Your Shifters of loanable funds supply curve images are ready. Shifters of loanable funds supply curve are a topic that is being searched for and liked by netizens now. You can Download the Shifters of loanable funds supply curve files here. Get all free images.

If you’re searching for shifters of loanable funds supply curve images information linked to the shifters of loanable funds supply curve interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

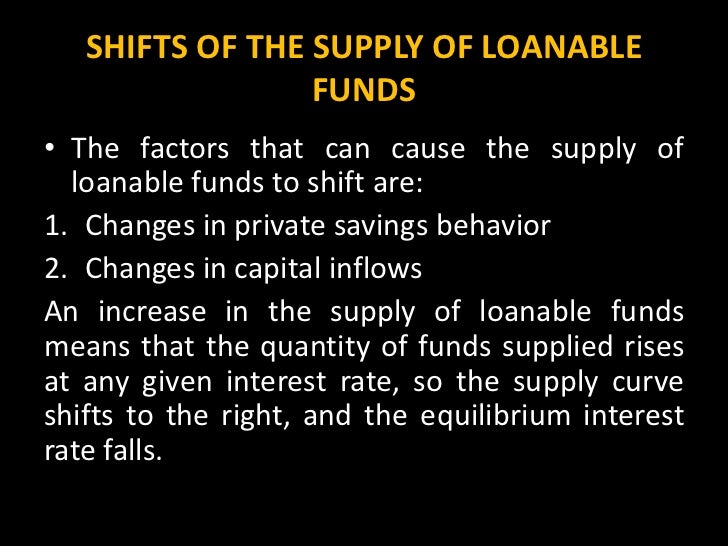

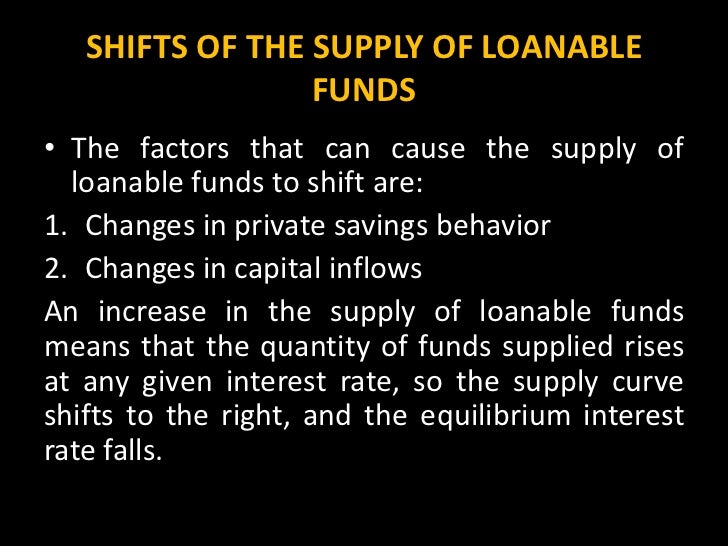

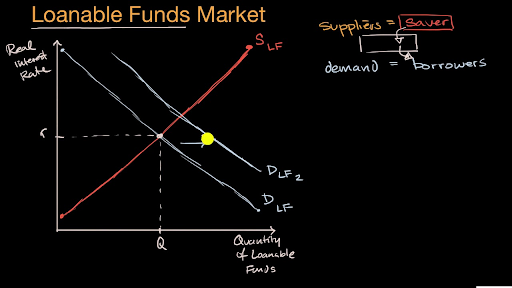

Shifters Of Loanable Funds Supply Curve. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market affect the quantity of capital demanded. Increase in supply Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. The bond demand curve and loanable funds supply curve will shift to the right.

Module 29 The Market For Loanable Funds From slideshare.net

Module 29 The Market For Loanable Funds From slideshare.net

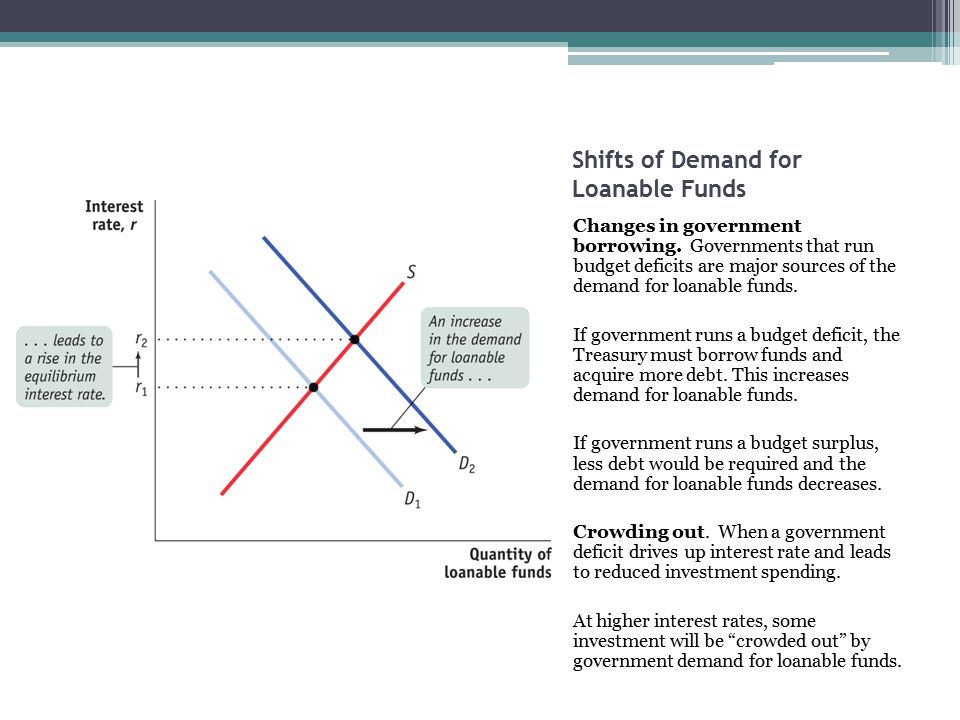

The supply of loanable funds will increaseshift to right so will the demand. Anything which increases national savings other than a decrease in the real interest rate will shift the supply curve of loanable funds to the right. Iv The real interest rate increases. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. Expectations For Future Economy direct Anticipation of economic performance. The curve itself does not shift There is an upward movement.

Borrowers demand loanable funds and savers supply loanable funds.

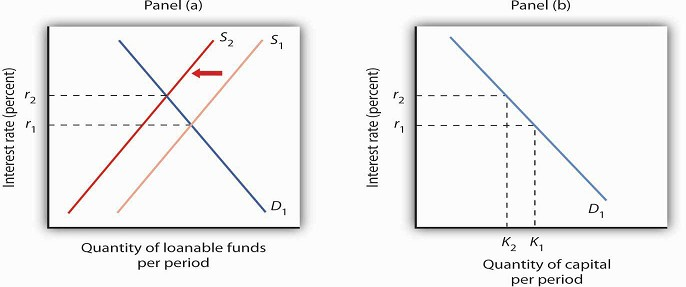

A Shift from mathrmS_1 to mathrmS_2 represents a decrease in the supply of Loanable funds because leftward shift of the supply curve of Loanable funds implies a fall in the quantity supplied of Loanable funds. B Neither curve shifts. The interest rate is determined in the market for loanable funds. The supply curve has a positive slope. Foreign Purchases of Domestic Assets direct International investments 4. If there is no change in the demand for capital D 1 the quantity of capital firms demand falls to K 2 in Panel b.

Source: slideplayer.com

Source: slideplayer.com

The quantity of loanable funds supplied decreases and the quantity. The Fed sells bonds. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for Loanable Funds. Interest rates on loanable funds typically decline over time. If there is no change in the demand for capital D 1 the quantity of capital firms demand falls to K 2 in Panel b.

Source: slideplayer.com

Source: slideplayer.com

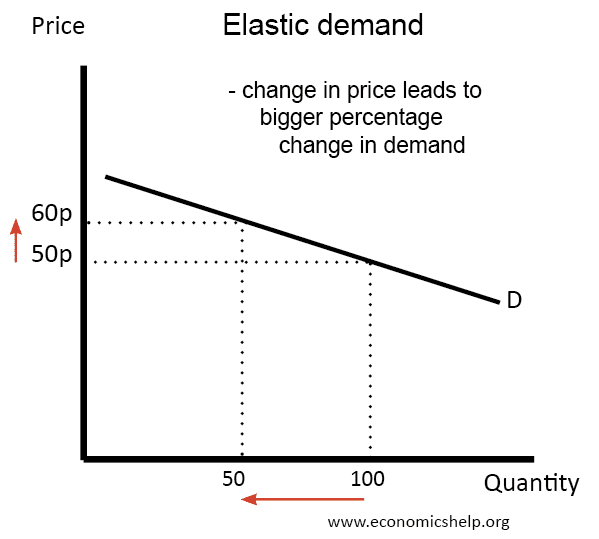

The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market affect the quantity of capital demanded. Loanable Funds Theory Business Demand for Loanable Funds There is an inverse relationship between interest rates and the quantity of loanable funds demanded The curve can shift in response to events that affect business borrowing preferences Example. Supply of Loanable Funds. That leads the supply curve to shift to the right.

Source: slideplayer.com

Source: slideplayer.com

Anything which increases national savings other than a decrease in the real interest. The supply of loanable funds will decreaseshift to left increasing interest rate. If there is a shortage in the market for loanable funds what happens. Borrowers demand loanable funds and savers supply loanable funds. Supply of loanable funds curve shifts rightwards.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The quantity of loanable funds supplied decreases and the quantity. Interest rates on loanable funds typically decline over time. It is a variation of a market model but what is being bought and sold is money that has been saved. The interest rate is determined in the market for loanable funds. In this case also a change in fiscal policy will shift the IS curve.

We can obtain the total supply curve of loanable funds by a lateral summation of the curves of saving S dishoarding DH bank money BM and disinvestment DI. B In the figure below the initial supply of loanable funds curve is SLF0 and the initial demand for loanable funds curve is DLF0. The greater the demand for loanable funds the more the curve shifts. The market is in equilibrium when the real interest rate has adjusted so. That leads the supply curve to shift to the right.

Source: slideshare.net

Source: slideshare.net

For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. Changes in the demand for capital affect the loanable funds market and changes in the loanable funds market affect the quantity of capital demanded. This video explains why the supply curve for loanable funds increases. The aggregate loanable fund supply curve SL also slopes upwards to the right showing the greater supply of loanable funds at higher rates of interest. We can obtain the total supply curve of loanable funds by a lateral summation of the curves of saving S dishoarding DH bank money BM and disinvestment DI.

The supply of loanable funds will increaseshift to right so will the demand. B With the shift in supply that is leftward shift of supply curve of Loanable funds the equilibrium. The Savings Rate direct Consumer or corporate savings levels 2. The higher a loans interest rate the fewer firms want the loan. B Neither curve shifts.

Iv The real interest rate increases. Conversely capital outflows will cause the curve to shift to the left and borrowed funds to decrease. Falling Interest Rates. Raises personal income taxes and cuts spending. We can obtain the total supply curve of loanable funds by a lateral summation of the curves of saving S dishoarding DH bank money BM and disinvestment DI.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Federal Reserve Lending direct Lending via discount window 3. A The supply for loanable funds shifts right and demand shifts left. Raises personal income taxes and cuts spending. If G increases or T falls S will fall if Y remains constant since. Falling Interest Rates.

Source: econ101help.com

Source: econ101help.com

Falling Interest Rates. The Fed sells bonds. Increase in supply Rightward shift in SLF curve Real interest rates decrease Quantity of investment increases. This video explains why the supply curve for loanable funds increases. Loanable Funds Theory Business Demand for Loanable Funds There is an inverse relationship between interest rates and the quantity of loanable funds demanded The curve can shift in response to events that affect business borrowing preferences Example.

Source: econ101help.com

Source: econ101help.com

It is a variation of a market model but what is being bought and sold is money that has been saved. The greater the demand for loanable funds the more the curve shifts. A change that begins in the loanable funds market can affect the. Conversely capital outflows will cause the curve to shift to the left and borrowed funds to decrease. There is an upward movement along the Supply of loanable funds curve BUT no shift in the curve.

Borrowers demand loanable funds and savers supply loanable funds. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for Loanable Funds. Expectations For Future Economy direct Anticipation of economic performance. There is an upward movement along the Supply of loanable funds curve BUT no shift in the curve. Raises personal income taxes and cuts spending.

Source: youtube.com

Source: youtube.com

The supply curve has a positive slope. Raises personal income taxes and cuts spending. The quantity of loanable funds supplied decreases and the quantity. Unemployment rate is 6 and CPI is inc. There is an upward movement along the Supply of loanable funds curve BUT no shift in the curve.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

B In the figure below the initial supply of loanable funds curve is SLF0 and the initial demand for loanable funds curve is DLF0. The quantity of loanable funds supplied decreases and the quantity. Raises personal income taxes and cuts spending. The Fed sells bonds. Quantity of savings increases.

We can obtain the total supply curve of loanable funds by a lateral summation of the curves of saving S dishoarding DH bank money BM and disinvestment DI. The supply of loanable funds will increaseshift to right so will the demand. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left. Foreign Purchases of Domestic Assets direct International investments 4. Conversely capital outflows will cause the curve to shift to the left and borrowed funds to decrease.

Source: youtube.com

Source: youtube.com

B With the shift in supply that is leftward shift of supply curve of Loanable funds the equilibrium. Anything which increases national savings other than a decrease in the real interest. It is a variation of a market model but what is being bought and sold is money that has been saved. Unemployment rate is 6 and CPI is inc. Anything which decreases national savings other than an increase in the real interest rate will shift the supply curve of loanable funds to the left.

Source: welkerswikinomics.com

Source: welkerswikinomics.com

To summarize a decrease in expected inflation will shift the bond supply curve and loanable funds demand curve to the left. The quantity of loanable funds supplied decreases and the quantity. The market is in equilibrium when the real interest rate has adjusted so. Demand for loanable funds decreases more often than it increases. Unemployment rate is 6 and CPI is inc.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

If there is a shortage in the market for loanable funds what happens. Shift demand curve down and to the left Decrease Utility derived from asset purchased with borrowed funds Willingness to borrow increases. Supply of loanable funds curve shifts rightwards. Decrease in supply Leftward shift of SLF Curve Real interest rates Changes in Demand for Loanable Funds. Iv The real interest rate increases.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title shifters of loanable funds supply curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.