Your Does supply and demand affect stock prices images are ready in this website. Does supply and demand affect stock prices are a topic that is being searched for and liked by netizens now. You can Download the Does supply and demand affect stock prices files here. Get all royalty-free photos.

If you’re searching for does supply and demand affect stock prices pictures information related to the does supply and demand affect stock prices keyword, you have visit the right site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

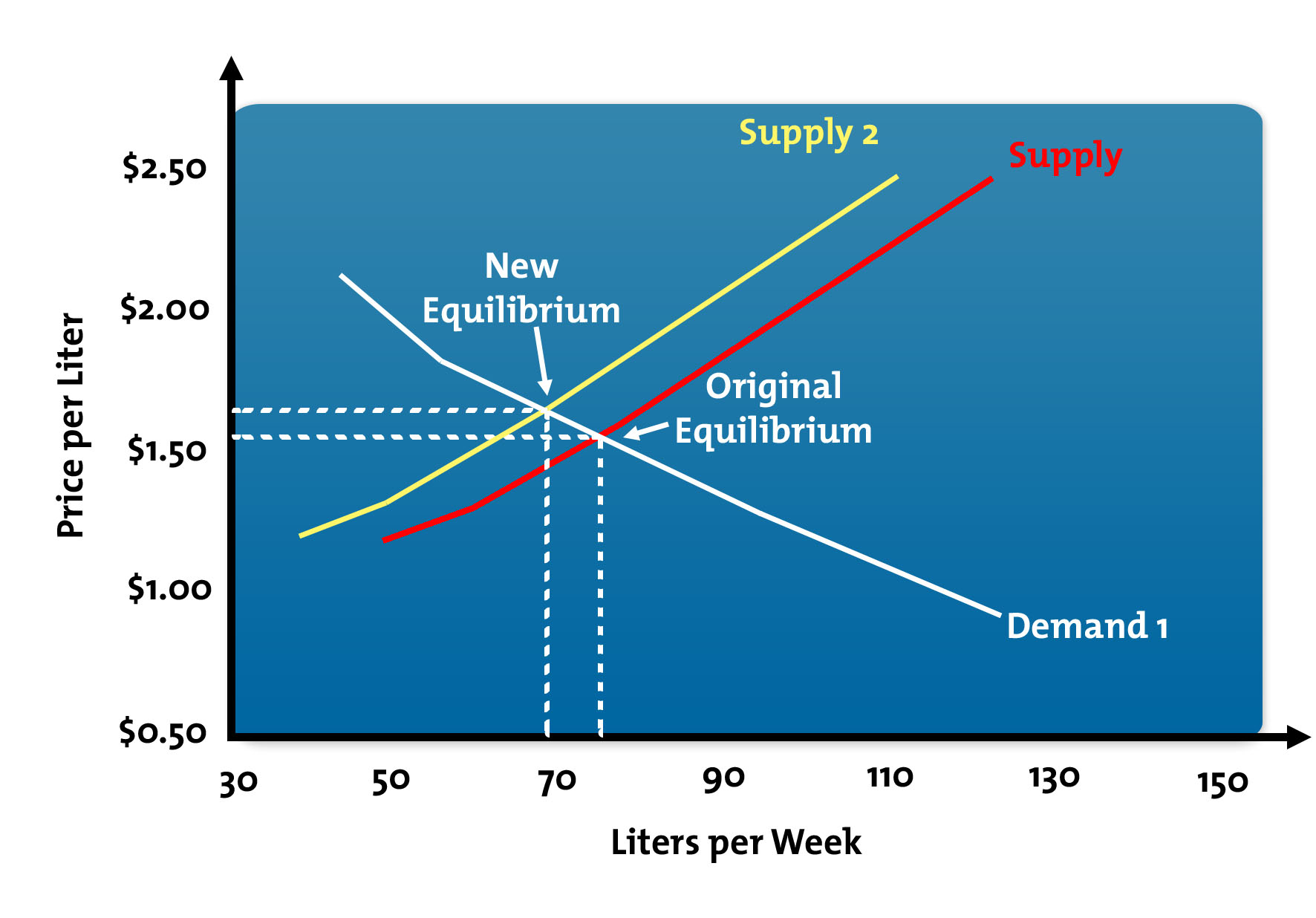

Does Supply And Demand Affect Stock Prices. 9 high-demand trending products and niches of 2021 How does the law of supply and demand affect prices. The decrease in demand causes excess supply to develop at the initial price. But while these trading tools are undoubtedly useful they can sometimes serve to abstract us from the reality that stock prices change solely due to a change in supply or demand. While supply and demand is the bottom-line factor that determines.

Law Of Supply Law Of Demand Economics Lessons Basic Economics From pinterest.com

Law Of Supply Law Of Demand Economics Lessons Basic Economics From pinterest.com

But expansions also cause the demand for bonds to increase the bond demand curve to shift right which has the effect of increasing bond prices and hence lowering bond yields. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. The decrease in demand causes excess supply to develop at the initial price. While supply and demand is the bottom-line factor that determines. When demand for shares exceeds supply which means the buyers are more than sellers the prices increase. If there are more buyers who want a product than there is product to go around the market price of the product tends to rise.

Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money.

Heres how he did it in 1962. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate. Stock prices change everyday by market forces. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. Stock prices tend to move higher when the money supply.

Source: mindtools.com

Source: mindtools.com

Stock prices tend to move higher when the money supply in an economy. Stock prices are related to business being good but it is not the causeStock prices are caused by supply and demandStock prices move based on the demand and supply of the stockIf many. So most of the time high demand leads to higher prices low demand leads to lower prices. A decrease in demand will cause a reduction in the equilibrium price and quantity of a good. Economic data interest rates and corporate results influence the demand.

Source: pinterest.com

Source: pinterest.com

For ETFs with illiquid holdings such as emerging markets the ETF can vary between trades of the holdings. If there are more buyers who want a product than there is product to go around the market price of the product tends to rise. While supply and demand is the bottom-line factor that determines. Economic data interest rates and corporate results influence the demand. In turn higher prices tend to moderate or reduce demand and.

Source: pinterest.com

Source: pinterest.com

In terms of financial markets supply and demand determine the pricing of stocks and other securities. But while these trading tools are undoubtedly useful they can sometimes serve to abstract us from the reality that stock prices change solely due to a change in supply or demand. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate.

Source: investopedia.com

Source: investopedia.com

Stock prices tend to move higher when the money supply in an economy. In turn higher prices tend to moderate or reduce demand and. Vernon Smith won a Nobel Prize in Economics for his work in experimental economics. Economic data interest rates and corporate results influence the demand. Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money.

Source: pinterest.com

Source: pinterest.com

Stock prices are related to business being good but it is not the causeStock prices are caused by supply and demandStock prices move based on the demand and supply of the stockIf many. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. The same structure is still used in experimental procedures today. We can find many examples of stocks staying in a flat range for days or.

Source: investopedia.com

Source: investopedia.com

We can find many examples of stocks staying in a flat range for days or. When demand for shares exceeds supply which means the buyers are more than sellers the prices increase. The same structure is still used in experimental procedures today. What items are in demand. The decrease in demand causes excess supply to develop at the initial price.

Source: pinterest.com

Source: pinterest.com

Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. By this we mean that share prices change because of supply and demand. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate. Increases in demand generally lead to higher prices and decreases in demand tend to lead to lower prices. We can find many examples of stocks staying in a flat range for days or.

Source: dotnettutorials.net

Source: dotnettutorials.net

The same structure is still used in experimental procedures today. Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. While supply and demand is the bottom-line factor that determines. We can find many examples of stocks staying in a flat range for days or. If the price decreases then potential demand also increases inverse relationship.

Source: pinterest.com

Source: pinterest.com

Stock prices tend to move higher when the money supply in an economy. This will present sometimes large variations between the last price of the ETF vs the. By this we mean that share prices change because of supply and demand. Stock prices are related to business being good but it is not the causeStock prices are caused by supply and demandStock prices move based on the demand and supply of the stockIf many. On the other hand high supplywhen theres lots of a productusually means lower prices and.

Source: pinterest.com

Source: pinterest.com

If the price decreases then potential demand also increases inverse relationship. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. Demand and supply in the market affect the prices of shares. The decrease in demand causes excess supply to develop at the initial price. In turn higher prices tend to moderate or reduce demand and.

Source: pinterest.com

Source: pinterest.com

If more people want to buy a stock demand than sell it. Increased prices typically result in. But while these trading tools are undoubtedly useful they can sometimes serve to abstract us from the reality that stock prices change solely due to a change in supply or demand. So most of the time high demand leads to higher prices low demand leads to lower prices. Stock prices tend to move higher when the money supply.

Source: ig.com

Source: ig.com

When supply and demand balance so they are roughly equal prices will gyrate. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate. Stock prices change everyday by market forces. The decrease in demand causes excess supply to develop at the initial price. In terms of financial markets supply and demand determine the pricing of stocks and other securities.

Source: in.pinterest.com

Source: in.pinterest.com

This will present sometimes large variations between the last price of the ETF vs the. When supply and demand balance so they are roughly equal prices will gyrate. Economic data interest rates and corporate results influence the demand. In turn higher prices tend to moderate or reduce demand and. If more people want to buy a stock demand than sell it.

Source: in.pinterest.com

Source: in.pinterest.com

Economic data interest rates and corporate results influence the demand. Vernon Smith won a Nobel Prize in Economics for his work in experimental economics. 9 high-demand trending products and niches of 2021 How does the law of supply and demand affect prices. Supply and demand variables are among the more pertinent and basic topics of economics. On the supply side if the price of a good or service increases then firms will be willing to.

Source: pinterest.com

Source: pinterest.com

Heres how he did it in 1962. The same structure is still used in experimental procedures today. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range. So most of the time high demand leads to higher prices low demand leads to lower prices. Often supply and demand find equilibrium at a price that buyers accept and sellers accommodate.

Source: pinterest.com

Source: pinterest.com

What items are in demand. We can find many examples of stocks staying in a flat range for days or. 9 high-demand trending products and niches of 2021 How does the law of supply and demand affect prices. In terms of financial markets supply and demand determine the pricing of stocks and other securities. When supply and demand balance so they are roughly equal prices will gyrate up and down in a narrow price range.

Source: pinterest.com

Source: pinterest.com

Producers and resellers often consider the level of supply and how this will affect. Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. Producers and resellers often consider the level of supply and how this will affect. The decrease in demand causes excess supply to develop at the initial price. By this we mean that share prices change because of supply and demand.

Source: pinterest.com

Source: pinterest.com

This will present sometimes large variations between the last price of the ETF vs the. If there are more buyers who want a product than there is product to go around the market price of the product tends to rise. If more people want to buy a stock demand than sell it. Increases in demand generally lead to higher prices and decreases in demand tend to lead to lower prices. In terms of financial markets supply and demand determine the pricing of stocks and other securities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does supply and demand affect stock prices by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.