Your Minneapolis state tax return status images are ready. Minneapolis state tax return status are a topic that is being searched for and liked by netizens now. You can Find and Download the Minneapolis state tax return status files here. Get all royalty-free vectors.

If you’re looking for minneapolis state tax return status pictures information related to the minneapolis state tax return status interest, you have visit the right blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Minneapolis State Tax Return Status. And in some cases this work could take 90 to 120 days. For the latest information on IRS refund processing see the IRS Operations Status page. Minnesota has a new online secure Taxpayer Access system that they are currently testing. Enter this information in the boxes below.

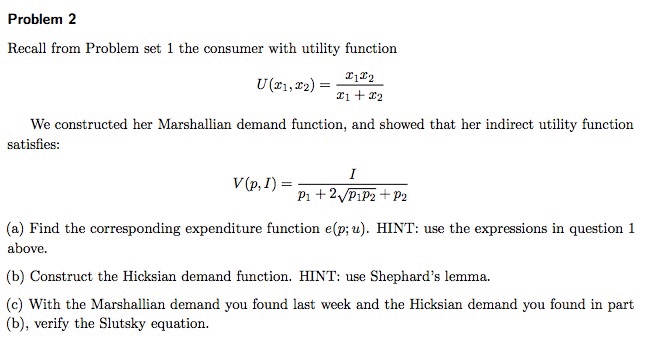

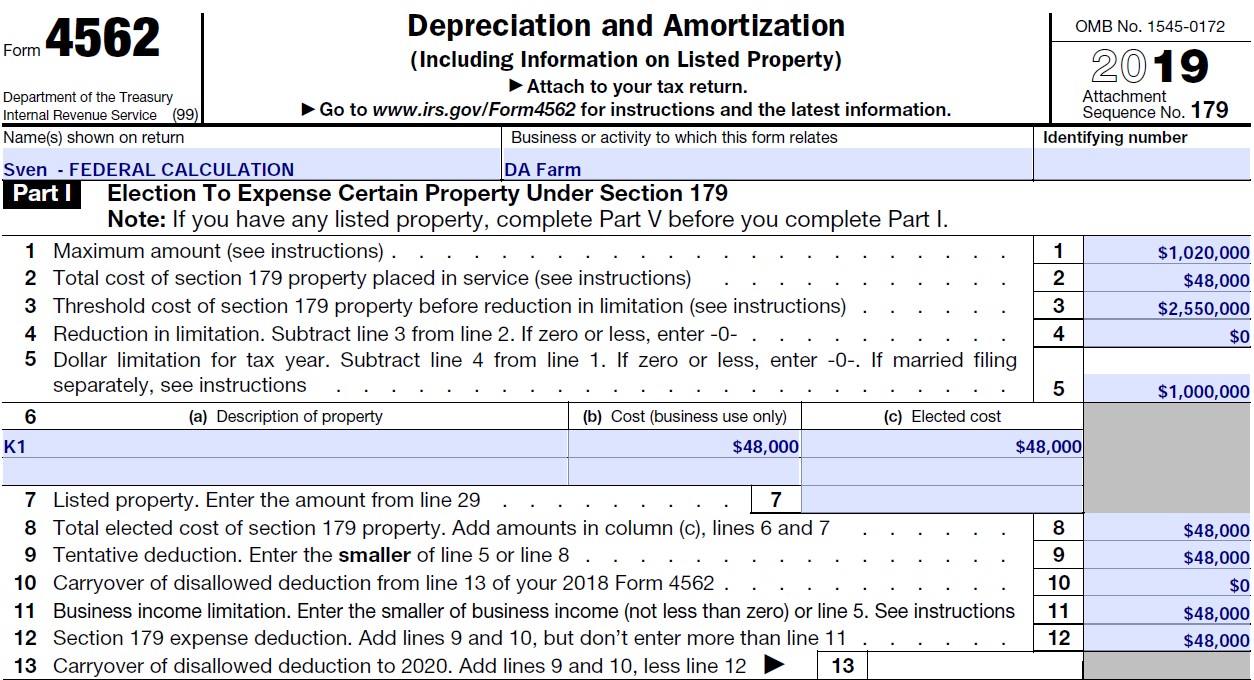

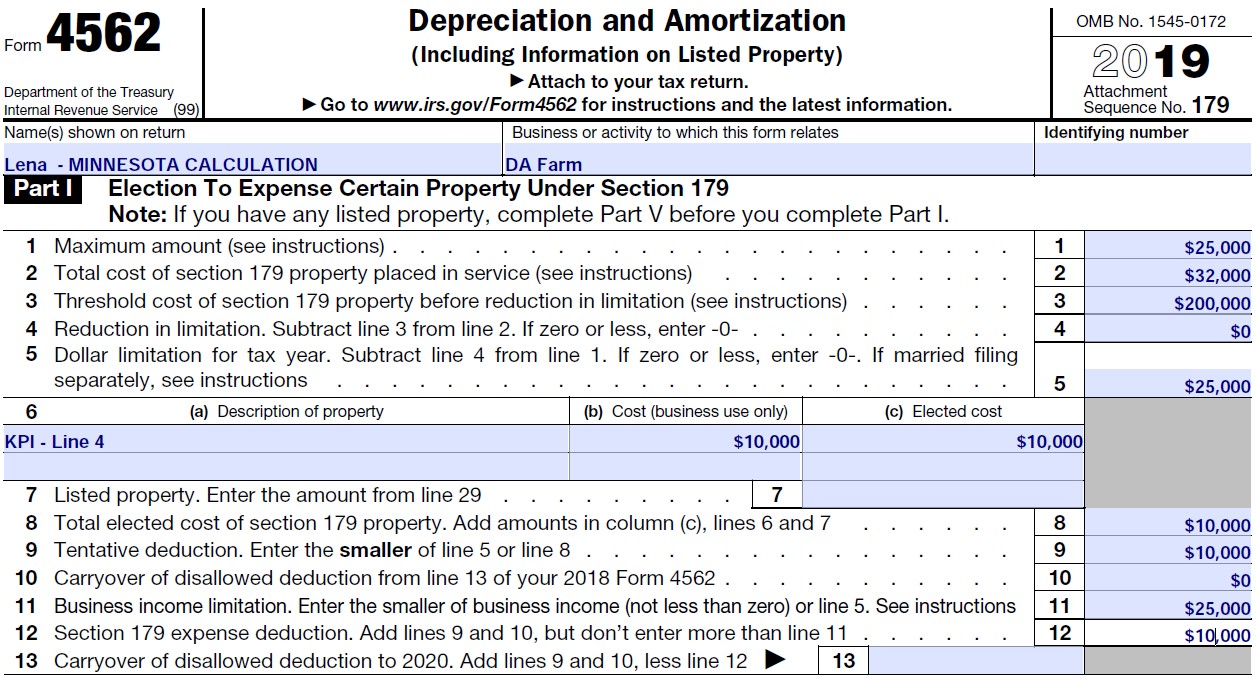

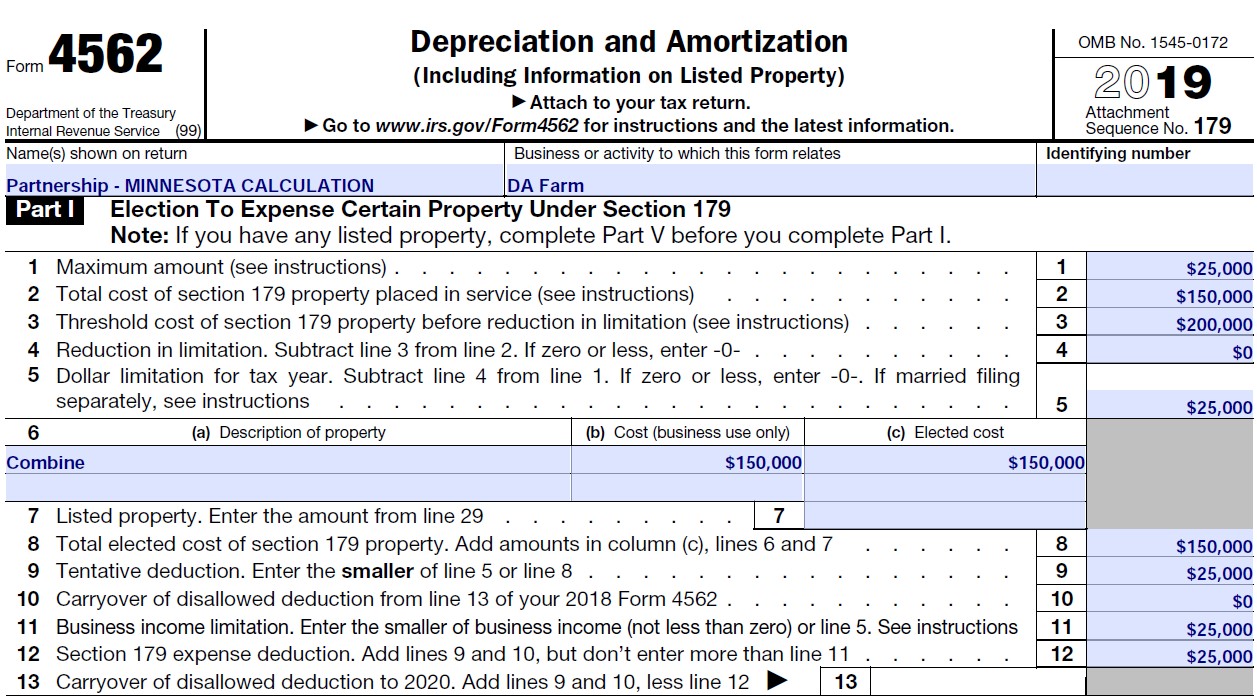

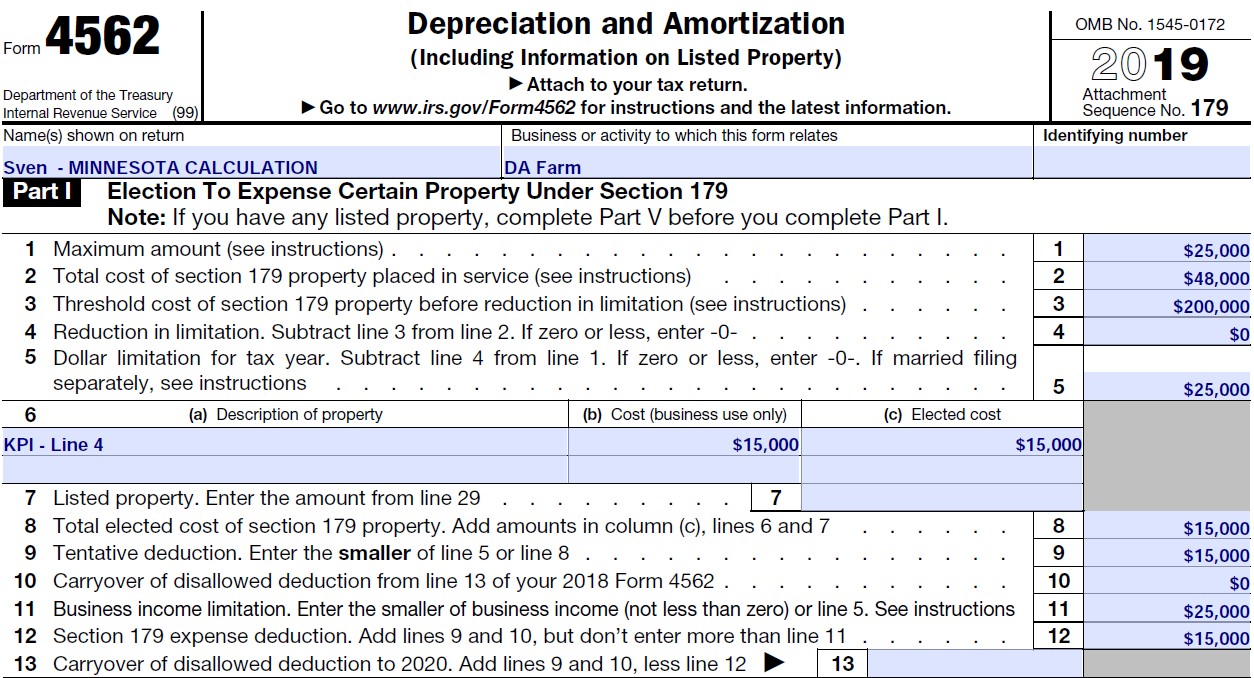

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue From revenue.state.mn.us

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue From revenue.state.mn.us

Residents of Minnesota must file state returns by April 15 or the next business day if that date falls on a weekend or holiday. Single married filing jointly qualifying widow er with dependent child married filing separately or head of household. Minnesota State Tax Refund Status Information. And in some cases this work could take 90 to 120 days. Minnesota Department of Revenue Mail Station 0010 600 N. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Minneapolis MN.

Minnesota has a new online secure Taxpayer Access system that they are currently testing.

For the latest information on IRS refund processing see the IRS Operations Status page. 705 percent on taxable income between 35481 and 140960. Minnesota Renters Property Tax Refund. Also many tax software companies such as 1040NOW File Express OLT TaxAct and TaxSlayer will allow you to file for your MN Property. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Minneapolis MN.

Source: pinterest.com

Source: pinterest.com

They have a fill in and print version as well as a print only version on the Minnesota Department of Revenue website. Enter this information in the boxes below. Minnesota has a new online secure Taxpayer Access system that they are currently testing. Check the Status of Your Current Years Refund Online Minnesota Contact Information Contact Information - Tax Help Line. It requires you to register before being able to use it.

Source: pinterest.com

Source: pinterest.com

It requires you to register before being able to use it. See reviews photos directions phone numbers and more for Mn State Tax Refund Status locations in Northeast Minneapolis Minneapolis MN. 785 percent on taxable income of 140961 and 250000. Single married filing jointly qualifying widow er with dependent child married filing separately or head of household. Learn more about how to file and pay Minnesota income tax from the pages in Filing Information below.

Source: pinterest.com

Source: pinterest.com

Check the Status of Your Current Years Refund Online Minnesota Contact Information Contact Information - Tax Help Line. It requires you to register before being able to use it. Minnesota recognizes federal filing statuses. They have a fill in and print version as well as a print only version on the Minnesota Department of Revenue website. File for your MN Renters Property Tax Refund using Minnesota State Form M1PR.

Source: pinterest.com

Source: pinterest.com

Enter this information in the boxes below. Paul MN 55145-0010 Mail your property tax refund return to. And in some cases this work could take 90 to 120 days. If you file your taxes by mail you can track your tax return and get a confirmation when the IRS has received it. 785 percent on taxable income of 140961 and 250000.

Source: pinterest.com

Source: pinterest.com

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Minneapolis MN. Learn more about how to file and pay Minnesota income tax from the pages in Filing Information below. Find information on how to file and pay your taxes access free tax preparation assistance and track your refund. Minnesota recognizes federal filing statuses. For the latest information on IRS refund processing see the IRS Operations Status page.

Source: www2.minneapolismn.gov

Source: www2.minneapolismn.gov

It requires you to register before being able to use it. Minnesota has a new online secure Taxpayer Access system that they are currently testing. Find information on how to file and pay your taxes access free tax preparation assistance and track your refund. Minnesota recognizes federal filing statuses. Enter this information in the boxes below.

Source: pinterest.com

Source: pinterest.com

File for your MN Renters Property Tax Refund using Minnesota State Form M1PR. Check the Status of Your Current Years Refund Online Minnesota Contact Information Contact Information - Tax Help Line. 985 percent on taxable income of 250001 and above. It requires you to register before being able to use it. If you filed a joint return please enter the first Social Security number shown on your return.

Source: pl.pinterest.com

Source: pl.pinterest.com

Check the Status of Your Current Years Refund Online Minnesota Contact Information Contact Information - Tax Help Line. 651-296-3781 Metro or 1-800-652-9094 Greater Minnesota Our hours of operation are. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Minnesota State Tax Refund Status Information. Minnesota Renters Property Tax Refund.

Source: revenue.state.mn.us

Source: revenue.state.mn.us

Residents of Minnesota must file state returns by April 15 or the next business day if that date falls on a weekend or holiday. Residents of Minnesota must file state returns by April 15 or the next business day if that date falls on a weekend or holiday. COVID-19 Processing Delays. The due date for 2020 returns was May 17 2021. 985 percent on taxable income of 250001 and above.

Source: revenue.state.mn.us

Source: revenue.state.mn.us

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. 785 percent on taxable income of 140961 and 250000. Minnesota State Tax Refund Status Information. 705 percent on taxable income between 35481 and 140960. If you filed a joint return please enter the first Social Security number shown on your return.

Source: revenue.state.mn.us

Source: revenue.state.mn.us

Check the status of your Minnesota State tax refund on the automated help line at 651 296-4444 available 24 hours a day seven days a week. It requires you to register before being able to use it. Enter this information in the boxes below. Also many tax software companies such as 1040NOW File Express OLT TaxAct and TaxSlayer will allow you to file for your MN Property. File for your MN Renters Property Tax Refund using Minnesota State Form M1PR.

Source: in.pinterest.com

Source: in.pinterest.com

If you file your taxes by mail you can track your tax return and get a confirmation when the IRS has received it. Learn more about how to file and pay Minnesota income tax from the pages in Filing Information below. 651-296-3781 Metro or 1-800-652-9094 Greater Minnesota Our hours of operation are. The due date for 2020 returns was May 17 2021. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

Source: revenue.state.mn.us

Source: revenue.state.mn.us

705 percent on taxable income between 35481 and 140960. File for your MN Renters Property Tax Refund using Minnesota State Form M1PR. Check the status of your Minnesota State tax refund on the automated help line at 651 296-4444 available 24 hours a day seven days a week. It requires you to register before being able to use it. If you file your taxes by mail you can track your tax return and get a confirmation when the IRS has received it.

Source: pinterest.com

Source: pinterest.com

COVID-19 Processing Delays. And in some cases this work could take 90 to 120 days. 651-296-3781 Metro or 1-800-652-9094 Greater Minnesota Our hours of operation are. They have a fill in and print version as well as a print only version on the Minnesota Department of Revenue website. Check the status of your Minnesota State tax refund on the automated help line at 651 296-4444 available 24 hours a day seven days a week.

Source: nl.pinterest.com

Source: nl.pinterest.com

Minnesota State Tax Refund Status Information. Single married filing jointly qualifying widow er with dependent child married filing separately or head of household. You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted. It requires you to register before being able to use it. Also many tax software companies such as 1040NOW File Express OLT TaxAct and TaxSlayer will allow you to file for your MN Property.

Source: pinterest.com

Source: pinterest.com

985 percent on taxable income of 250001 and above. Minnesota State Tax Refund Status Information. File for your MN Renters Property Tax Refund using Minnesota State Form M1PR. If you file your taxes by mail you can track your tax return and get a confirmation when the IRS has received it. 785 percent on taxable income of 140961 and 250000.

Source: pinterest.com

Source: pinterest.com

Minnesota Department of Revenue Mail Station 0010 600 N. The due date for 2020 returns was May 17 2021. The status you use on your Minnesota state return must match the status you use on your federal income tax return. You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted. Minnesota State Tax Refund Status Information.

Source: www2.minneapolismn.gov

Source: www2.minneapolismn.gov

651-296-3781 Metro or 1-800-652-9094 Greater Minnesota Our hours of operation are. They have a fill in and print version as well as a print only version on the Minnesota Department of Revenue website. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review. Minnesota Department of Revenue Mail Station 0010 600 N. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title minneapolis state tax return status by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.