Your Shifters of loanable funds market supply images are available. Shifters of loanable funds market supply are a topic that is being searched for and liked by netizens today. You can Download the Shifters of loanable funds market supply files here. Download all free photos and vectors.

If you’re looking for shifters of loanable funds market supply pictures information linked to the shifters of loanable funds market supply topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

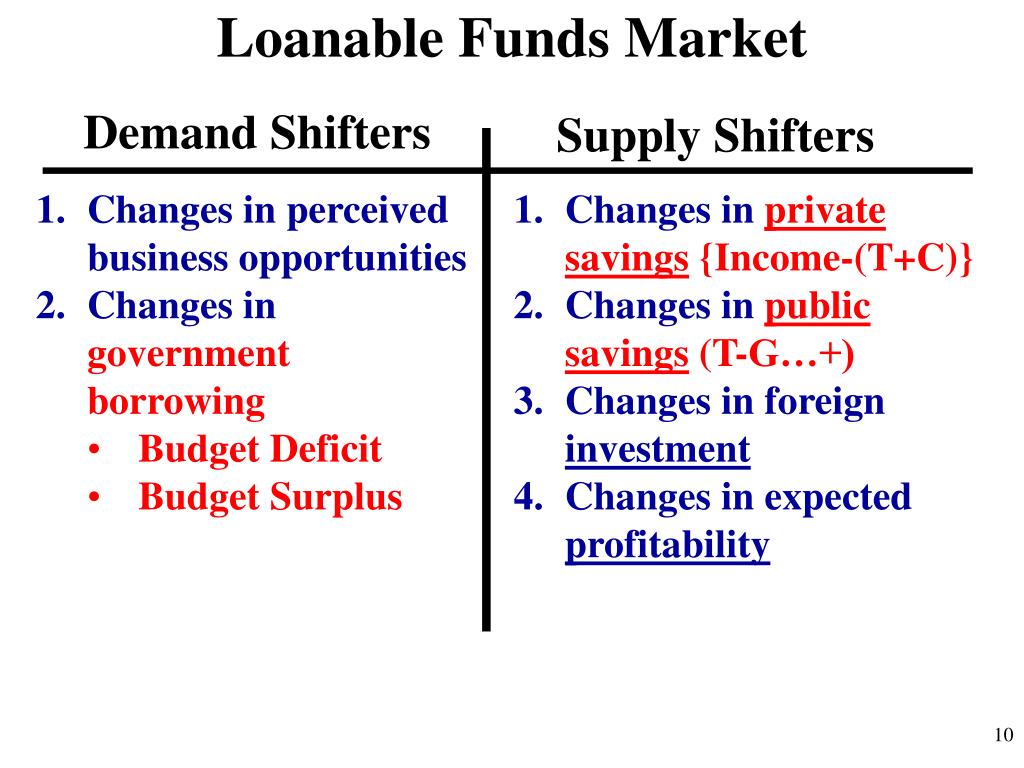

Shifters Of Loanable Funds Market Supply. In that case the market faces an excess supply of loanable funds. Government Budget Deficits direct Borrowing in order to spend 2. The loanable funds market illustrates the interaction of borrowers and savers in the economy. Is an interest rate of 50 good or bad.

Shifting The Demand Curve For Loanable Funds Youtube From youtube.com

Shifting The Demand Curve For Loanable Funds Youtube From youtube.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. We learned above that only the fed can shift the money supply curve but. Interest is the price paid for the use of money. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. Shifters Of Loanable Funds 9 out of 10 based on 162 ratings. By saving thus the firms may not enter the loanable-funds market but this influences the rate of interest by reducing the demand for loanable funds.

I had a brief exchange with George Will yesterday you dont have to read the snark just watch the clip that was I realized later precisely about liquidity.

Borrowers demand loanable funds and savers supply loanable funds. Foreign Demand for Domestic Currency direct International exchangeconverting to US dollars 4. The relationship between real interest rates and the quantity of loanable funds supplied is direct or positive. Two conditions of equilibrium. 2000-2006 home prices were going up and savings went down. A change that begins in the loanable funds market can affect the quantity of capital firms demand.

Source: opentextbooks.org.hk

Source: opentextbooks.org.hk

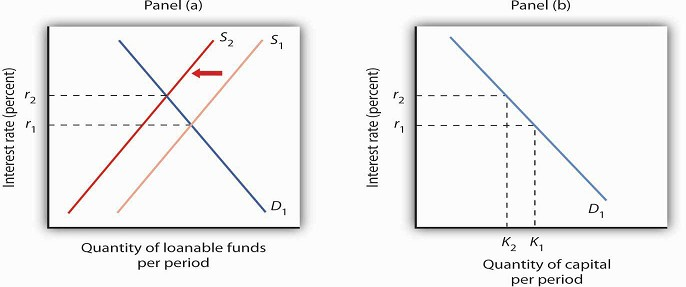

The Supply of money SHIFTS due to actions of the fed. Suppose the market interest rate is higher than the equilibrium interest rate. Real interest rate rate of return the laws of supply and demand explain the behavior of savers and borrowers. Therefore absent any spillover from the money market the supply of loanable funds would be the dashed vertical line at LF 1 denoted s. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a.

Source: slidetodoc.com

Source: slidetodoc.com

A change in disposable income expected future income wealth or default risk changes the supply of loanable funds. Updated 1142021 Jacob Reed The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantityWhat makes this market different is the axis labels and the determinants that shift both curves. The term loanable funds includes all forms of credit such as loans bonds or savings deposits. In that case the market faces an excess supply of loanable funds. Suppose the market interest rate is higher than the equilibrium interest rate.

Source: slideplayer.com

Source: slideplayer.com

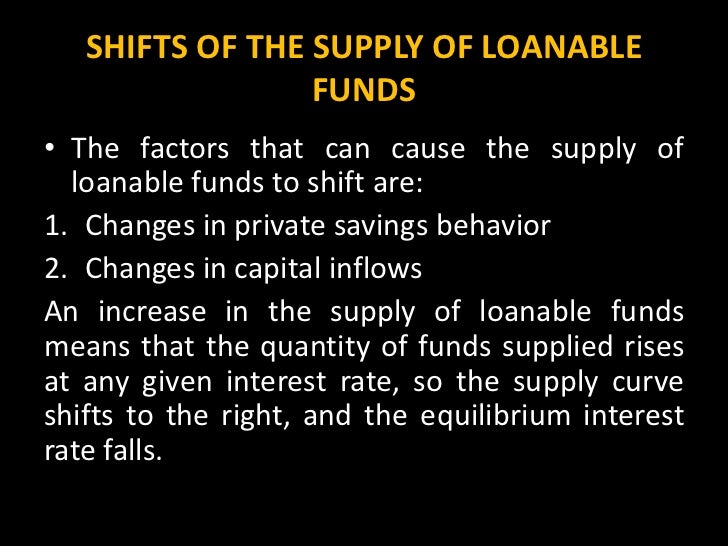

A change that begins in the loanable funds market can affect the quantity of capital firms demand. It is the return a lender receives for allowing borrowers the use of a dollar for one year calculated as a. Here a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel a. Study online flashcards and notes for Macro Shifters including FOREX. 3 Supply Shifters for the Loanable Funds Market.

Source: slideserve.com

Source: slideserve.com

The loanable funds market provides another approach to looking at the effects of increases in the budget deficit. Interest is the price paid for the use of money. 1 Changes in private savings behavior ex. We learned above that only the fed can shift the money supply curve but. The Supply of money SHIFTS due to actions of the fed.

Source: slidetodoc.com

Source: slidetodoc.com

So drawing it and manipulating it isnt too difficult if you remember a few key things. As a result interest rates have a tendency to fall. 72 the curve S slopes from left upwards to the right showing that savings. A change that begins in the loanable funds market can affect the quantity of capital firms demand. Is an interest rate of 50 good or bad.

Source: slideshare.net

Source: slideshare.net

The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. 2 Changes in public savings. Examples of events that can shift the demand for loanable funds are Changes in the anticipated rate of return earned on investment spending Government policies There is an important implication of that first determinant of investment demand. Step 3 in the loanable funds market the supply of loanable funds also declines since agents now have less saving to offer to borrowers. Assuming there is no change in the demand for capital the quantity of capital demanded falls from K1 to K2 in Panel b.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The loanable funds market provides another approach to looking at the effects of increases in the budget deficit. Foreign Demand for Domestic Currency direct International exchangeconverting to US dollars 4. Demand for Loanable Funds. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied. Shifts in The Supply or Demand Curves Anything that affects the demand for loanable funds except a change in the interest rate will cause a shift in the demand curve.

Source: slideplayer.com

Source: slideplayer.com

I had a brief exchange with George Will yesterday you dont have to read the snark just watch the clip that was I realized later precisely about liquidity. It is the return a lender receives for allowing borrowers the use of a dollar for one year calculated as a. 1 Changes in private savings behavior ex. This is why many economists say that savings is investment. Study online flashcards and notes for Macro Shifters including FOREX.

Source: youtube.com

Source: youtube.com

2000-2006 home prices were going up and savings went down. Suppose the market interest rate is higher than the equilibrium interest rate. The loanable funds market illustrates the interaction of borrowers and savers in the economy. The Supply of money SHIFTS due to actions of the fed. Assuming there is no change in the demand for capital the quantity of capital demanded falls from K1 to K2 in Panel b.

Source: slideplayer.com

Source: slideplayer.com

The reason is that a ceteris paribus increase in the interest rate results in an excess supply in the money market that spills over into the. Loanable funds market supply shifters. The supply of funds in the loanable funds market comes from the. Equilibrium is at the real interest rate where dollars saved equals dollars invested. Assuming there is no change in the demand for capital the quantity of capital demanded falls from K1 to K2 in Panel b.

Source: youtube.com

Source: youtube.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. Loanable funds market supply shifters. However the supply of loanable funds —- is upward sloping when plotted against the interest rate. S 2 indicates a decrease shift to the left of the supply curve. The reason is that a ceteris paribus increase in the interest rate results in an excess supply in the money market that spills over into the.

Source: slideserve.com

Source: slideserve.com

Two conditions of equilibrium. This is why many economists say that savings is investment. It is the return a lender receives for allowing borrowers the use of a dollar for one year calculated as a. We learned above that only the fed can shift the money supply curve but. Loanable Funds The supply of loanable funds is from savings The demand of loanable funds comes from investment.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

A change that begins in the loanable funds market can affect the quantity of capital firms demand. Economics Interest Rates and Loanable Funds. Suppose the market interest rate is higher than the equilibrium interest rate. Government Budget Deficits direct Borrowing in order to spend 2. 3 Changes in capital inflows ex.

Source: slidetodoc.com

Source: slidetodoc.com

The demand for funds in the loanable funds market comes from the private sector business investment and consumer borrowing the government sector budget deficits and the foreign sector. Loanable Funds The supply of loanable funds is from savings The demand of loanable funds comes from investment. A change that begins in the loanable funds market can affect the quantity of capital firms demand. The supply of funds in the loanable funds market comes from the. Equilibrium is at the real interest rate where dollars saved equals dollars invested.

Source: slidetodoc.com

Source: slidetodoc.com

Shifts in The Supply or Demand Curves Anything that affects the demand for loanable funds except a change in the interest rate will cause a shift in the demand curve. Foreign Demand for Domestic Currency direct International exchangeconverting to US dollars 4. All Borrowing Loans Credit direct Applying for funds 3. Suppose the market interest rate is higher than the equilibrium interest rate. Loanable Funds The supply of loanable funds is from savings The demand of loanable funds comes from investment.

Source: slideplayer.com

Source: slideplayer.com

3 Supply Shifters for the Loanable Funds Market. Therefore absent any spillover from the money market the supply of loanable funds would be the dashed vertical line at LF 1 denoted s. Interest is the price paid for the use of money. Suppose the market interest rate is higher than the equilibrium interest rate. If the government has a budget surplus it increases the supply of loanable funds the real interest rate falls which decreases household saving and decreases the quantity of private funds supplied.

Source: econ101help.com

Source: econ101help.com

I had a brief exchange with George Will yesterday you dont have to read the snark just watch the clip that was I realized later precisely about liquidity. The loanable funds market illustrates the interaction of borrowers and savers in the economy. For example an increase in borrowing resulting from an improvement in consumer or business confidence would cause the demand curve for loanable funds to shift to the right. Loanable funds market supply shifters. Real interest rate rate of return the laws of supply and demand explain the behavior of savers and borrowers.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

The loanable funds market provides another approach to looking at the effects of increases in the budget deficit. Assuming there is no change in the demand for capital the quantity of capital demanded falls from K1 to K2 in Panel b. Foreign countries parking money in domestic banks because of savings opportunities ex. Shifters Of Loanable Funds 9 out of 10 based on 104 ratings. Real interest rates are procyclical.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title shifters of loanable funds market supply by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.