Your Money supply increase graph images are ready. Money supply increase graph are a topic that is being searched for and liked by netizens now. You can Find and Download the Money supply increase graph files here. Download all free images.

If you’re looking for money supply increase graph pictures information linked to the money supply increase graph keyword, you have come to the right blog. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

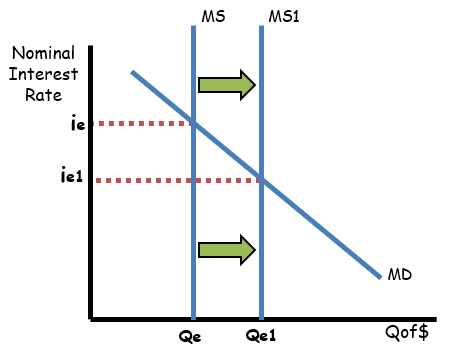

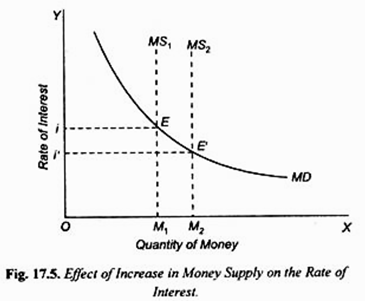

Money Supply Increase Graph. If starting from this situation the Fed increases the money supply banks will increase their lending activity. The economys central bank decreases the money supply. At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1. This increase in supplyin accordance with the law of.

Fiscal And Monetary Policies And Is Lm Curve Model From economicsdiscussion.net

Fiscal And Monetary Policies And Is Lm Curve Model From economicsdiscussion.net

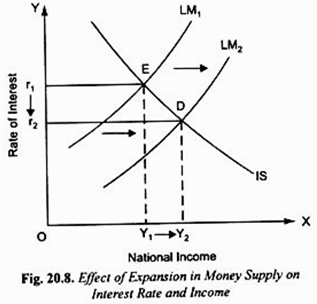

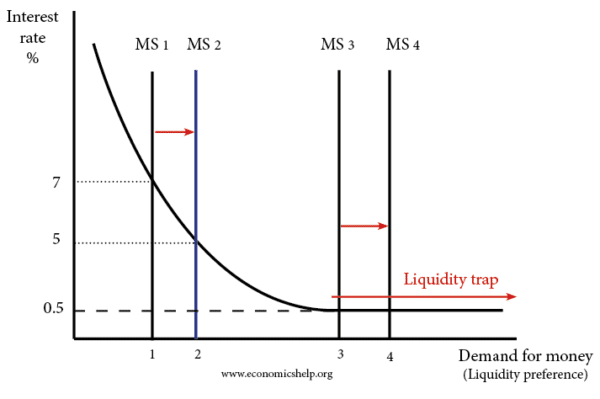

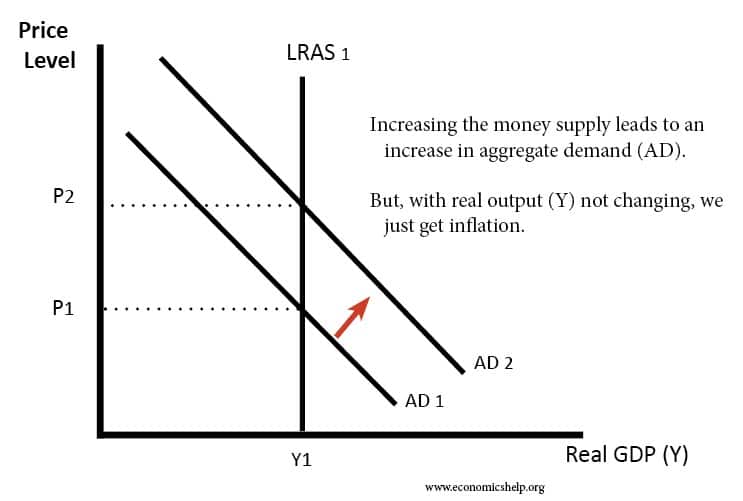

The long run equilibrium is shown by the green dot 1 with the price level at 105. An increase in the money supply M S causes an increase in the real money supply M S P since P remains constant. Has spiked at an unprecedented rate. M1 Money Supply Long-Term NOV-30 2020. This increase is shown in the FRED graph above red line where we measure M1s opportunity cost as the one-year US. The LM curve shifts right left when the money supply real money balances increases decreases.

This is for two main reasons.

M2 rose 38 percent in March 67 percent in April and 50 percent in May a stunning 83 percent annualized growth rate for three months. The economys central bank decreases the money supply. Before May 2020 M2 consists of M1 plus 1 savings deposits including money market deposit accounts. In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate. 2 small-denomination time deposits time deposits in amounts of less than 100000 less individual retirement account IRA and Keogh balances at depository. M1 Money Supply Long-Term NOV-30 2020.

M2 includes M1 physical cash and checkable deposits as well as less liquid money such as saving bank accounts. Equilibrium in a market is found where the quantity supplied equals the quantity demanded because surpluses situations where supply exceeds demand pushes prices down and shortages situations where demand exceeds supply drive prices up. Interest rates increase therefore investment spending increases negative demand shock i. Money Supply Charts. Now suppose there is an increase in the money supply.

Source: mrmedico.info

Source: mrmedico.info

Has spiked at an unprecedented rate. The money supply in the US. If starting from this situation the Fed increases the money supply banks will increase their lending activity. Equilibrium in a market is found where the quantity supplied equals the quantity demanded because surpluses situations where supply exceeds demand pushes prices down and shortages situations where demand exceeds supply drive prices up. In this graph the supply of and demand for money come together to determine the nominal interest rate in an economy.

Source: snssri.org

Source: snssri.org

If starting from this situation the Fed increases the money supply banks will increase their lending activity. Increasing the money supply eg. The Fed ceased publishing M-3 its broadest money supply measure in March 2006. The easiest way to see this is to first imagine a graph where money demand is fixed and the money supply increases shifts right leading to a lower interest rate and vice versa. Draw a graph of the AD-AS model to show the effect of each of the following ceteris paribus changes.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Now suppose there is an increase in the money supply. Figure 2512 An Increase in the Money Supply. This increase in money supply will support an increase in income to Y 2 as opposed to Y 1. Before May 2020 M1 consists of 1 currency outside the US. The effect of an increase in the money supply expansionary monetary policy Lets start with an economy in long run equilibrium with the price level equal to that anticipated by decision makers.

Source: economicshelp.org

Source: economicshelp.org

If M1 carries the opportunity cost of not earning much interest then why has the M1 money supply been increasing. Increasing the money supply eg. Treasury yield green line. When you view money supply and velocity together one notices they tend to offset each other. Equilibrium in a market is found where the quantity supplied equals the quantity demanded because surpluses situations where supply exceeds demand pushes prices down and shortages situations where demand exceeds supply drive prices up.

Source: www2.harpercollege.edu

Source: www2.harpercollege.edu

Inflation or the rate at which the average price of goods or services. An increase in the money supply means that more money is available for borrowing in the economy. This corresponds to an increase in the money supply to M in Panel b. M1 Money Supply Long-Term NOV-30 2020. M2 rose 38 percent in March 67 percent in April and 50 percent in May a stunning 83 percent annualized growth rate for three months.

Source: pressbooks.senecacollege.ca

Source: pressbooks.senecacollege.ca

206 flatter than L 0 M 0 which assumes a fixed real money supply. Then an increase in the interest rate from i 0 to i 1 shifts the money supply out from Mi 0 to Mi 1 in Fig. Has spiked at an unprecedented rate. M2 rose 38 percent in March 67 percent in April and 50 percent in May a stunning 83 percent annualized growth rate for three months. The next chart is the Long-Term M1 Money Supply chart since 1980.

Source: chegg.com

Source: chegg.com

This Demonstration shows the implications for the economy if the money supply is increased. Has spiked at an unprecedented rate. The Fed ceased publishing M-3 its broadest money supply measure in March 2006. Initially this change decreases interest rates as seen on the money market graph. An increase in the money supply means that more money is available for borrowing in the economy.

This lifted the year-over-year growth rate of M2 to 23 percent almost double its prior fastest rate in the modern era. The easiest way to see this is to first imagine a graph where money demand is fixed and the money supply increases shifts right leading to a lower interest rate and vice versa. This increases the quantity of investment shown on the investment demand graph which increases aggregate demand. Draw a graph of the AD-AS model to show the effect of each of the following ceteris paribus changes. This Demonstration shows the implications for the economy if the money supply is increased.

Source: chegg.com

Source: chegg.com

Initially this change decreases interest rates as seen on the money market graph. Through quantitative easing creating money electronically. If starting from this situation the Fed increases the money supply banks will increase their lending activity. The easiest way to see this is to first imagine a graph where money demand is fixed and the money supply increases shifts right leading to a lower interest rate and vice versa. The effect of an increase in the money supply expansionary monetary policy Lets start with an economy in long run equilibrium with the price level equal to that anticipated by decision makers.

Before May 2020 M1 consists of 1 currency outside the US. The LM curve shifts right left when the money supply real money balances increases decreases. The Fed ceased publishing M-3 its broadest money supply measure in March 2006. This lifted the year-over-year growth rate of M2 to 23 percent almost double its prior fastest rate in the modern era. Everything else being equal an increase in the money supply is likely to cause inflation.

This increase in money supply will support an increase in income to Y 2 as opposed to Y 1. In this graph the supply of and demand for money come together to determine the nominal interest rate in an economy. The next chart is the Long-Term M1 Money Supply chart since 1980. This increase in money supply will support an increase in income to Y 2 as opposed to Y 1. Money Supply M0 in the United States increased to 6394800 USD Million in November from 6331000 USD Million in October of 2021.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

This decrease will shift the aggregate demand curve to the left. Government and foreign banks and official institutions less cash items in the process of collection. The economys central bank decreases the money supply. The SGS M-3 Continuation estimates current M-3 based on ongoing Fed reporting of M-3s largest components M-2 institutional money funds and partial large time deposits and proprietary modeling of the balance. The interest rate must fall to r 2 to achieve equilibrium.

Source: economicshelp.org

Source: economicshelp.org

This Demonstration shows the implications for the economy if the money supply is increased. M1 Money Supply Long-Term NOV-30 2020. Increasing the money supply eg. The decrease in the money supply is mirrored by an equal decrease in the nominal output otherwise known as Gross Domestic Product GDP. Before May 2020 M2 consists of M1 plus 1 savings deposits including money market deposit accounts.

The nancial market - Shifts of the LM curve An increase in the money supply causes the LM curve to shift down. The nancial market - Shifts of the LM curve An increase in the money supply causes the LM curve to shift down. The money supply in the US. M2 includes M1 physical cash and checkable deposits as well as less liquid money such as saving bank accounts. This Demonstration shows the implications for the economy if the money supply is increased.

Source: investopedia.com

Source: investopedia.com

The interest rate must fall to r 2 to achieve equilibrium. The decrease in the money supply is mirrored by an equal decrease in the nominal output otherwise known as Gross Domestic Product GDP. This corresponds to an increase in the money supply to M in Panel b. The next chart is the Long-Term M1 Money Supply chart since 1980. It uses the four key graphs taught in AP Macroeconomics.

Source: economicshelp.org

Source: economicshelp.org

M2 rose 38 percent in March 67 percent in April and 50 percent in May a stunning 83 percent annualized growth rate for three months. This lifted the year-over-year growth rate of M2 to 23 percent almost double its prior fastest rate in the modern era. Then an increase in the interest rate from i 0 to i 1 shifts the money supply out from Mi 0 to Mi 1 in Fig. Treasury yield green line. The long run equilibrium is shown by the green dot 1 with the price level at 105.

Source: steemit.com

Source: steemit.com

26 rows The US M2 Money Stock is critical in understanding and forecasting. When you view money supply and velocity together one notices they tend to offset each other. Introduction to Macroeconomics TOPIC 4. This increase in supplyin accordance with the law of. The Fed increases the money supply by buying bonds increasing the demand for bonds in Panel a from D 1 to D 2 and the price of bonds to P b 2.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money supply increase graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.