Your How to calculate the price elasticity coefficient images are available in this site. How to calculate the price elasticity coefficient are a topic that is being searched for and liked by netizens today. You can Get the How to calculate the price elasticity coefficient files here. Get all free photos.

If you’re looking for how to calculate the price elasticity coefficient images information connected with to the how to calculate the price elasticity coefficient keyword, you have come to the right site. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

How To Calculate The Price Elasticity Coefficient. The maturity of the bond is 10 years. Also provide interpretation in the form of variance percentage in datasets. CPE cookies ΔQΔP cookies P cookies Q We know from our regression that ΔQΔP cookies is the coefficient of Price of Cookies -871. Bond Price 926 857 794 735 6802 68058.

Term Paper On The Elasticity Of Demand Economics From economicsdiscussion.net

Term Paper On The Elasticity Of Demand Economics From economicsdiscussion.net

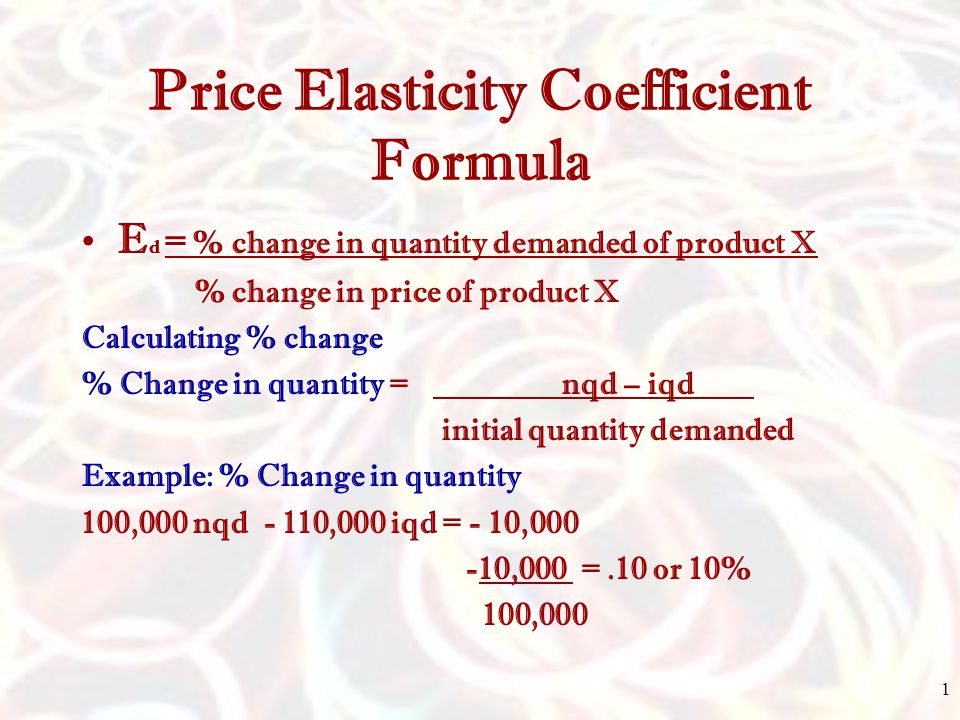

In contrast studies on price-elasticity of high-energy dense foods are scarce. CPE cookies ΔQΔP cookies P cookies Q We know from our regression that ΔQΔP cookies is the coefficient of Price of Cookies -871. Price Elasticity of Demand 4385 98. Industry PriceP Marginal costMC Elasticity of demandE d Lerner indexL A. So we use the formula. We can use the value of the Lerner index to calculate the marginal cost MC of a firm as follows.

CPE cookies ΔQΔP cookies P cookies Q We know from our regression that ΔQΔP cookies is the coefficient of Price of Cookies -871.

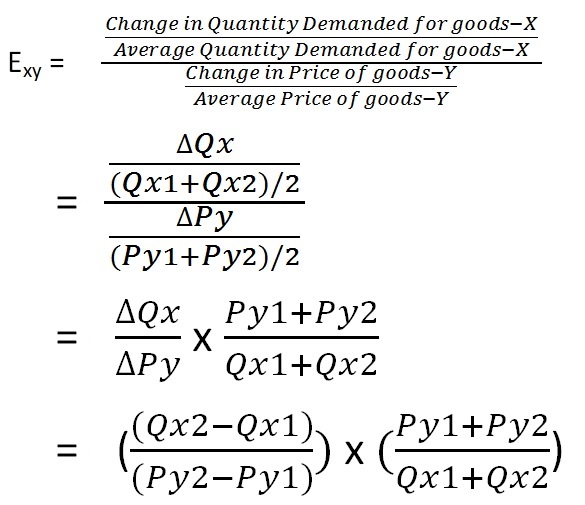

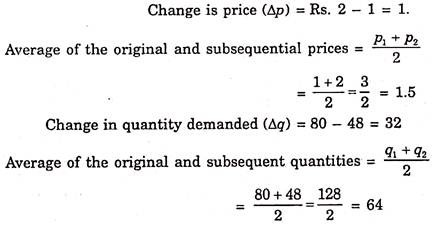

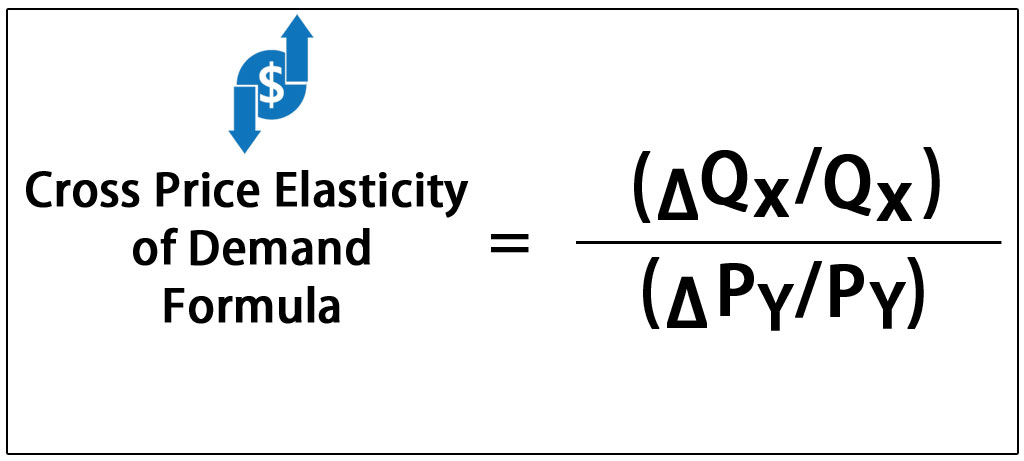

Demand is perfectly inelastic meaning that demand does not change at all when the price changes. Cross price elasticity of demand midpoint formula often produces three outcomes based on the variation of either the demand and price. Lets calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5 and yield is 8. Bond Price 926 857 794 735 6802 68058. A recent study in Mexico estimated that the price elasticity of SSB was 116 and between 106 and 129 for soft drinks 24 25 In Ecuador the price-elasticity of SSB ranges between 117 and 133 depending on the socioeconomic group. To calculate Cross Price Elasticity of Demand we are essentially looking for how the price of cookies impacts the sales of eggs.

Source: youtube.com

Source: youtube.com

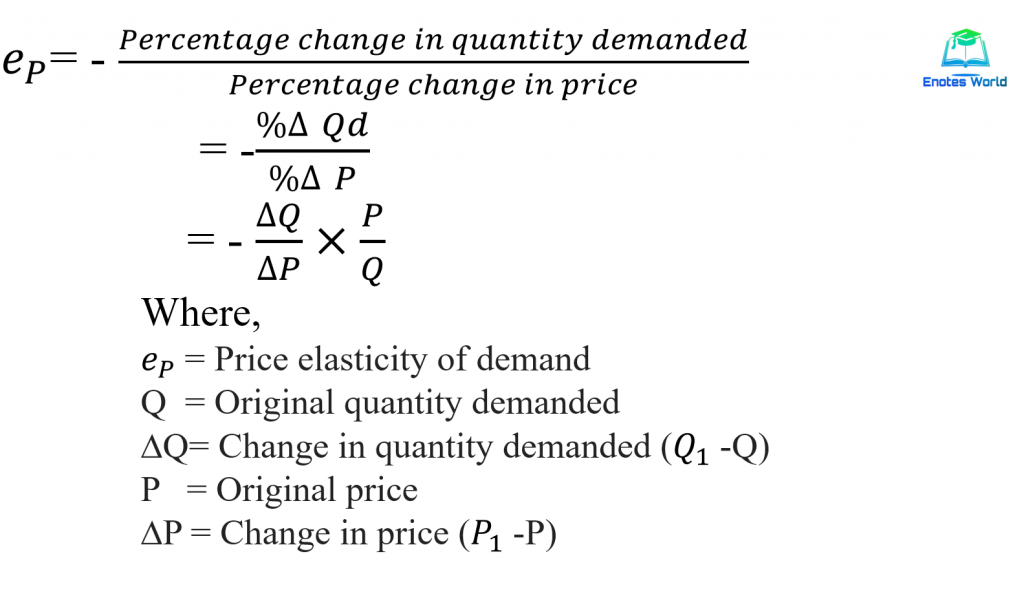

The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will. Bond Pricing Formula Example 2. In the Cellophane case Professor Stocking believed that a change in the price of one product will induce a price change of its rivalry in the same direction so he firstly regarded that movement of two prices in the same direction explicitly reflects a high cross. CPE cookies ΔQΔP cookies P cookies Q We know from our regression that ΔQΔP cookies is the coefficient of Price of Cookies -871. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula.

Source: youtube.com

Source: youtube.com

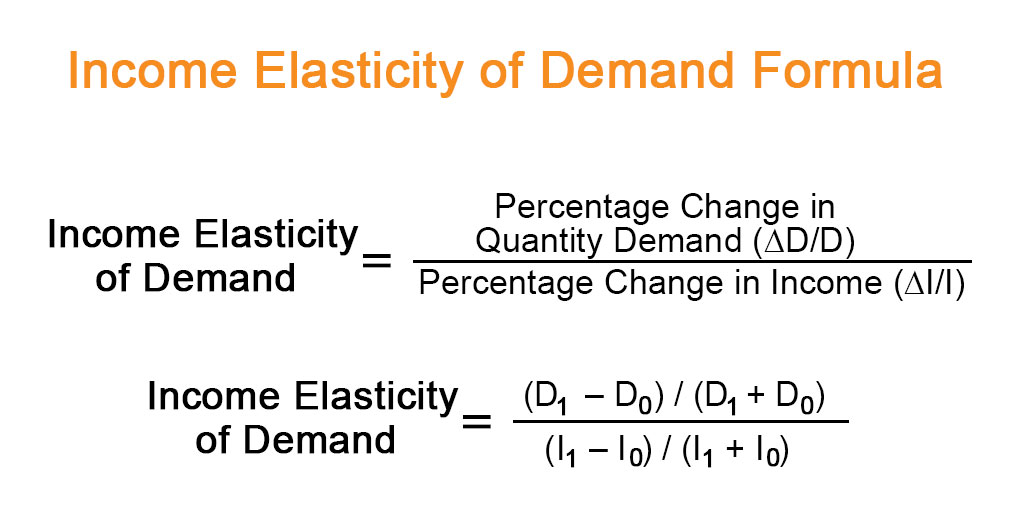

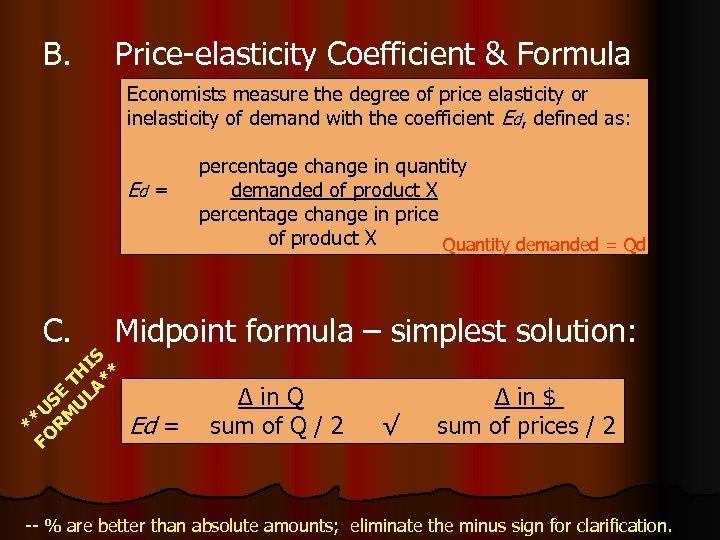

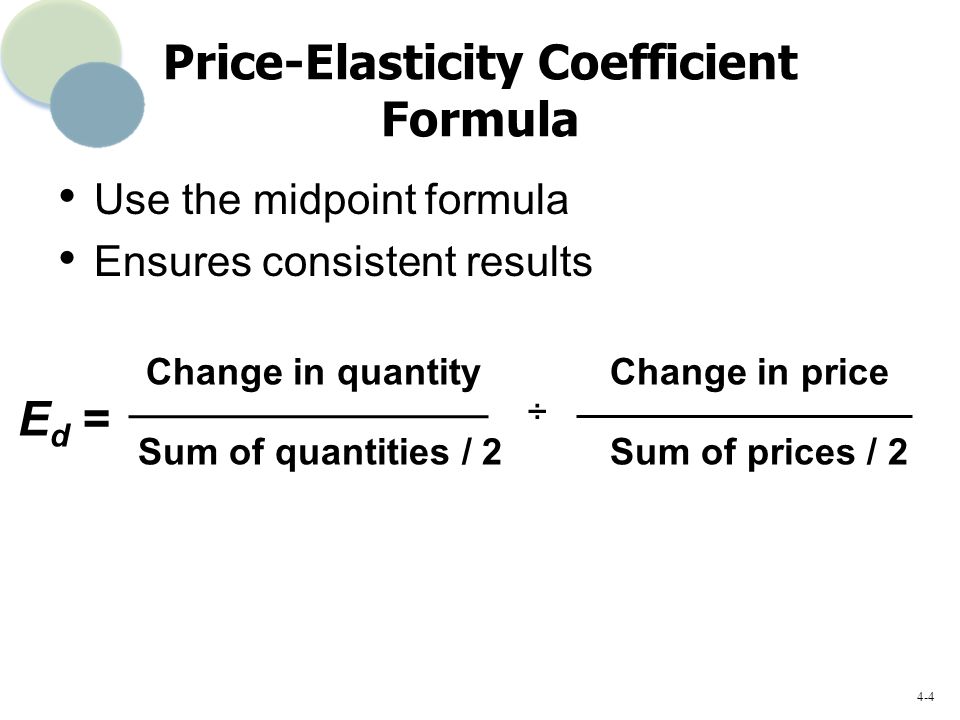

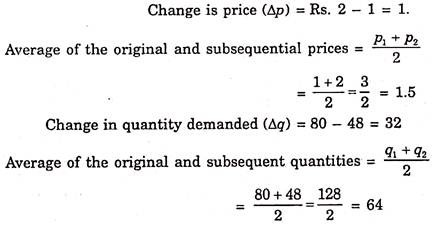

Understanding the Coefficient of Elasticity. We use the mean price. A recent study in Mexico estimated that the price elasticity of SSB was 116 and between 106 and 129 for soft drinks 24 25 In Ecuador the price-elasticity of SSB ranges between 117 and 133 depending on the socioeconomic group. This change in quantity demanded as a result of say a rise in price by a firm will affect the total consumers expenditure and will therefore affect the earnings of the firm. Industry PriceP Marginal costMC Elasticity of demandE d Lerner indexL A.

Source: slideplayer.com

Source: slideplayer.com

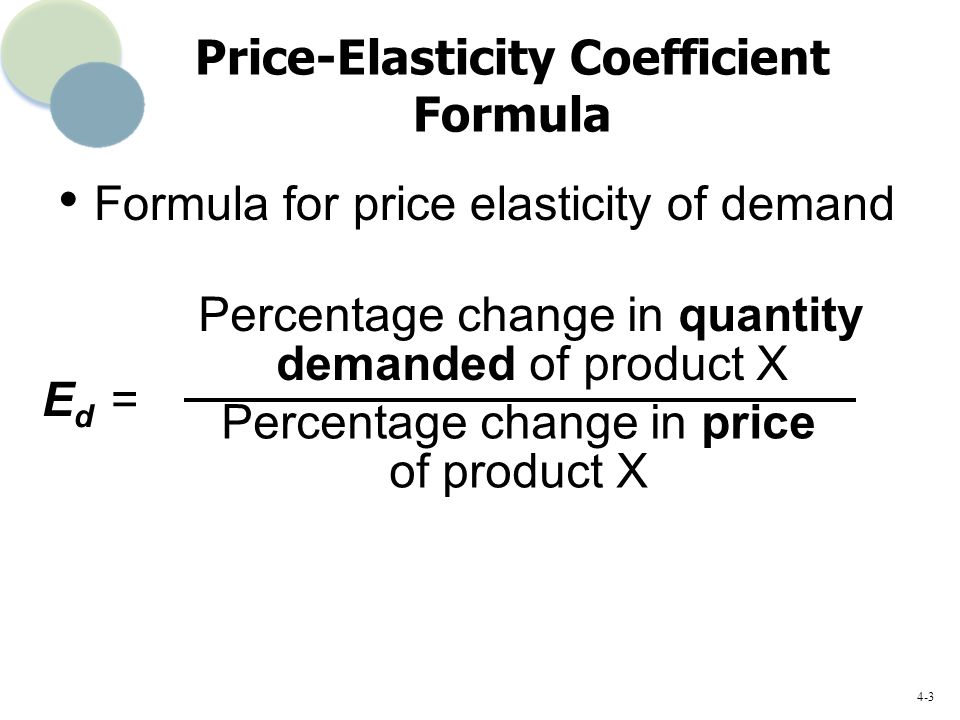

This calculator provides the solution in different ways such as the regression sum method and correlation coefficient method. If the factor is equal to 1 the percentage change in price is identical to the percentage change in quantity. In contrast studies on price-elasticity of high-energy dense foods are scarce. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula. For L -1E d and E d -1L the elasticity of demand for industry A will be -25.

Source: www2.harpercollege.edu

Source: www2.harpercollege.edu

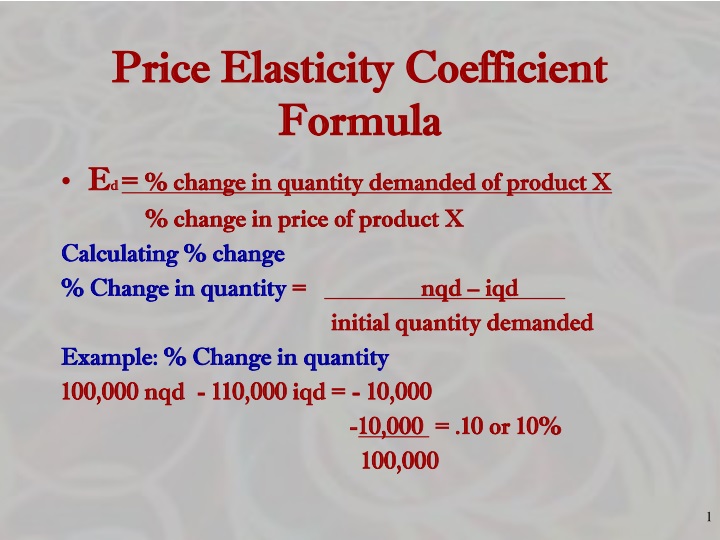

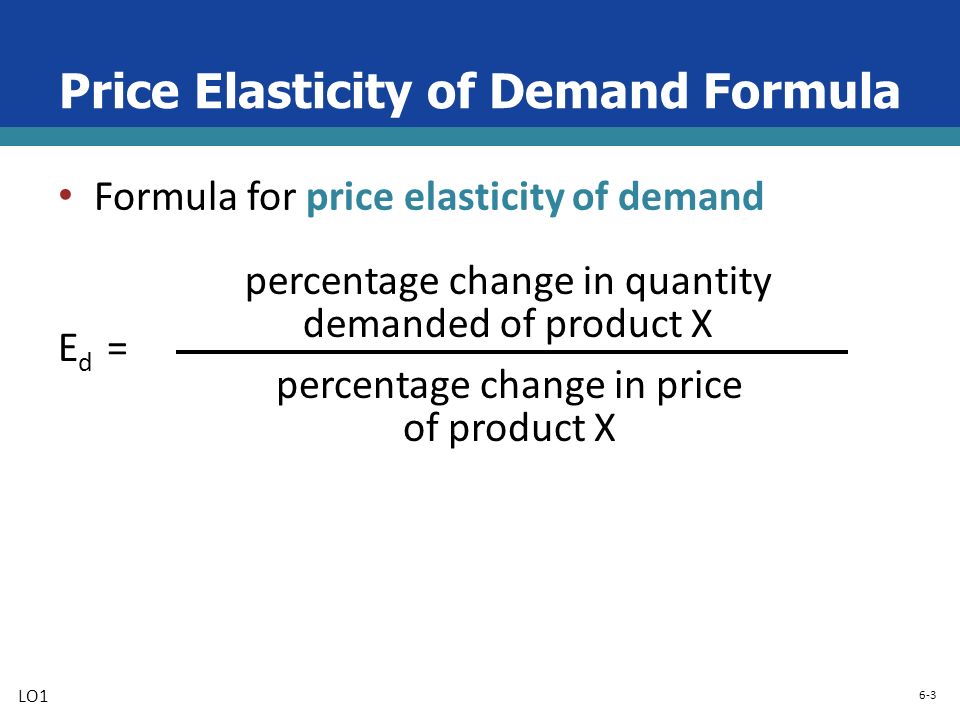

The maturity of the bond is 10 years. Cross price elasticity of demand midpoint formula often produces three outcomes based on the variation of either the demand and price. To calculate Cross Price Elasticity of Demand we are essentially looking for how the price of cookies impacts the sales of eggs. The concept of price elasticity of demand originated by Alfred Marshall predicted relative changes between price and quantity. Different coefficient values have various implications for the price elasticity of demand of products.

Source: asklent.com

Source: asklent.com

That is the coefficient may be equal to 1 1. We use the mean price. Our efficient price elasticity calculator uses a simple price elasticity formula to determine how demand for goodsservices may change in response to a change in the prices of those goodsservices. The price elasticity of demand calculator allows is the smart tool that allows you to calculate the price elasticity by different methods. Bond Price 926 857 794 735 6802 68058.

Source: slidetodoc.com

Source: slidetodoc.com

This change in quantity demanded as a result of say a rise in price by a firm will affect the total consumers expenditure and will therefore affect the earnings of the firm. So we use the formula. That is the coefficient may be equal to 1 1. The price elasticity of demand calculator allows is the smart tool that allows you to calculate the price elasticity by different methods. How large a reduction in price of a product is required to increase sales say by 25 percent.

Source: slideplayer.com

Source: slideplayer.com

It has been found by some empirical studies that business firms often fail to take elasticity into account while taking decisions regarding prices or they give insufficient attention to the coefficient of price elasticity. Lets calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5 and yield is 8. E 0. It has been found by some empirical studies that business firms often fail to take elasticity into account while taking decisions regarding prices or they give insufficient attention to the coefficient of price elasticity. The concept of price elasticity of demand originated by Alfred Marshall predicted relative changes between price and quantity.

Source: slidetodoc.com

Source: slidetodoc.com

If the factor is equal to 1 the percentage change in price is identical to the percentage change in quantity. Bond Pricing Formula Example 2. This calculator provides the solution in different ways such as the regression sum method and correlation coefficient method. The price elasticity of demand calculator allows is the smart tool that allows you to calculate the price elasticity by different methods. In contrast studies on price-elasticity of high-energy dense foods are scarce.

Source: educba.com

Source: educba.com

That is the coefficient may be equal to 1 1. Our efficient price elasticity calculator uses a simple price elasticity formula to determine how demand for goodsservices may change in response to a change in the prices of those goodsservices. In contrast studies on price-elasticity of high-energy dense foods are scarce. A recent study in Mexico estimated that the price elasticity of SSB was 116 and between 106 and 129 for soft drinks 24 25 In Ecuador the price-elasticity of SSB ranges between 117 and 133 depending on the socioeconomic group. E 0.

Source: enotesworld.com

Source: enotesworld.com

The coefficient of determination calculator finds the correlation coefficient r squared for the given regression model. The coefficient of determination calculator finds the correlation coefficient r squared for the given regression model. This change in quantity demanded as a result of say a rise in price by a firm will affect the total consumers expenditure and will therefore affect the earnings of the firm. The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will. We use the mean price.

Source: slideserve.com

Source: slideserve.com

In the Cellophane case Professor Stocking believed that a change in the price of one product will induce a price change of its rivalry in the same direction so he firstly regarded that movement of two prices in the same direction explicitly reflects a high cross. Bond Pricing Formula Example 2. The concept of price elasticity of demand originated by Alfred Marshall predicted relative changes between price and quantity. Bond Price Rs 10799. If the factor is equal to 1 the percentage change in price is identical to the percentage change in quantity.

Source: youtube.com

Source: youtube.com

So we use the formula. Industry PriceP Marginal costMC Elasticity of demandE d Lerner indexL A. Cross price elasticity of demand midpoint formula often produces three outcomes based on the variation of either the demand and price. It has been found by some empirical studies that business firms often fail to take elasticity into account while taking decisions regarding prices or they give insufficient attention to the coefficient of price elasticity. E 0.

Source: slideplayer.com

Source: slideplayer.com

The concept of price elasticity of demand originated by Alfred Marshall predicted relative changes between price and quantity. Lets calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5 and yield is 8. Bond Price 926 857 794 735 6802 68058. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula. It has been found by some empirical studies that business firms often fail to take elasticity into account while taking decisions regarding prices or they give insufficient attention to the coefficient of price elasticity.

Source: present5.com

Source: present5.com

In the Cellophane case Professor Stocking believed that a change in the price of one product will induce a price change of its rivalry in the same direction so he firstly regarded that movement of two prices in the same direction explicitly reflects a high cross. For L -1E d and E d -1L the elasticity of demand for industry A will be -25. This change in quantity demanded as a result of say a rise in price by a firm will affect the total consumers expenditure and will therefore affect the earnings of the firm. Our efficient price elasticity calculator uses a simple price elasticity formula to determine how demand for goodsservices may change in response to a change in the prices of those goodsservices. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula.

Source: youtube.com

Source: youtube.com

We can use the value of the Lerner index to calculate the marginal cost MC of a firm as follows. Our efficient price elasticity calculator uses a simple price elasticity formula to determine how demand for goodsservices may change in response to a change in the prices of those goodsservices. So we use the formula. This is because change in the price of a product will bring about a change in the quantity demanded depending upon the coefficient of elasticity. Also provide interpretation in the form of variance percentage in datasets.

Source: youtube.com

Source: youtube.com

The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will. The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will. E 0. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula. Industry PriceP Marginal costMC Elasticity of demandE d Lerner indexL A.

Source: slideplayer.com

Source: slideplayer.com

The price elasticity of demand calculator allows is the smart tool that allows you to calculate the price elasticity by different methods. A recent study in Mexico estimated that the price elasticity of SSB was 116 and between 106 and 129 for soft drinks 24 25 In Ecuador the price-elasticity of SSB ranges between 117 and 133 depending on the socioeconomic group. E 0. Our efficient price elasticity calculator uses a simple price elasticity formula to determine how demand for goodsservices may change in response to a change in the prices of those goodsservices. Demand is perfectly inelastic meaning that demand does not change at all when the price changes.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

It has been found by some empirical studies that business firms often fail to take elasticity into account while taking decisions regarding prices or they give insufficient attention to the coefficient of price elasticity. This calculator provides the solution in different ways such as the regression sum method and correlation coefficient method. Bond Price 926 857 794 735 6802 68058. In contrast studies on price-elasticity of high-energy dense foods are scarce. Bond Pricing Formula Example 2.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate the price elasticity coefficient by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.