Your Negative demand shock inflation images are ready. Negative demand shock inflation are a topic that is being searched for and liked by netizens now. You can Download the Negative demand shock inflation files here. Get all free vectors.

If you’re searching for negative demand shock inflation images information connected with to the negative demand shock inflation interest, you have come to the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

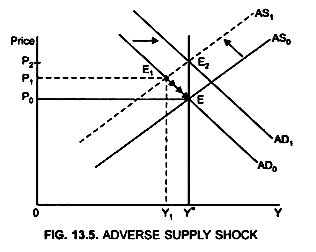

Negative Demand Shock Inflation. But if the shock is negative shifting AS to the left the output is not good since. Increasing oil prices and the 2008 financial panic. Either shock will have an effect on the prices of the product or service. If the Fed fails to do so then the demand shock could result in a permanent change in the inflation rate which would cause workers and business firms to abandon their original.

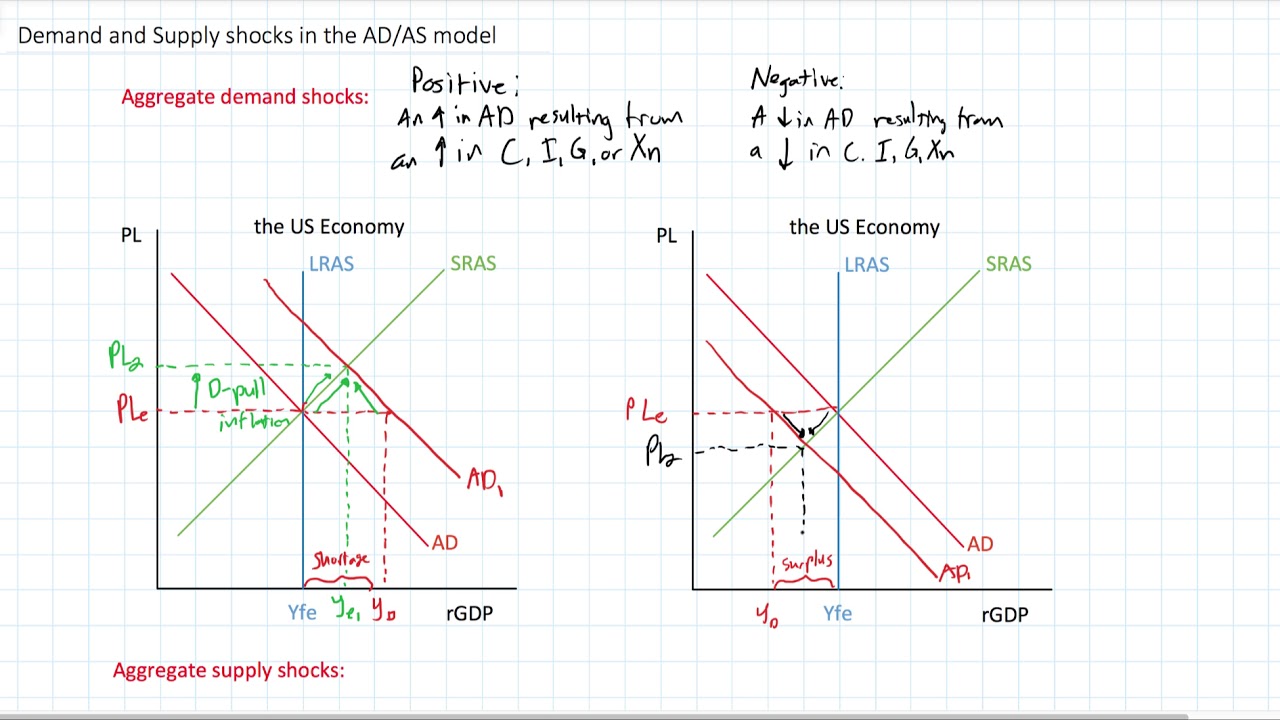

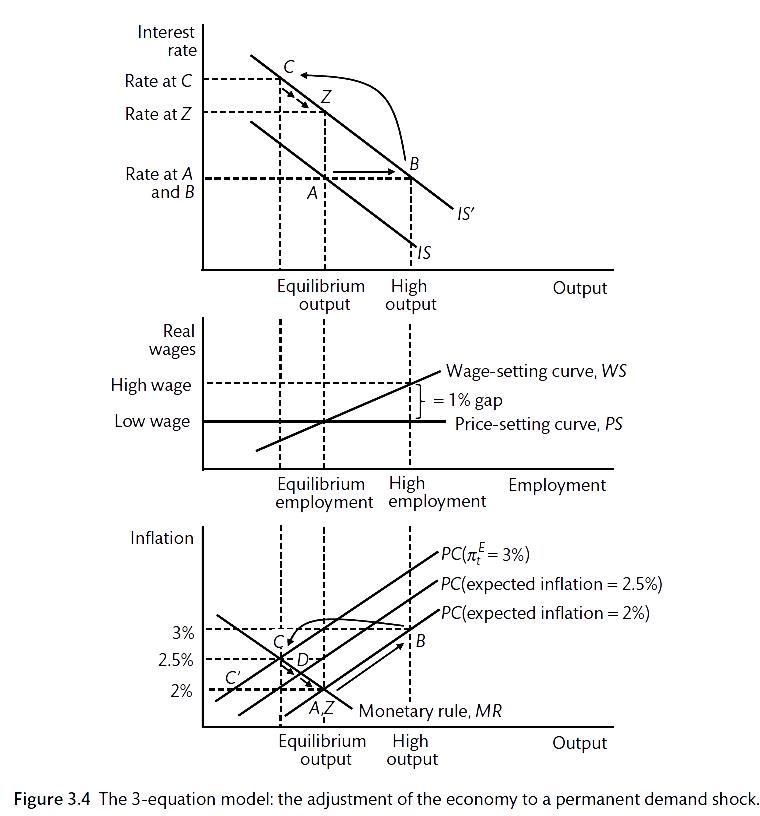

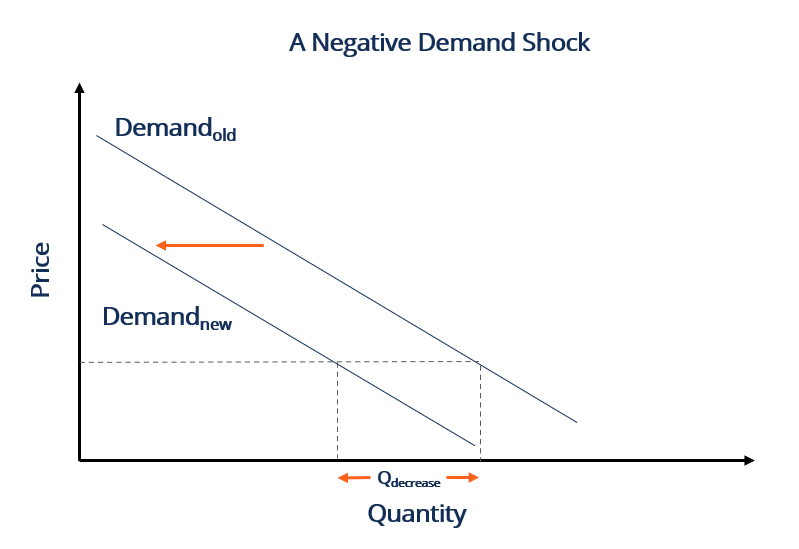

Illustrate the effects on output and domestic inflation of a temporary negative demand shock which lasts for one period. Adverse demand shocks lower mixture. Economic Growth Slowing Selective Investing Is More Important Than Ever. Economic Growth Slowing Selective Investing Is More Important Than Ever. Negative demand shocks can come from contractionary policy such as tightening the money supply or decreasing government spending. If the Fed fails to do so then the demand shock could result in a permanent change in the inflation rate which would cause workers and business firms to abandon their original.

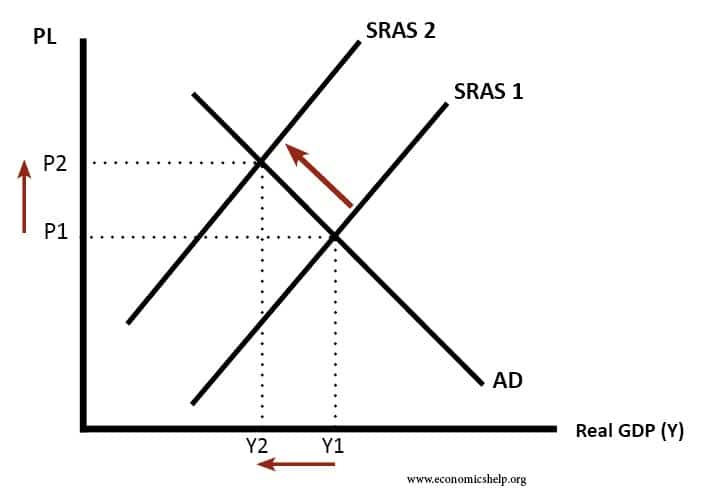

In the short run a leftward in the aggregate demand curve will cause.

Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation. Adverse demand shock inflation. Refinery fires for instance might lower out there refined oil merchandise like gasoline. This pushes the expected inflation rate below its. Illustrate the effects on output and domestic inflation of a temporary negative demand shock which lasts for one period. Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation.

Source: slidetodoc.com

Source: slidetodoc.com

Declining housing prices and the 2008 financial panic. A negative demand shock contraction in aggregate demand yields a decrease in expected production under its equilibrium level. C is thr correct answer. Adverse provide shocks and. Economic Growth Slowing Selective Investing Is More Important Than Ever.

Source: quizlet.com

Source: quizlet.com

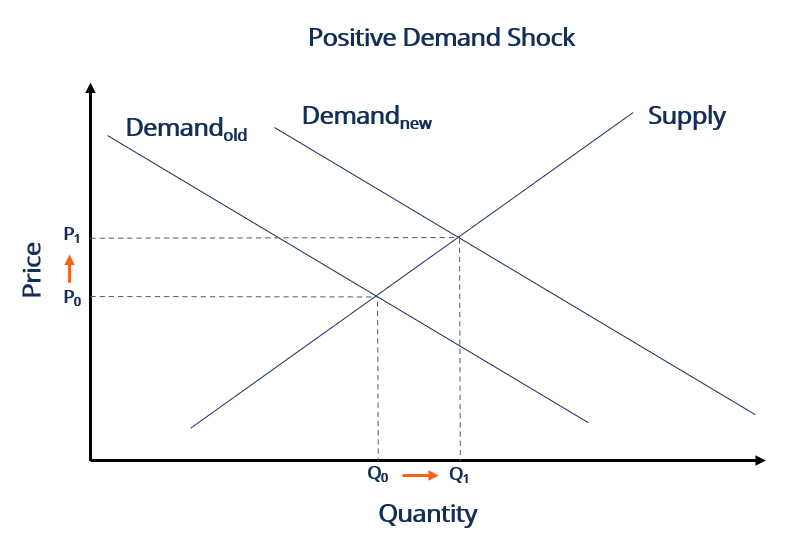

Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation. Explain the short run effects as well as the economys. A positive demand shock increases aggregate demand AD and a negative demand shock decreases aggregate demand. A negative demand shock contraction in aggregate demand yields a decrease in expected production under its equilibrium level. Negative demand shocks decrease aggregate demand in the economy because people.

Source: youtube.com

Source: youtube.com

When demand for goods. As shown below the entire demand curve shifts left. However increased consumption can lead to inflation if the economy is near full capacity. Negative Demand Shocks. This pushes the expected inflation rate below its.

In the short run a leftward in the aggregate demand curve will cause. Suppose the economy is producing at the natural rate of. A negative demand shock. Economic Growth Slowing Selective Investing Is More Important Than Ever. This will cause expected.

Source: medium.com

Source: medium.com

Negative demand shocks can come from contractionary policy such as tightening the money supply or decreasing government spending. Topics include AD shocks such as changes in consumption investment government. We see that at any price the quantity. Negative demand shocks cause aggregate demand to decrease. The first OPEC oil-price shock in 1973 caused the AS curves in all industrialized countries to shift upward.

When the Fed supplies too much monetary. Adverse provide shocks and. If the Fed fails to do so then the demand shock could result in a permanent change in the inflation rate which would cause workers and business firms to abandon their original. Topics include AD shocks such as changes in consumption investment government. A positive demand shock is a sudden increase in demand while a negative demand shock is a decrease in demand.

Source: bookdown.org

Source: bookdown.org

In the DAS - DAD Model suppose there is a negative demand shock that occurs at time t. A negative demand shock contraction in aggregate demand yields a decrease in expected production under its equilibrium level. The first OPEC oil-price shock in 1973 caused the AS curves in all industrialized countries to shift upward. But if the shock is negative shifting AS to the left the output is not good since. When the Fed supplies too much monetary.

Source: economicshelp.org

Source: economicshelp.org

What is a negative supply shock. Negative Demand Shocks. Increase the rate of growth of the money supply to restore spending growth. Prices of goods and services are affected in both cases. A negative demand shock.

Source: mises.org

Source: mises.org

However increased consumption can lead to inflation if the economy is near full capacity. We see that at any price the quantity. However increased consumption can lead to inflation if the economy is near full capacity. Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation. Negative demand shocks can come from contractionary policy such as tightening the money supply or decreasing government spending.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This pushes the expected inflation rate below its. Increasing oil prices and the 2008 financial panic. Adverse demand shocks lower mixture. This will cause expected. A negative demand shock will _____ inflation and will _____ aggregate output in the long run.

Source: wikiwand.com

Source: wikiwand.com

Refinery fires for instance might lower out there refined oil merchandise like gasoline. Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation. Increasing oil prices and the 2008 financial panic. The first OPEC oil-price shock in 1973 caused the AS curves in all industrialized countries to shift upward. The negative demand shock is a persistent one and continues in period 3.

Source: slidetodoc.com

Source: slidetodoc.com

We see that at any price the quantity. This pushes the expected inflation rate below its. Economic Growth Slowing Selective Investing Is More Important Than Ever. Adverse demand shocks lower mixture. In the short run a leftward in the aggregate demand curve will cause.

Source: researchgate.net

Source: researchgate.net

Increase the rate of growth of the money supply to restore spending growth. A negative demand shock will _____ inflation and will _____ aggregate output in the long run. Economic Growth Slowing Selective Investing Is More Important Than Ever. This pushes the expected inflation rate below its. A negative demand shock contraction in aggregate demand yields a decrease in expected production under its equilibrium level.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

A positive supply shock increases output causing prices to decrease due to a shift in the supply curve to the right while a negative supply shock decreases production causing prices to rise. A positive supply shock increases output causing prices to decrease due to a shift in the supply curve to the right while a negative supply shock decreases production causing prices to rise. Adverse provide shocks and. Explain the short run effects as well as the economys. IS curve continues to shift leftward from IS to IS and given bank rate at 500 output falls from y2 to y3.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Adverse provide shocks and. Topics include AD shocks such as changes in consumption investment government. Negative demand shocks decrease aggregate demand in the economy because people. The Bank of Canada validated this negative supply shock with an increase in the money supply. In this lesson summary review and remind yourself of the key terms and graphs related to changes in the AD-AS model.

Source: link.springer.com

Source: link.springer.com

Adverse provide shocks and. A negative demand shock will _____ inflation and will _____ aggregate output in the long run. Negative Demand Shocks. Declining housing prices and the 2008 financial panic. Suppose the economy is producing at the natural rate of.

Source: researchgate.net

Source: researchgate.net

Prices of goods and services are affected in both cases. Suppose the economy is producing at the natural rate of. When demand for goods. We see that at any price the quantity. As shown below the entire demand curve shifts left.

Source: slidetodoc.com

Source: slidetodoc.com

In the case of a negative shock to aggregate demand the central bank should. Negative demand shocks decrease aggregate demand in the economy because people. Negative demand shocks cause aggregate demand to decrease. We see that at any price the quantity. Ad Get Insights on Rising Dividends and How Pricing Power Can Help Companies Fight Inflation.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title negative demand shock inflation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.