Your How does supply and demand affect stock prices images are available in this site. How does supply and demand affect stock prices are a topic that is being searched for and liked by netizens now. You can Get the How does supply and demand affect stock prices files here. Download all free images.

If you’re searching for how does supply and demand affect stock prices pictures information related to the how does supply and demand affect stock prices topic, you have visit the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

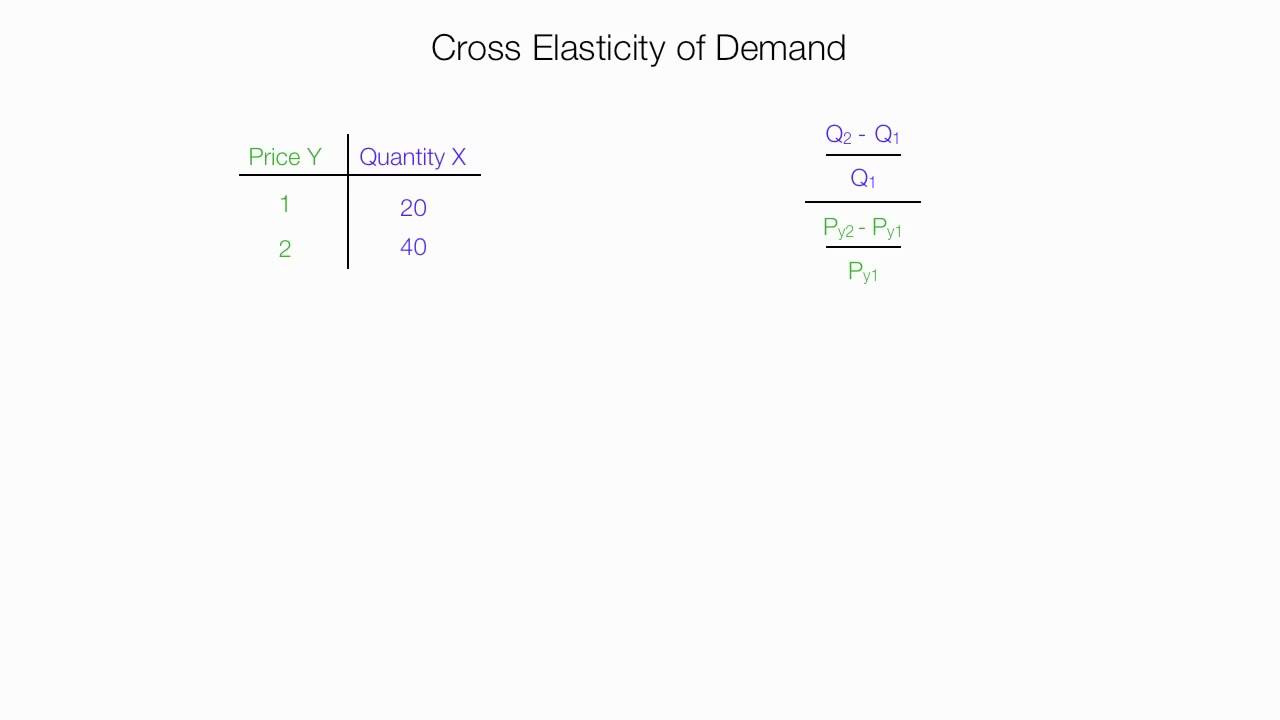

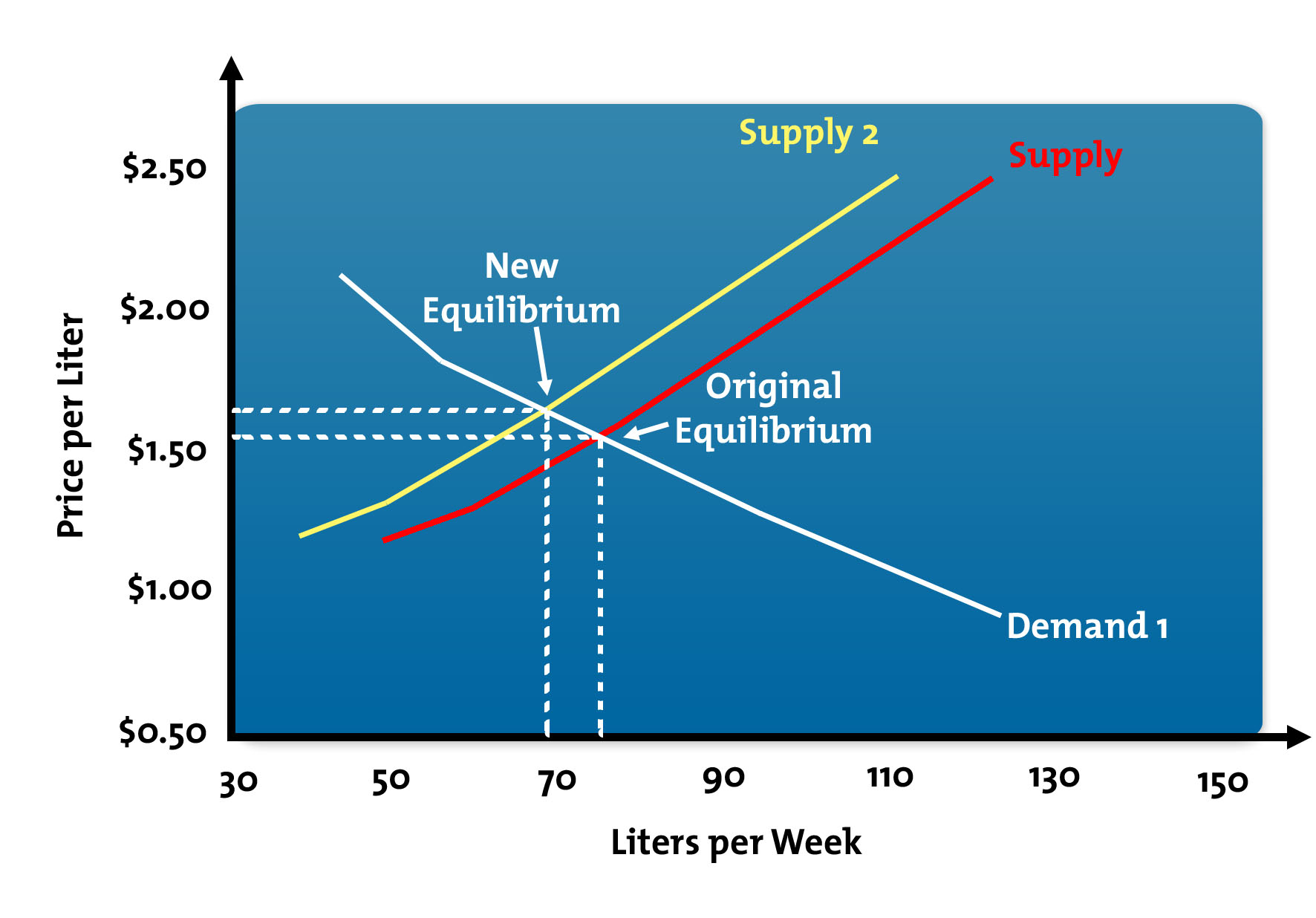

How Does Supply And Demand Affect Stock Prices. This means that they have an inverse relationship. On the supply side if the price of a good or service increases then firms will be willing to. The price at which the quantity demanded is exactly equal to the quantity supplied. Stock prices change everyday by market forces.

Forex System Trading Howtolearnforex Trading Charts Forex Trading Stock Options Trading From pinterest.com

Forex System Trading Howtolearnforex Trading Charts Forex Trading Stock Options Trading From pinterest.com

If more people want to buy a stock demand than sell it. Buyers - Create demand for the stock at their ideal price. Market prices are affected by anything that affects. In terms of financial markets supply and demand determine the pricing of stocks and other securities. However it will only rise to the point where buyers find the price attractive. After which demand will typically wane.

Stock prices are a direct result of supply and demand.

That is the supply and demand together determine what the price will be. On the supply side if the price of a good or service increases then firms will be willing to. Buyers - Create demand for the stock at their ideal price. By this we mean that share prices change because of supply and demand. In terms of financial markets supply and demand determine the pricing of stocks and other securities. Also called the equilibrium price.

Source: pinterest.com

Source: pinterest.com

Stock prices are a direct result of supply and demand. After which demand will typically wane. It is a tradeoff on what investors think the company is worth at a given. When demand for shares exceeds supply which means the buyers are more than sellers the. Demand and Supply.

Source: ig.com

Source: ig.com

Yet in all the recent discussion about how the market is due for a correction and is overvalued and has. When demand for shares exceeds supply which means the buyers are more than sellers the. With sellers serving as the supply. Price is derived by the interaction of supply and demand. The more attractive a company is in the eyes of investors the greater the demand for its stock becomes and consequently the higher the market price of that stock rises.

Source: pinterest.com

Source: pinterest.com

The stock market is a continuous two-way auction. However it will only rise to the point where buyers find the price attractive. If more people want to buy a stock demand than sell it. All the other influences like debt balance sheets earnings and so on affect the desirability of owning or selling a stock. This means that they have an inverse relationship.

Source: pinterest.com

Source: pinterest.com

Because the price of everything is determined by supply and demand. Stock prices are a direct result of supply and demand. An exchange of goods or services. A decrease in demand will cause a reduction in the equilibrium price and quantity of a good. After which demand will typically wane.

Source: dotnettutorials.net

Source: dotnettutorials.net

In terms of financial markets supply and demand determine the pricing of stocks and other securities. After which demand will typically wane. Supply and demand affect prices in the market by interacting with one another. Demand and supply in the market affect the prices of shares. It is a tradeoff on what investors think the company is worth at a given.

Source: in.pinterest.com

Source: in.pinterest.com

An exchange of goods or services. The higher the supply the lower the price will be and the higher the demand the higher the price will be. If there is a short supply and low demand price will remain steady. On the supply side if the price of a good or service increases then firms will be willing to. If the price decreases then potential demand also increases inverse relationship.

Source: pinterest.com

Source: pinterest.com

By this we mean that share prices change because of supply and demand. If the price decreases then potential demand also increases inverse relationship. The more attractive a company is in the eyes of investors the greater the demand for its stock becomes and consequently the higher the market price of that stock rises. Price is derived by the interaction of supply and demand. Demand and Supply.

Source: pinterest.com

Source: pinterest.com

With sellers serving as the supply. This means that they have an inverse relationship. The higher the supply the lower the price will be and the higher the demand the higher the price will be. An exchange of goods or services. Price is tied to supply in demand.

Source: pinterest.com

Source: pinterest.com

If more people want to buy a stock demand than sell it. Supply and demand affect prices in the market by interacting with one another. Because the price of everything is determined by supply and demand. By this we mean that share prices change because of supply and demand. Sellers - Supply the stock at their ideal price.

Source: investopedia.com

Source: investopedia.com

On the supply side if the price of a good or service increases then firms will be willing to. That is the supply and demand together determine what the price will be. Demand and supply in the market affect the prices of shares. However it will only rise to the point where buyers find the price attractive. Demand and Supply.

Source: pinterest.com

Source: pinterest.com

When demand for shares exceeds supply which means the buyers are more than sellers the. This will present sometimes large variations between the last price of the ETF vs the. All the other influences like debt balance sheets earnings and so on affect the desirability of owning or selling a stock. A decrease in demand will cause a reduction in the equilibrium price and quantity of a good. In short the more.

Source: pinterest.com

Source: pinterest.com

On the supply side if the price of a good or service increases then firms will be willing to. Market prices are affected by anything that affects. With sellers serving as the supply. In short the more. Because the price of everything is determined by supply and demand.

Source: pinterest.com

Source: pinterest.com

Economic data interest rates and corporate results influence the. Yet in all the recent discussion about how the market is due for a correction and is overvalued and has. Even though the price trend of a stock depends on the demand and supply which is limited for each day in the market the standard and performance of the stock plays major role to control. A decrease in demand will cause a reduction in the equilibrium price and quantity of a good. The price at which the quantity demanded is exactly equal to the quantity supplied.

Source: in.pinterest.com

Source: in.pinterest.com

The more attractive a company is in the eyes of investors the greater the demand for its stock becomes and consequently the higher the market price of that stock rises. Market prices are affected by anything that affects. If more people want to buy a stock demand than sell it. The higher the supply the lower the price will be and the higher the demand the higher the price will be. Buyers and sellers give their best price and are automatically matched when those two prices converge.

Source: investopedia.com

Source: investopedia.com

Demand and Supply. Economic data interest rates and corporate results influence the. That is the supply and demand together determine what the price will be. Because the price of everything is determined by supply and demand. If more people want to buy a stock demand than sell it.

Source: mindtools.com

Source: mindtools.com

Price is derived by the interaction of supply and demand. However it will only rise to the point where buyers find the price attractive. Also called the equilibrium price. Demand and supply in the market affect the prices of shares. If more people want to buy a stock demand than sell it.

Source: investopedia.com

Source: investopedia.com

Buyers and sellers give their best price and are automatically matched when those two prices converge. When demand for shares exceeds supply which means the buyers are more than sellers the. A decrease in demand will cause a reduction in the equilibrium price and quantity of a good. The more attractive a company is in the eyes of investors the greater the demand for its stock becomes and consequently the higher the market price of that stock rises. If more people want to buy a stock demand than sell it.

Source: pinterest.com

Source: pinterest.com

All the other influences like debt balance sheets earnings and so on affect the desirability of owning or selling a stock. This will present sometimes large variations between the last price of the ETF vs the. Yet in all the recent discussion about how the market is due for a correction and is overvalued and has. Price is derived by the interaction of supply and demand. Even though the price trend of a stock depends on the demand and supply which is limited for each day in the market the standard and performance of the stock plays major role to control.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does supply and demand affect stock prices by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.