Your Negative correlation demand images are available in this site. Negative correlation demand are a topic that is being searched for and liked by netizens today. You can Get the Negative correlation demand files here. Find and Download all free photos.

If you’re looking for negative correlation demand images information connected with to the negative correlation demand keyword, you have pay a visit to the right blog. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

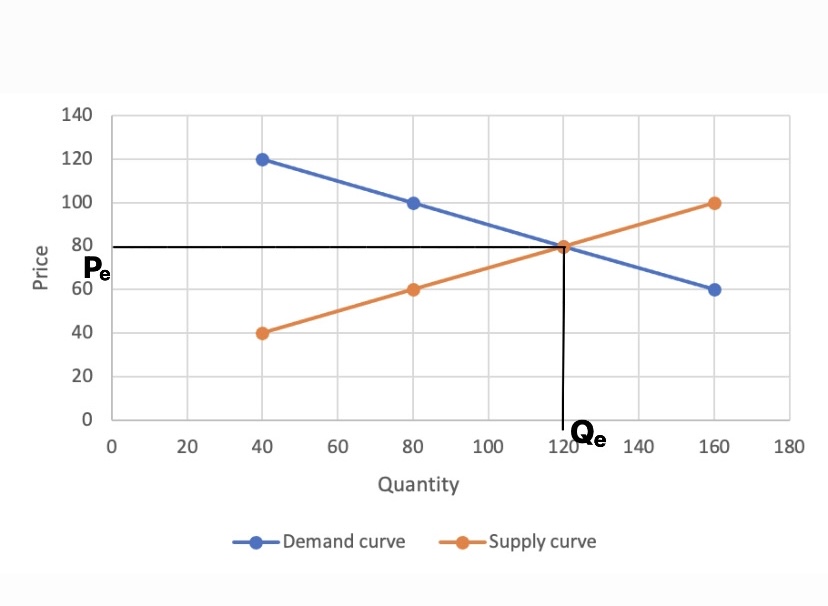

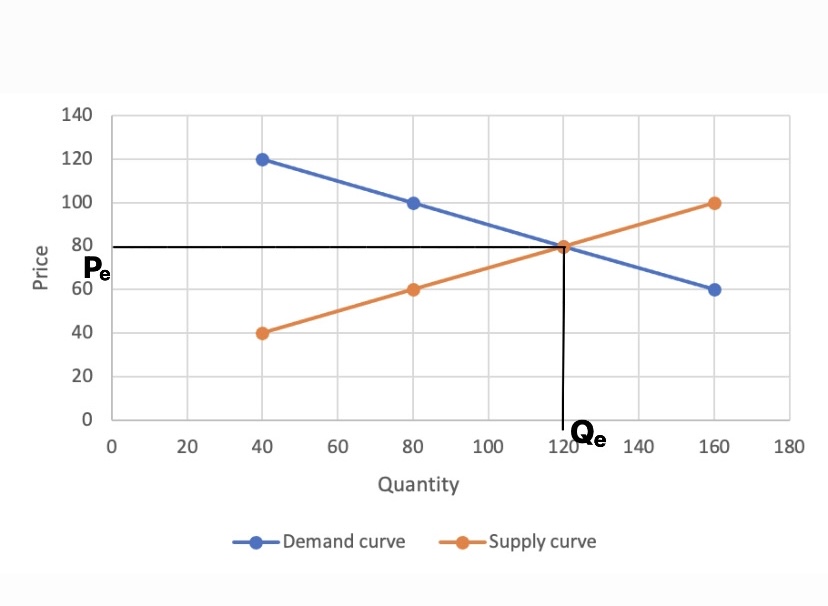

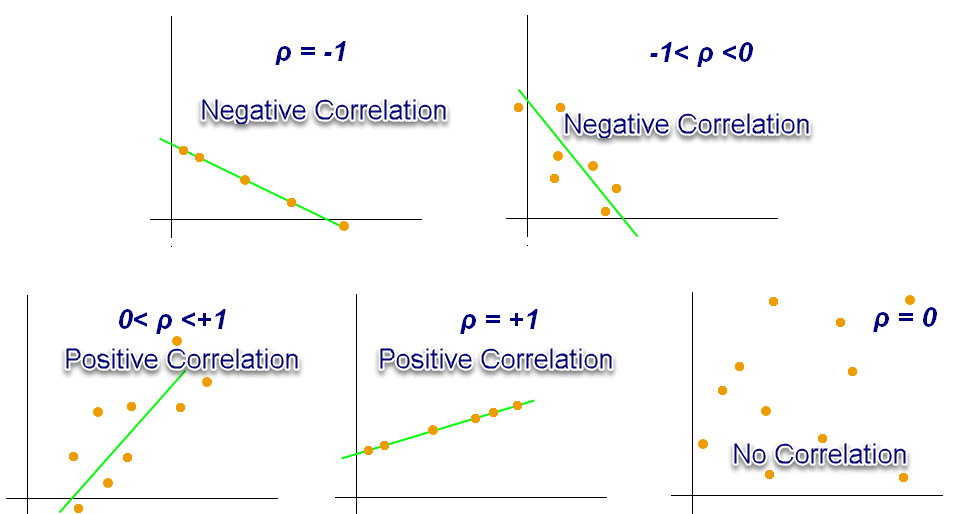

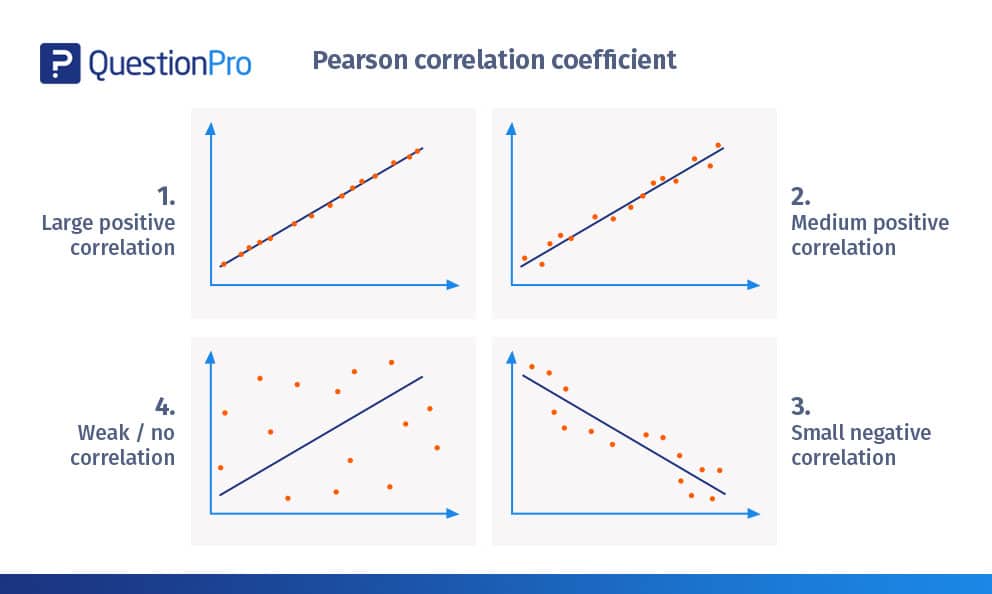

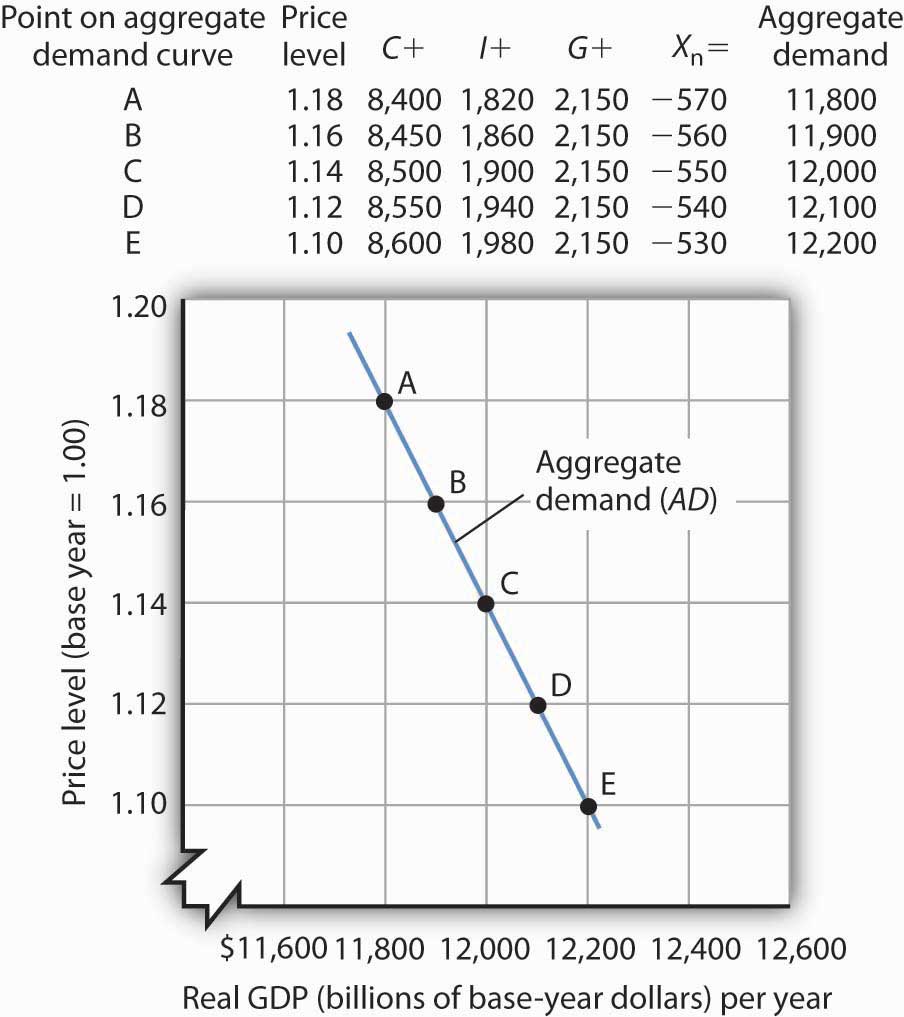

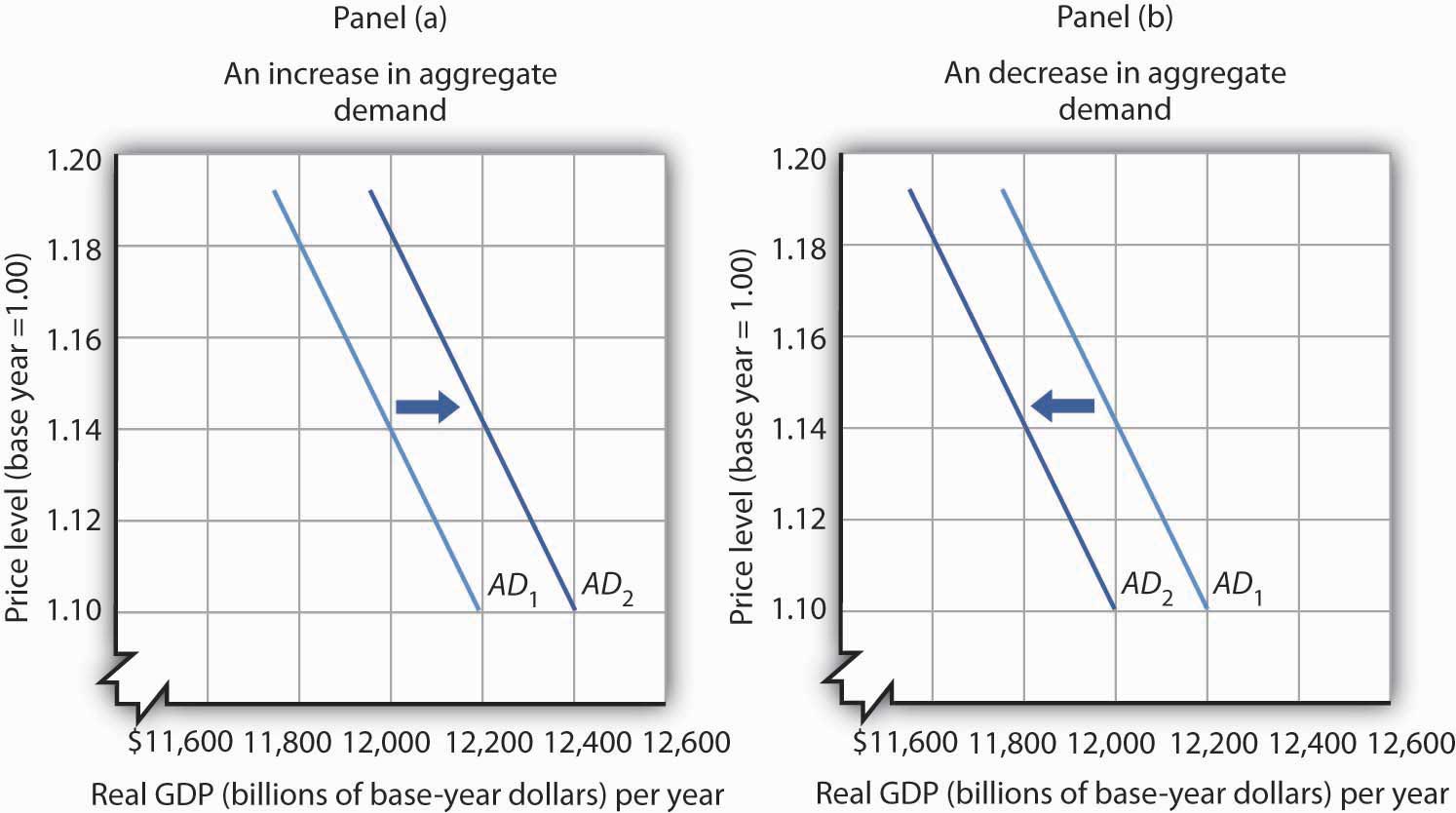

Negative Correlation Demand. It is a corollary of the CauchySchwarz inequality that the absolute value of the Pearson correlation coefficient is not bigger than 1. Shock increases demand D while a negative one decreases demand. Shifts in inflation and thus a shift in potential GDP are called supply shocks or price shocks. Correlation in a Whole.

Law Of Demand Wikipedia From en.wikipedia.org

Law Of Demand Wikipedia From en.wikipedia.org

Consider the following variable examples that would produce negative correlations. The higher the number of absences the lower a students grades will be. Think of school absences for example. As for spending increases unemployment decreases generally. Ii Current and resistance keeping the voltage constant iii Price and demand for goods. Registrations and cinema attendance.

It is a corollary of the CauchySchwarz inequality that the absolute value of the Pearson correlation coefficient is not bigger than 1.

In other words while x gains value y decreases in value. Yellow cars and accident rates. Conventionally bonds are considered far less risky than stocks so demand rises when the stock market is particularly volatile. Here if one variable increases the other decreases and vice versa. A negative correlation between two variables means that one decreases in value while the other increases in value or vice versa. Supply or price shocks usually occur when a temporary shortage of a key.

Source: tutor2u.net

Source: tutor2u.net

A price and demand of a commodity. As for spending increases unemployment decreases generally. For example unemployment and consumer spending. I Volume and pressure of perfect gas. The correlation is said to be positive when the variables move together in the same direction.

Source: investopedia.com

Source: investopedia.com

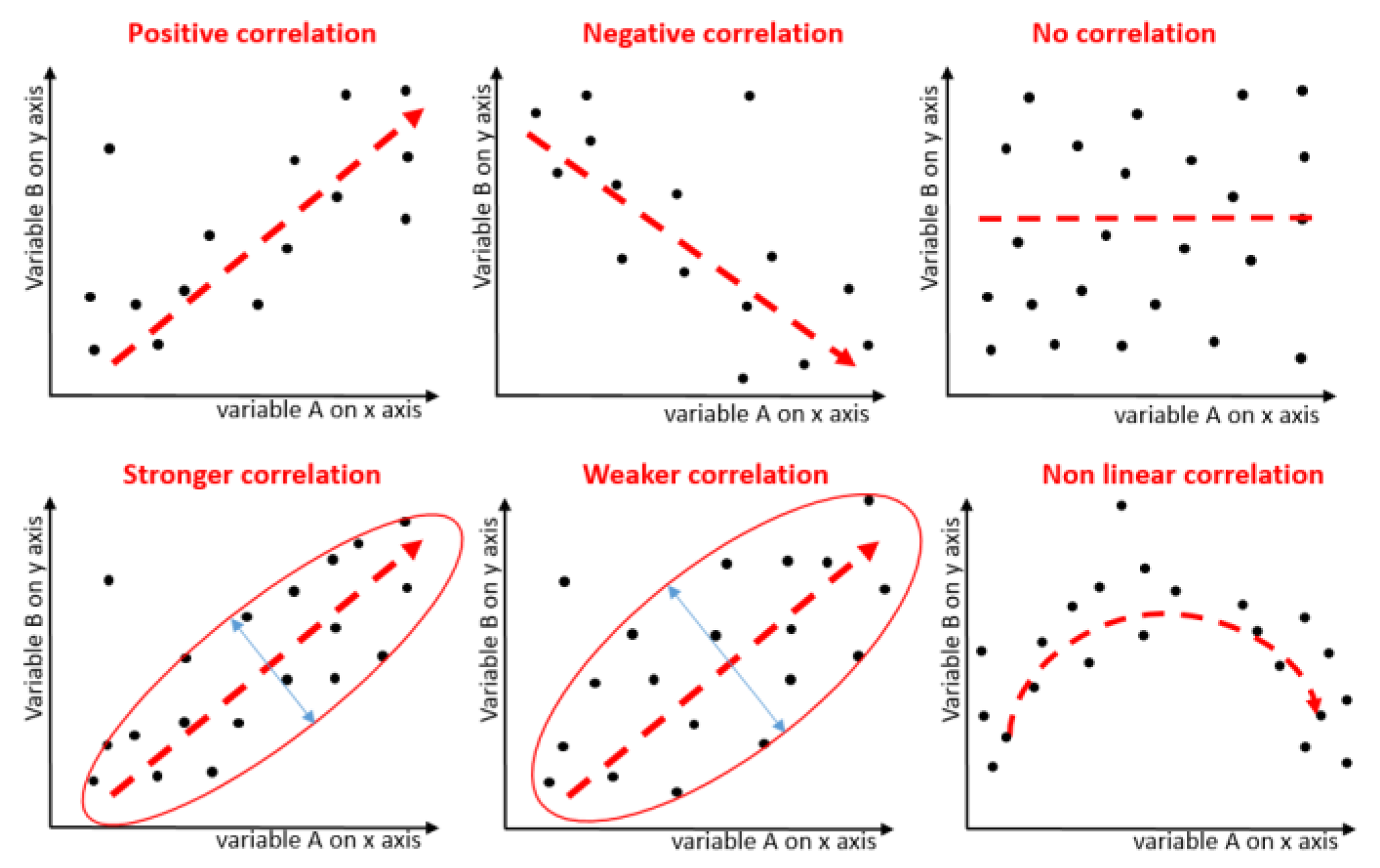

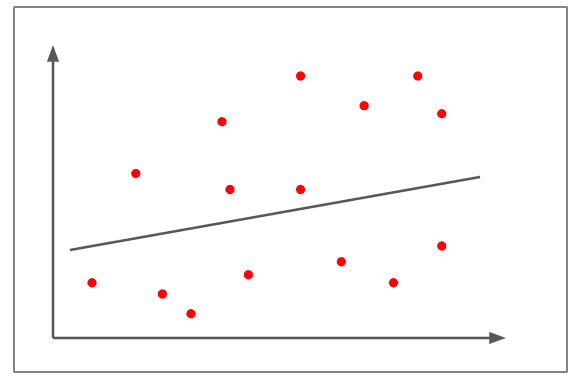

It is a corollary of the CauchySchwarz inequality that the absolute value of the Pearson correlation coefficient is not bigger than 1. Examples of negatively correlated variables include. There is no tendency for the variables to fluctuate in tandem either positively or negatively. This means when one variable increases the other decreases and when one decreases the other increases. Correlation if it exists is linear ie.

Source: en.wikipedia.org

Source: en.wikipedia.org

Some other examples of series of negative correlation are. The price of chicken has risen and the price of steak sauce has fallen. A negative correlation between two variables means that one decreases in value while the other increases in value or vice versa. And to the contrary quality supplied will increase with the increase of price. New medical evidence has been released that indicates a negative correlation between a persons beef consumption and life expectancy.

Source: investopedia.com

Source: investopedia.com

New medical evidence has been released that indicates a negative correlation between a persons beef consumption and life expectancy. Supply or price shocks usually occur when a temporary shortage of a key. Many trends associated with economics involve negative correlation. And to the contrary quality supplied will increase with the increase of price. Therefore the value of a correlation coefficient ranges between -1 and 1.

Source: emathzone.com

Source: emathzone.com

Shifts in inflation and thus a shift in potential GDP are called supply shocks or price shocks. Commodity supply and demand. Types of Correlation Correlation is commonly classified into negative and positive correlation. A negative correlation is a relationship between two variables in which an increase in one variable is associated with a decrease in the other. Consider the following variable examples that would produce negative correlations.

Source: studyfinance.com

Source: studyfinance.com

Although negative correlation is a common part of psychological and statistical analysis you can also. In other words while x gains value y decreases in value. Supply or price shocks usually occur when a temporary shortage of a key. Other decreases and vice versa then the correlation is called a negative correlation. Shock increases demand D while a negative one decreases demand.

Source: calculators.org

Source: calculators.org

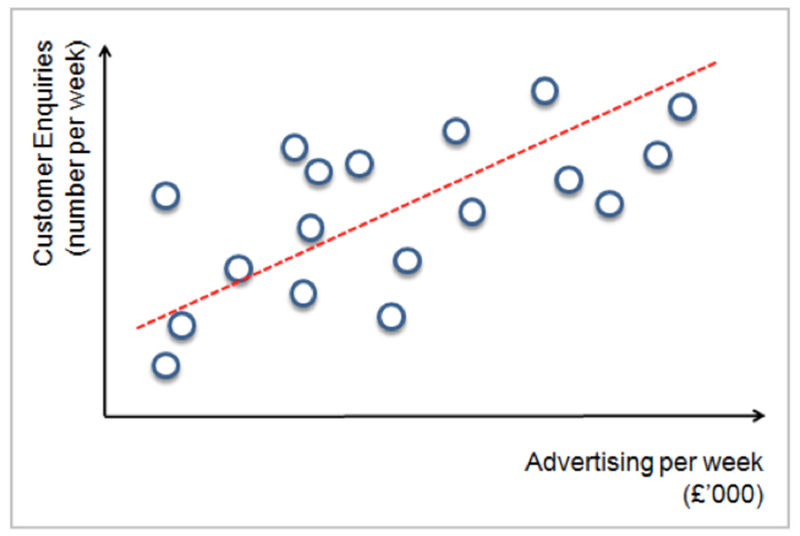

Relationship Negative Correlation. This relationship between the movements can be helpful for matters relating to economic policies. Many trends associated with economics involve negative correlation. The relative movement of the two variables can be represented by drawing a straight line on graph paper. Pages printed and printer ink supply.

Source: questionpro.com

Source: questionpro.com

Registrations and cinema attendance. And to the contrary quality supplied will increase with the increase of price. Correlation if it exists is linear ie. Pages printed and printer ink supply. Zero indicates a lack of correlation.

Source: investopedia.com

Source: investopedia.com

There is no tendency for the variables to fluctuate in tandem either positively or negatively. Correlation in the opposite direction is called a negative correlation. We know that when the price of a product increases its demand will decrease. Two people or situations known as variables with a negative correlation have an inverse relationship which means one increases as the other decreases. This relationship between the movements can be helpful for matters relating to economic policies.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Correlation if it exists is linear ie. Therefore the value of a correlation coefficient ranges between -1 and 1. For example the correlation between demand and price is said to be negative because as price increases the quantity demanded decreases and as price decreases the quantity demanded increases. Correlation in a Whole. Two people or situations known as variables with a negative correlation have an inverse relationship which means one increases as the other decreases.

Source: sciencedirect.com

Source: sciencedirect.com

A negative correlation is written as -1. Shock increases demand D while a negative one decreases demand. The relative movement of the two variables can be represented by drawing a straight line on graph paper. New medical evidence has been released that indicates a negative correlation between a persons beef consumption and life expectancy. Here if one variable increases the other decreases and vice versa.

Source: mdpi.com

Source: mdpi.com

For example unemployment and consumer spending. Here if one variable increases the other decreases and vice versa. These MCQ for Class 11 Economics with Answers have been prepared based on the latest CBSE and NCERT syllabus and examination guidelines for Class. Shifts in inflation and thus a shift in potential GDP are called supply shocks or price shocks. Consider the following variable examples that would produce negative correlations.

Source: byjus.com

Source: byjus.com

Supply or price shocks usually occur when a temporary shortage of a key. This means when one variable increases the other decreases and when one decreases the other increases. When some customers have higher reservation prices for one item in the bundle but lower reservation prices for another item in the bundle whereas another group of customers has the reverse preferences Marginal costs for production should be low. As for spending increases unemployment decreases generally. In other words while x gains value y decreases in value.

Source: studyfinance.com

Source: studyfinance.com

Shock increases demand D while a negative one decreases demand. Lower degrees of correlation are expressed by non-zero coefficents between 1 and -1. This relationship between the movements can be helpful for matters relating to economic policies. New medical evidence has been released that indicates a negative correlation between a persons beef consumption and life expectancy. Therefore the value of a correlation coefficient ranges between -1 and 1.

The price of chicken has risen and the price of steak sauce has fallen. Ii Current and resistance keeping the voltage constant iii Price and demand for goods. Shifts in inflation and thus a shift in potential GDP are called supply shocks or price shocks. Negative correlation of demand. The correlation coefficient is 1 in the case of a perfect direct increasing linear relationship correlation 1 in the case of a perfect inverse.

Source: questionpro.com

Source: questionpro.com

Yellow cars and accident rates. Although negative correlation is a common part of psychological and statistical analysis you can also. Negative correlation is said to exist when a rise in the value of one variable leads to a fall in the value of the other variable and vice versa. It is a corollary of the CauchySchwarz inequality that the absolute value of the Pearson correlation coefficient is not bigger than 1. Ii Current and resistance keeping the voltage constant iii Price and demand for goods.

Source: efficy.com

Source: efficy.com

Shifts in inflation and thus a shift in potential GDP are called supply shocks or price shocks. It is a corollary of the CauchySchwarz inequality that the absolute value of the Pearson correlation coefficient is not bigger than 1. Zero indicates a lack of correlation. The higher the number of absences the lower a students grades will be. The price of chicken has risen and the price of steak sauce has fallen.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Negative correlation is said to exist when a rise in the value of one variable leads to a fall in the value of the other variable and vice versa. Types of Correlation Correlation is commonly classified into negative and positive correlation. The demand curve for beef must be positively sloped. Zero indicates a lack of correlation. Lower degrees of correlation are expressed by non-zero coefficents between 1 and -1.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title negative correlation demand by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.