Your Draw a supply and demand diagram with a tax on the sale of the good images are ready in this website. Draw a supply and demand diagram with a tax on the sale of the good are a topic that is being searched for and liked by netizens today. You can Download the Draw a supply and demand diagram with a tax on the sale of the good files here. Download all free photos.

If you’re searching for draw a supply and demand diagram with a tax on the sale of the good images information linked to the draw a supply and demand diagram with a tax on the sale of the good topic, you have visit the ideal blog. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

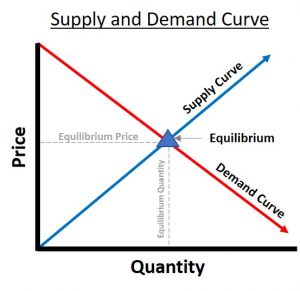

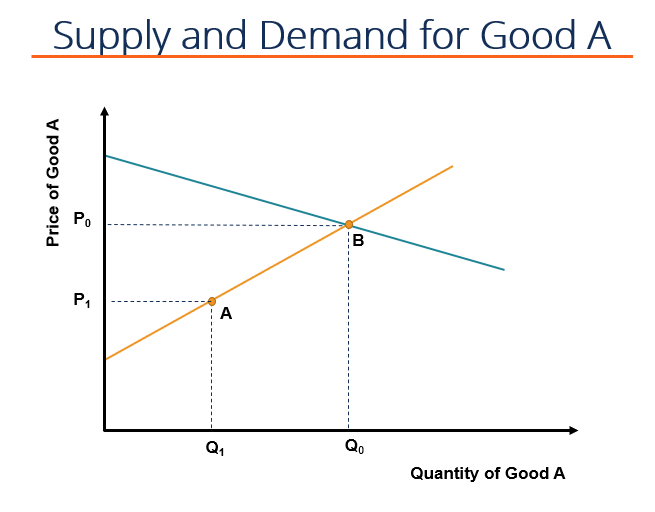

Draw A Supply And Demand Diagram With A Tax On The Sale Of The Good. In the diagram SS is the supply curve before tax S t S t is the supply curve after tax. Show the deadweight loss. It is obvious that. The government sets a maximum price of OJ for the good.

Represent the equilibrium on the axes below using a properly labeled supply and demand diagram. While supply for the product has not changed all of the determinants of supply are the same producers incur higher cost which is why we will see a new equilibrium point. Draw a supply-and-demand diagram with a tax on the sale of a good. Which area represents that part of the tax revenue paid by consumers. 38 3P P - 2 40 4P P 10 Q D 8 and Q S 8. Note that the equations are already solved for P.

P Set Q D Q S P 2.

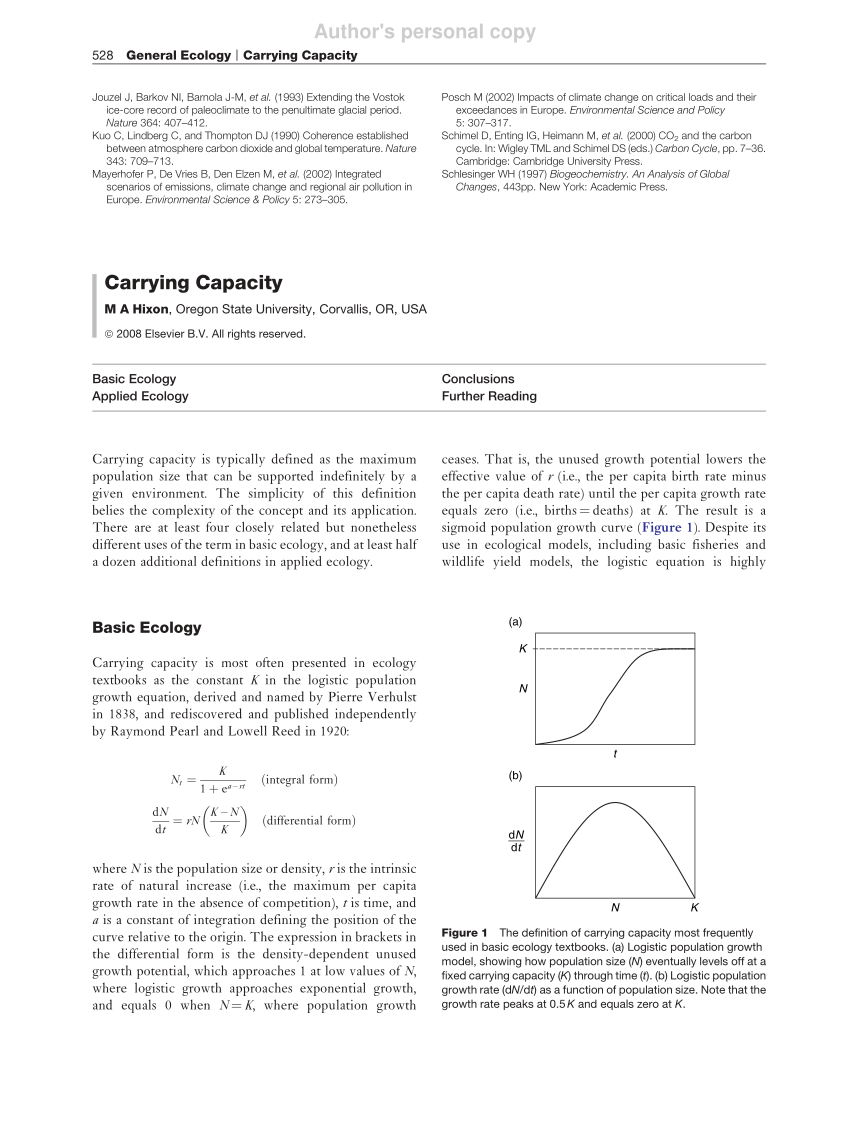

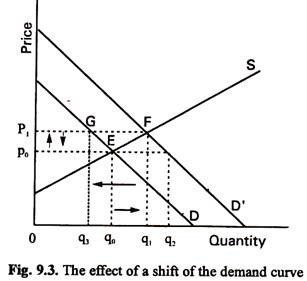

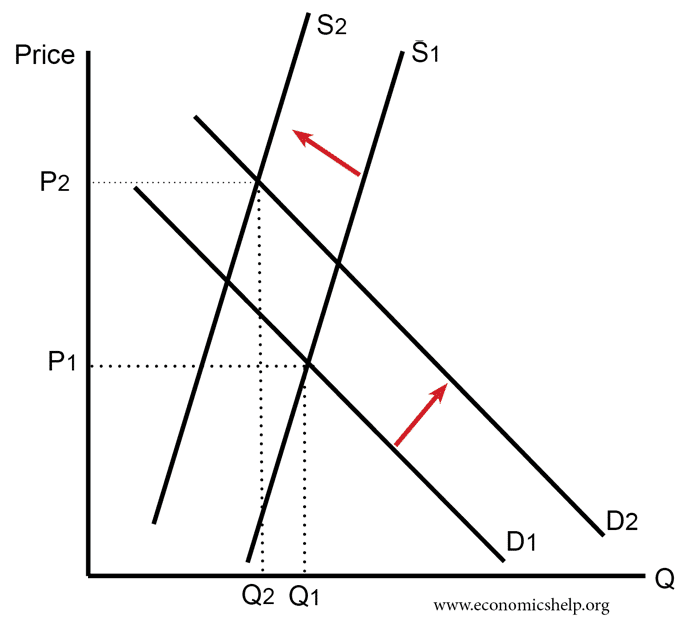

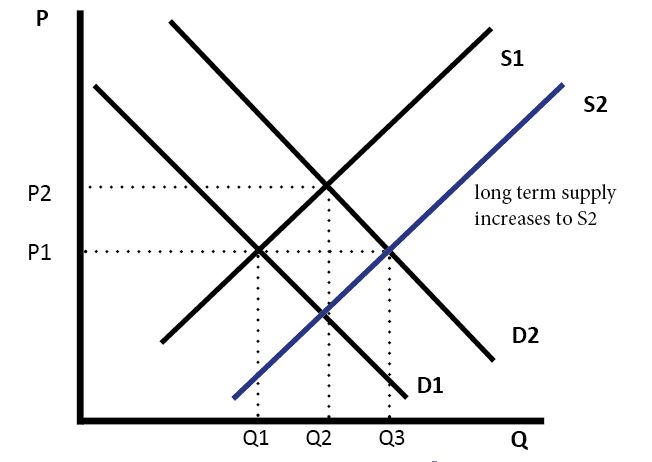

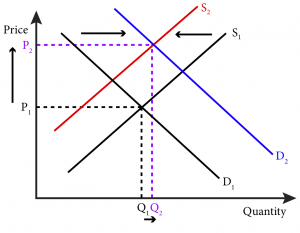

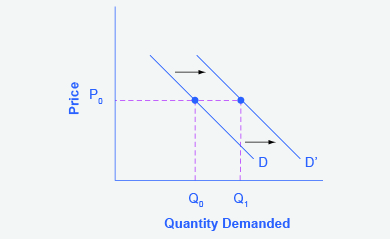

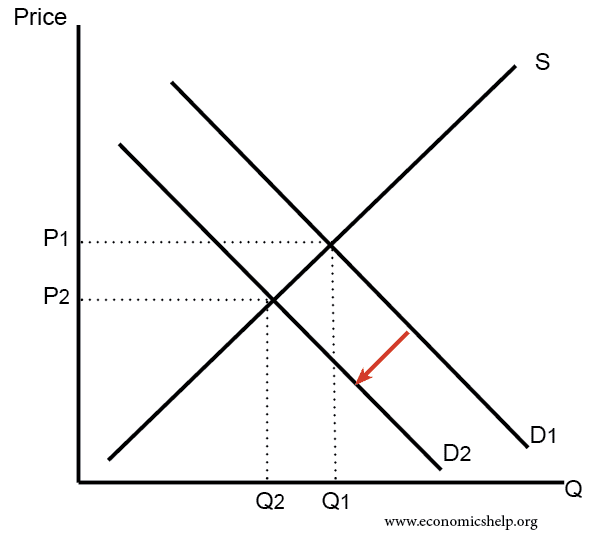

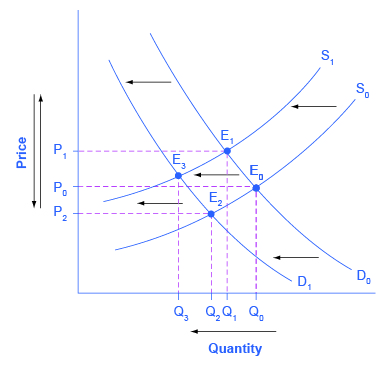

Equilibrium price will fall and equilibrium quantity will. Income taxes will affect demand in the same way as changes in income did because they are essentially the same thing. A Decrease in Demand. Show the tax revenue. Taxes on supply and demand The VAT on the suppliers will shift the supply curve to the left symbolizing a reduction in supply similar to firms facing higher input costs. Lets draw a supply-and-demand graph with a tax on the sale of a good.

Source: investopedia.com

Source: investopedia.com

Draw a supply-and-demand diagram with. Lets draw a supply-and-demand graph with a tax on the sale of a good. Each of these changes in demand will be shown as a shift in the demand curve. Before the tax 2 million. The government sets a maximum price of OJ for the good.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

The government imposes an excise tax on the sale of all toothbrushes. Why do they have this effect. Example the incidence of a tax on cigarettes. Suppose the market demand and supply curves for mead are given by the equations Q D 38 3P and Q S P 2. To draw the graph we begin by drawing the supply and demand curves.

Source: www2.harpercollege.edu

Source: www2.harpercollege.edu

In both of your diagrams show the change in the price paid by car. Show the deadweight loss. Identify consumer surplus and producer surplus with free trade. C To draw the graph we begin by drawing the supply and demand curves. Why do they have this effect.

Source: researchgate.net

Source: researchgate.net

In both of your diagrams show the change in the price paid by car. In the figure shows how the quantity of a good offered for sale changes as the price of the good changes. In both of your diagrams show the change in the price paid by car. Note that the equations are already solved for P. 1 Take a highlighter or colored pencil and make a border around the rectangular region encompassing Cost to Consumers and Cost to Producers.

Source: pressbooks.bccampus.ca

Source: pressbooks.bccampus.ca

Travelers pay 550 per ticket 450 of which the airlines receive. Solve for the equilibrium price and quantity. Or we can draw it graphically as we have done in Figure 21. Panel b of Figure 310 Changes in Demand and Supply shows that a decrease in demand shifts the demand curve to the left. C To draw the graph we begin by drawing the supply and demand curves.

Source: economicshelp.org

Source: economicshelp.org

What happens to consumer and producer surplus when the sale of a good is taxed. Draw a supply-and-demand diagram with. In this case the tax burden is split evenly between the consumer and producer. Show the tax revenue. To draw the graph we begin by drawing the supply and demand curves.

Source: acqnotes.com

Source: acqnotes.com

3 How do the elasticities of supply and demand affect the deadweight loss of a tax. Slaughtering the cows will result in an increase in the supply of beef to the market which will in turn lead to a decrease in the equilibrium price of beef and an increase in the equilibrium quantity of beef. Draw a supply-and-demand diagram with a tax on the sale of a good. Draw a supply and demand diagram that illustrates the new equi librium price and quantity of lobsters. Show the tax revenue.

Source: economicshelp.org

Source: economicshelp.org

Draw a supply-and-demand diagram with a tax on the sale of a good. Show the tax revenue 3. And plot the demand and supply curves if the government has imposed an indirect tax at a rate of. Show the deadweight loss. Suppose the market demand and supply curves for mead are given by the equations Q D 38 3P and Q S P 2.

2 Calculate the Total Tax Revenue in this economy by finding the area of the rectangle border. Identify consumer surplus and producer surplus before trade is allowed. How will this affect the consumers and producers of the good. Income taxes will affect demand in the same way as changes in income did because they are essentially the same thing. Draw the supply-and-demand diagram for an importing country.

Source: open.oregonstate.education

Source: open.oregonstate.education

Example the incidence of a tax on cigarettes. Draw a supply-and-demand diagram with a tax on the sale of the good. Travelers pay 550 per ticket 450 of which the airlines receive. What happens to consumer and producer surplus when the sale of a good is taxed. Q_D Q_S QD.

Source: study.com

Source: study.com

Show the tax revenue. It is obvious that. When demand is elastic the tax burden is mainly on the producer. Equilibrium price will fall and equilibrium quantity will. Show the deadweight loss.

Source: opentextbc.ca

Source: opentextbc.ca

Or we can draw it graphically as we have done in Figure 21. The textbook publisher will offer more textbooks for sale at any given price representing a rightward shift of the supply curve from S 1 to S 2. Draw a supply-and-demand diagram with a tax on the sale of the good. How will this affect the consumers and producers of the good. Which area represents that part of the tax revenue paid by consumers.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Show the deadweight loss. In both of your diagrams show the change in the price paid by car. In this case the tax burden is split evenly between the consumer and producer. Chicken and beef are substitute goods. As the price falls to the new equilibrium level the quantity supplied decreases to 20 million pounds of coffee per month.

Source: economicshelp.org

Source: economicshelp.org

Show the deadweight loss. How do the elasticities of supply and demand affect the deadweight loss of a tax. Draw a supply and demand diagram that illustrates the new equi librium price and quantity of lobsters. Illustrate using a supply and demand diagram. In another diagram show how a tax on car sellers of 1000 per car affects the quantity of cars sold and the price of cars.

Source: khanacademy.org

Source: khanacademy.org

How do the ela the deadweight effect. Show the deadweight loss. How will this affect the consumers and producers of the good. A 33-29 900-0. Slaughtering the cows will result in an increase in the supply of beef to the market which will in turn lead to a decrease in the equilibrium price of beef and an increase in the equilibrium quantity of beef.

Taxes have the ability to impact a consumers ability to afford a good but the type of tax impacts the change in demand. How do the ela the deadweight effect. How do the elasticities of supply and demand affect the deadweight loss of a tax. Travelers pay 550 per ticket 450 of which the airlines receive. Draw a supply-and-demand diagram with a tax on the sale of the good.

Show the tax revenue. Show the deadweight loss. The equilibrium price falls to 5 per pound. Income taxes will affect demand in the same way as changes in income did because they are essentially the same thing. Draw a supply-and-demand diagram with a tax on the sale of a good.

Source: investopedia.com

Source: investopedia.com

Show the tax revenue. Solve for the equilibrium price and quantity. Why do they have this effect. Draw a supply-and-demand diagram with a tax on the sale of the good. How will this affect the consumers and producers of the good.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title draw a supply and demand diagram with a tax on the sale of the good by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.