Your How to calculate elasticity from regression excel images are available in this site. How to calculate elasticity from regression excel are a topic that is being searched for and liked by netizens now. You can Find and Download the How to calculate elasticity from regression excel files here. Download all royalty-free photos and vectors.

If you’re searching for how to calculate elasticity from regression excel images information related to the how to calculate elasticity from regression excel topic, you have pay a visit to the right site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

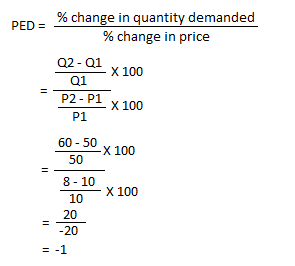

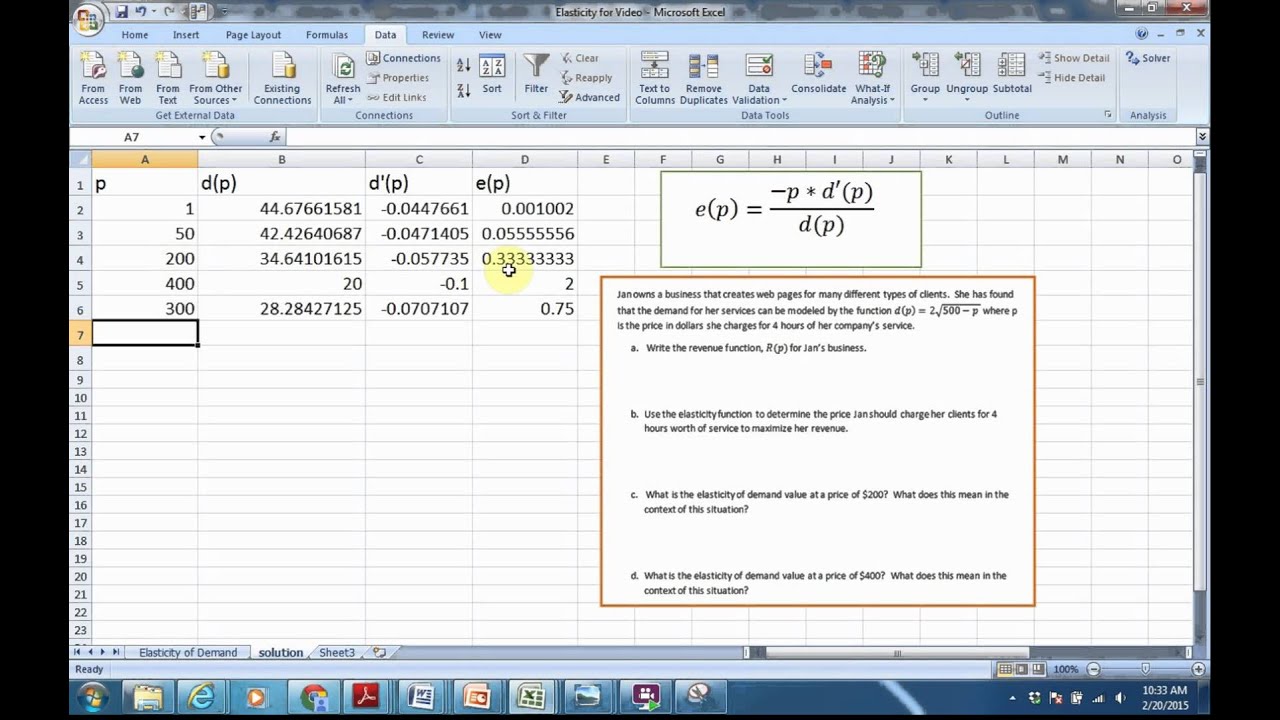

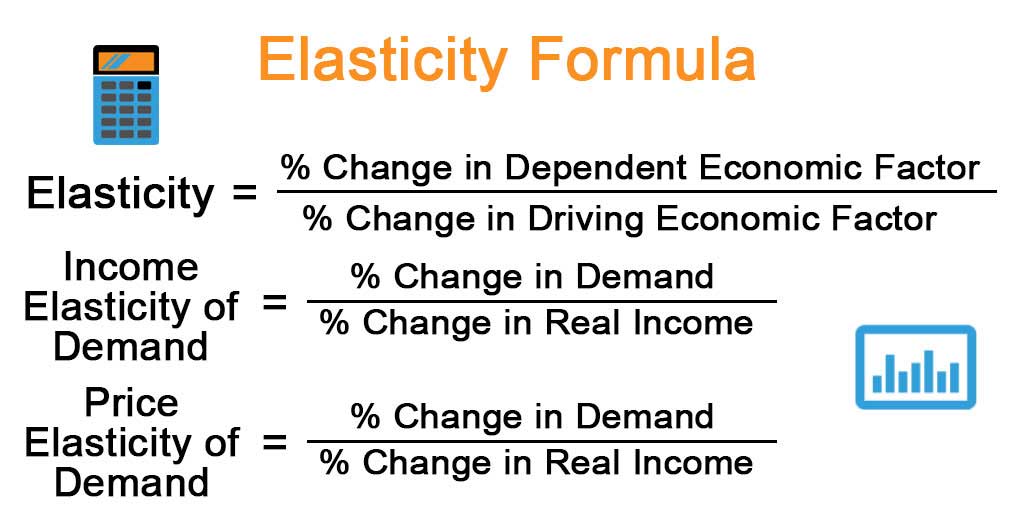

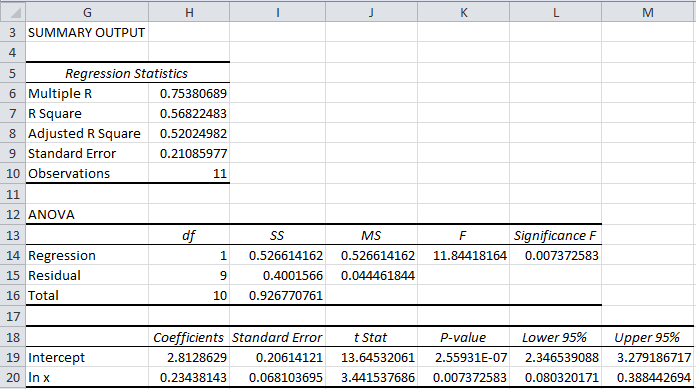

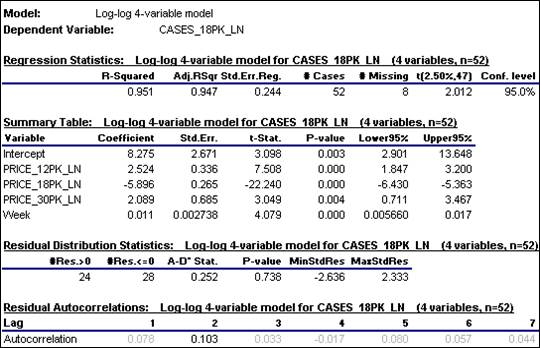

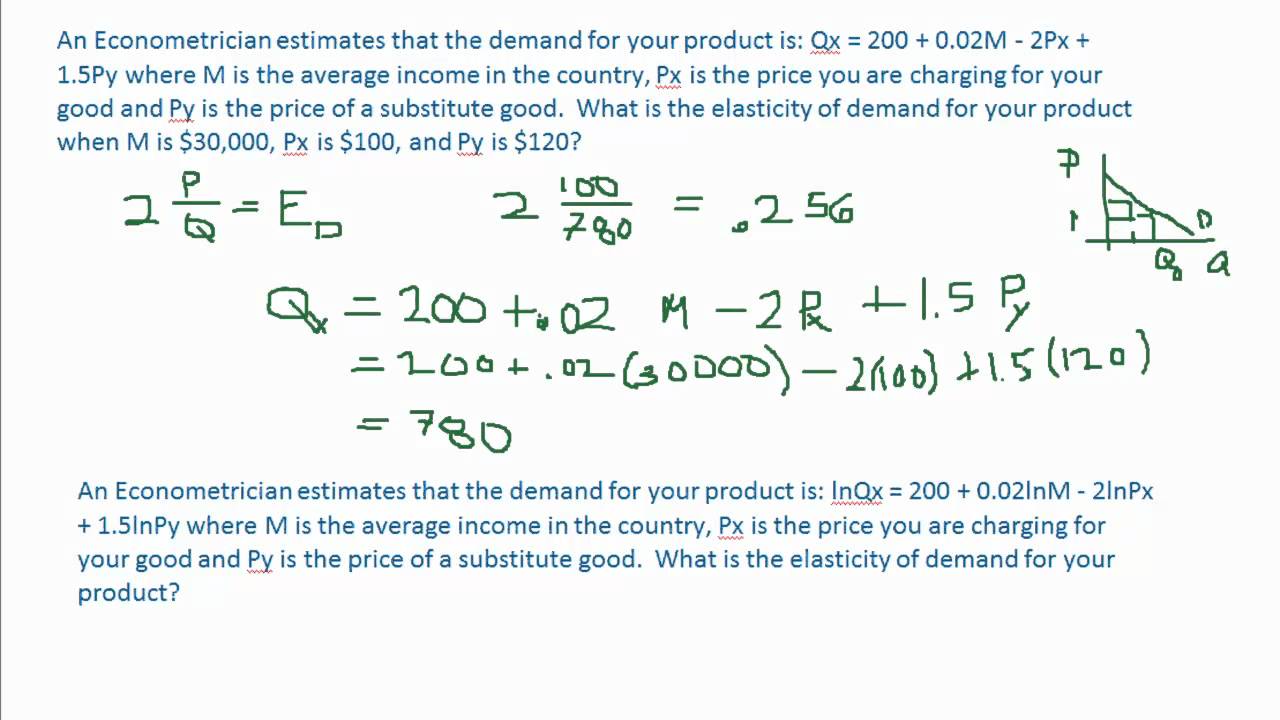

How To Calculate Elasticity From Regression Excel. Mathlog Ya b log X math and the elasticity is. At this point is the greatest weight of the data used to estimate the coefficient. How demand for a product reacts to a change in its own price. Constructing a price regression under the asumption of price inelastic demand is pretty straight forward since you do not have the problem of dealing with simultaneous equations.

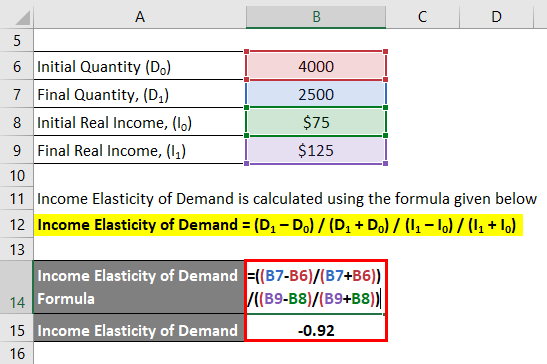

Income Elasticity Of Demand Formula Examples With Excel Template From educba.com

Income Elasticity Of Demand Formula Examples With Excel Template From educba.com

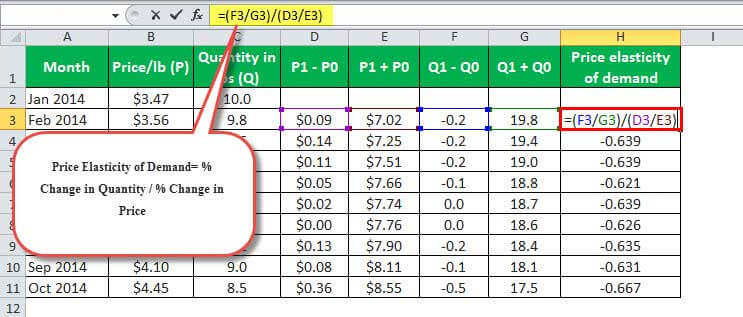

Along a straight-line demand curve the percentage change thus elasticity changes continuously as the scale changes while the slope the estimated regression coefficient remains constant. Two sets of elasticities can be computed. To run the regression arrange your data in columns as seen below. The Regression Macro which is part of the Analysis ToolPak is standard with Excel however it is not always active and available for use. Im not familar with the Leontiff model. In the General tab select columns A B and C in the Prices Demand and Groups fields.

Mathepsilon frac bY Xfrac X Y b math Depending on your regression equation the elasticity is therefore either the estimated coefficient double log the coefficient multiplied divided by the left-hand variable linear-log multiplied by the right-hand variable log-linear or the fraction of.

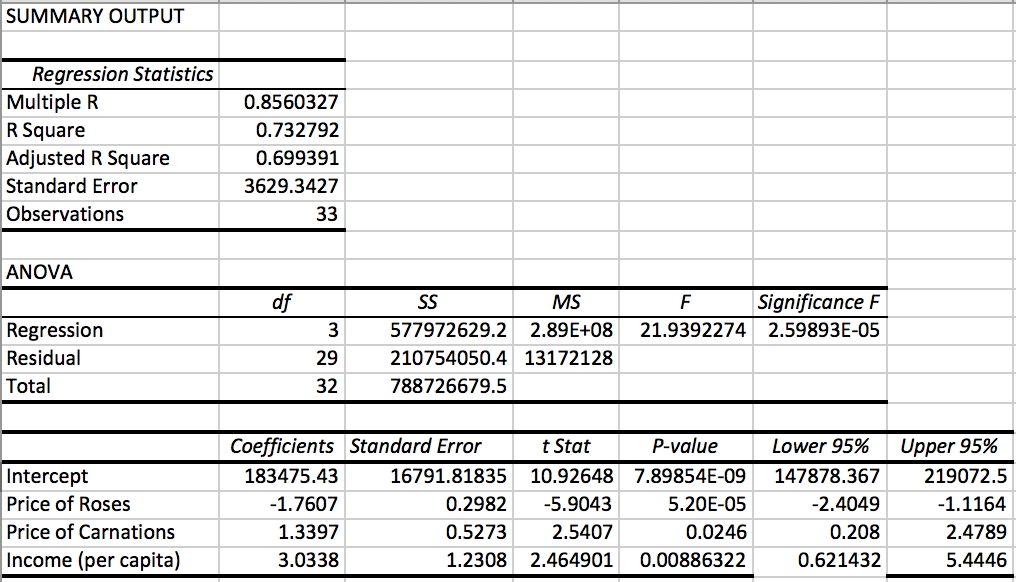

Two sets of elasticities can be computed. Multiplying the slope times provides an elasticity measured in percentage terms. Here we choose to compute the arc elasticities. Yb1x1b2x2b3x3 where Y is the dependent variable price used to represent demand X1 X2 and X3 are the independent variables price of corn flakes etc and b1 b2 and b3 are the coefficients or parameters of your equation. The Price Elasticity of Demand dialog appears. Very roughly the estimated parameters a b c are constants and I is an exogenous variable weve assumed the price change is so small that it does not change national income.

Source: youtube.com

Source: youtube.com

Elasticity is calculated from the following functional formsY a bXlnY a blnXInY a bXIf this video helps please consider a donation. Qh 2052 - 200Ph 100Pc 0023A 00005I. In the General tab select columns A B and C in the Prices Demand and Groups fields. You need to provide the two inputs ie. It is very easy and simple.

Source: youtube.com

Source: youtube.com

To run the regression arrange your data in columns as seen below. After this period we begin to increase prices in Group 1 by 1 on weekdays stay constant in group 2 and decrease in Group 3 by 1 on weekdays. In the General tab select columns A B and C in the Prices Demand and Groups fields. Mathlog Ya b log X math and the elasticity is. In the menu box.

Source: educba.com

Source: educba.com

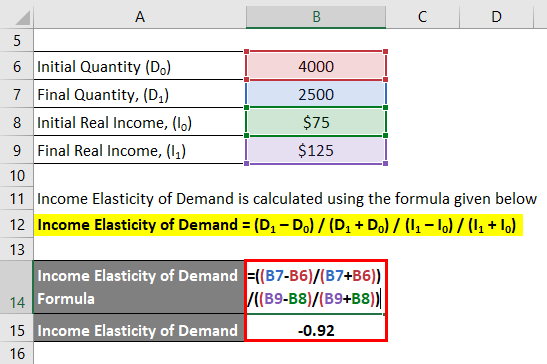

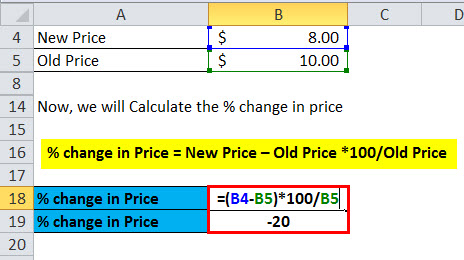

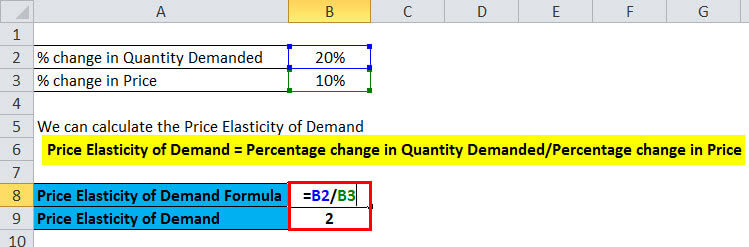

Remember that all OLS regression lines will go through the point of means. 2 days ago Here we will do the same example of the Price Elasticity Of Demand formula in Excel. How demand for a product reacts to a change in its own price. You need to provide the two inputs ie. Regression Analysis using Excel Simple regression Use Solver and some simple utility function to compute some demands for commodity 1 as a function of income and prices.

Source: educba.com

Source: educba.com

I have data set on several SKU within one Brand which were divided by 3 groups daily demand and prices during one month. You will now see a window listing the various statistical tests that Excel can perform. To calculate Elasticity of Demand we use the formula. Very roughly the estimated parameters a b c are constants and I is an exogenous variable weve assumed the price change is so small that it does not change national income. The demand function is computed using an econometric regression which refers to the use of an advanced statistical model to fit data.

Source: educba.com

Source: educba.com

P c ln. Is that possible in MS Excel. The Price Elasticity of Demand dialog appears. Scroll down to find the regression option and click OK. Along a straight-line demand curve the percentage change thus elasticity changes continuously as the scale changes while the slope the estimated regression coefficient remains constant.

Source: researchgate.net

Source: researchgate.net

The demand function is computed using an econometric regression which refers to the use of an advanced statistical model to fit data. Regression Analysis using Excel Simple regression Use Solver and some simple utility function to compute some demands for commodity 1 as a function of income and prices. Very roughly the estimated parameters a b c are constants and I is an exogenous variable weve assumed the price change is so small that it does not change national income. P c ln. Constructing a price regression under the asumption of price inelastic demand is pretty straight forward since you do not have the problem of dealing with simultaneous equations.

Source: youtube.com

Source: youtube.com

To run the regression arrange your data in columns as seen below. I have data set on several SKU within one Brand which were divided by 3 groups daily demand and prices during one month. Along a straight-line demand curve the percentage change thus elasticity changes continuously as the scale changes while the slope the estimated regression coefficient remains constant. Qh 2052 - 200Ph 100Pc 0023A 00005I. The Regression Macro which is part of the Analysis ToolPak is standard with Excel however it is not always active and available for use.

Source: opentextbc.ca

Source: opentextbc.ca

Mathlog Ya b log X math and the elasticity is. Two sets of elasticities can be computed. The Regression Macro which is part of the Analysis ToolPak is standard with Excel however it is not always active and available for use. As a relative measure it is unit independent which turns it into a winner. I am wondering how to include price elasticity demand side in a linear price regression model that is based on asuming price is the result of demandsupply.

Source: researchgate.net

Source: researchgate.net

Mathepsilon frac bY Xfrac X Y b math Depending on your regression equation the elasticity is therefore either the estimated coefficient double log the coefficient multiplied divided by the left-hand variable linear-log multiplied by the right-hand variable log-linear or the fraction of. Take the derivative of both sides with respect to P. P c ln. The documentation might be a little unclear but it says that it is calculated as the point estimates scaled by the mean of Y divided by the mean of X where scaled is being used for divided by. Conceptually three conditions are commonly distinguished.

Source: educba.com

Source: educba.com

Elasticity scores of indicate an elastic demand This means that if one increases the price by one percent the quantity of demand decreases. Going back to the demand for gasoline. Elasticity is defined as the percent change in quantity divided by percentage change in price. Click on the Data menu and then choose the Data Analysis tab. Im not familar with the Leontiff model.

Source: real-statistics.com

Source: real-statistics.com

I have data set on several SKU within one Brand which were divided by 3 groups daily demand and prices during one month. EViews calculates the elasticity at means as Coefficient_on_X MeanXMeanY which is what you state is correct. Assuming the data is under 1 Million count Also what Add-ins are required and could someone suggest any models. Mathlog Ya b log X math and the elasticity is. The Regression Macro which is part of the Analysis ToolPak is standard with Excel however it is not always active and available for use.

Source: people.duke.edu

Source: people.duke.edu

Two sets of elasticities can be computed. Click on the Data menu and then choose the Data Analysis tab. The PE -3084 4732075 -070 formulacoefficientsPricemeandf2meandf1 -07033066. Scroll down to find the regression option and click OK. I have data set on several SKU within one Brand which were divided by 3 groups daily demand and prices during one month.

Source: educba.com

Source: educba.com

Two sets of elasticities can be computed. Is that possible in MS Excel. Excel can handle number crunching very well except how it handles very large and very. Write up your demand function in the form. It is very easy and simple.

Source: youtube.com

Source: youtube.com

Here is a small sample We now try to fit a linear demand curve x 11abp. Elasticity scores of indicate an elastic demand This means that if one increases the price by one percent the quantity of demand decreases. In the General tab select columns A B and C in the Prices Demand and Groups fields. Qh 2052 - 200Ph 100Pc 0023A 00005I. You will now see a window listing the various statistical tests that Excel can perform.

Source: youtube.com

Source: youtube.com

I need to calculate elasticity for a large group of data with multiple variables. Change in demand after a change in competing products prices. To calculate Elasticity of Demand we use the formula. Change in Quantity Demanded and change in Price You can easily calculate the Price Elasticity of Demand using Formula in. The PE -3084 4732075 -070 formulacoefficientsPricemeandf2meandf1 -07033066.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Scroll down to find the regression option and click OK. Take the derivative of both sides with respect to P. Change in Quantity Demanded and change in Price You can easily calculate the Price Elasticity of Demand using Formula in. Im not familar with the Leontiff model. Yb1x1b2x2b3x3 where Y is the dependent variable price used to represent demand X1 X2 and X3 are the independent variables price of corn flakes etc and b1 b2 and b3 are the coefficients or parameters of your equation.

Source: educba.com

Source: educba.com

Very roughly the estimated parameters a b c are constants and I is an exogenous variable weve assumed the price change is so small that it does not change national income. Is that possible in MS Excel. Constructing a price regression under the asumption of price inelastic demand is pretty straight forward since you do not have the problem of dealing with simultaneous equations. Elasticity is calculated from the following functional formsY a bXlnY a blnXInY a bXIf this video helps please consider a donation. Now input the cells containing your data.

Source: youtube.com

Source: youtube.com

After this period we begin to increase prices in Group 1 by 1 on weekdays stay constant in group 2 and decrease in Group 3 by 1 on weekdays. Conceptually three conditions are commonly distinguished. The formula to estimate an elasticity when an OLS demand curve has been estimated becomes. Take the derivative of both sides with respect to P. Going back to the demand for gasoline.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate elasticity from regression excel by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.