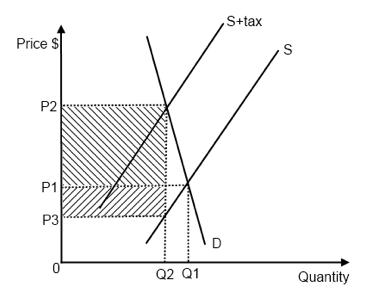

2138 we show the effect of the imposition of an ad valorem tax on equilibrium price. This means that the supply curve shifts to the left and outwards as price increases. Is where the tax is a percentage of the selling price. Where 0 and fi 0 and aggregate supply curve is. Say the tax is a fixed tax for example VAT and not an ad valorem tax. At the market equilibrium if demand is more elastic than supply in absolute value a 1 specific tax will A raise the price to consumers by 50 cents.

Source: economicshelp.org

Source: economicshelp.org

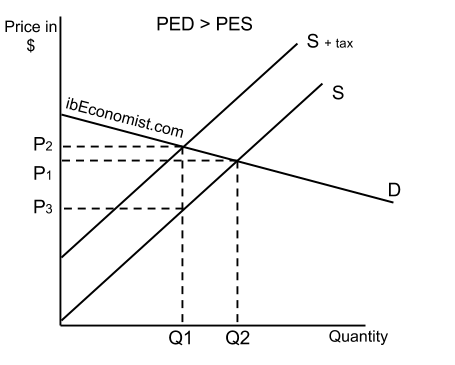

12 tax on purchases over 15m. The market equilibrium is at quantity Q2 and price P1 where demand D intersects supply S. Become steeper Consider a market characterized by the following demand and supply conditions. This is due to the fact that as the price of the goodservice increases the more the Ad valorem tax increases. B raise the price to consumers by less than 50 cents.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

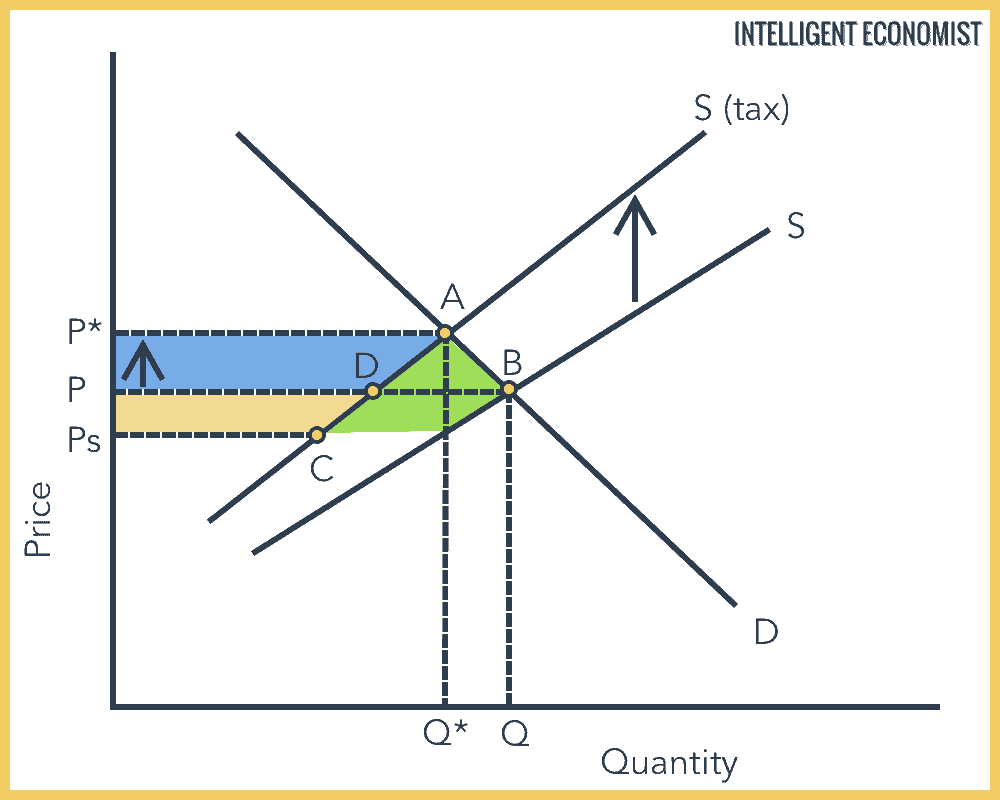

Become steeper Consider a market characterized by the following demand and supply conditions. The equilibrium price looks like its about 375 per hamburger. In the above diagram an ad valorem tax leads to a pivotal upward shift in the supply curve S from S 0 to S 1 as the amount of the tax increases when the quantity supplied increases and this is because a higher quantity supplied corresponds to a higher price on the supply curve. Aggregate demand curve is. If we have a completely unfettered market no intervention no taxes nothing like that then we see we have an equilibrium price and an equilibrium quantity.

Source: slideplayer.com

Source: slideplayer.com

This means that the supply curve shifts to the left and outwards as price increases. Government will be imposing an ad valorem tax of z. 2 tax on purchases between 125000 and 250000. B raise the price to consumers by less than 50 cents. An indirect tax may take one of two forms a specific per unit tax or an ad valorem tax.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

Effect of a small tax increase on price which determines who bears effective burden of tax. Effect of a small tax increase on price which determines who bears effective burden of tax. 5 tax on purchases from 250000 up to 925000. In the above diagram an ad valorem tax leads to a pivotal upward shift in the supply curve S from S 0 to S 1 as the amount of the tax increases when the quantity supplied increases and this is because a higher quantity supplied corresponds to a higher price on the supply curve. This means that the supply curve shifts to the left and outwards as price increases.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

5 tax on purchases from 250000 up to 925000. Since the two types of taxes are very much similar to each other we can use only industry demand and supply curves to analyse the effect of an ad valorem tax. The equilibrium price looks like its about 375 per hamburger. This is shown in Figure 2. 12 tax on purchases over 15m.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

An ad valorem tax will make the new supply curve diverge from the original the vertical gap between the two supply curves will increase when moving along the X axis click here for examples. The demand curve DD shows the price that the buyers would pay at each quantity purchased and the curve D t D t shows the price net of tax that the sellers would receive at each quantity sold. This is shown in Figure 2. Is where the tax is a percentage of the selling price. An ad valorem tax is expressed as a percentage.

Source: slideplayer.com

Source: slideplayer.com

We want to characterize dpdt. Aggregate demand curve is. A tax is levied on suppliers. Figure 32 - The effect of ad valorem tax on the supply curve. This lesson explains in two parts the different impacts of these two types of tax on a.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

TAX INCIDENCE Demand for good x is Dq decreases with q p t Supply for good x is Sp increases with p Equilibrium condition. This means that the supply curve shifts to the left and outwards as price increases. The equilibrium price looks like its about 375 per hamburger. 2 tax on purchases between 125000 and 250000. The marginal tax rates on new houses in the UK is.

Source: slideplayer.com

Source: slideplayer.com

2 tax on purchases between 125000 and 250000. We want to characterize dpdt. The equilibrium price looks like its about 375 per hamburger. The ad-valorem tax effectively shift the supply curve from S1 upward to supply curve S2 as in diagram2. There are intersecting supply and demand curves.

Source: ibguides.com

Source: ibguides.com

2 tax on purchases between 125000 and 250000. 2138 we show the effect of the imposition of an ad valorem tax on equilibrium price. In the above diagram an ad valorem tax leads to a pivotal upward shift in the supply curve S from S 0 to S 1 as the amount of the tax increases when the quantity supplied increases and this is because a higher quantity supplied corresponds to a higher price on the supply curve. Is where the tax is a percentage of the selling price. The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service.

Source: learneconomicsonline.com

Source: learneconomicsonline.com

The market equilibrium is at quantity Q2 and price P1 where demand D intersects supply S. Need tutoring for A-level economics. An ad valorem tax causes the supply curve to. When either specific taxes or valorem taxes are imposed the market will shrink in size decrease in quantity thus possibly lower the level of employment in the market since firms might employ fewer people. At the market equilibrium if demand is more elastic than supply in absolute value a 1 specific tax will A raise the price to consumers by 50 cents.

Source: ibguides.com

Source: ibguides.com

At the market equilibrium if demand is more elastic than supply in absolute value a 1 specific tax will A raise the price to consumers by 50 cents. An ad valorem tax is a tax that is based on the assessed value of a property product or service. The equilibrium price looks like its about 375 per hamburger. Q Sp Dp t Start from t 0 and Sp Dp. B raise the price to consumers by less than 50 cents.

Source: medium.com

Source: medium.com

The sales tax on the consumer shifts the demand curve to the left symbolizing a reduction in demand for the product because of the higher price. TAX INCIDENCE Demand for good x is Dq decreases with q p t Supply for good x is Sp increases with p Equilibrium condition. B raise the price to consumers by less than 50 cents. An ad valorem tax will make the new supply curve diverge from the original the vertical gap between the two supply curves will increase when moving along the X axis click here for examples. If a per unit tax is imposed every point on the supply curve shifts vertically upwards by the amount of the tax the intersection of the new supply curve S T with the original demand curve D yields the new equilibrium quantity q 1 and price p 1.

Source: slideplayer.com

Source: slideplayer.com

Effect of a small tax increase on price which determines who bears effective burden of tax. There are intersecting supply and demand curves. Effect of a small tax increase on price which determines who bears effective burden of tax. 12 tax on purchases over 15m. The market equilibrium is at quantity Q2 and price P1 where demand D intersects supply S.

Source: ibeconomist.com

Source: ibeconomist.com

An ad valorem tax is a tax that is based on the assessed value of a property product or service. Figure 32 - The effect of ad valorem tax on the supply curve. The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service. The sales tax on the consumer shifts the demand curve to the left symbolizing a reduction in demand for the product because of the higher price. What is ad valorem tax example.

Source: edexceleconomicsrevision.com

Source: edexceleconomicsrevision.com

The marginal tax rates on new houses in the UK is. Now if an ad valorem tax is imposed on the good and the buyers are to pay the tax then the price that the buyers would pay would include the tax and the sellers will receive the price net of tax. An ad valorem tax is a tax that is based on the assessed value of a property product or service. An indirect tax may take one of two forms a specific per unit tax or an ad valorem tax. Consider the demand and the supply schedules of wine and the effect of a specific tax of 3 per bottle.

Source: economicshelp.org

Source: economicshelp.org

PX 50 - 5QX and PX 32 QX. TAX INCIDENCE Demand for good x is Dq decreases with q p t Supply for good x is Sp increases with p Equilibrium condition. At the market equilibrium if demand is more elastic than supply in absolute value a 1 specific tax will A raise the price to consumers by 50 cents. This is an ad valorem tax on buying a new house. This is due to the fact that as the price of the goodservice increases the more the Ad valorem tax increases.

Source: intelligenteconomist.com

Source: intelligenteconomist.com

At the market equilibrium if demand is more elastic than supply in absolute value a 1 specific tax will A raise the price to consumers by 50 cents. Say the tax is a fixed tax for example VAT and not an ad valorem tax. PX 50 - 5QX and PX 32 QX. The equilibrium price looks like its about 375 per hamburger. Consider the demand and the supply schedules of wine and the effect of a specific tax of 3 per bottle.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title supply and demand curve of ad valorem tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.