Your How to calculate tax revenue supply and demand graph images are ready. How to calculate tax revenue supply and demand graph are a topic that is being searched for and liked by netizens now. You can Get the How to calculate tax revenue supply and demand graph files here. Get all free photos.

If you’re looking for how to calculate tax revenue supply and demand graph images information linked to the how to calculate tax revenue supply and demand graph topic, you have visit the right site. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

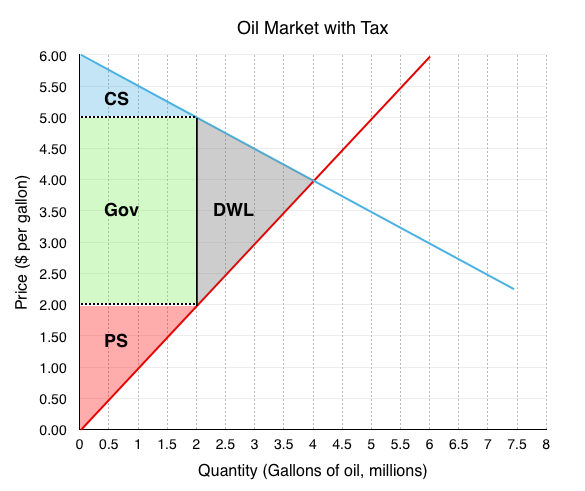

How To Calculate Tax Revenue Supply And Demand Graph. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. Download Free business credit limit calculator for trade and business credit teams. The market price determined by the forces of demand and supply is Rs 15000 per TV set. With 4 tax on producers the supply curve after tax is P Q3 4.

Application The Costs Of Taxation Tutorsonnet From tutorsonnet.com

Application The Costs Of Taxation Tutorsonnet From tutorsonnet.com

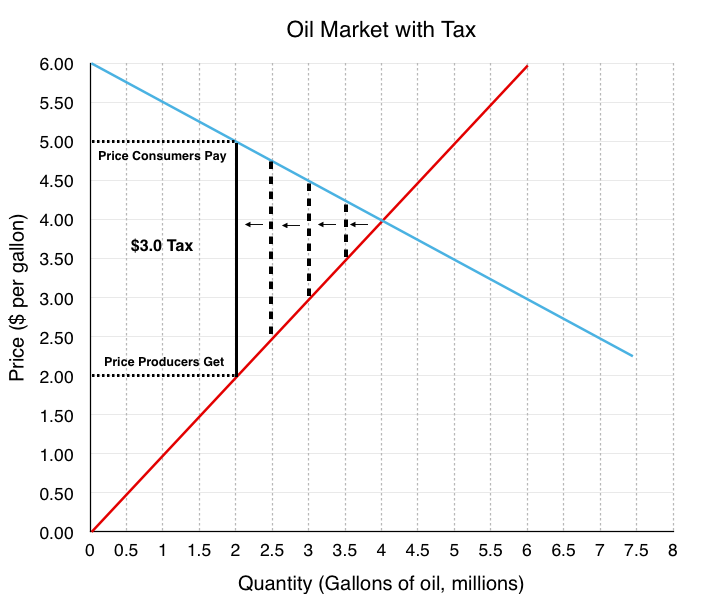

Let us take another example wherein the original demand curve is represented by the equation -008x 80 and the supply curve by 008x where x is the quantity demand. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. Producers would want to supply less due to the imposition of a tax. Our lessons are m. 125 125 from each sold kilogram of potatoes. The orange rectangle represents the tax revenue the per unit tax times the quantity sold.

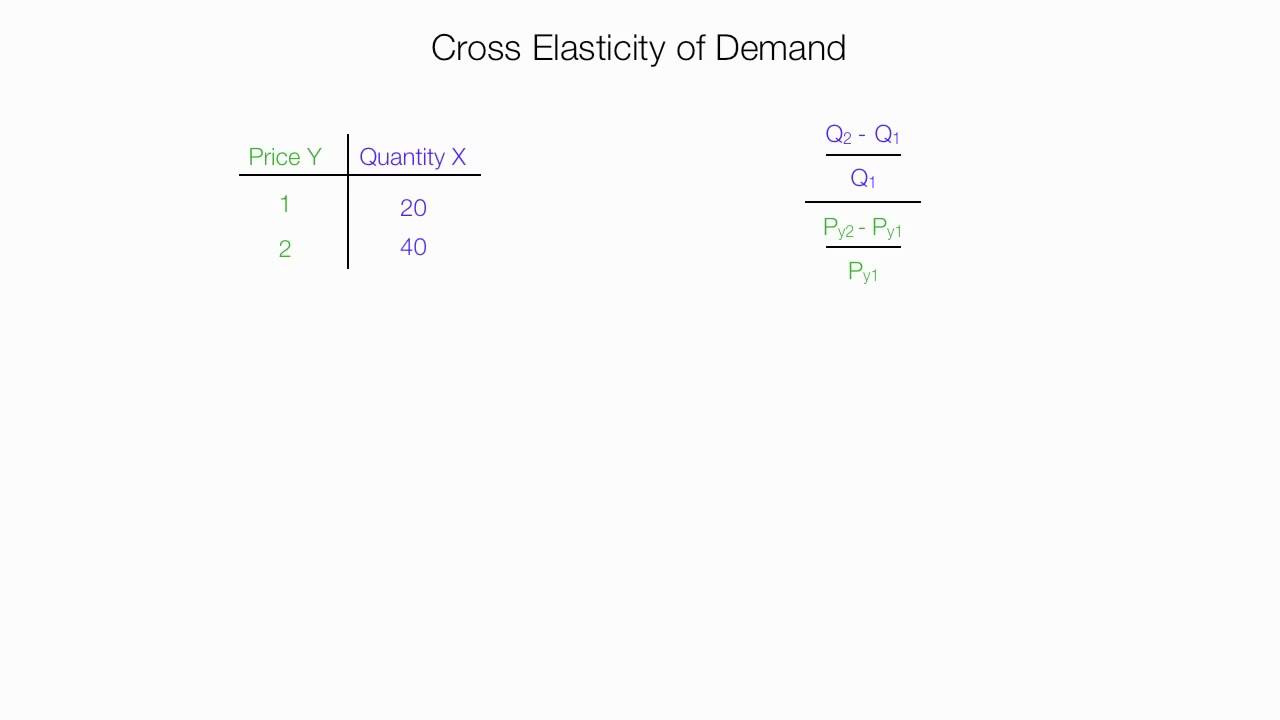

Q_D Q_S QD.

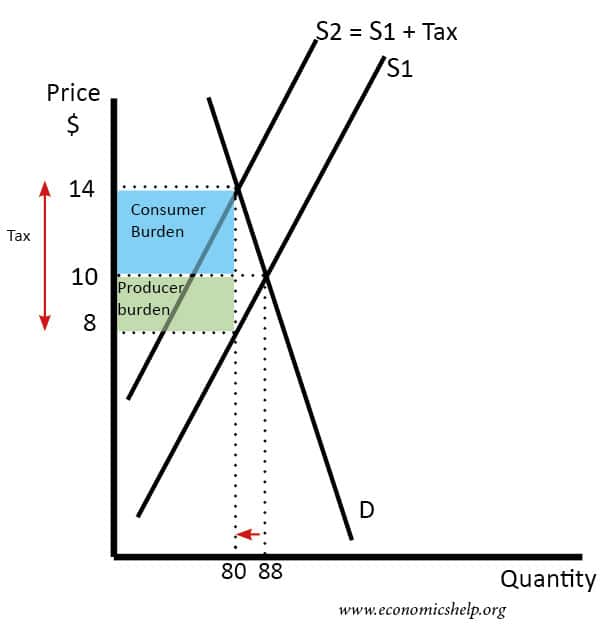

In this case the tax is 12. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Improve this question. The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. In this case the total tax revenue 7 70 490. Producers would want to supply less due to the imposition of a tax.

Source: sites.oxy.edu

Source: sites.oxy.edu

The producer burden is 4 95 380. In this case the tax is 12. The tax incidence on the consumers is given by the difference between the price paid and the initial equilibrium price. In this case the total tax revenue 7 70 490. 125 125 from each sold kilogram of potatoes.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. The producer burden is 4 95 380. Since in equilibrium qty demanded equals qty. The government decides to levy a tax of 2 per unit on the good to be paid by the seller. In this case a higher.

Source: khanacademy.org

Source: khanacademy.org

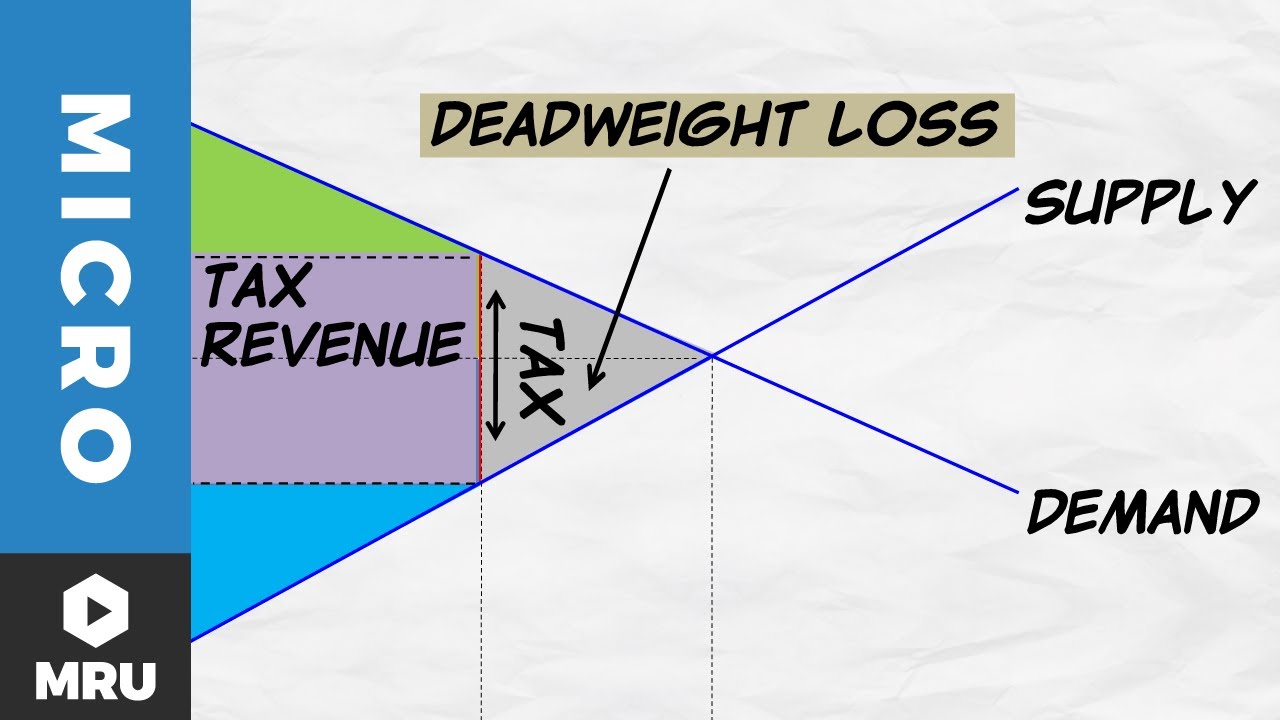

To figure out how to calculate deadweight loss from taxation refer to the graph shown below. Indicates the price buyers pay and indicates the price sellers receive net of the tax. Rewrite the demand and supply equation as P 20 Q and P Q3. And I must find the equilibrium quantity of the curves after the 2 tax has been taken into account for. The orange rectangle represents the tax revenue the per unit tax times the quantity sold.

Source: tutorsonnet.com

Source: tutorsonnet.com

The market price determined by the forces of demand and supply is Rs 15000 per TV set. Q_D Q_S QD. If this video is a little fast we apologize. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. Now so far i could do the following.

Source: ecampusontario.pressbooks.pub

Source: ecampusontario.pressbooks.pub

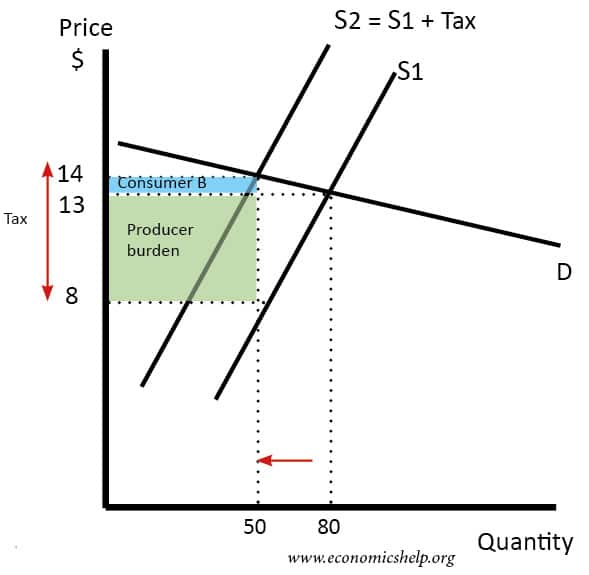

A simple multiplication shows that the total revenue from the sale of 105000 sets is Rs 1575 crore. However the tax incidence is mostly borne by the producer. The tax incidence on the consumers is given by the difference between the price paid and the initial equilibrium price. How do you calculate tax on supply and demand curve. Calculate the amount of tax revenue collected by the government and the distribution of tax payments between buyers and sellers.

Source: instructables.com

Source: instructables.com

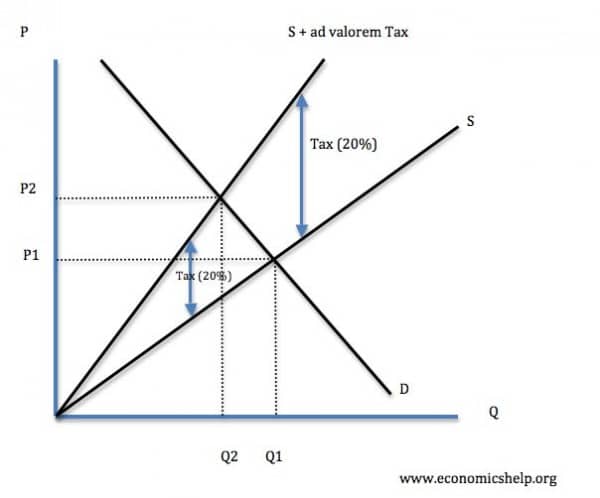

With the tax the supply curve shifts by the tax amount from Supply 0 to Supply 1. A simple multiplication shows that the total revenue from the sale of 105000 sets is Rs 1575 crore. A firms revenue is where its supply and demand curve intersect producing an equilibrium level of price and quantity. Q D Q S. Producers would want to supply less due to the imposition of a tax.

Source: youtube.com

Source: youtube.com

How do you calculate quantity supplied after tax. Example breaking down tax incidence. Use the diagram to find out the new equilibrium price and quantity. PDF practice problem 1 solutions - Syracuse University Calculating impact of a tax - example The inverse demand curve or average revenue curve for the product of a perfectly competitive industry is give by p80-05Q where p is the price and Q is the quantity. This is a very quick video about how to calculate revenue using the supply and demand curves.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

AP is owned by the College Board which does not endorse this site or the above reviewStudy Questions1 Show supply demand with an equilibrium price and. So from the demand and supply functions we get 05Q200-05Q Q200. However due to some external factors the demand curve shifted to -008x 60. The consumer only pays a small percentage. It postulates that in a competitive market the unit price for a particular good.

And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. Improve this question. How do you calculate quantity supplied after tax. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. A per unit tax is a fixed tax on a product independent of the products price.

PDF practice problem 1 solutions - Syracuse University Calculating impact of a tax - example The inverse demand curve or average revenue curve for the product of a perfectly competitive industry is give by p80-05Q where p is the price and Q is the quantity. However the tax incidence is mostly borne by the producer. The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. All the producers have to sell their product at this price. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram.

The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. A per unit tax is a fixed tax on a product independent of the products price. This calculation is relatively easy if you already have the supply and demand curves for the firm.

Source: chegg.com

Source: chegg.com

Calculate the deadweight loss based on the given conditions. A per unit tax is a fixed tax on a product independent of the products price. In this case the tax is 12. The government decides to levy a tax of 2 per unit on the good to be paid by the seller. Calculate the revenue received by the firms.

Source: researchgate.net

Source: researchgate.net

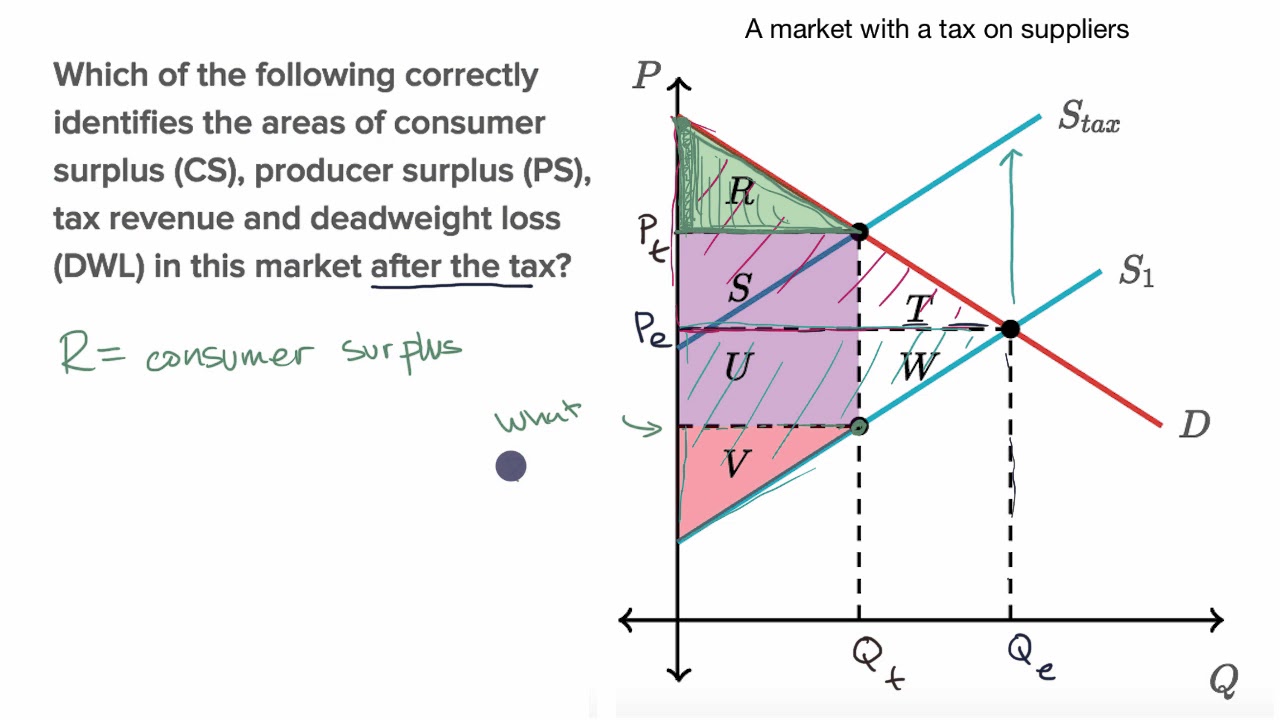

In this video we break down how to identify consumer surplus producer surplus tax revenue and tax incidence and dead weight loss after a tax. A simple multiplication shows that the total revenue from the sale of 105000 sets is Rs 1575 crore. How do you calculate tax on supply and demand curve. Hence the new equilibrium quantity after tax can be found from equating P Q3 4 and P 20 Q so Q3 4 20 Q which gives QT 12. However due to some external factors the demand curve shifted to -008x 60.

Source: economicshelp.org

Source: economicshelp.org

Improve this question. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. 125 125 from each sold kilogram of potatoes. This is a very quick video about how to calculate revenue using the supply and demand curves. With 4 tax on producers the supply curve after tax is P Q3 4.

Source: economicshelp.org

Source: economicshelp.org

The tax increases the market price from 17 to 25. The tax incidence on the consumers is given by the difference between the price paid and the initial equilibrium price. Use the diagram to find out the new equilibrium price and quantity. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. The producer burden is 4 95 380.

Source: khanacademy.org

Source: khanacademy.org

The government decides to levy a tax of 2 per unit on the good to be paid by the seller. First let us calculate the equilibrium price and equilibrium quantity that were before the imposed tax. 125 125 from each sold kilogram of potatoes. With the tax the supply curve shifts by the tax amount from Supply 0 to Supply 1. Q D Q S.

Source: economicshelp.org

Source: economicshelp.org

It can be represented as a wedge between the supply and demand curves. All the producers have to sell their product at this price. The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. The tax increases the market price from 17 to 25. Tax incidence is a description of how the burden of a tax falls in a market.

Source: economicshelp.org

Source: economicshelp.org

The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. The equilibrium price and quantity before the imposition of tax are Q 0 and P 0. If this video is a little fast we apologize. All the producers have to sell their product at this price. And I must find the equilibrium quantity of the curves after the 2 tax has been taken into account for.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate tax revenue supply and demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.