Your How to calculate money supply increase images are ready in this website. How to calculate money supply increase are a topic that is being searched for and liked by netizens today. You can Download the How to calculate money supply increase files here. Get all free images.

If you’re searching for how to calculate money supply increase pictures information linked to the how to calculate money supply increase interest, you have visit the right site. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

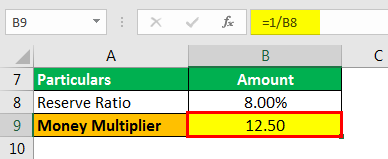

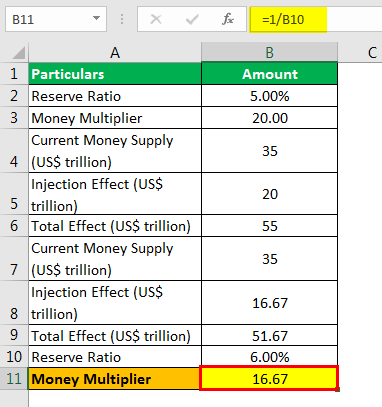

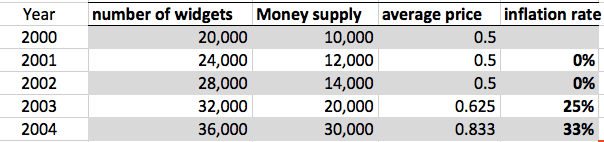

How To Calculate Money Supply Increase. The 1st term of the above equation is the money multiplier in terms of the currency-to-deposit ratio CD the required reserve ratio r and the excess-reserves-to-deposit ratio ERD. Even if you start at 571 billion in the year 2000 and add the 7 percentages in the right column rate of inflation to each succeeding year you only come with 61046 billion. In this example the money multiplier is 11 10. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier.

Deflationary Gap From id.pinterest.com

Deflationary Gap From id.pinterest.com

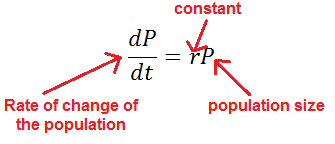

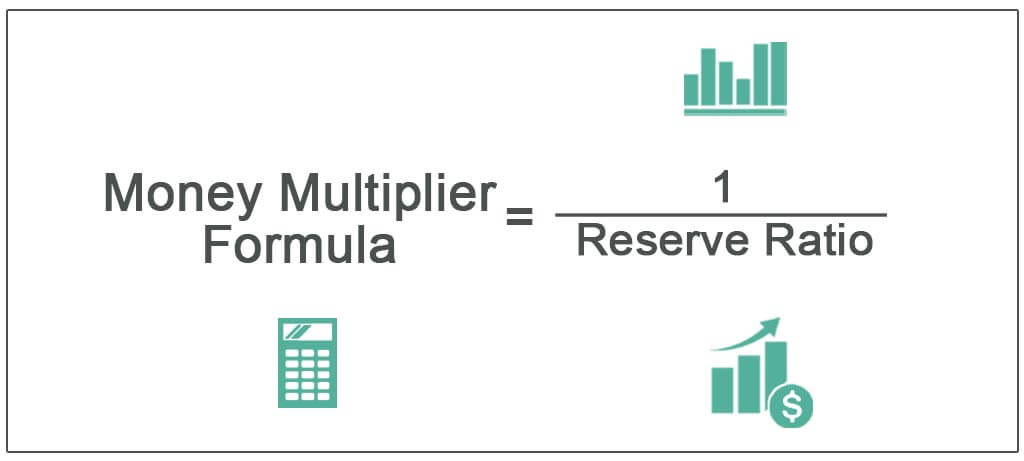

Evaluation of the Money Multiplier The total increase in the money supply is the sum of the increases at each step. Banks cant create an unlimited amount of money. CD r ERD. If m 1 45 and MB decreases by 1 million the money supply will decrease by 45 million and so forth. Firstly Money Multiplier 1 Reserve Ratio. This initial increase in the.

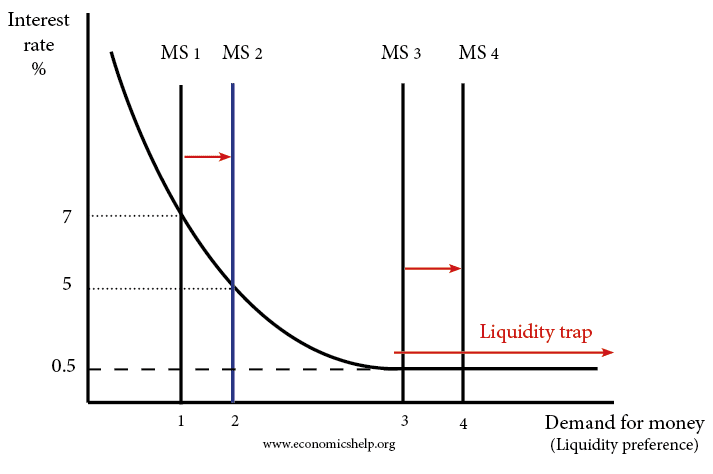

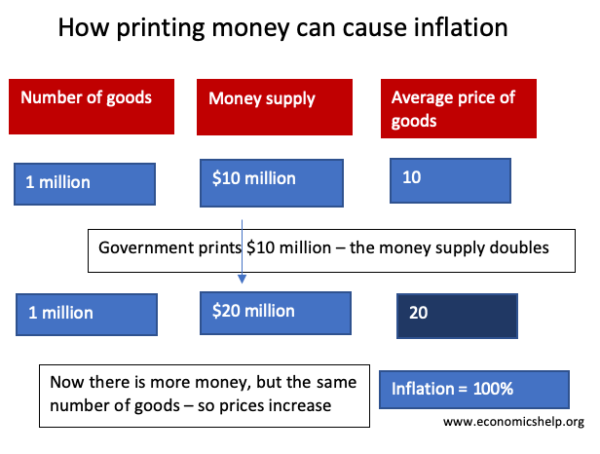

Monetarists believe there is a strong link between the money supply and inflation.

Money supply and inflation. Bank balance sheet free response question. The Fed can increase the money supply by lowering the reserve. The formulas for calculating changes in the money supply are as follows. M V P T where. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier.

Source: id.pinterest.com

Source: id.pinterest.com

M 100 90 81 100 100. Hence if more money comes in the market then inflation will increase and vice versa will be the case therefore the statement made by student 2 is correct that higher reserve ratio will reduce inflation and the statement made by student 1 is incorrect. The money multiplier determines the limit of how much money a bank can create. Required reserves excess reserves and bank behavior. 1 This section deals with increase in money supply given two scenarios see a and b below.

Source: pinterest.com

Source: pinterest.com

Monetarists believe there is a strong link between the money supply and inflation. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier. Money creation in a fractional reserve system. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier. Firstly Money Multiplier 1 Reserve Ratio.

Source: pinterest.com

Source: pinterest.com

Money supply and inflation. Evaluation of the Money Multiplier The total increase in the money supply is the sum of the increases at each step. Banks cant create an unlimited amount of money. The formulas for calculating changes in the money supply are as follows. Since the bank has 300 in excess reserves it can loan out the entire 300 which we then multiply by the money multipler to find the total expansion of the money supply.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

MS R MM. The Fed can increase the money supply by lowering the reserve. Click to see full answer. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier. The formulas for calculating changes in the money supply are as follows.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

How do you calculate change in reserves. Required reserves excess reserves and bank behavior. M 100 90 81 100 100. You can use this money multiplier calculator. Well now add time deposits of 900 million and money market funds of 800 million and calculate M2 m 2 1 C D T D MMF D rr ER D C D m 2 1100400900400800400210400100400.

Source: economicshelp.org

Source: economicshelp.org

So money supply CD Also high powered money CR where c is currency a View the full answer Transcribed image text. The money multiplier is how much the money supply will change if there is a change in the monetary base. Monetarists believe there is a strong link between the money supply and inflation. Note that if banks decide to keep more. Since the bank has 300 in excess reserves it can loan out the entire 300 which we then multiply by the money multipler to find the total expansion of the money supply.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The formulas for calculating changes in the money supply are as follows. So if m 1 26316 and the monetary base increases by 100000 the money supply will increase by 263160. Even if you start at 571 billion in the year 2000 and add the 7 percentages in the right column rate of inflation to each succeeding year you only come with 61046 billion. In 7 years time the money supply grew by at least 249 billion. M Money Supply V Velocity of circulation the number of times money changes hands P Average Price Level T Volume of transactions of goods and services.

Source: economicshelp.org

Source: economicshelp.org

Introduction to fractional reserve banking. M V P T where. The money multiplier determines the size of the expansion. Note that if banks decide to keep more. Central banks use several methods called monetary policy to increase or decrease the amount of money in the economy.

Source: cz.pinterest.com

Source: cz.pinterest.com

M V P T where. Well now add time deposits of 900 million and money market funds of 800 million and calculate M2 m 2 1 C D T D MMF D rr ER D C D m 2 1100400900400800400210400100400. This initial increase in the. The Fed can increase the money supply by lowering the reserve. Finally to calculate the maximum change in the money supply use the formula Change in Money Supply Change in Reserves Money Multiplier.

Source: pinterest.com

Source: pinterest.com

So if m 1 26316 and the monetary base increases by 100000 the money supply will increase by 263160. When Margie deposited 1000000 into her bank the reserve ratio was ten percent. Hence if more money comes in the market then inflation will increase and vice versa will be the case therefore the statement made by student 2 is correct that higher reserve ratio will reduce inflation and the statement made by student 1 is incorrect. 90 2 an infinite geometric sum. The money multiplier is equal to 1r where r is the reserve ratio.

Source: pinterest.com

Source: pinterest.com

See New York Fed. R is the change in reserves. At the very least thats a 62 annual rate of inflation 436 7 years 62. Due to changes in the financial system the money supply has been difficult to measure accurately this makes it difficult to implement Monetarism which states there is a relationship between the money supply and inflation. Money supply is the quantity of money available in an economy for immediate use.

Source: pinterest.com

Source: pinterest.com

So money supply CD Also high powered money CR where c is currency a View the full answer Transcribed image text. Monetarists believe there is a strong link between the money supply and inflation. If the money supply. Even if you start at 571 billion in the year 2000 and add the 7 percentages in the right column rate of inflation to each succeeding year you only come with 61046 billion. 90 2 an infinite geometric sum.

Source: economicshelp.org

Source: economicshelp.org

M Money Supply V Velocity of circulation the number of times money changes hands P Average Price Level T Volume of transactions of goods and services. So money supply CD Also high powered money CR where c is currency a View the full answer Transcribed image text. Banks cant create an unlimited amount of money. This initial increase in the. Maximum change in the money supply excess reserves x the money multiplier.

Source: investopedia.com

Source: investopedia.com

The money multiplier is how much the money supply will change if there is a change in the monetary base. The formulas for calculating changes in the money supply are as follows. The 1st term of the above equation is the money multiplier in terms of the currency-to-deposit ratio CD the required reserve ratio r and the excess-reserves-to-deposit ratio ERD. Money creation in a fractional reserve system. The money multiplier is how much the money supply will change if there is a change in the monetary base.

Source: investopedia.com

Source: investopedia.com

In 7 years time the money supply grew by at least 249 billion. MM is the money multiplier. CD r ERD. M Money Supply V Velocity of circulation the number of times money changes hands P Average Price Level T Volume of transactions of goods and services. Banking and the expansion of the money supply.

Source: pinterest.com

Source: pinterest.com

CD r ERD. The money multiplier is equal to 1r where r is the reserve ratio. So if m 1 26316 and the monetary base increases by 100000 the money supply will increase by 263160. Money supply is the quantity of money available in an economy for immediate use. Banking and the expansion of the money supply.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

90 2 an infinite geometric sum. CD r ERD. The Fed can increase the money supply by lowering the reserve. Evaluation of the Money Multiplier The total increase in the money supply is the sum of the increases at each step. The money multiplier is how much the money supply will change if there is a change in the monetary base.

Source: pinterest.com

Source: pinterest.com

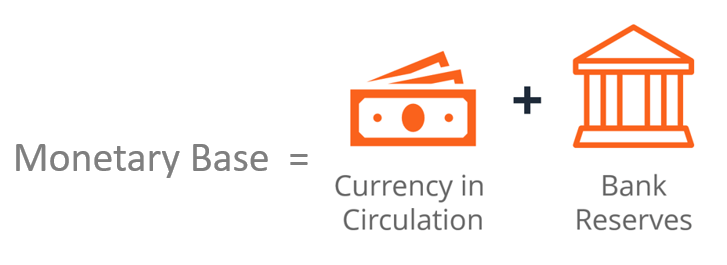

So money supply CD Also high powered money CR where c is currency a View the full answer Transcribed image text. Firstly Money Multiplier 1 Reserve Ratio. The Fed can increase the money supply by lowering the reserve. 1 This section deals with increase in money supply given two scenarios see a and b below. It equals the currency held by public plus demand deposits at banks and monetary base is the sum of total currency in circulation and the amount held by banks as reserves.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate money supply increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.