Your Money demand curve downward sloping images are ready. Money demand curve downward sloping are a topic that is being searched for and liked by netizens today. You can Download the Money demand curve downward sloping files here. Get all royalty-free vectors.

If you’re searching for money demand curve downward sloping pictures information linked to the money demand curve downward sloping topic, you have visit the ideal blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Money Demand Curve Downward Sloping. Verified Answer The inverse relationship between the quantity of money demanded and the interest rate results in a. This illustrates an inverse relationship between money and the interest rate which leads to a downward-sloping demand curve for money. This paper explains the reason why according to neo classical economic theory the demand curve is downward sloping. Money demand when plotted against the interest rate.

Reading The Foundations Of Demand Curve Microeconomics From courses.lumenlearning.com

Reading The Foundations Of Demand Curve Microeconomics From courses.lumenlearning.com

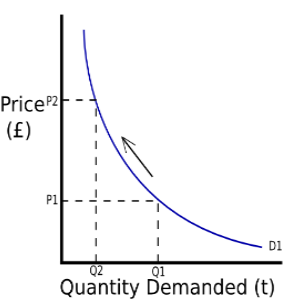

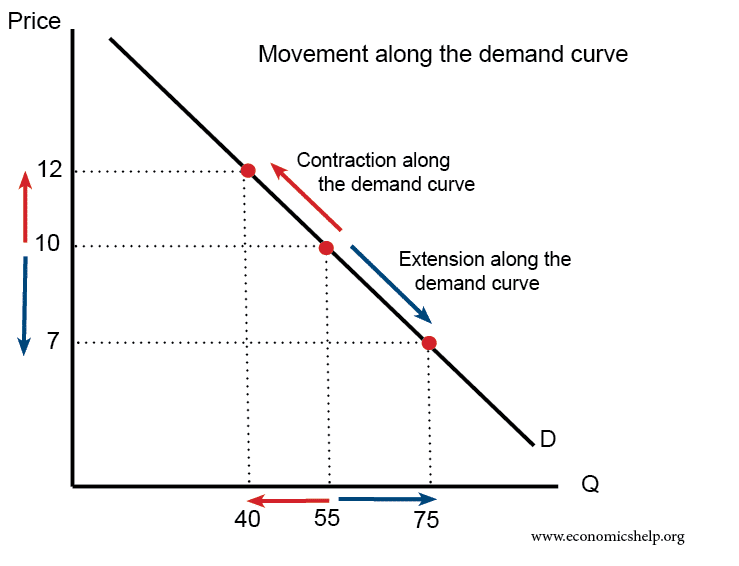

17 The money demand curve is downward sloping because a lower interest rates cause households and firms to switch from money to financial assets. A decrease in price leads to movement down the demand curve. B Banks typically want more savings when the interest rate is higher. It complies with the law of demand. The aggregate demand curve is downward sloping because a. This movement is called a change in quantity demanded.

The aggregate demand curve is downward sloping because a.

The law of demand explains the functional relationship between the price of a commodity and its demand. Notice that the demand curve for money is downward sloping which means that people want to hold less of their wealth in the form of money the higher that interest rates on bonds and other. A At higher interest rates the opportunity cost of holding money is lower. C lower interest rates cause households and firms to switch from money to bonds. It also seeks to explain the marginal utility theory and historical distinction between use- value and exchange-. The slope of a demand curve is downward because the demand for lower prices makes quantity demanded increase.

Source: economicshelp.org

Source: economicshelp.org

This answer is incorrect. Downward-sloping because the opportunity cost of holding money rises as the interest rate falls. A downward-sloping demand curve holds true in most of our day-to-day cases. Figure 257 The Demand Curve for Money. This is because you could be getting a lot of money in interest if you held your wealth in bonds rather than money.

Source: vskills.in

Source: vskills.in

At the same time individuals earn interest when they hold bonds. At the same time individuals earn interest when they hold bonds. So that is why the demand curve for money slopes downward –. Therefore the classic linear and downward-sloping demand curve implies. It is assumed that money pays no interest.

Source: toppr.com

Source: toppr.com

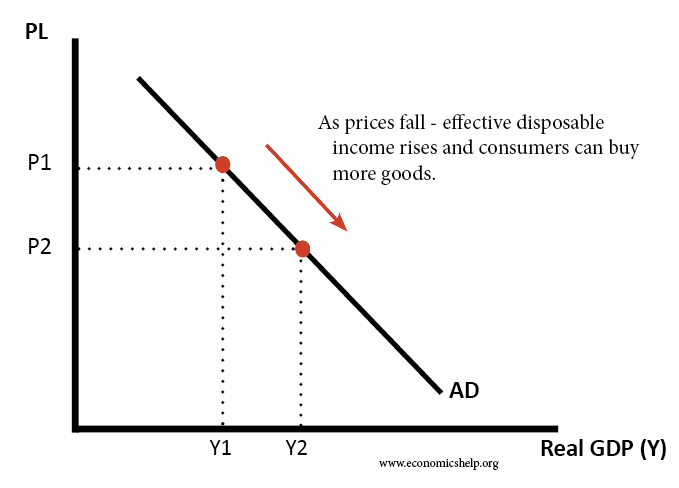

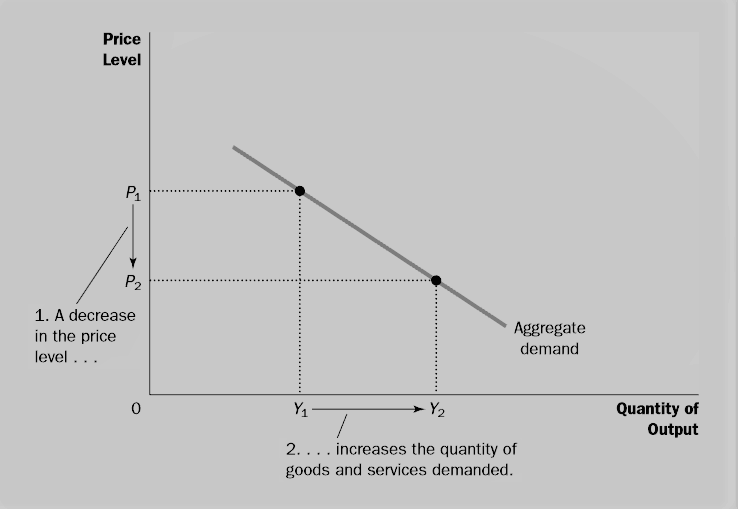

B Banks typically want more savings when the interest rate is higher. C lower interest rates cause households and firms to switch from money to bonds. It means that other things equal a fall in the economys overall level of prices from say P1 to P2 tends to raise the number of goods and services demanded from Y1 to Y2. Upward-sloping because the opportunity cost of holding money rises with the interest rate. This paper explains the reason why according to neo classical economic theory the demand curve is downward sloping.

Source: pinterest.com

Source: pinterest.com

The aggregate demand curve is downward sloping because a. This is because you could be getting a lot of money in interest if you held your wealth in bonds rather than money. C lower interest rates cause households and firms to switch from money to bonds. This movement is called a change in quantity demanded. B lower interest rates cause households and firms to switch from financial assets to money.

Source: economicshelp.org

Source: economicshelp.org

Its downward slope expresses the negative relationship between the quantity of money demanded and the interest rate. Upward-sloping because the opportunity cost of holding money rises with the interest rate. The demand curve for a monopolist slopes downward because the market demand curve which is downward sloping applies to the monopolists market activity. A At higher interest rates the opportunity cost of holding money is lower. Interest rates rise the quantity of money consumers hold decreases.

A decrease in government spending reduces prices and makes consumption demand increase b. A decrease in price leads to movement down the demand curve. The transactions demand for money curve is upward sloping and the asset demand for money curve is downward sloping. This illustrates an inverse relationship between money and the interest rate which leads to a downward-sloping demand curve for money. A decrease in government spending reduces prices and makes consumption demand increase b.

Source: ifioque.com

Source: ifioque.com

Demand for the monopolists product increases as its price decreases. A decrease in price leads to movement down the demand curve. Upward-sloping because the opportunity cost of holding money rises with the interest rate. It complies with the law of demand. A change in the price level causes a movement along the aggregate demand curve.

Source: ifioque.com

Source: ifioque.com

The slope of a demand curve is downward because the demand for lower prices makes quantity demanded increase. Upward-sloping because the opportunity cost of holding money rises with the interest rate. The money demand curve is. It means that other things equal a fall in the economys overall level of prices from say P1 to P2 tends to raise the number of goods and services demanded from Y1 to Y2. 17 The money demand curve is downward sloping because a lower interest rates cause households and firms to switch from money to financial assets.

It also highlights some of the factors that affected the demand of a commodity by a consumer the relationship between these factors and demand. A change in the price level causes a movement along the aggregate demand curve. Course Hero member to access this document. The slope of a demand curve is downward because the demand for lower prices makes quantity demanded increase. This curve is always downward sloping due to an inverse relationship between price and demand.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

The slope of a demand curve is downward because the demand for lower prices makes quantity demanded increase. So as the interest rate increases individuals are more willing to incur the costs associated with converting bonds to money when they wish to buy goods. Upward-sloping because the opportunity cost of holding money rises with the interest rate. Money demand when plotted against the interest rate. A decrease in government spending reduces prices and makes consumption demand increase b.

Source: quickonomics.com

Source: quickonomics.com

Restrictive monetary policy is typically used during periods of recession. Upload your study docs or become a. A decrease in price leads to movement down the demand curve. The most important tool that explains this relationship is the demand curve. It also seeks to explain the marginal utility theory and historical distinction between use- value and exchange-.

Source: ilearnthis.com

Source: ilearnthis.com

This movement is called a change in quantity demanded. Its downward slope expresses the negative relationship between the quantity of money demanded and the interest rate. The demand curve for money shows the quantity of money demanded at each interest rate. By the law of demand a higher price lowers consumers willingness and ability to buy causing the quantity demanded to fall. At the same time individuals earn interest when they hold bonds.

Source: pinterest.com

Source: pinterest.com

It also seeks to explain the marginal utility theory and historical distinction between use- value and exchange-. The slope of a demand curve is downward because the demand for lower prices makes quantity demanded increase. This movement is called a change in quantity demanded. Downward-sloping because the opportunity cost of holding money rises as the interest rate falls. So as the interest rate increases individuals are more willing to incur the costs associated with converting bonds to money when they wish to buy goods.

Source: economicsonline.co.uk

Source: economicsonline.co.uk

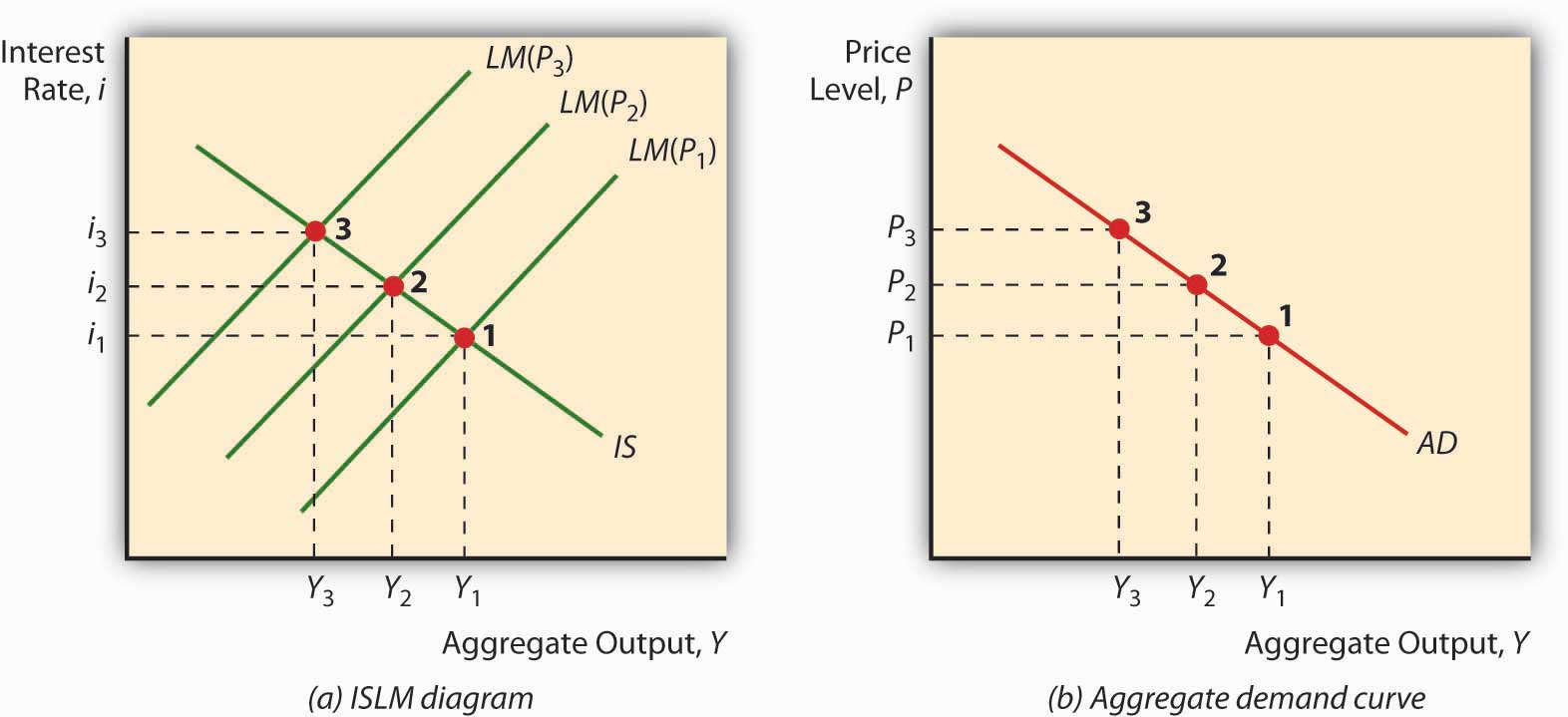

This paper explains the reason why according to neo classical economic theory the demand curve is downward sloping. The aggregate demand curve is downward sloping. The money demand curve is. Verified Answer The inverse relationship between the quantity of money demanded and the interest rate results in a. Money demand when plotted against the interest rate.

Source: economicshelp.org

Source: economicshelp.org

An increase in the price level reduces real money holdings which reduces the amount of expenditures. Upload your study docs or become a. Money Demand when plotted against the interest rate is downward sloping because. Money demand when plotted against the interest rate. This paper explains the reason why according to neo classical economic theory the demand curve is downward sloping.

Source: study.com

Source: study.com

The aggregate demand curve is downward sloping because a. This preview shows page 1 - 3 out of 6 pages. The aggregate demand curve is downward sloping. This curve is always downward sloping due to an inverse relationship between price and demand. The aggregate demand curve is downward sloping because a.

Upload your study docs or become a. This is because you could be getting a lot of money in interest if you held your wealth in bonds rather than money. So that is why the demand curve for money slopes downward –. As income increases it causes an increase in the amount of planned expenditures. Therefore the classic linear and downward-sloping demand curve implies.

Upward-sloping because the opportunity cost of holding money rises with the interest rate. So that is why the demand curve for money slopes downward –. Verified Answer The inverse relationship between the quantity of money demanded and the interest rate results in a. A downward-sloping demand curve holds true in most of our day-to-day cases. The law of demand explains the functional relationship between the price of a commodity and its demand.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money demand curve downward sloping by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.