Your Budget deficit supply and demand curve images are available in this site. Budget deficit supply and demand curve are a topic that is being searched for and liked by netizens now. You can Find and Download the Budget deficit supply and demand curve files here. Get all free photos.

If you’re looking for budget deficit supply and demand curve pictures information connected with to the budget deficit supply and demand curve interest, you have visit the right site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

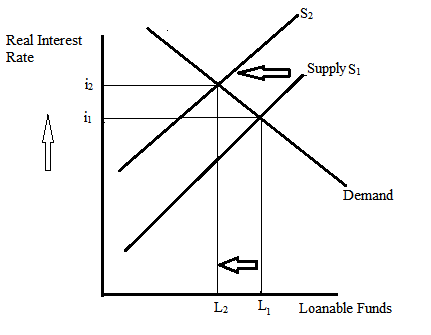

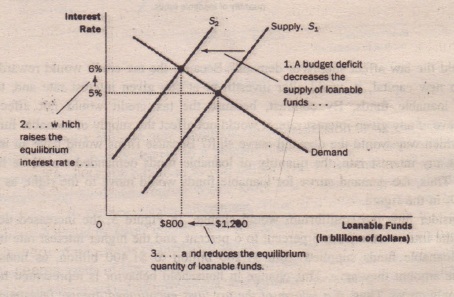

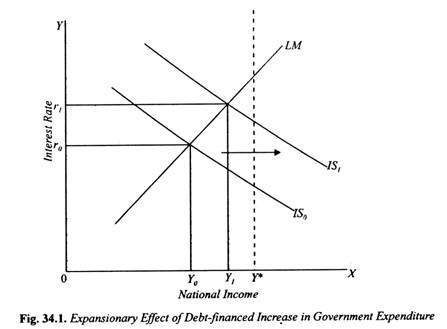

Budget Deficit Supply And Demand Curve. In the figure when the budget deficit reduces the supply of loanable funds the interest rate rises from 5 percent to 6 percent. Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. Say the government increases the budget deficit. Requirements of the same amount shifts both the supply and demand curves for loanable funds to the left equally.

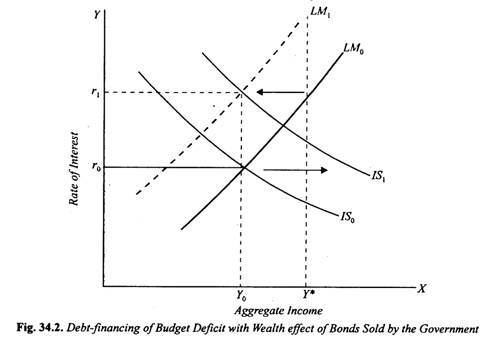

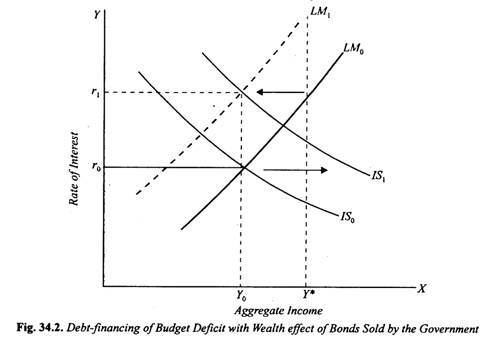

Government Borrowing For Financing Of Fiscal Deficit From economicsdiscussion.net

Government Borrowing For Financing Of Fiscal Deficit From economicsdiscussion.net

Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. Government runs a budget deficit and finances the deficit through the sale of US. In the loanable funds framework the supply represents the total amount that is being lent out at different. This means that national saving will decrease which leads to a decrease in the supply of loanable funds. The demand and supply curves in this model have a special meaning. Page 4 5 The incidence of various types of taxes upon costs is a very complicated issue and is normally.

Suppose the government starts spending more causing the government budget deficit to increase.

The demand and supply curves in this model have a special meaning. We derive this relation in much the same way we did for the IS curve. Changes in private savings and capital inflows shift the supply curve. Surpluses increase the supply of loanable funds. Suppose the government has a balanced budget and wants to increase spending without changing tax rates. Subsequently one may also ask what happens when.

Source: bilbo.economicoutlook.net

Source: bilbo.economicoutlook.net

Actions And Shifts Alongside A Demand Or Provide Curve Economics On-line Economics On-line. This happens because the governments expenses surpass its revenues. However the difficulty is that this fiscal tightening can cause lower economic growth which in turn can cause a higher cyclical deficit government get less tax revenue in a recession. Provide And Demand Why Do You Care Advisor S Edge. The demand and supply curves in this model have a special meaning.

Deficits decrease the supply of loanable funds. The government enters the loanable funds market to borrow 150 billion for economic stimulus spending. In summary the demand for credit consists of two components. The original equilibrium occurs at E 0 the intersection of aggregate demand curve AD 0 and aggregate supply curve AS 0 at an output level of 200 and a price level of 90. Now suppose the government is experiencing a budget deficit.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Actions And Shifts Alongside A Demand Or Provide Curve Economics On-line Economics On-line. Suppose the government has a balanced budget and wants to increase spending without changing tax rates. 1 1 After the budget deficit occurs suppose the new equilibrium real interest rate is 5. Treasury Bills Notes or Bonds this is counted as part of the demand for credit. Changes in saving behavior by the.

Source: chegg.com

Source: chegg.com

When governments run budget deficits they often borrow by selling bonds pushing the supply curve rightward and bond prices down yields up ceteris paribus. Budget deficits of the seven Summit countries which dropped to their late 1970s low of 17 percent of GNP in 1979 started. This happens because the governments expenses surpass its revenues. Show the effect of the budget deficit on the market for loanable funds by shifting the demand D curve the supply 5 curve or both 0 0 0 0 INTEREST RATE LOANABLE FUNDS Based on this model the budget deficit leads to in the interest rate and in the level of investment. Changes in saving behavior by the.

Source: slideplayer.com

Source: slideplayer.com

When governments run surpluses and they occasionally do believe it or not they redeem andor buy their bonds back on net pushing the supply curve to the left and bond prices up yields down all else being equal. One year later aggregate supply has shifted to the right to AS 1 in the process of long-term economic growth and aggregate demand has also shifted to the right to AD 1. Thus a budget deficit shifts the supply curve for loanable funds to the left from S1 to S2 as shown in Figure 25-4. Subsequently one may also ask what happens when. TREND Budget Deficit Supply And Demand Curve.

Source: rhayden.us

Source: rhayden.us

Suppose the government has a balanced budget and wants to increase spending without changing tax rates. Surpluses decrease the demand for loanable funds. A reduction in the budget deficit that causes a shift to the right of the curve S representing total national savings. The increase in government spending will reduce Public Saving. This means that national saving will decrease which leads to a decrease in the supply of loanable funds.

Source: slidetodoc.com

Source: slidetodoc.com

1 1 After the budget deficit occurs suppose the new equilibrium real interest rate is 5. A reduction in the budget deficit that causes a shift to the right of the curve S representing total national savings. Deficits decrease the supply of loanable funds. Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. Thus a budget deficit shifts the supply curve for loanable funds to the left from S1 to S2 as shown in Figure 13-4.

![]() Source: policonomics.com

Source: policonomics.com

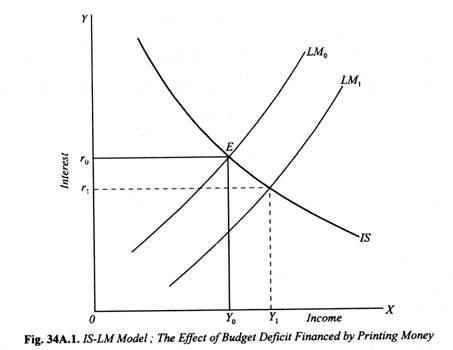

As the equilibrium interest rate shifts from E 0 to E 1 the interest rate rises from 5 to 6 in this example. Suppose the central bank adjusts the money supply to hold the interest rate constant investment spending remains unchanged and the marginal propensity to consume is ⅔. Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. Government runs a budget deficit and finances the deficit through the sale of US. The original equilibrium occurs at E 0 the intersection of aggregate demand curve AD 0 and aggregate supply curve AS 0 at an output level of 200 and a price level of 90.

Source: slideplayer.com

Source: slideplayer.com

Government runs a budget deficit and finances the deficit through the sale of US. With the economy in a recession due to inadequate aggregate demand the government increases its purchases by 1200. Subsequently one may also ask what happens when. Page 4 5 The incidence of various types of taxes upon costs is a very complicated issue and is normally. Treasury Bills Notes or Bonds this is counted as part of the demand for credit.

Source: louis.oercommons.org

Source: louis.oercommons.org

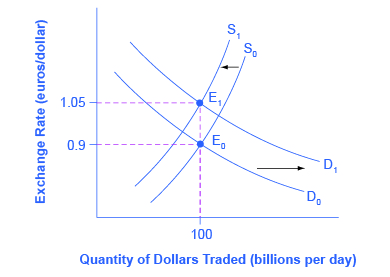

How much money is available for private investment after this action has shifted the demand curve as shown in the figure. A reduction in the budget deficit that causes a shift to the right of the curve S representing total national savings. It leads the demand curve to shift to the right and causes the economys interest rates to rise. Requirements of the same amount shifts both the supply and demand curves for loanable funds to the left equally. Budget Deficits and Interest Rates In the financial market an increase in government borrowing can shift the demand curve for financial capital to the right from D 0 to D 1.

Source: homeworklib.com

Source: homeworklib.com

Now suppose the government is experiencing a budget deficit. Budget deficits of the seven Summit countries which dropped to their late 1970s low of 17 percent of GNP in 1979 started. Suppose the central bank adjusts the money supply to hold the interest rate constant investment spending remains unchanged and the marginal propensity to consume is ⅔. The obvious way to reduce a budget deficit is to increase tax rates and cut government spending. The demand curve represents the demand for.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

When governments run surpluses and they occasionally do believe it or not they redeem andor buy their bonds back on net pushing the supply curve to the left and bond prices up. Budget deficit where expenditures exceed revenues would have a stimulating effect. However the difficulty is that this fiscal tightening can cause lower economic growth which in turn can cause a higher cyclical deficit government get less tax revenue in a recession. The logic of this point of view is that if the government runs a deficit it has to borrow money just like everyone else. In the loanable funds framework the supply represents the total amount that is being lent out at different.

Source: economicskey.com

Source: economicskey.com

Other markets there is a supply curve and a demand curve. Other markets there is a supply curve and a demand curve. Furthermore two factors that cause a shift in the supply curve are. The demand curve represents the demand for. Subsequently one may also ask what happens when.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Now suppose the government is experiencing a budget deficit. Third we can compare the old and new equilibria. Thus a budget deficit shifts the supply curve for loanable funds to the left from S1 to S2 as shown in Figure 13-4. Furthermore two factors that cause a shift in the supply curve are. A reduction in the budget deficit that causes a shift to the right of the curve S representing total national savings.

Source: opentextbc.ca

Source: opentextbc.ca

Show the effect of the budget deficit on the market for loanable funds by shifting the demand D curve the supply 5 curve or both 0 0 0 0 INTEREST RATE LOANABLE FUNDS Based on this model the budget deficit leads to in the interest rate and in the level of investment. TREND Budget Deficit Supply And Demand Curve. Deficits increase the demand for loanable funds. The higher interest rate is one economic mechanism by which government borrowing can crowd. Suppose the central bank adjusts the money supply to hold the interest rate constant investment spending remains unchanged and the marginal propensity to consume is ⅔.

Source: chegg.com

Source: chegg.com

Thus a budget deficit shifts the supply curve for loanable funds to the left from S1 to S2 as shown in Figure 13-4. The government enters the loanable funds market to borrow 150 billion for economic stimulus spending. Surpluses decrease the demand for loanable funds. Budget Deficits and Interest Rates In the financial market an increase in government borrowing can shift the demand curve for financial capital to the right from D 0 to D 1. The following graph shows the demand curve in the foreign-currency exchange market.

Source: economicsdiscussion.net

Source: economicsdiscussion.net

Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. TREND Budget Deficit Supply And Demand Curve. Actions And Shifts Alongside A Demand Or Provide Curve Economics On-line Economics On-line. Page 4 5 The incidence of various types of taxes upon costs is a very complicated issue and is normally. Show the effect of the budget deficit on the market for loanable funds by shifting the demand D curve the supply 5 curve or both 0 0 0 0 INTEREST RATE LOANABLE FUNDS Based on this model the budget deficit leads to in the interest rate and in the level of investment.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

How much money is available for private investment after this action has shifted the demand curve as shown in the figure. However the difficulty is that this fiscal tightening can cause lower economic growth which in turn can cause a higher cyclical deficit government get less tax revenue in a recession. Say the government increases the budget deficit. How much money is available for private investment after this action has shifted the demand curve as shown in the figure. THE AGGREGATE SUPPLY - AGGREGATE DEMAND MODEL.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title budget deficit supply and demand curve by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.