Your Effect of tax on supply and demand graph images are available. Effect of tax on supply and demand graph are a topic that is being searched for and liked by netizens now. You can Download the Effect of tax on supply and demand graph files here. Find and Download all free vectors.

If you’re searching for effect of tax on supply and demand graph pictures information linked to the effect of tax on supply and demand graph keyword, you have pay a visit to the right blog. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

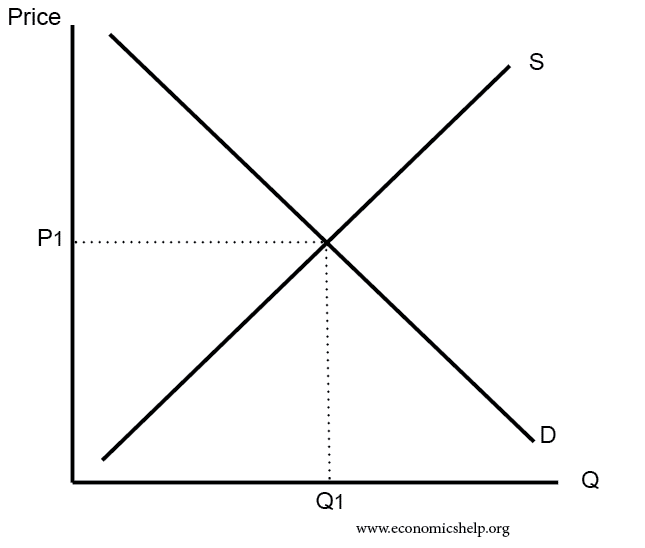

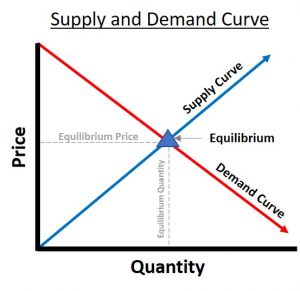

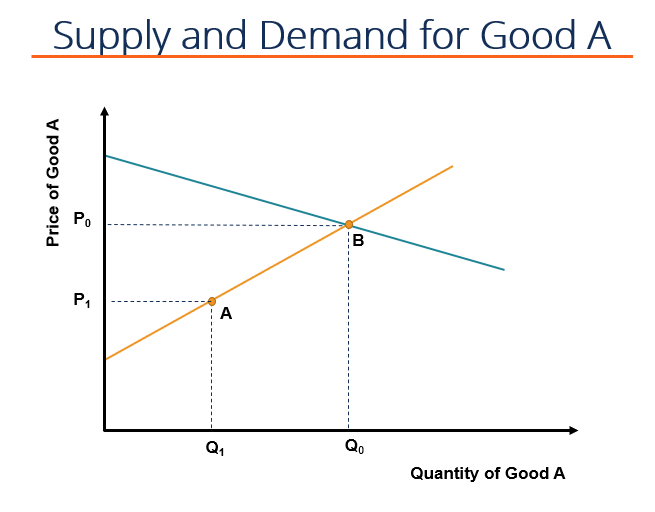

Effect Of Tax On Supply And Demand Graph. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Before you begin understand that the economic graph of supply and demand is a model. How do excise taxes affect the supply curve.

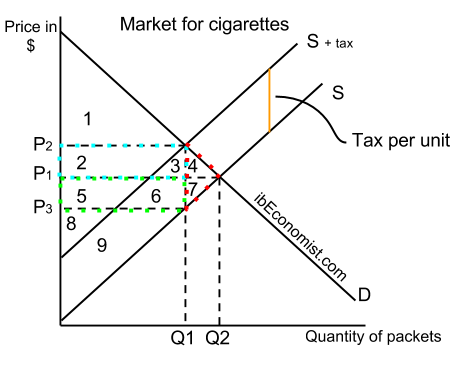

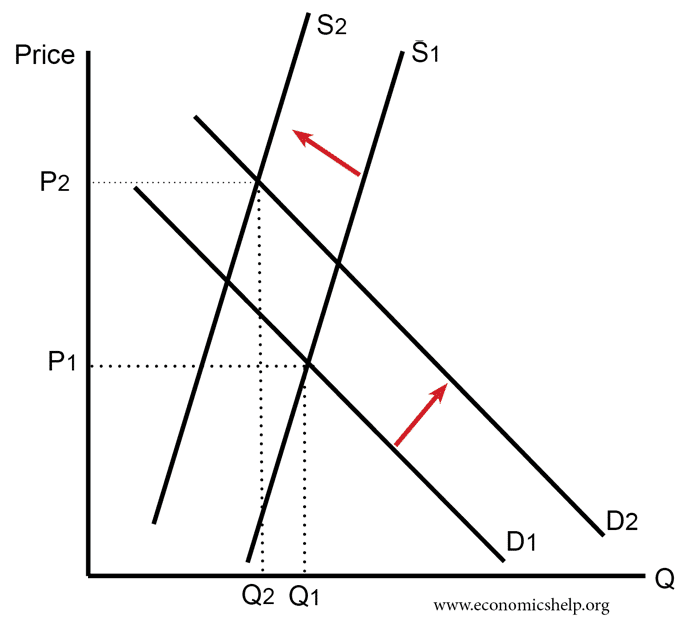

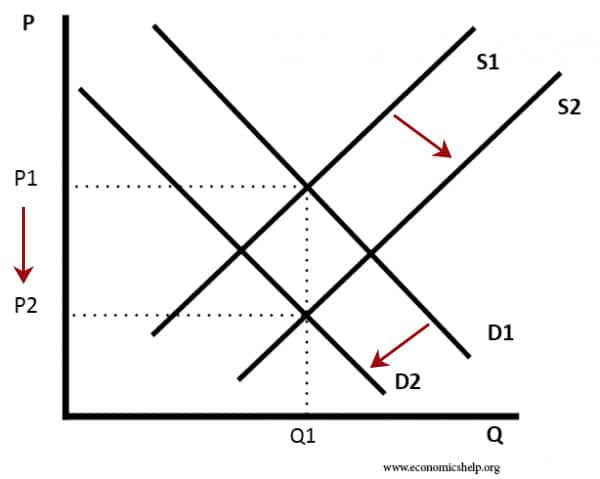

This simply means that a tax will have the effect of shifting the industry supply curve to the left. The Effects of Subsidies on the Supply Demand Curve. Similarly the price the seller obtains falls but by less than the tax. Actually the imposition of a tax upon a commodity causes the supply curve to move vertically upwards by the amount of the tax ie. Tax burden evenly split. A tax increases the price a buyer pays by less than the tax.

It illustrates a concept based on select economic assumptions- it does not reflect a precise reality.

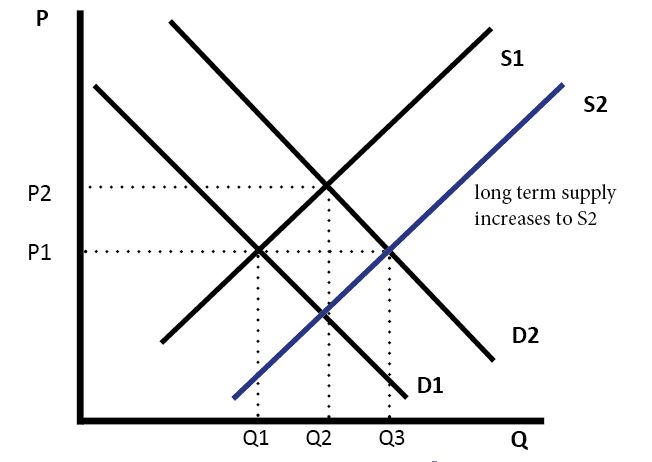

The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. When demand is elastic the tax burden is mainly on the producer. Tax burden on producer. The figures given in Table 93 may now be plotted on a graph. Steel and aluminum industry. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Tariffs from one country encourage production in other parts of the world. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus. Similarly the price the seller obtains falls but by less than the tax. When costs of production increase the.

Source: ibeconomist.com

Source: ibeconomist.com

The relative effect on buyers and sellers is known as the incidence of the tax. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Businesses can be taxed directly or indirectly through a variety of means. It includes graphs and examples to help develop the intuition of how an income tax affects the supply and demand of labor. Any tax on a business will affect its supply.

Use the diagram to find out the new equilibrium price and quantity. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. Actually the imposition of a tax upon a commodity causes the supply curve to move vertically upwards by the amount of the tax ie. The consumers will now pay price P while producers will receive P P t. The Effect of Tax on the Demand Curve.

To be more specific a per unit tax will shift the industry supply curve vertically upward to S 1 as shown in Fig. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. How do excise taxes affect the supply curve. The relative effect on buyers and sellers is known as the incidence of the tax.

Source: economicshelp.org

Source: economicshelp.org

In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus. Use the diagram to find out the new equilibrium price and quantity. Example the incidence of a tax on cigarettes. The figures given in Table 93 may now be plotted on a graph. Economists are often concerned with the effect of government policies like taxes or subsidies on the interaction of supply and demand.

Source: assignmentexpert.com

Source: assignmentexpert.com

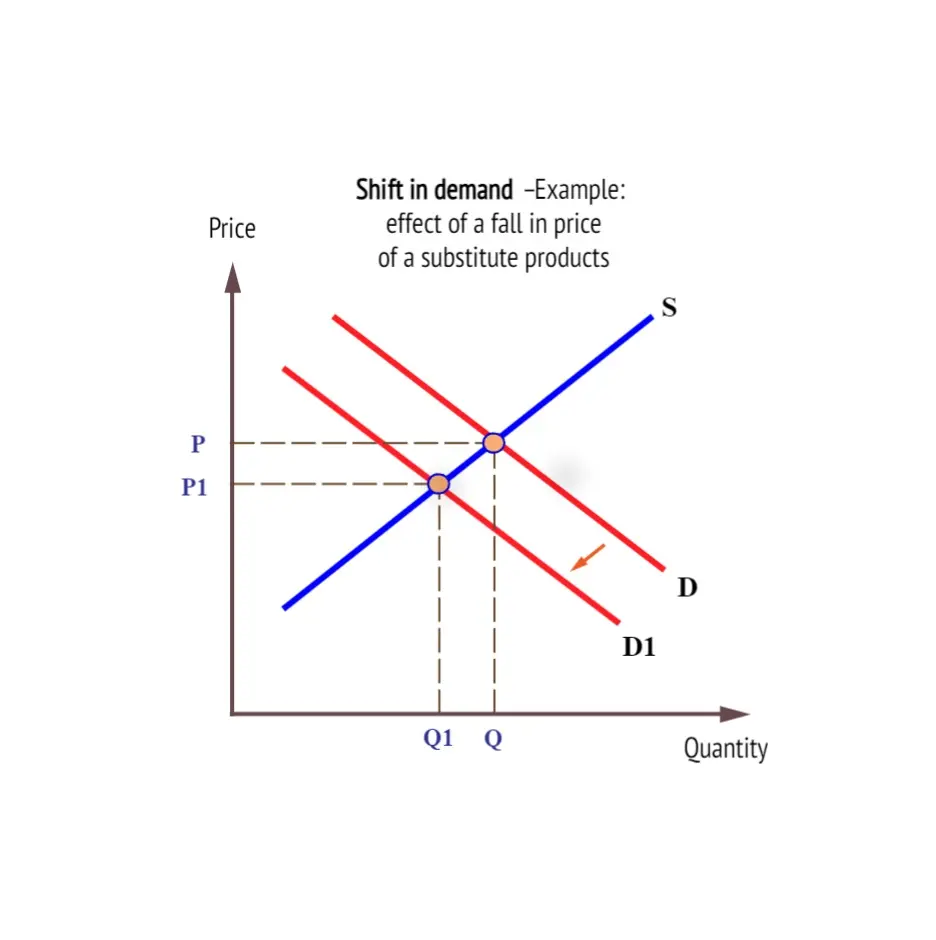

Before you begin understand that the economic graph of supply and demand is a model. Shifts from D to D. When demand is elastic the tax burden is mainly on the producer. Before you begin understand that the economic graph of supply and demand is a model. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram.

Source: economics.stackexchange.com

Source: economics.stackexchange.com

Tariffs from one country encourage production in other parts of the world. Also from the graph we can see that increase in demand leads to the shift of the demand curve to the right and the decrease in the demand causes the shift. A tax increases the price a buyer pays by less than the tax. The demand curve because of the tax t. Find the price paid by consumers.

The variation of the surplus of each agents is quite telling. When costs of production increase the. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. Calculate the tax revenue received by the government indicate it on your diagram. In this case the tax burden is split evenly between the consumer and producer.

Source: economicshelp.org

Source: economicshelp.org

This simply means that a tax will have the effect of shifting the industry supply curve to the left. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. In this case the tax burden is split evenly between the consumer and producer. Also from the graph we can see that increase in demand leads to the shift of the demand curve to the right and the decrease in the demand causes the shift. Tariffs from one country encourage production in other parts of the world.

Source: investopedia.com

Source: investopedia.com

Supply and Demand With A Tax - YouTube. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices. The goal of the 25 tax. A person can sum up the supply-side implications of a tariff quite concisely. A tax increases the price a buyer pays by less than the tax.

Source: acqnotes.com

Source: acqnotes.com

Calculate the tax revenue received by the government indicate it on your diagram. Markets supply and demand curve after of the post-tax it can be seen that the tax effect is the same as the flow of supply and demand curves respectively to the left and the top and the left. The variation of the surplus of each agents is quite telling. City or state taxes and taxes on corporate profits are just two examples. Supply and Demand With A Tax - YouTube.

When a government imposes an excise tax on a good however it drives a wedge between the supply curve and the demand curve forcing a new equilibrium where the amount paid by the consumer is greater than the amount received by the producer. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. The imposition of the tax has caused the supply curve to shift to the left from SS to ST. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram.

Source: study.com

Source: study.com

How do excise taxes affect the supply curve. The tax paid by the consumer is calculated as P 0 P 1. In ugly-rose we can see that the consumers who have an inelastic demand loose a lot actually most of the total loss of surplus. This post goes over the effect of a new income tax on the supply and demand of labor or the labor market. Also from the graph we can see that increase in demand leads to the shift of the demand curve to the right and the decrease in the demand causes the shift.

Source: sanandres.esc.edu.ar

Source: sanandres.esc.edu.ar

It means that if the price is increasing the quantity of demand is decreasing and vice versa. It illustrates a concept based on select economic assumptions- it does not reflect a precise reality. The effect of a commodity tax is to create a gap between demand price and supply price. The consumers will now pay price P while producers will receive P P t. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax.

Source: economicshelp.org

Source: economicshelp.org

The Effect of Tax on the Demand Curve. Extensive study in economics has considered this issue and theories exist to explain the relationship between taxes and the demand curve. When demand is elastic the tax burden is mainly on the producer. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices. To be more specific a per unit tax will shift the industry supply curve vertically upward to S 1 as shown in Fig.

Source: economicshelp.org

Source: economicshelp.org

These grants are used whenever there is a shortage in supply to encourage the purchase of safety or healthy products or whenever it is in the best interest of the public. The Effects of Subsidies on the Supply Demand Curve. Taxes increase the costs of producing and selling items which the business may pass on to the consumer in the form of higher prices. If the government imposes a specific tax per unit of 3 plot the new supply curve on the original supply and demand diagram. The imposition of the tax has caused the supply curve to shift to the left from SS to ST.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. If a government puts a 1 tax on each packet of cigarettes the legal incidence is on the cigarette smoker. If the supply curve is relatively flat the supply is price elastic. It means that if the price is increasing the quantity of demand is decreasing and vice versa. Similarly the price the seller obtains falls but by less than the tax.

Source: assignmentexpert.com

Source: assignmentexpert.com

The relative effect on buyers and sellers is known as the incidence of the tax. Tax burden on producer. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. If demand is fairly inelastic the tax will fall mainly on the buyer. A tax increases the price a buyer pays by less than the tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title effect of tax on supply and demand graph by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.